The European Club Finance and Investment Landscape

This report is the second of two produced during this season where UEFA’s Intelligence Centre explores and analyses the European football landscape and documents the successes and challenges of European club football.

It provides colour and substance on such subjects as the types of investment coming into football, the record revenue levels reported by clubs, the increased debt that has built up at clubs during the pandemic and the drivers of revenue polarisation in European football.

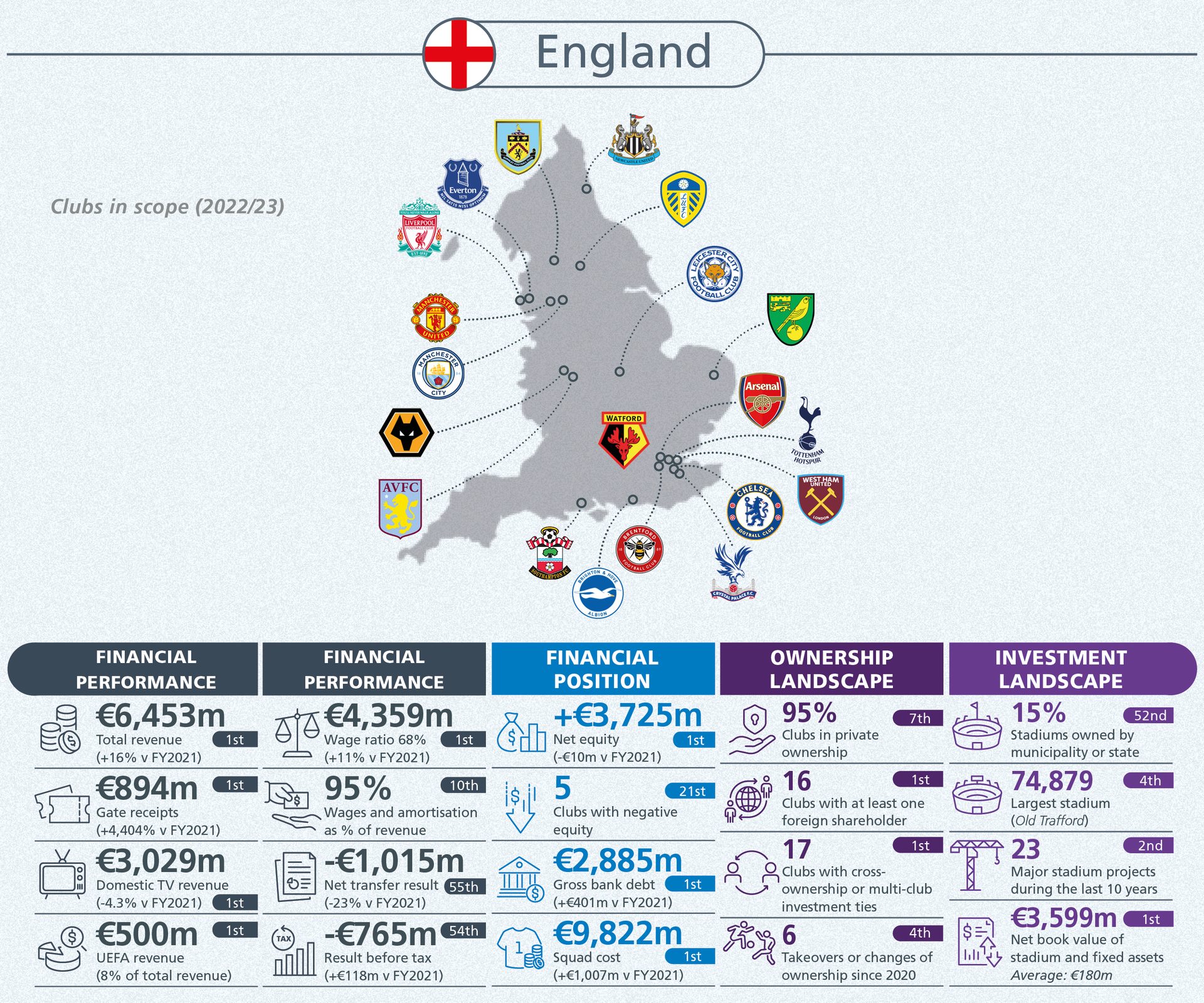

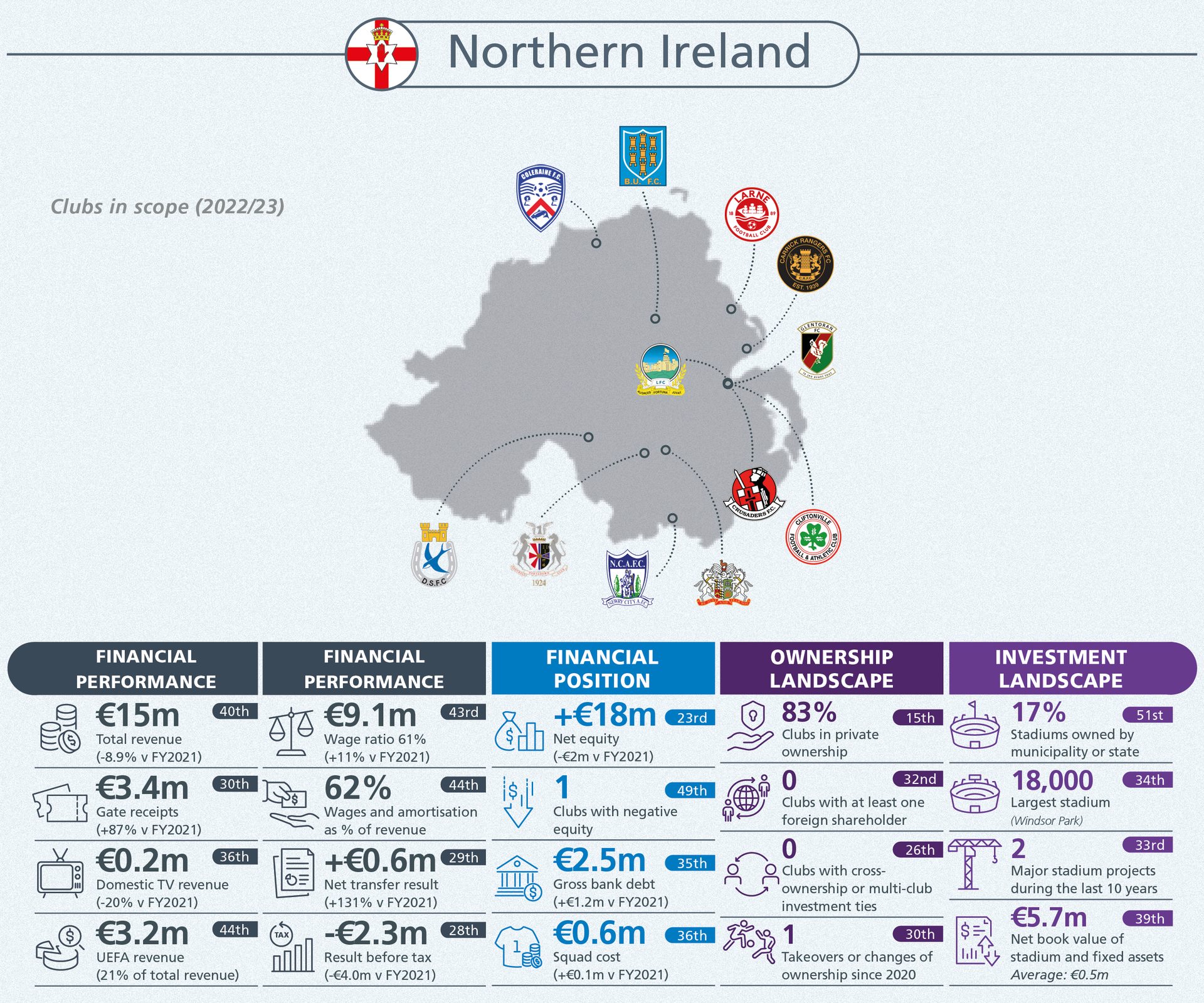

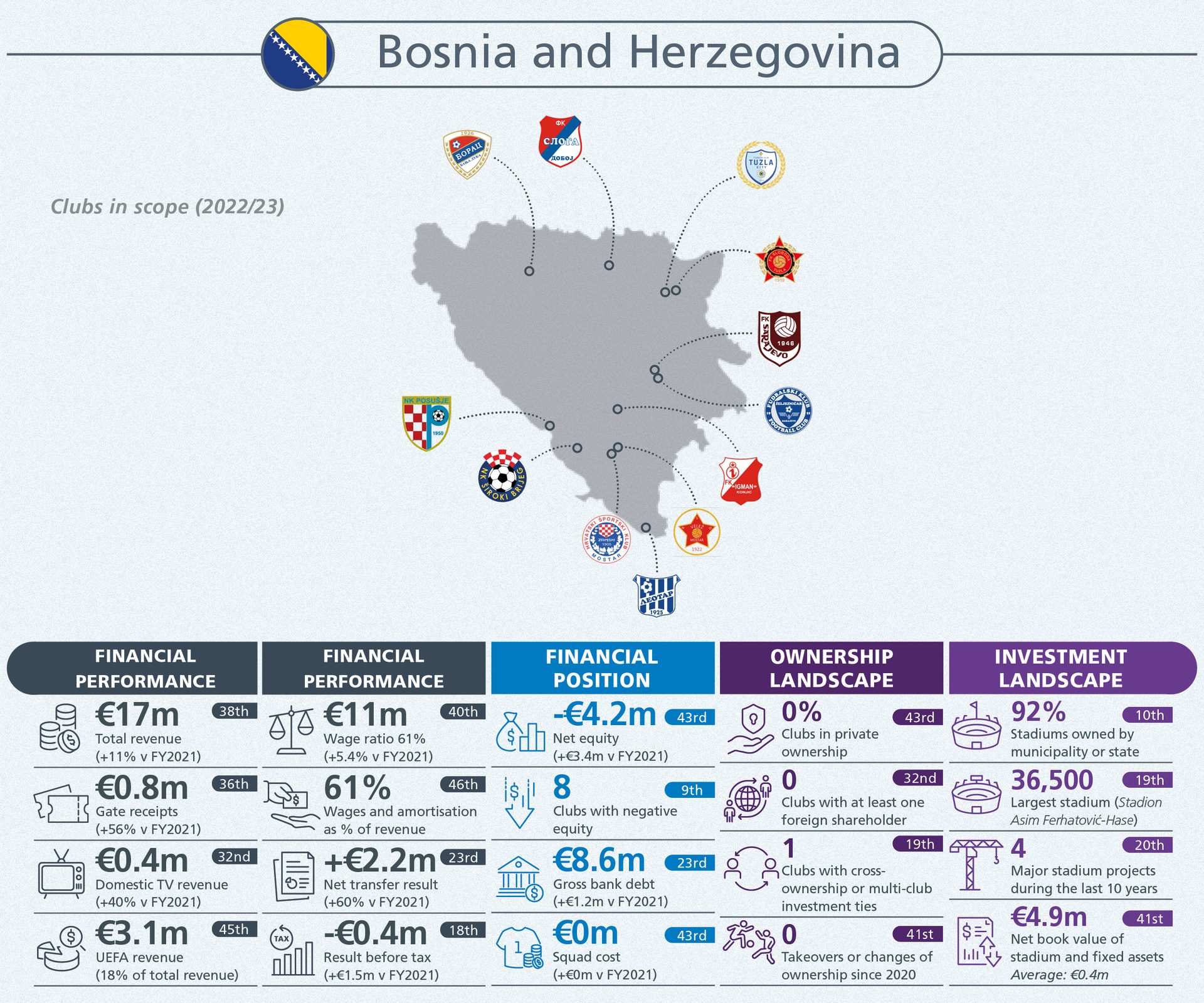

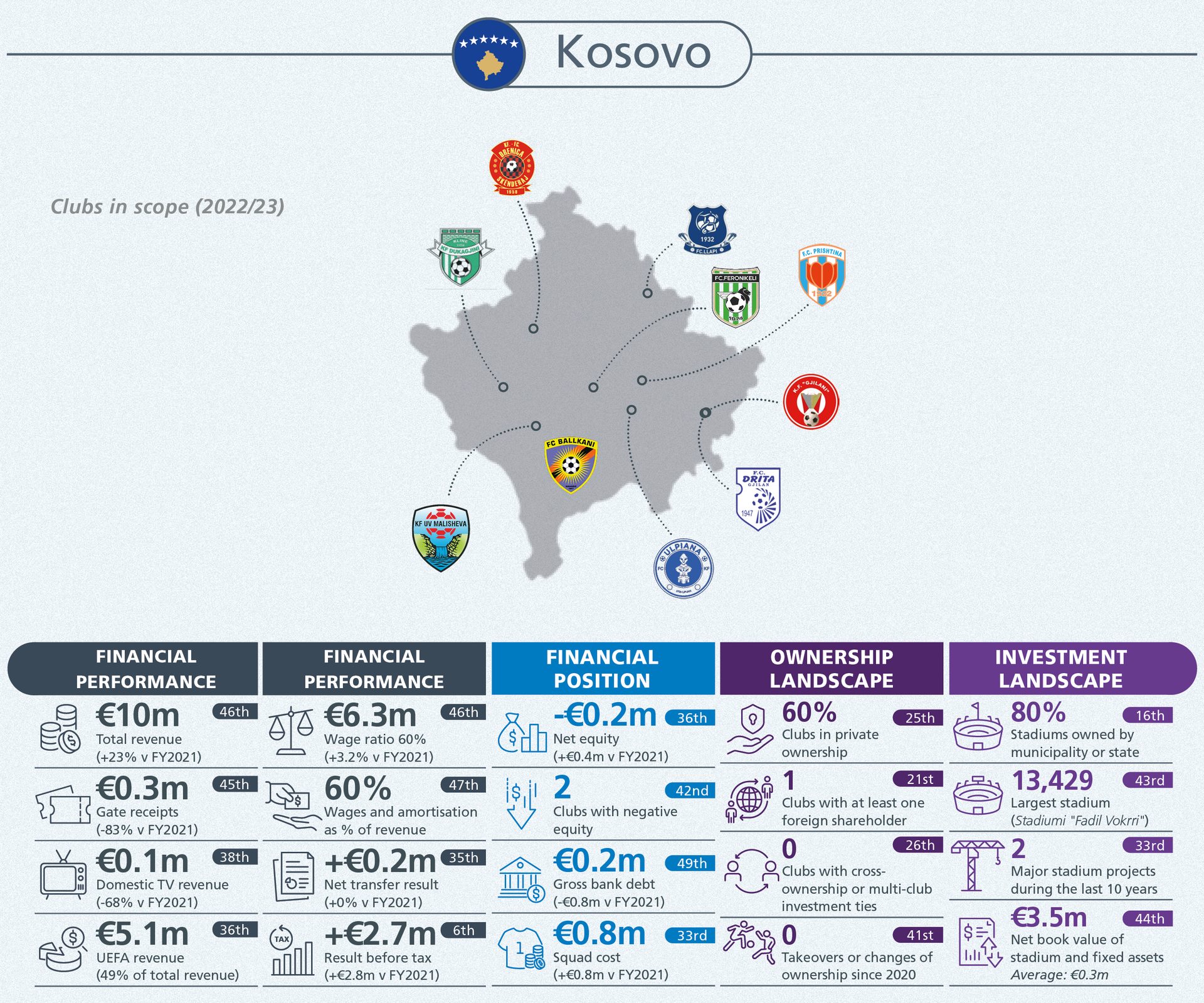

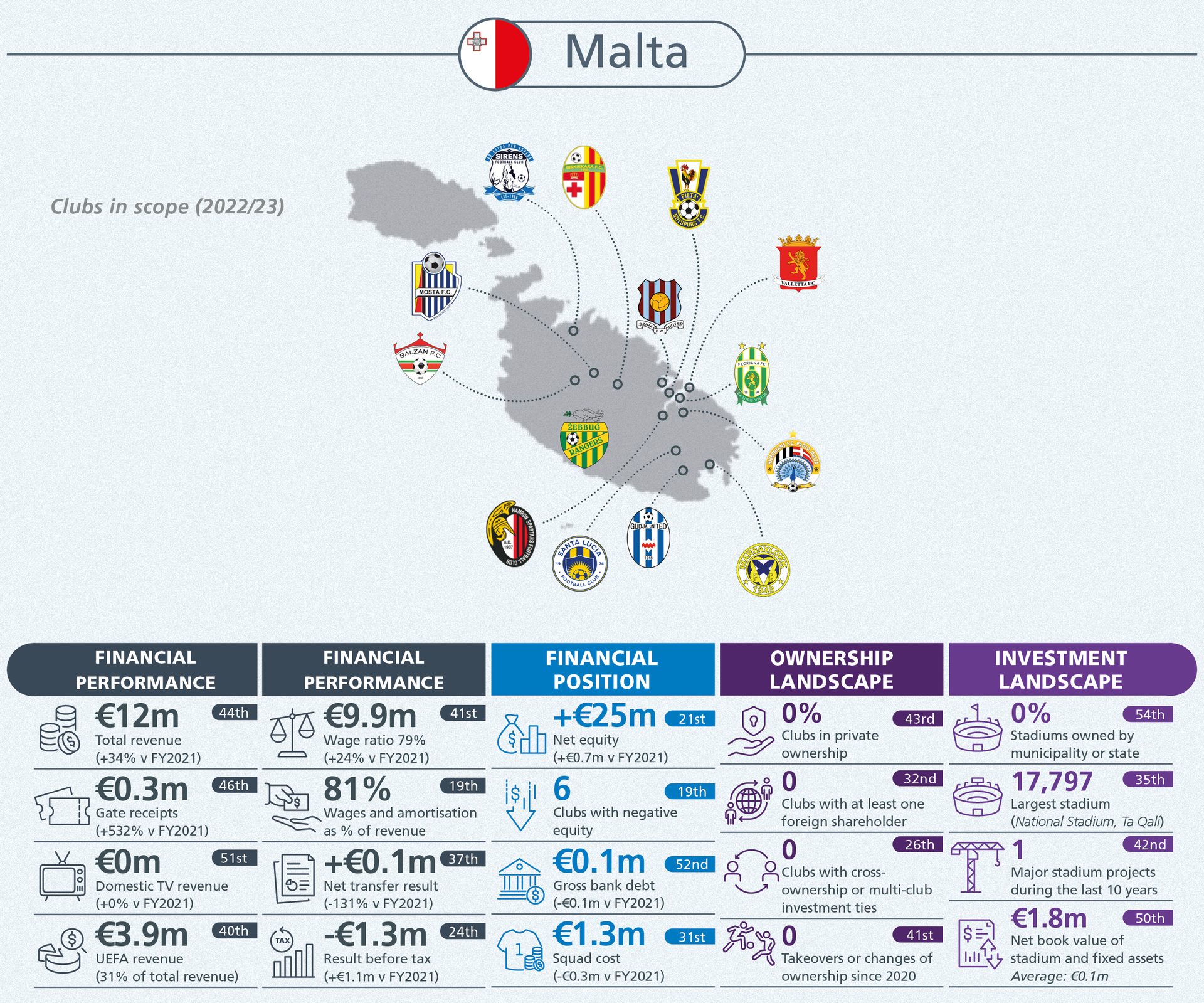

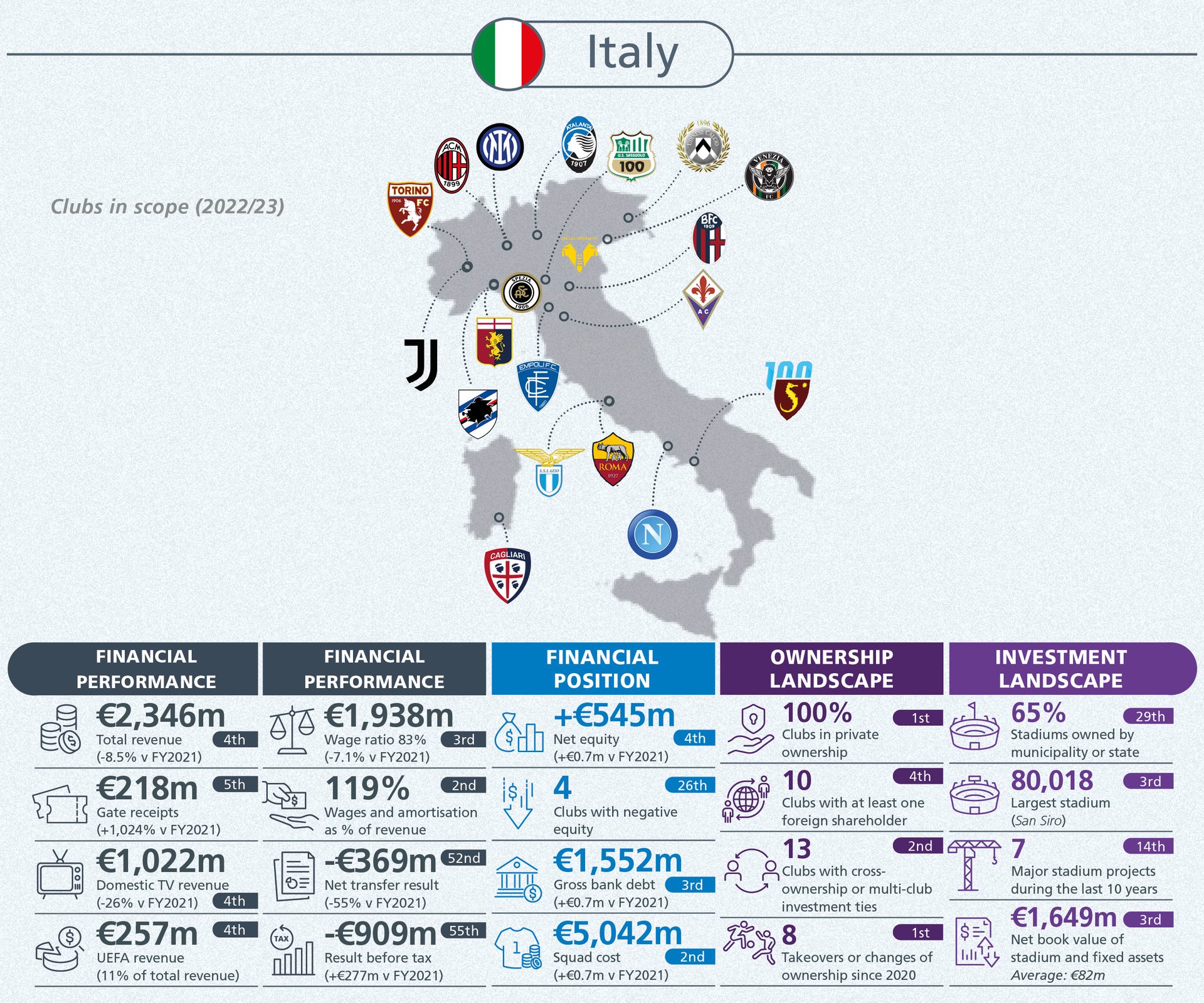

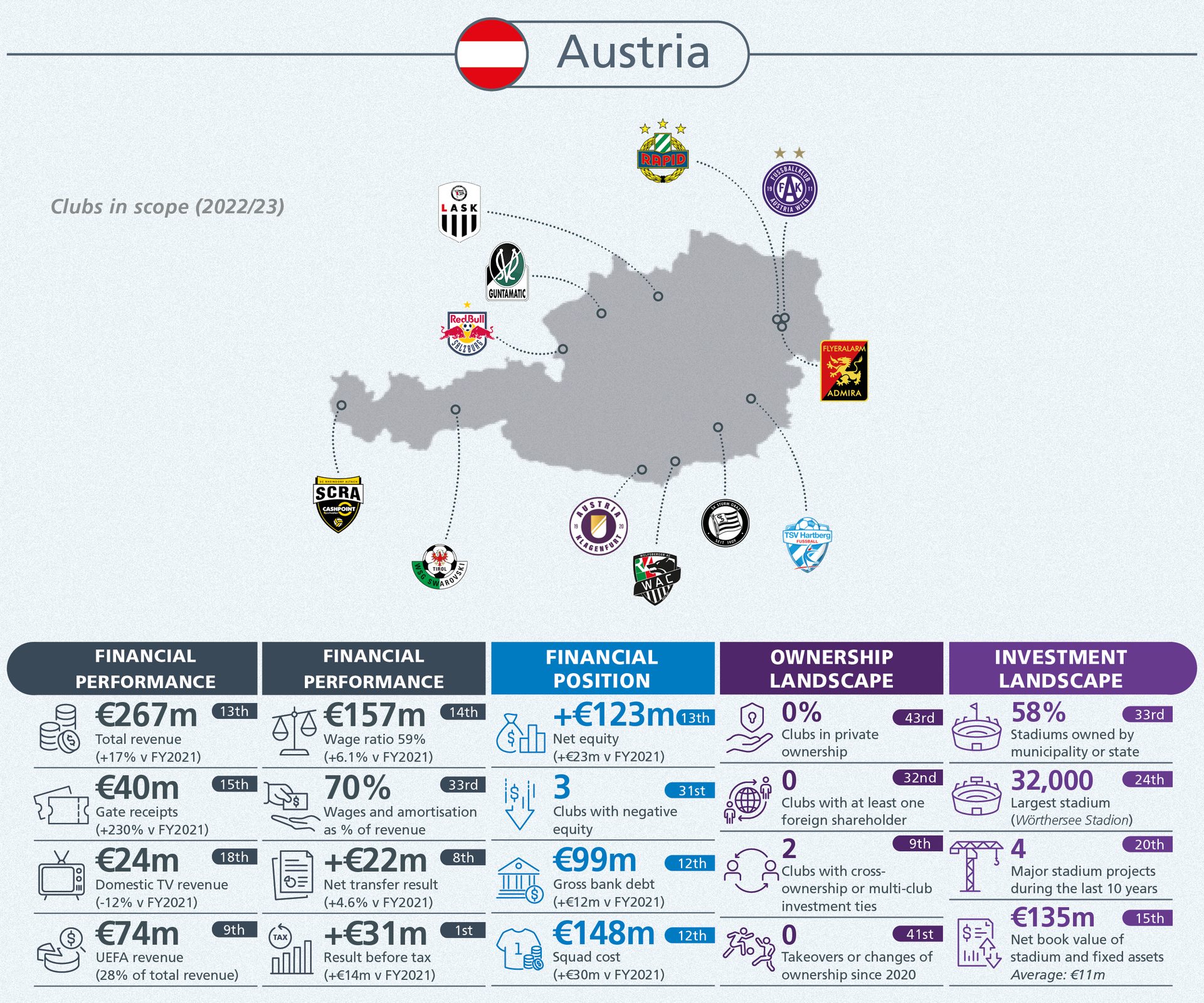

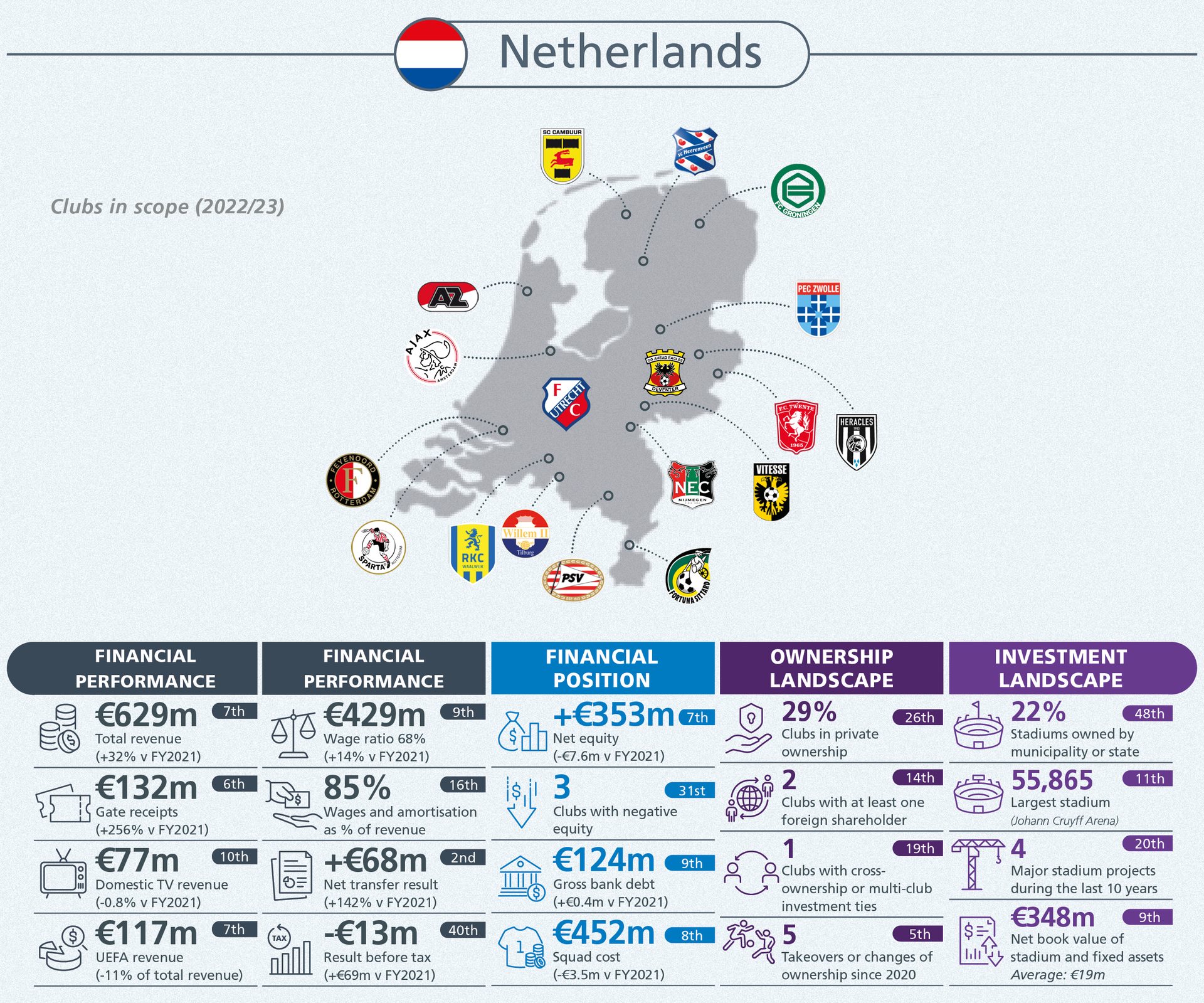

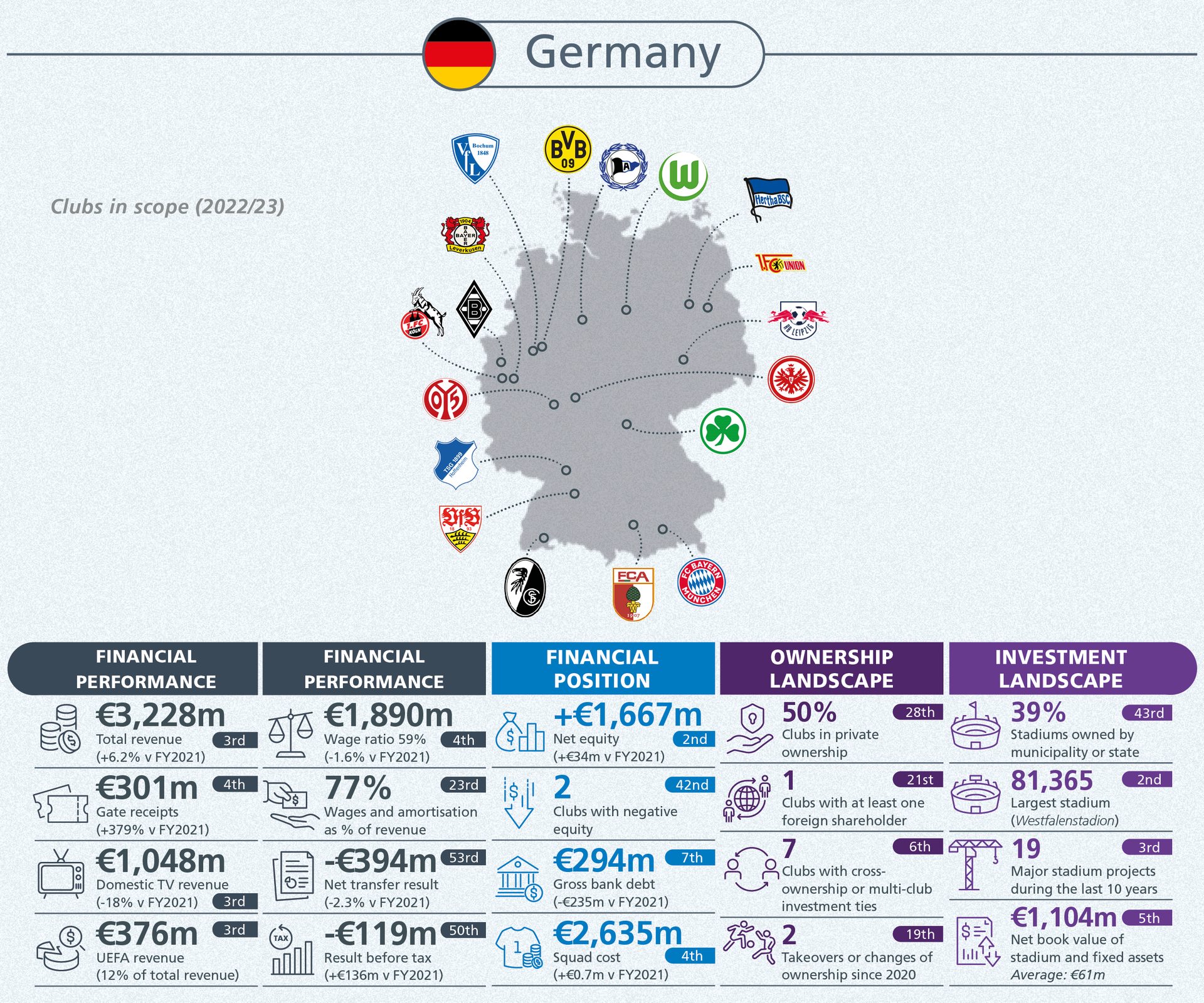

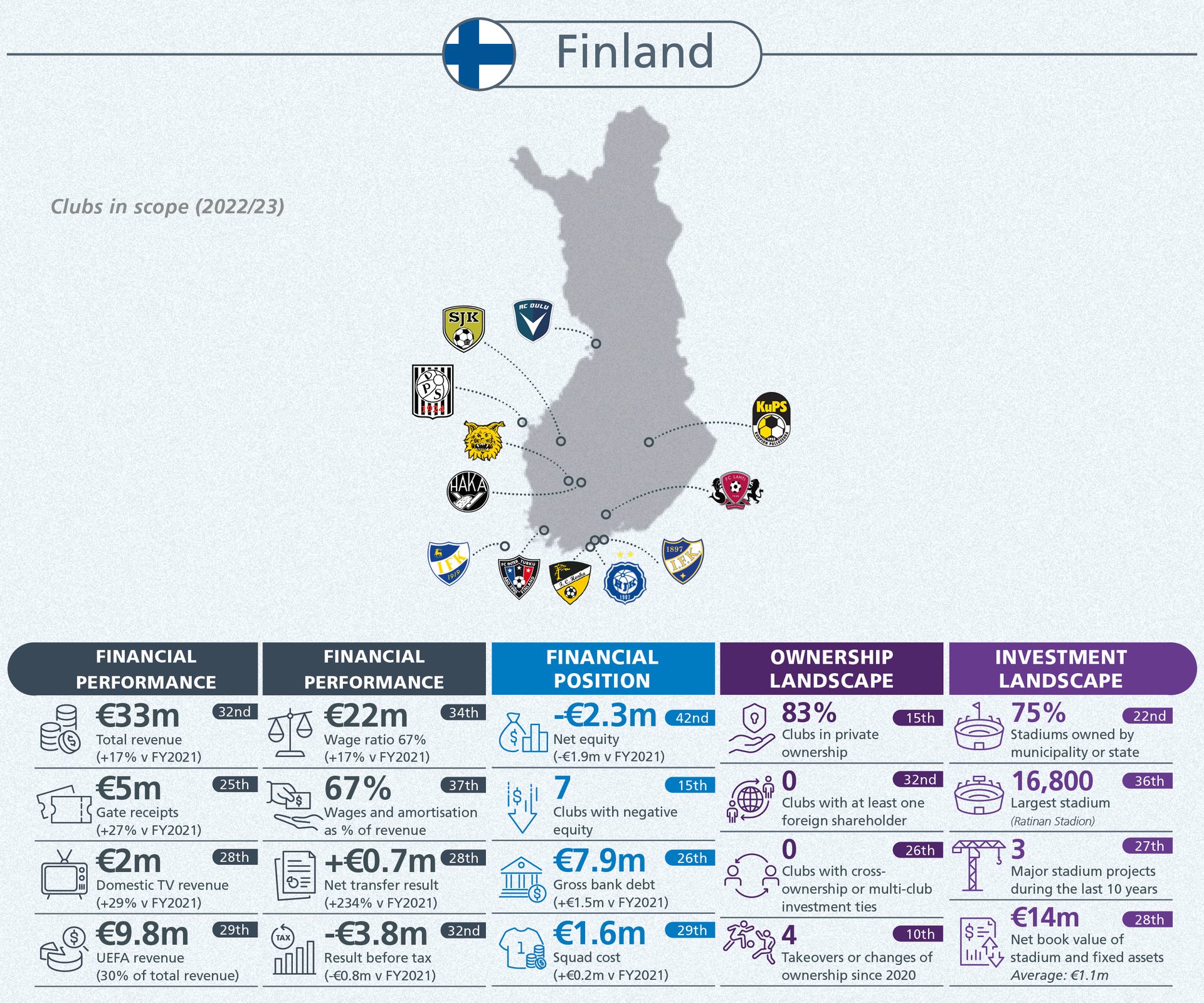

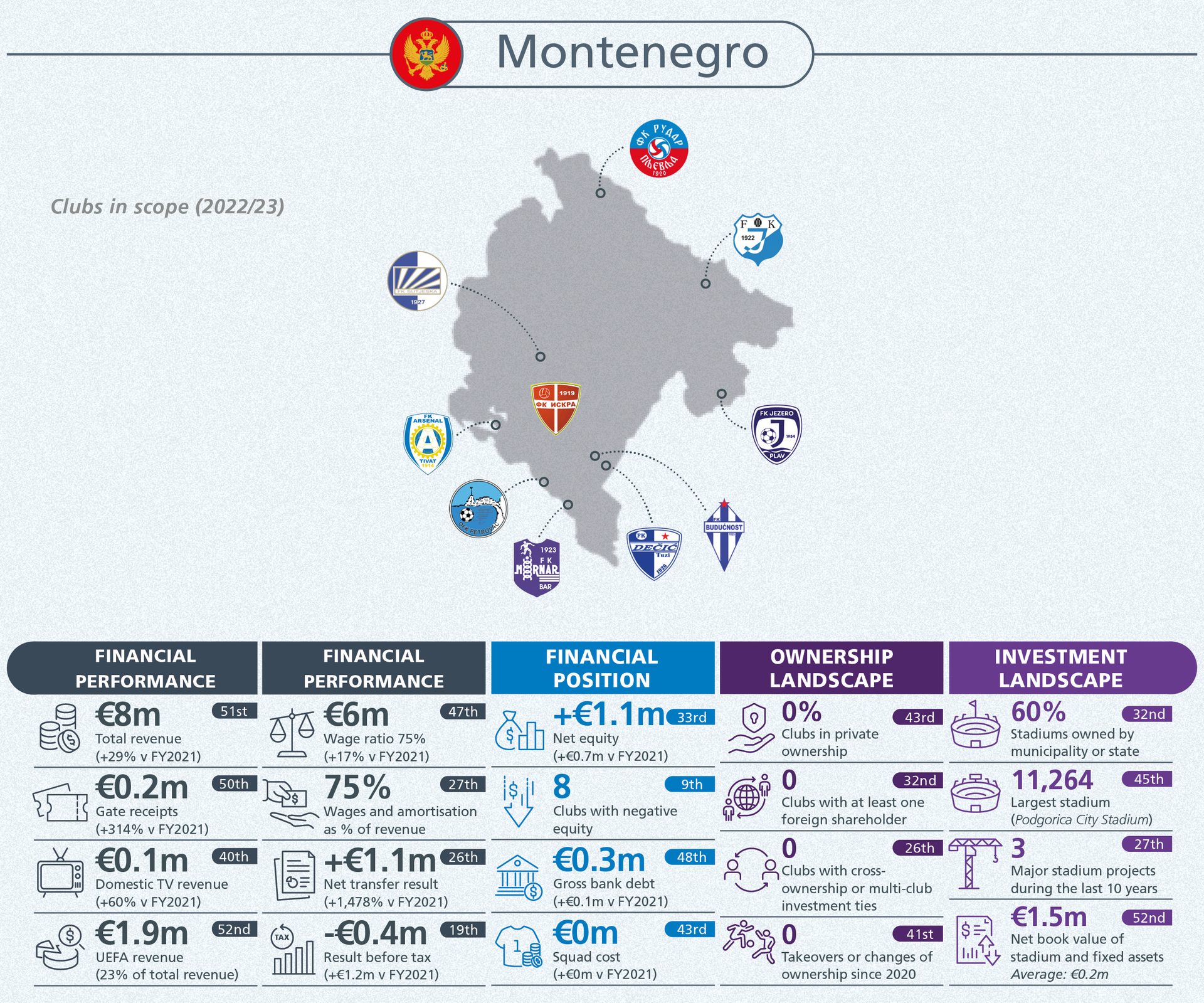

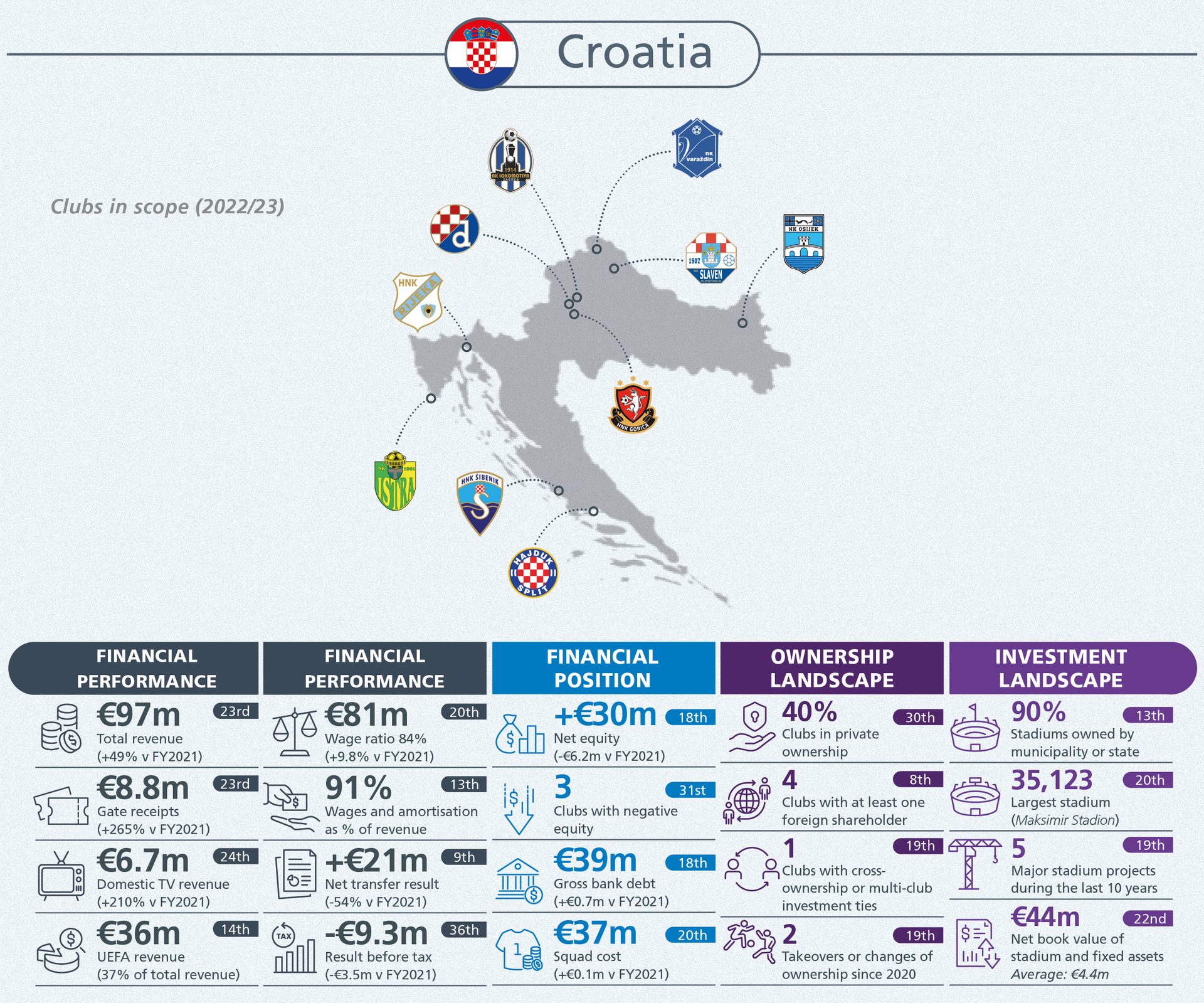

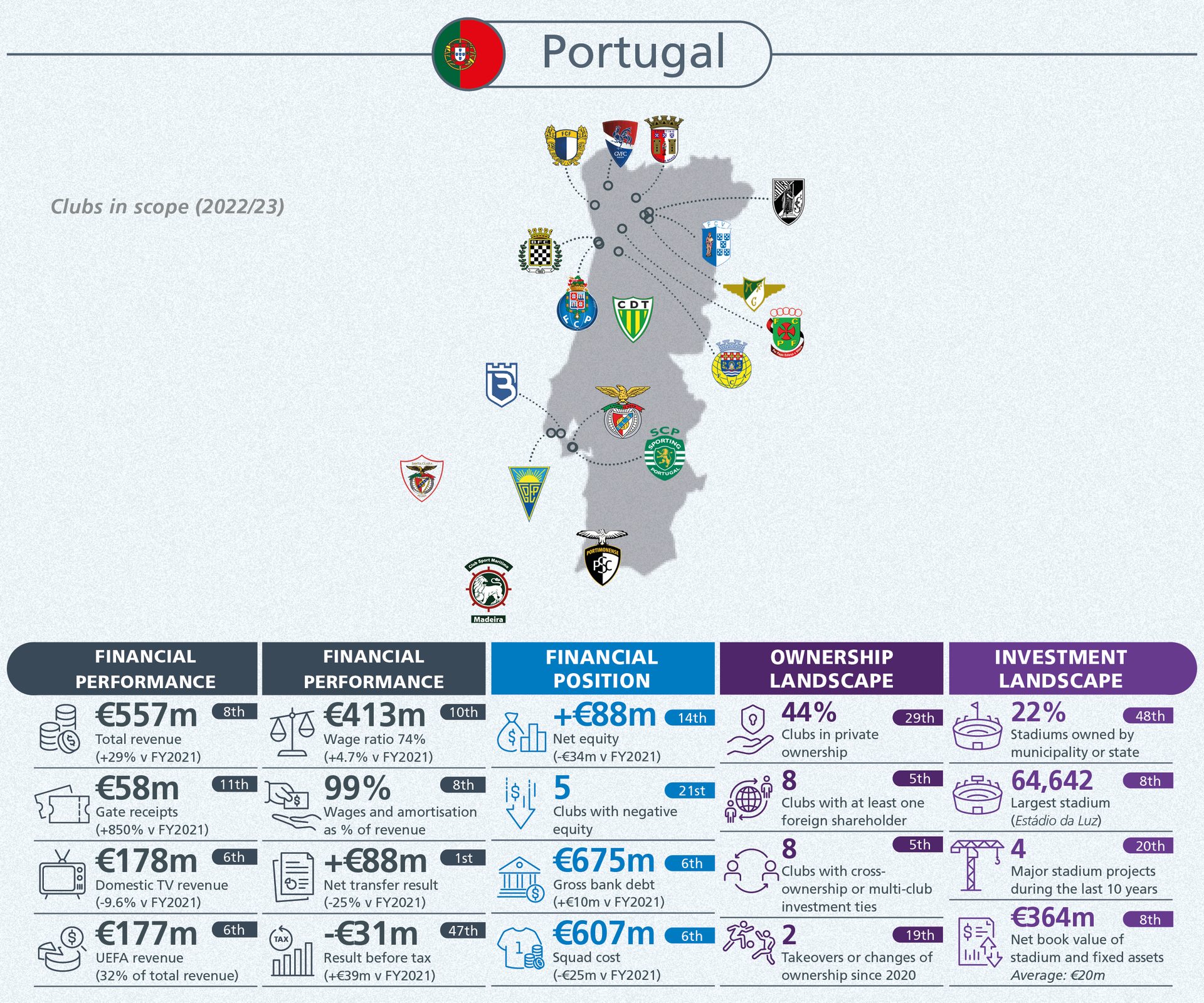

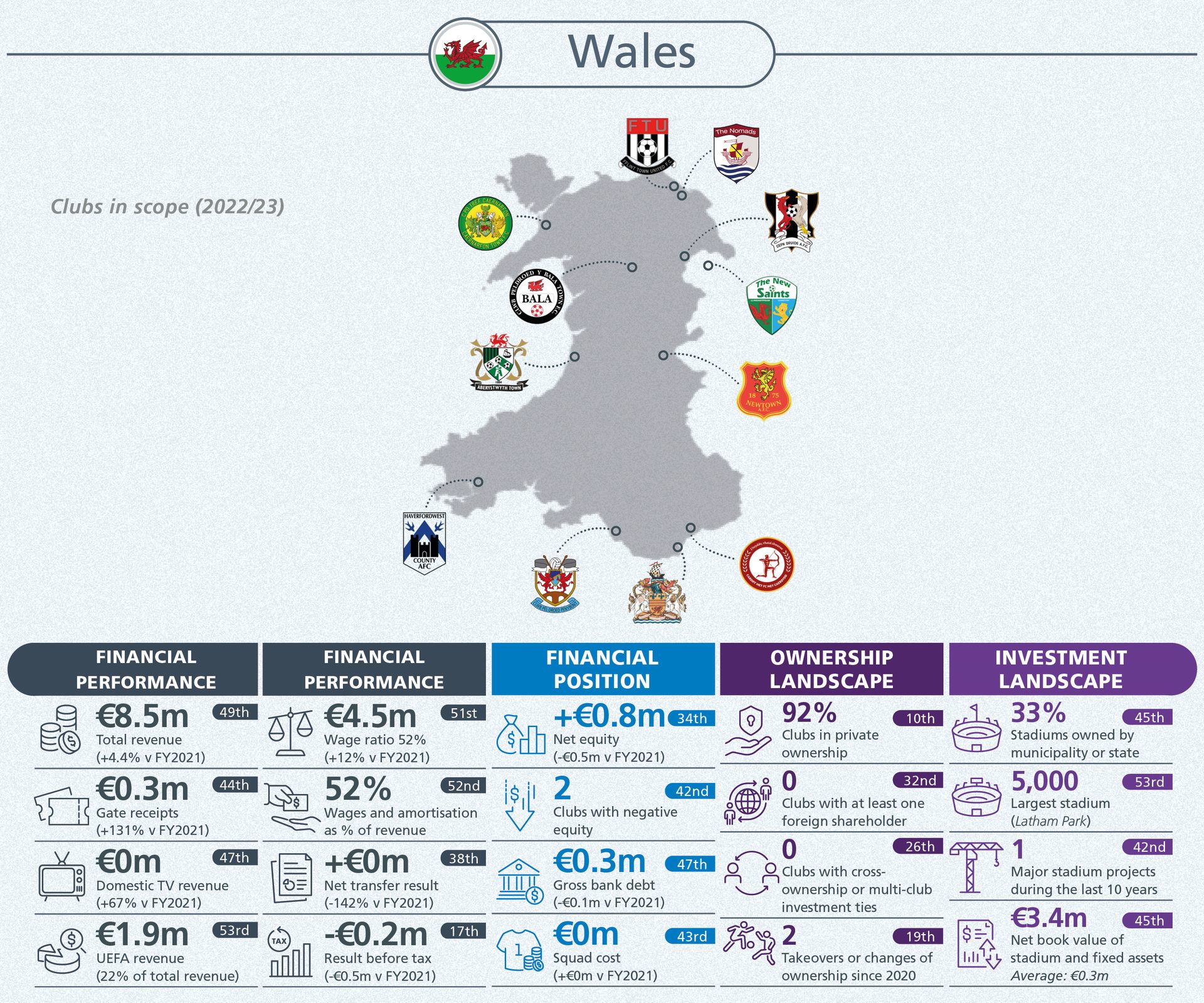

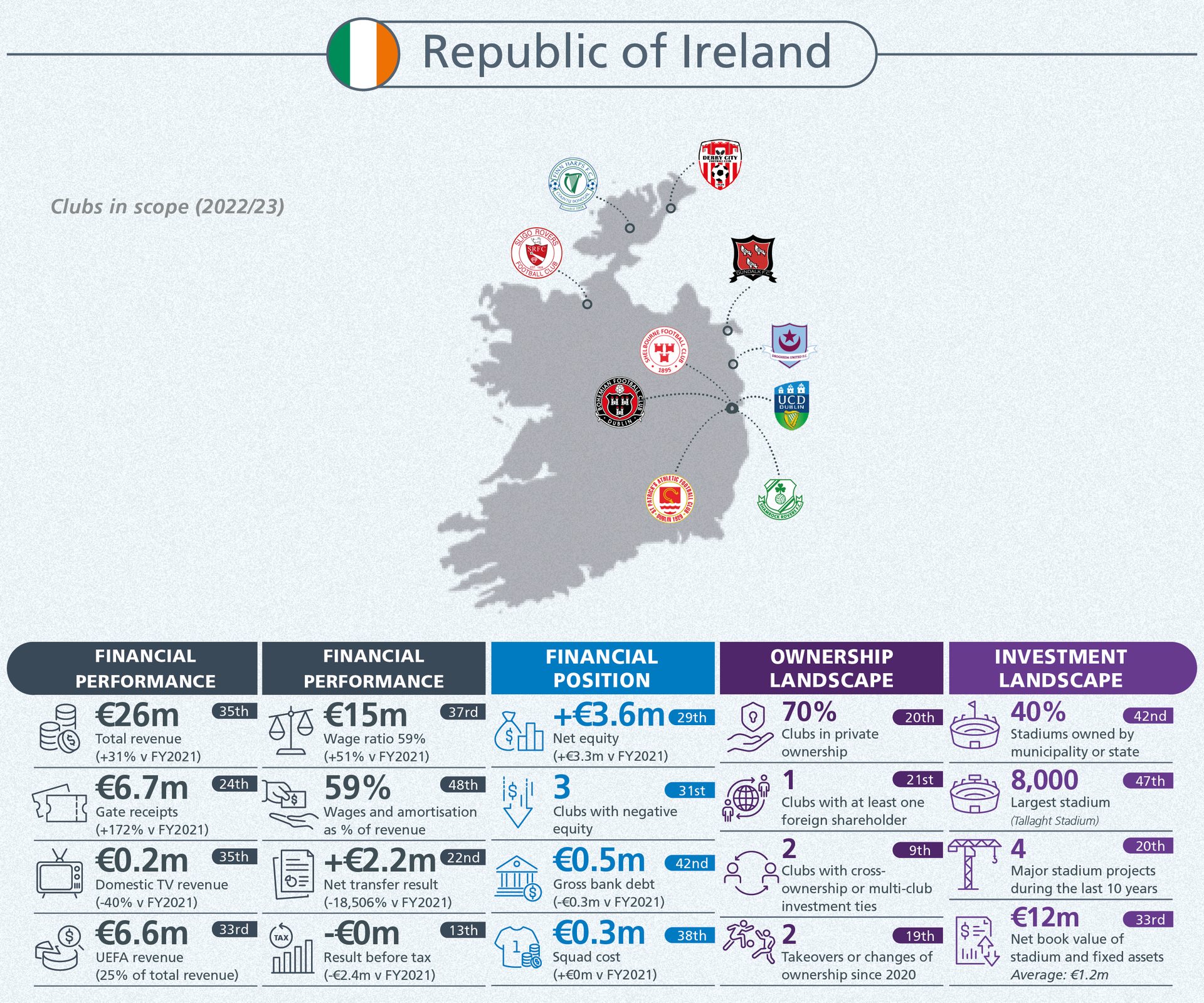

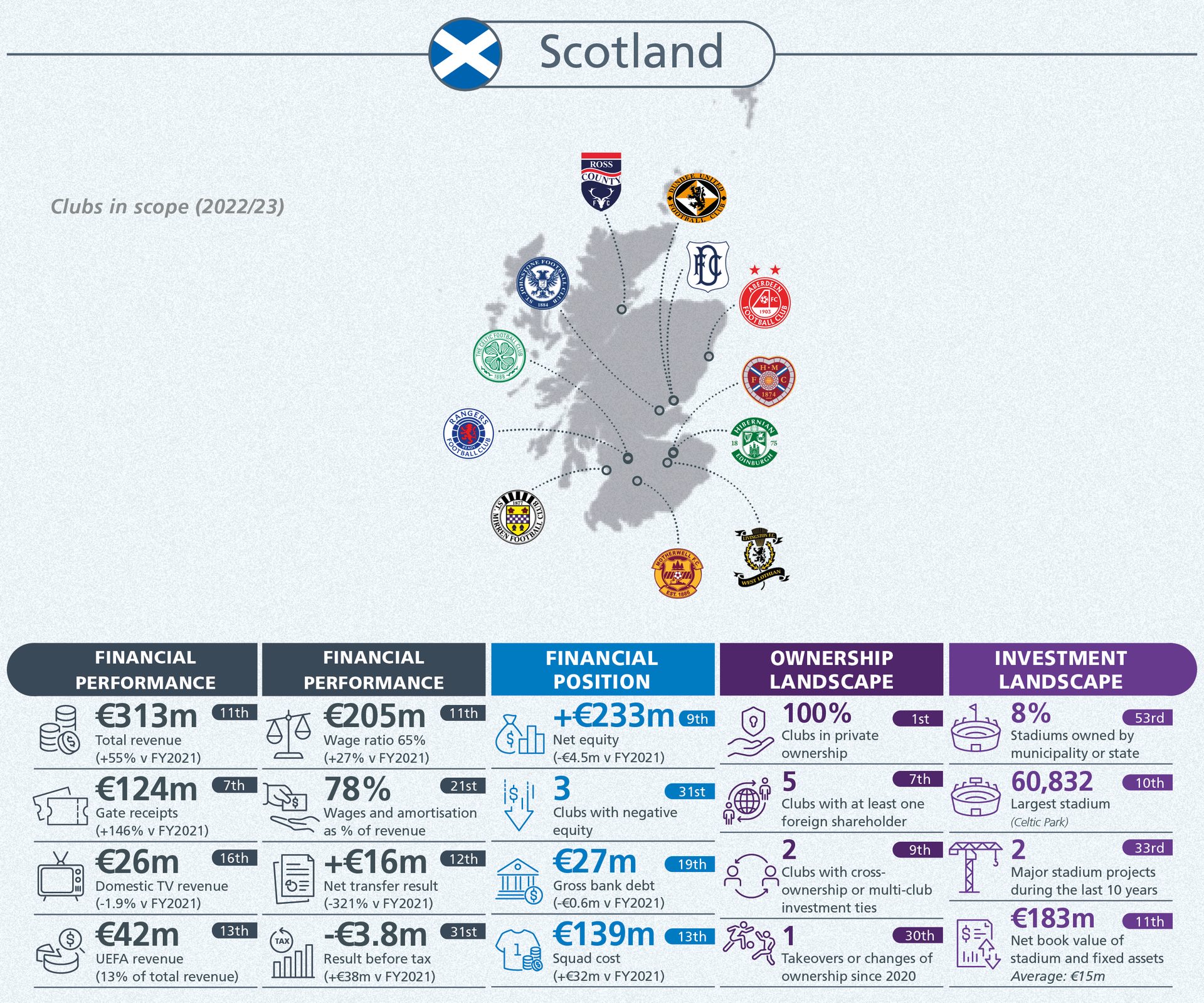

It documents the full scope of football finances, from detailed analyses of the top 20 clubs across ten measures, to 20 KPIs across all 55 European top tier leagues.

The UEFA Intelligence Centre landscape reports have long brought transparency to European football with the aim to support evidence-based policy making and decision taking. For those of you that love football, why not explore further?

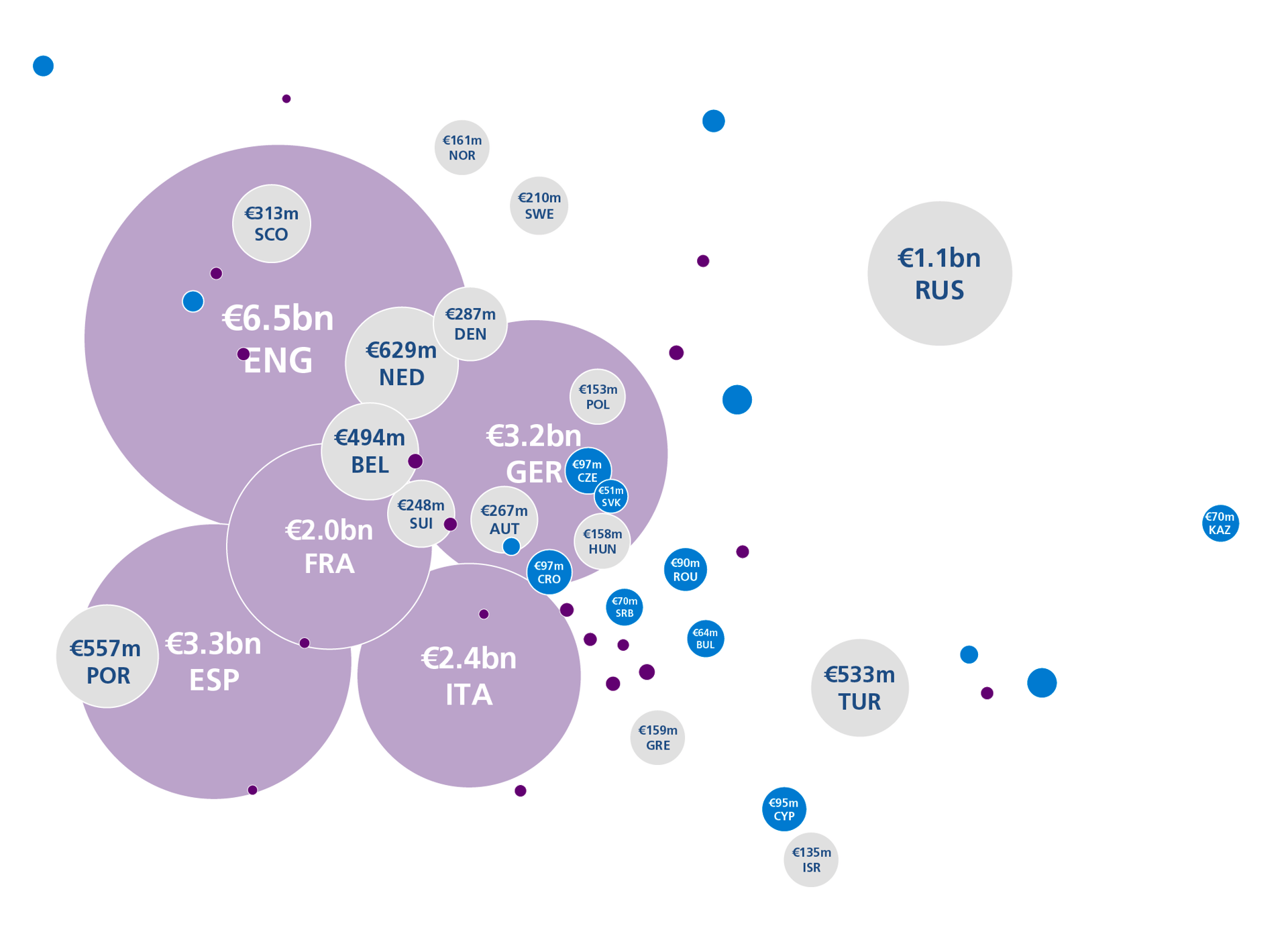

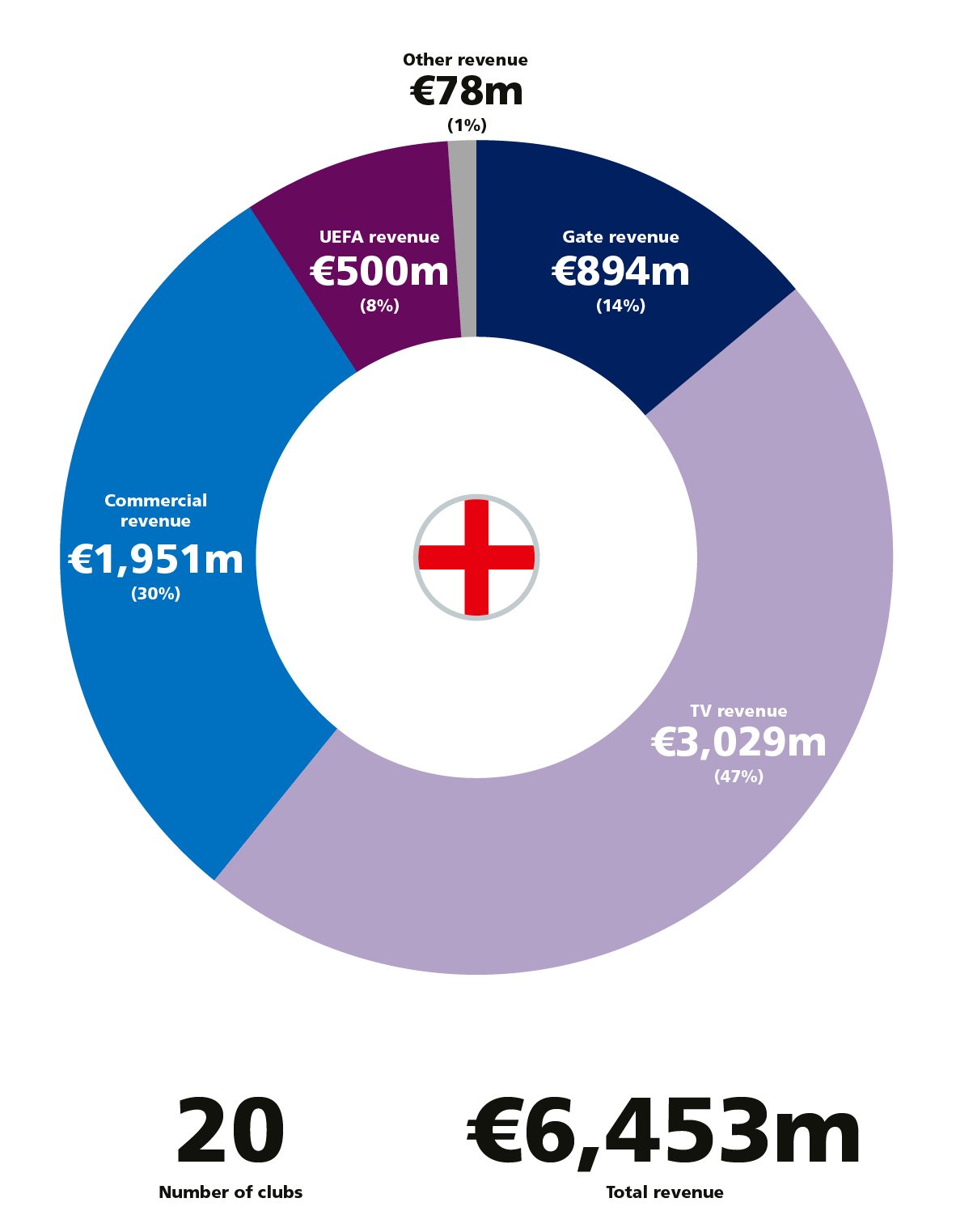

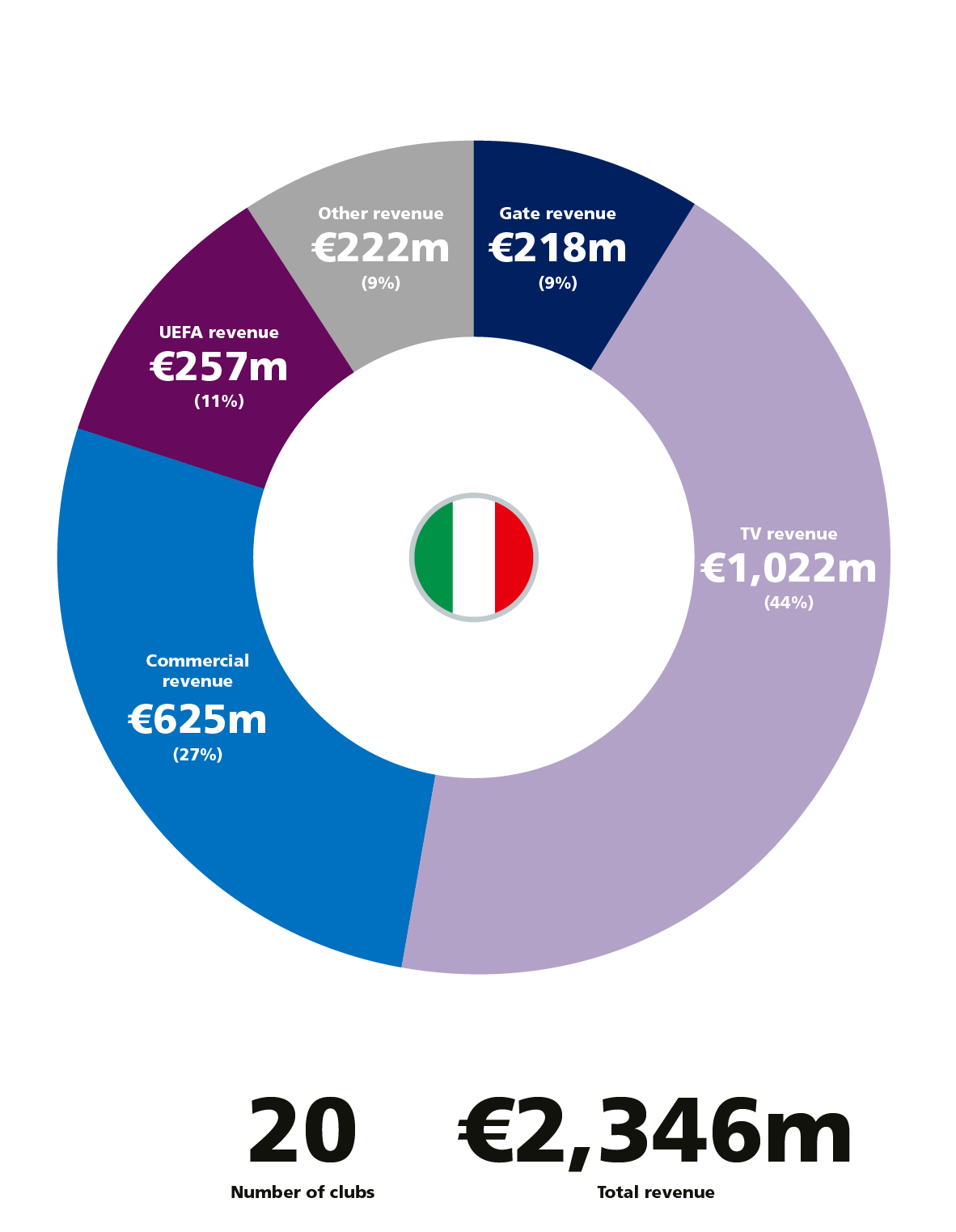

Top division club revenues reached €24bn in 2022, increasing over €10bn in the last decade and will push further beyond €26bn in 2023.

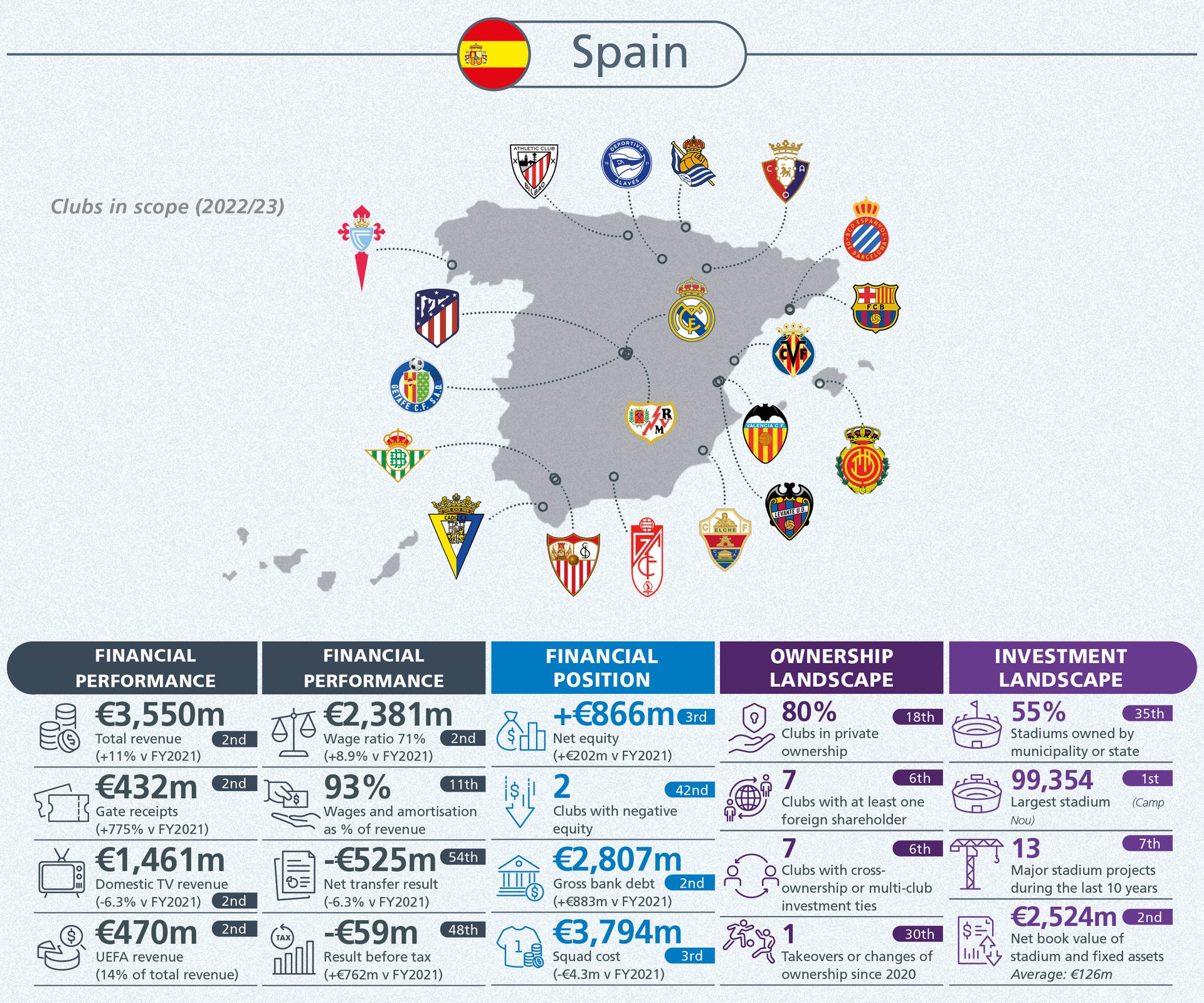

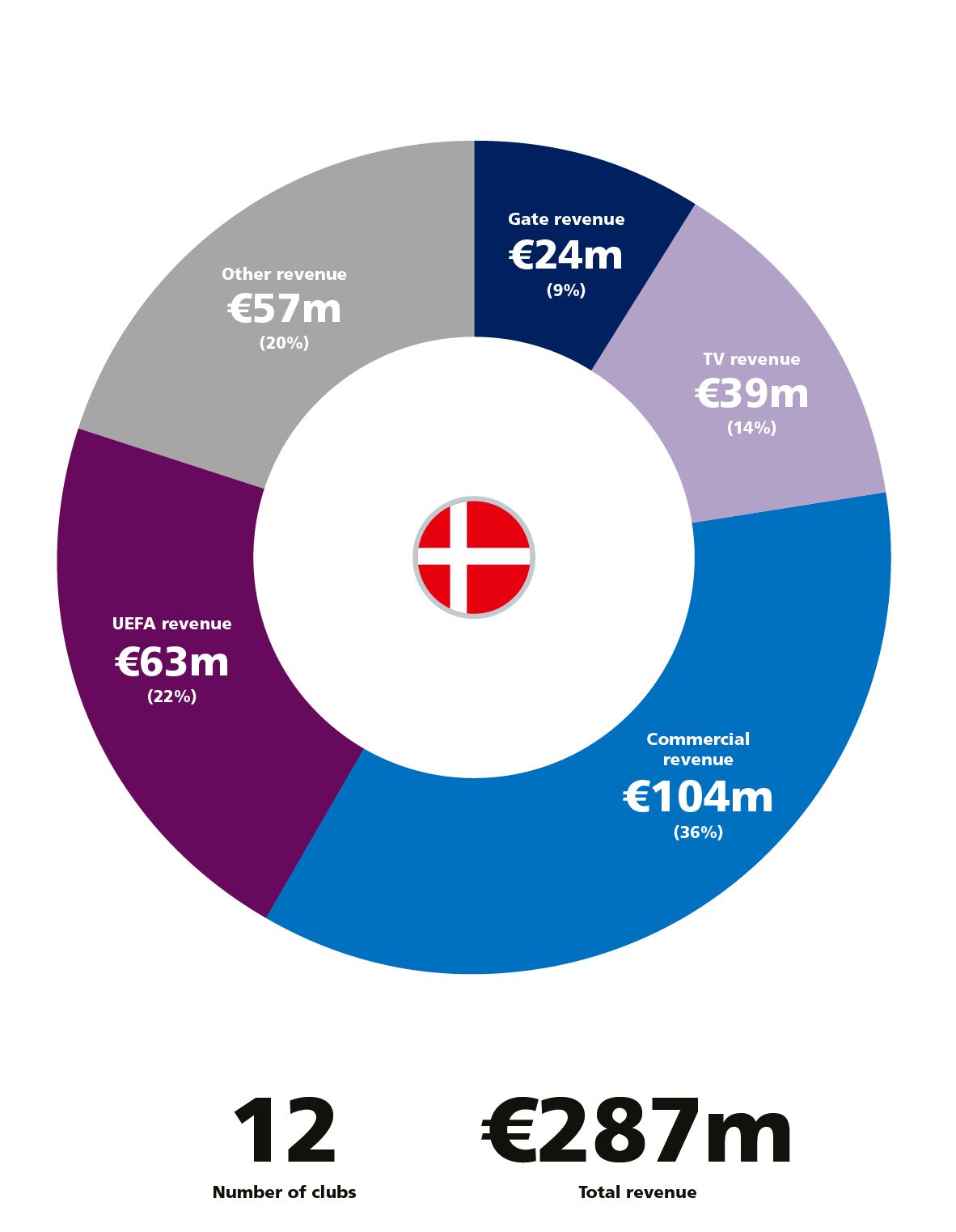

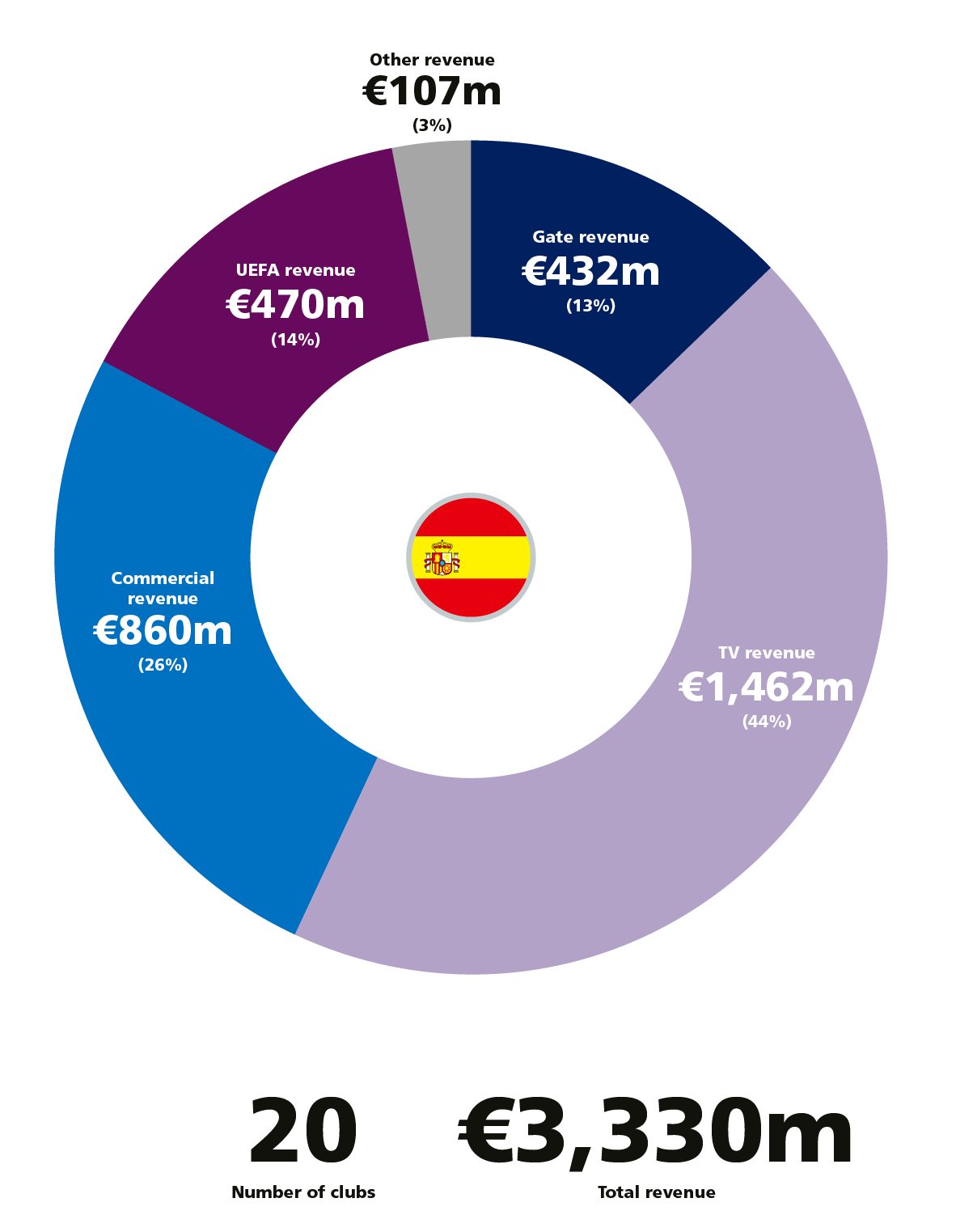

Revenue levels between countries and within countries remain large. The report explains how TV revenues drive the gap between countries and commercial revenues drive the gaps between clubs.

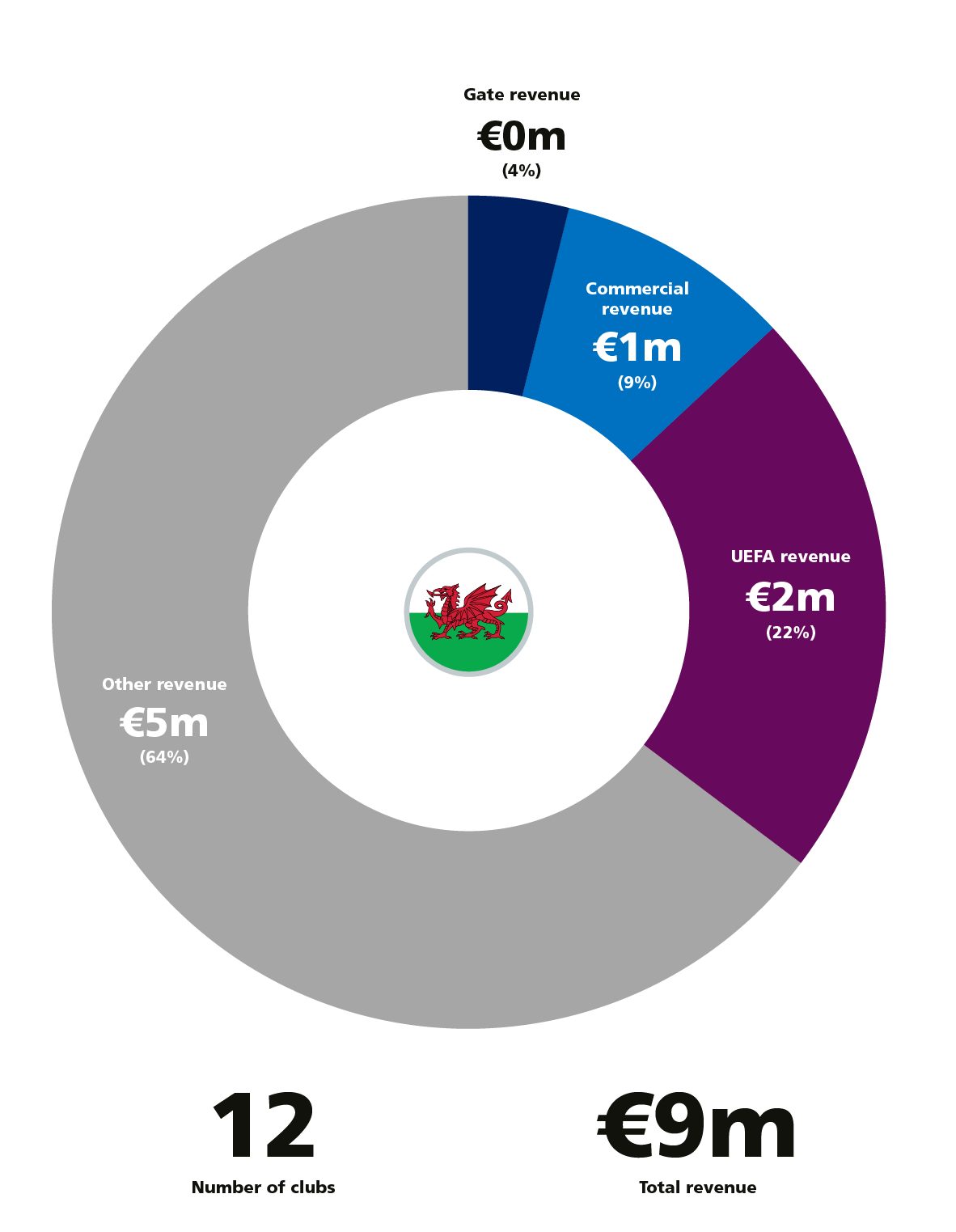

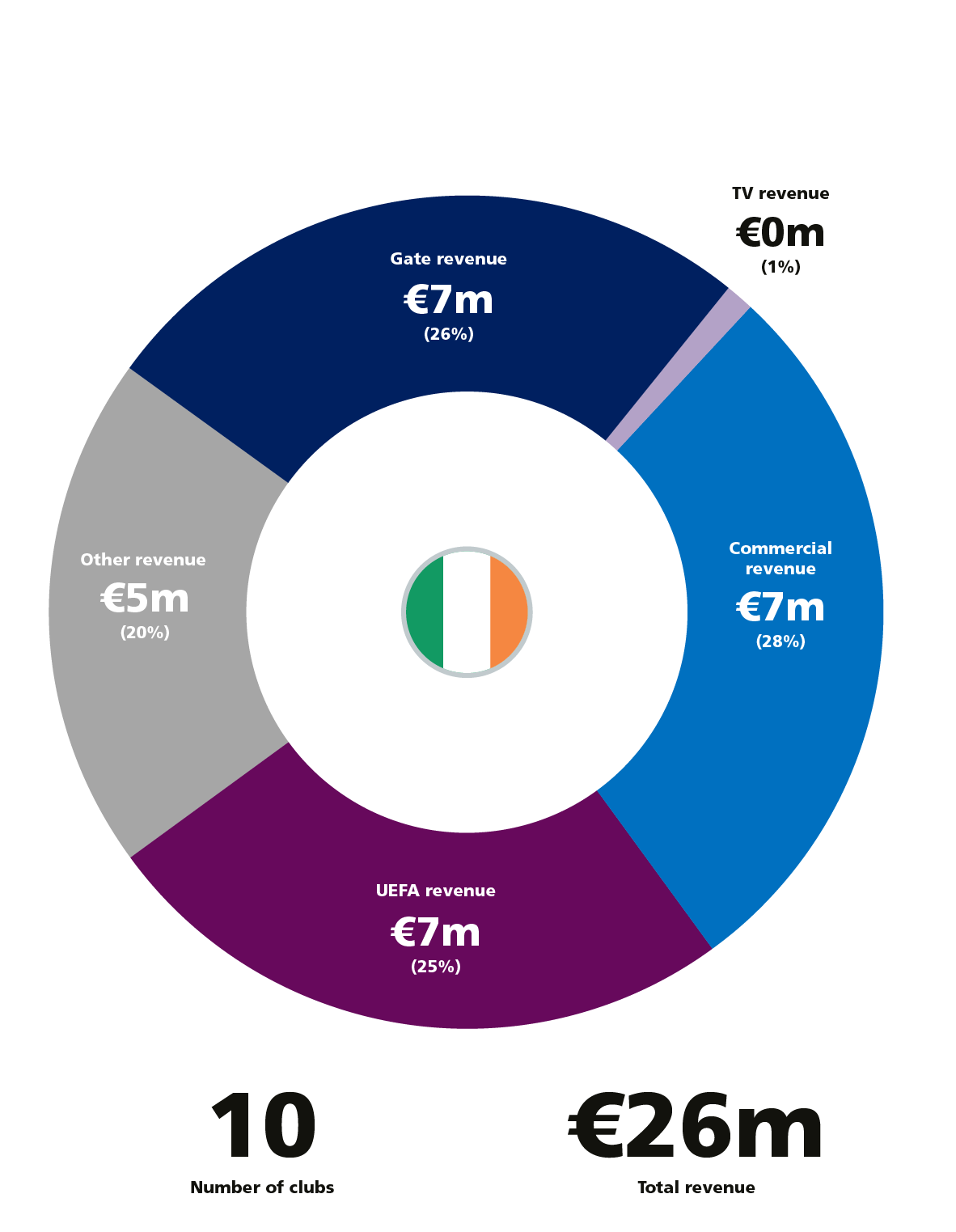

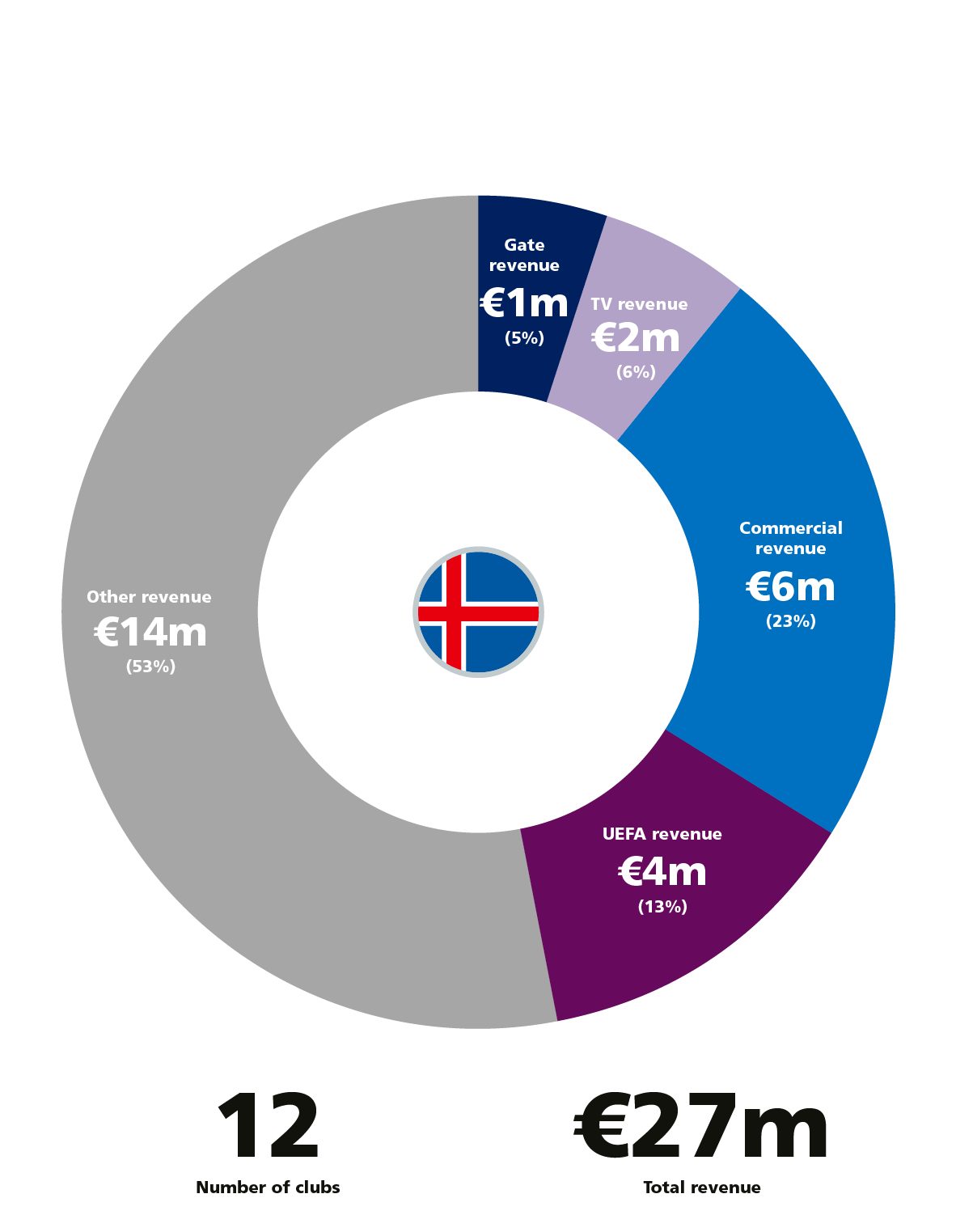

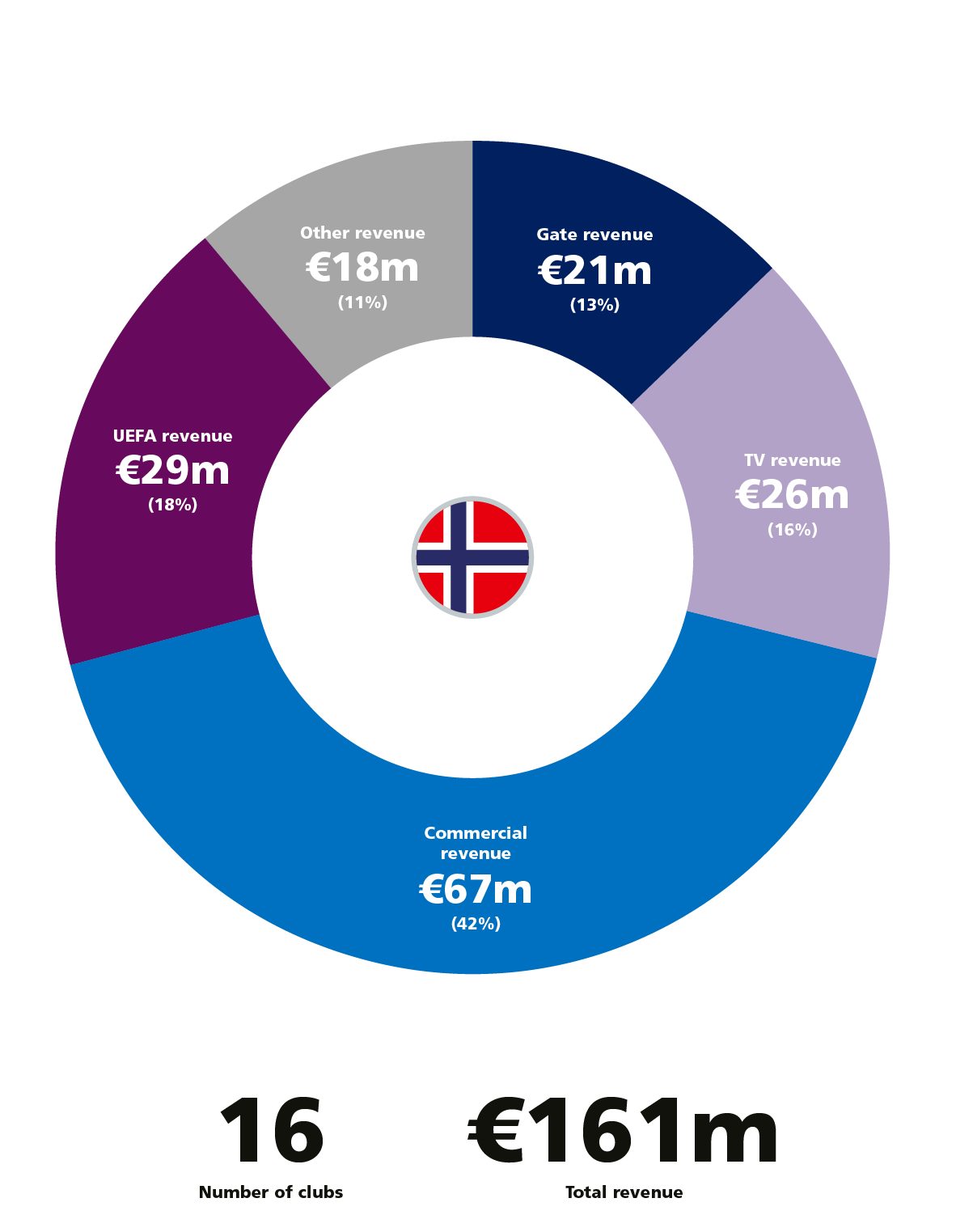

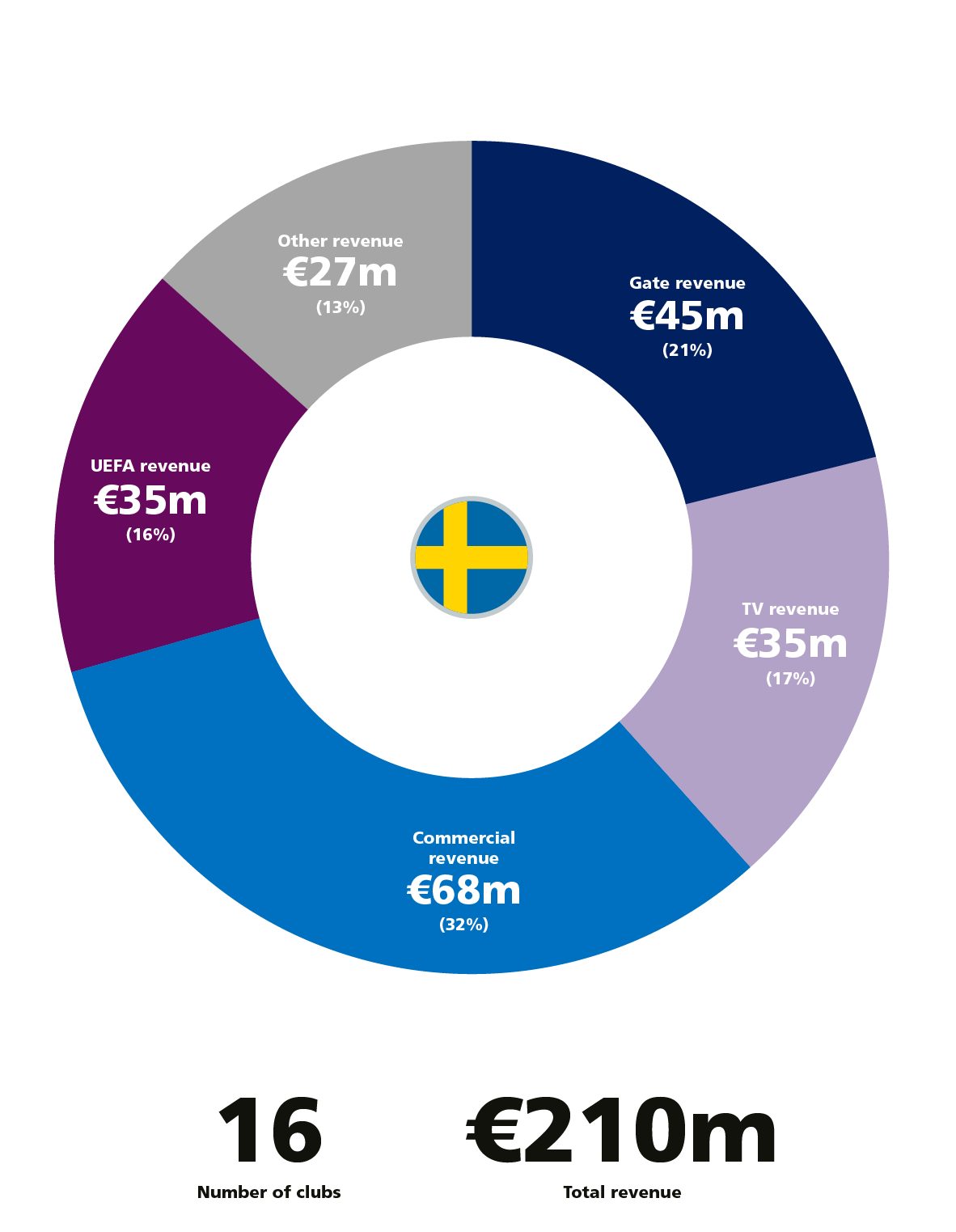

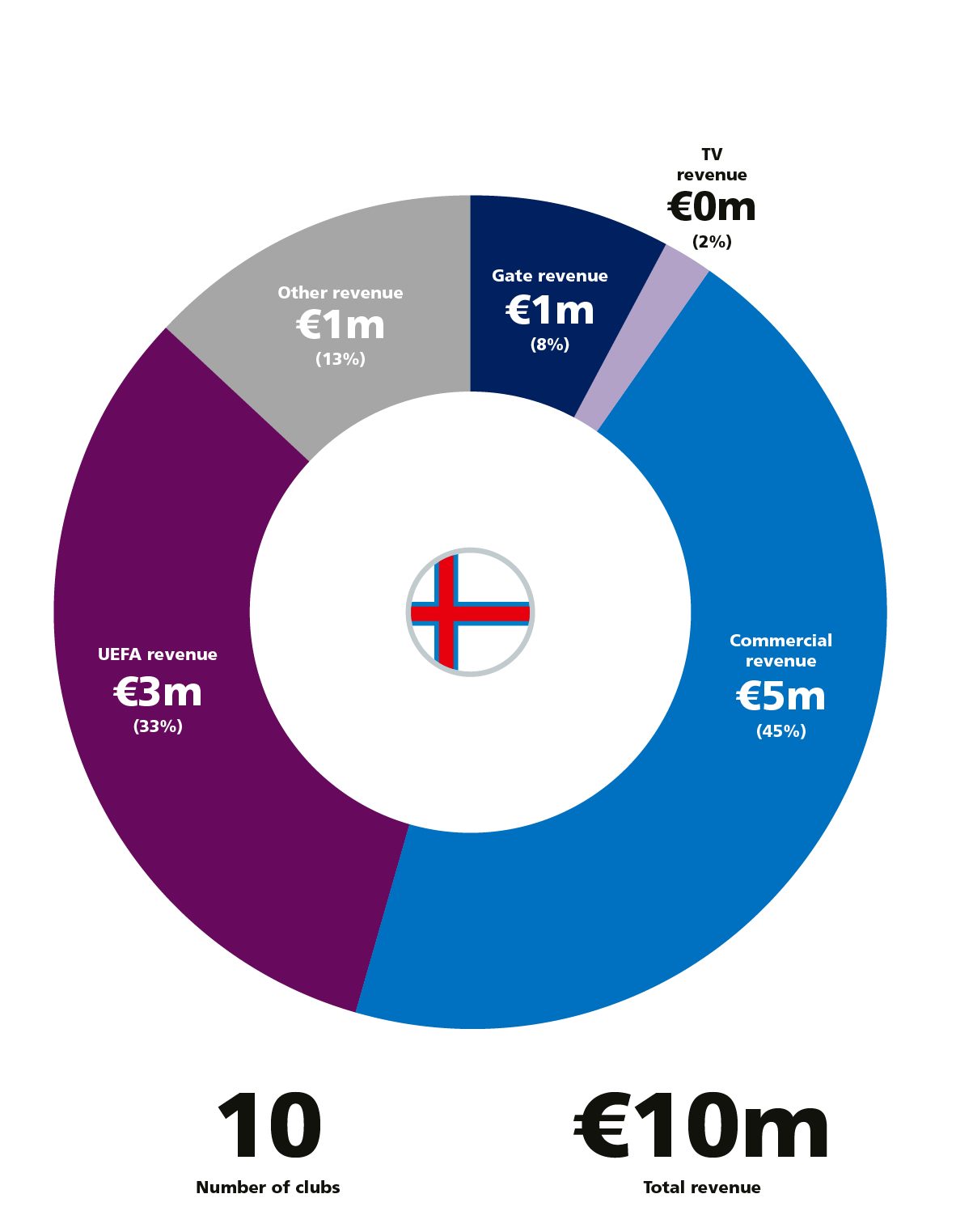

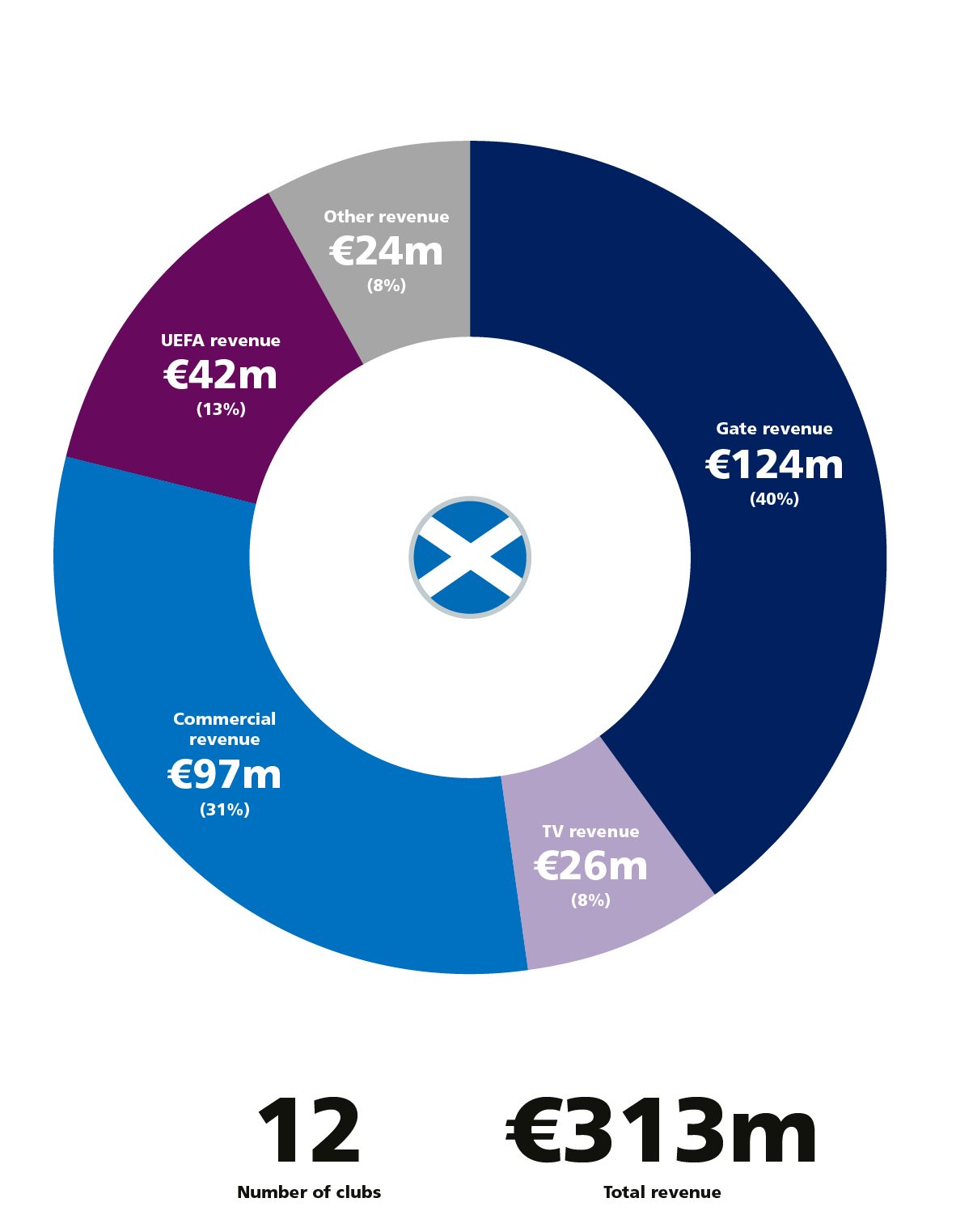

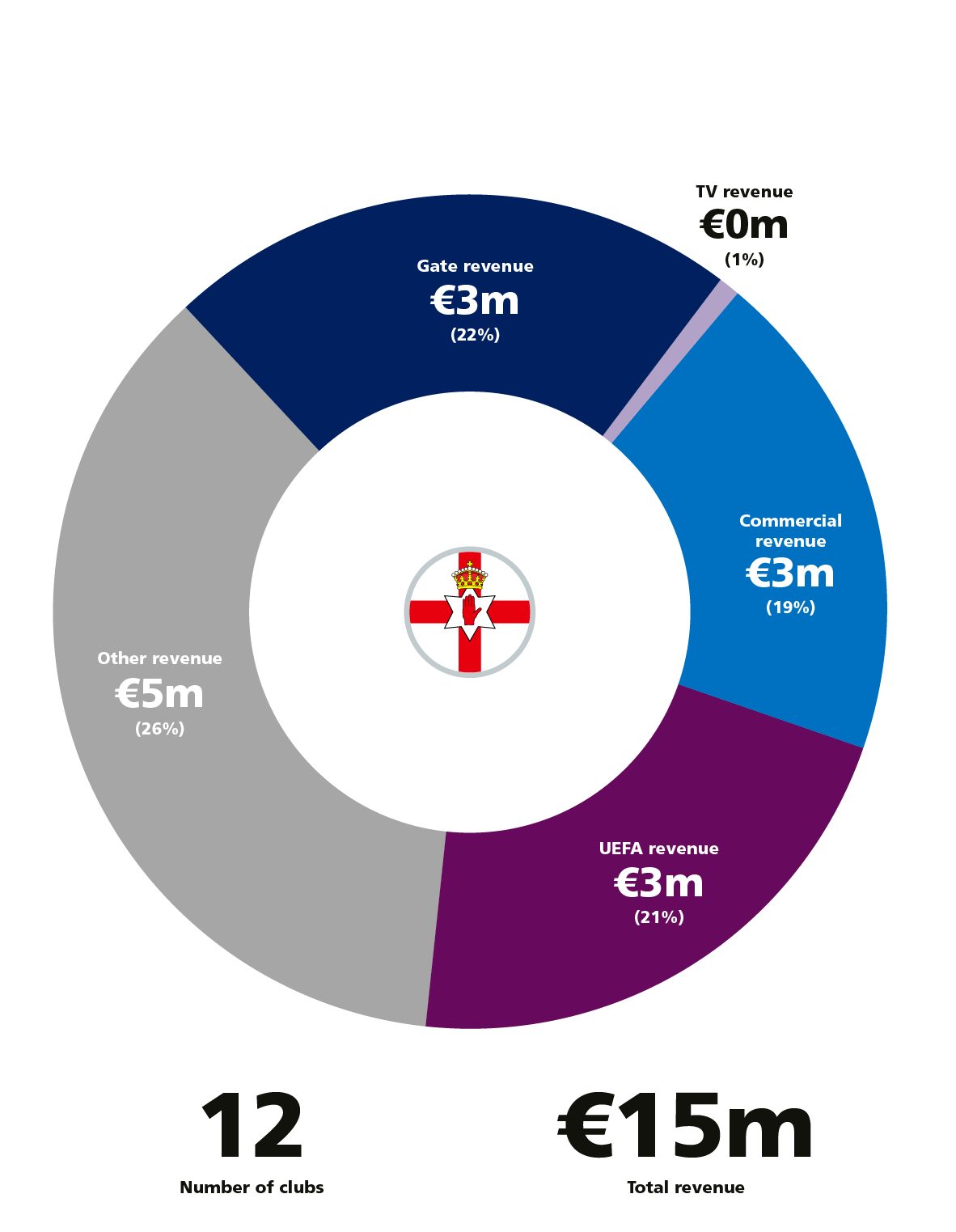

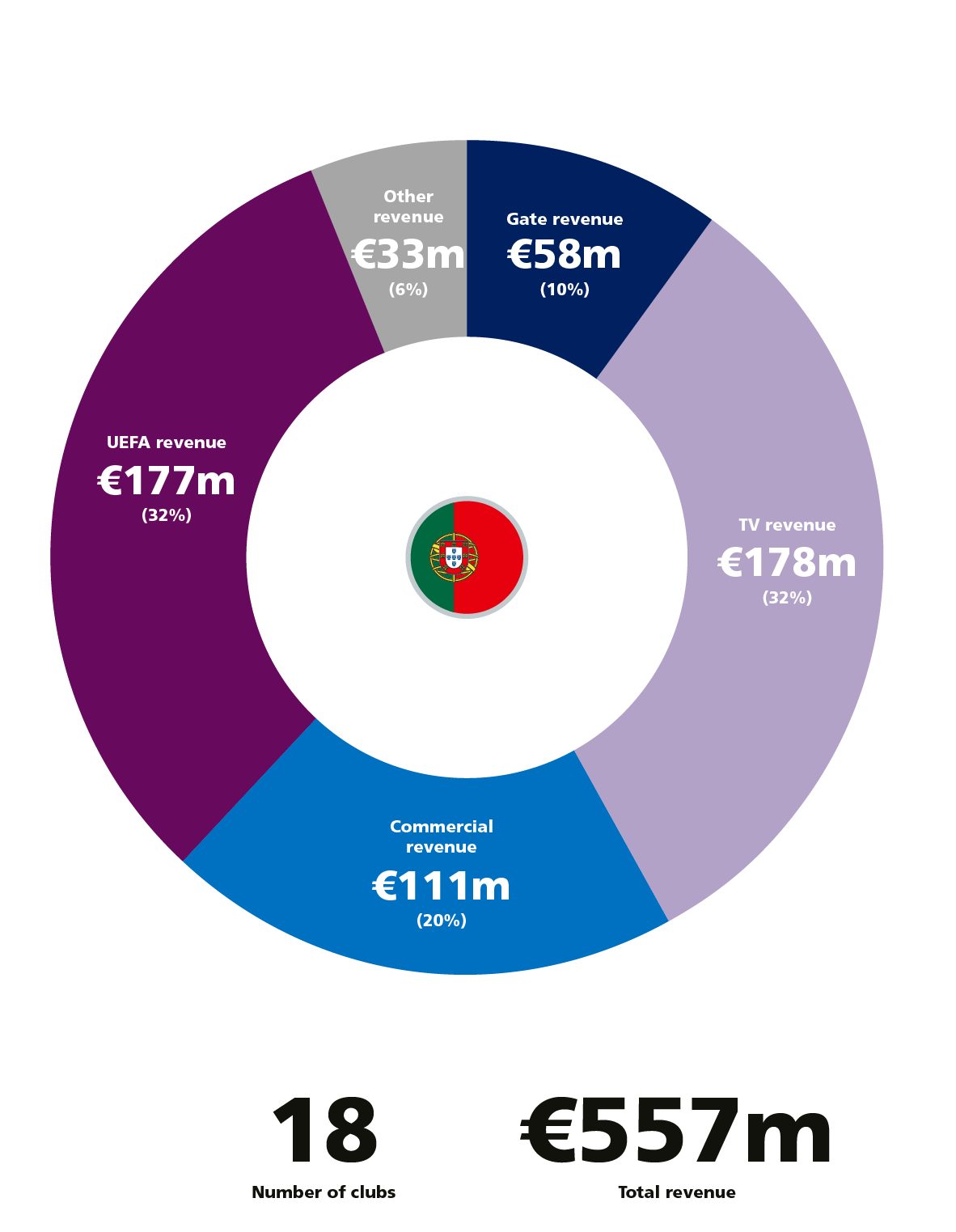

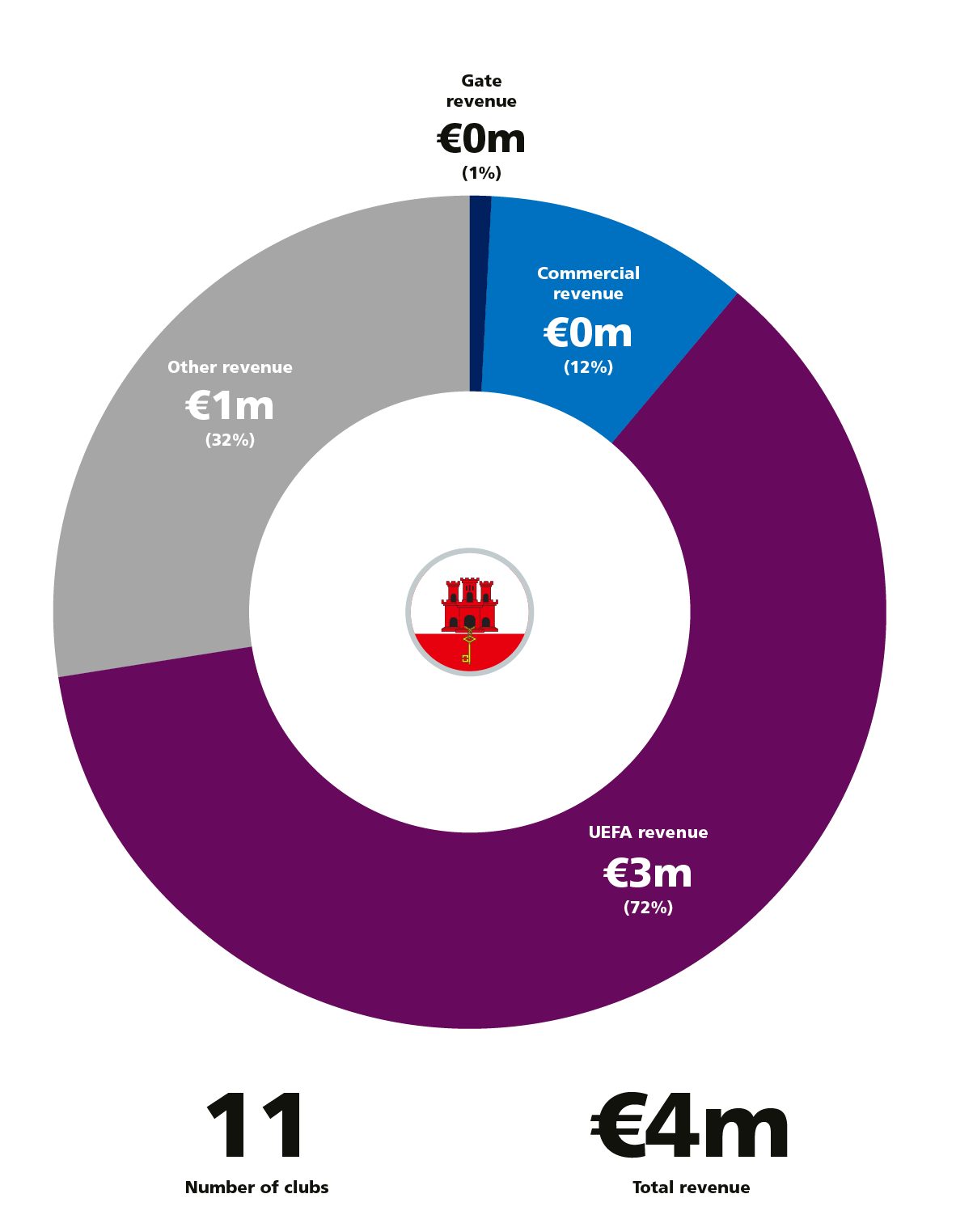

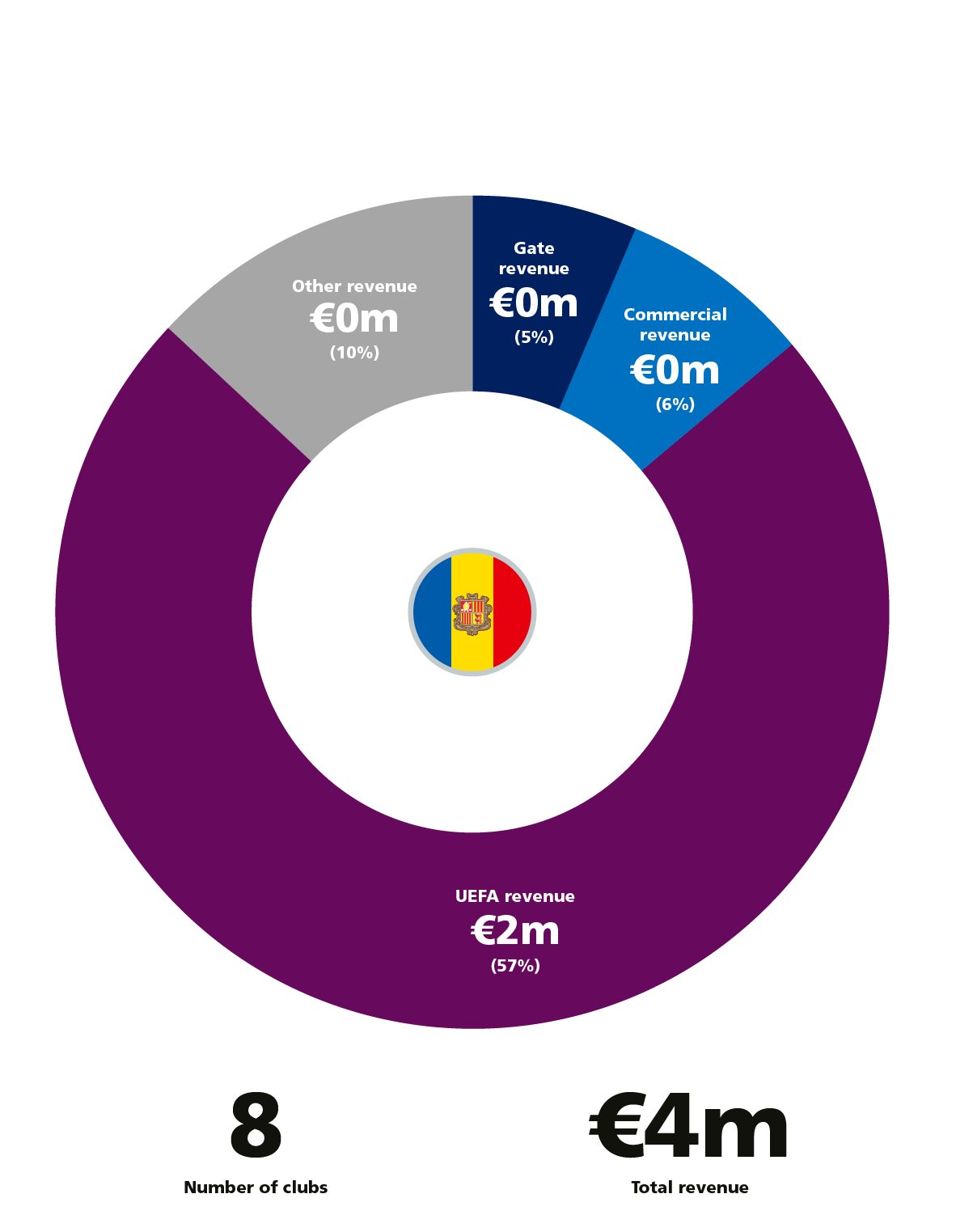

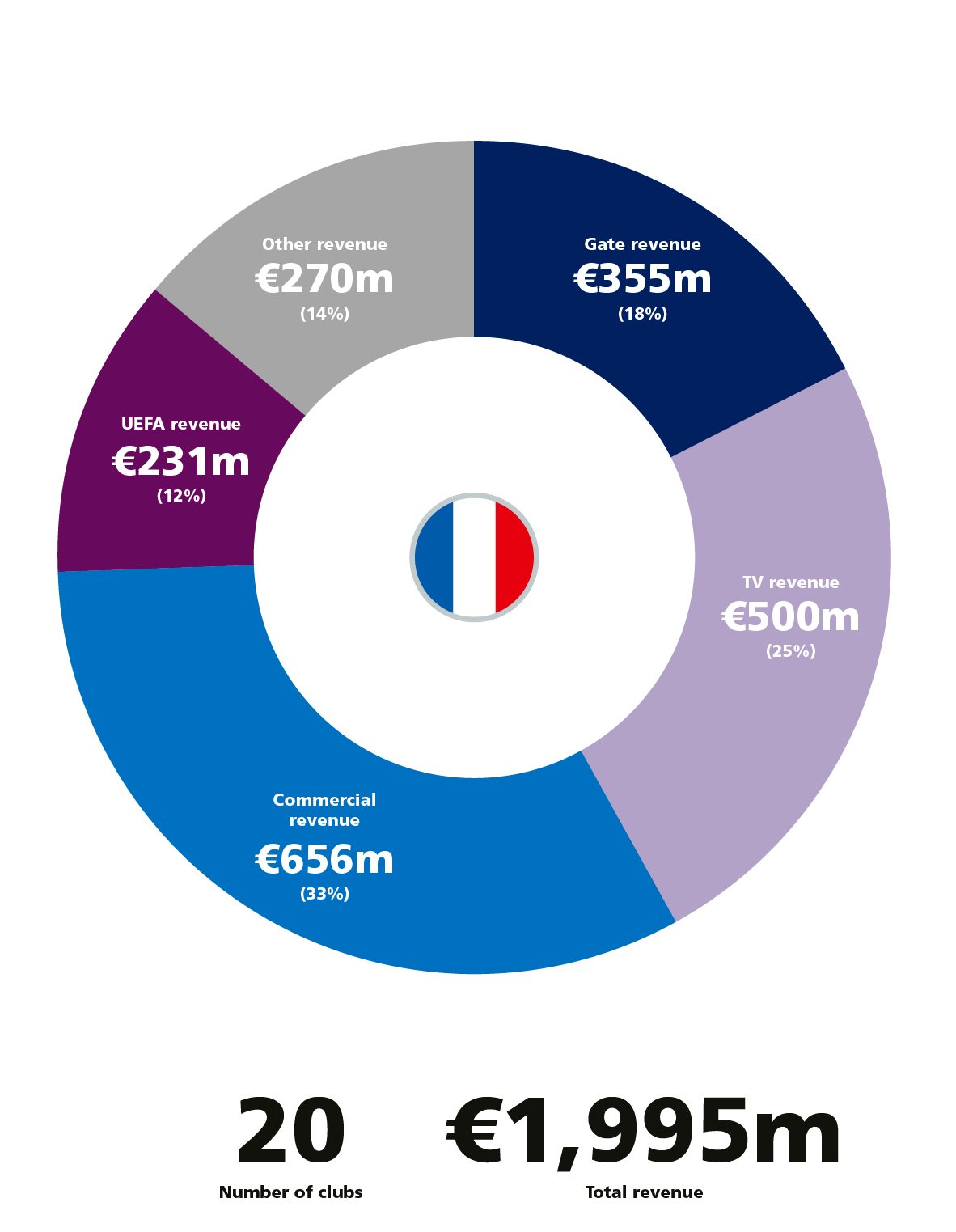

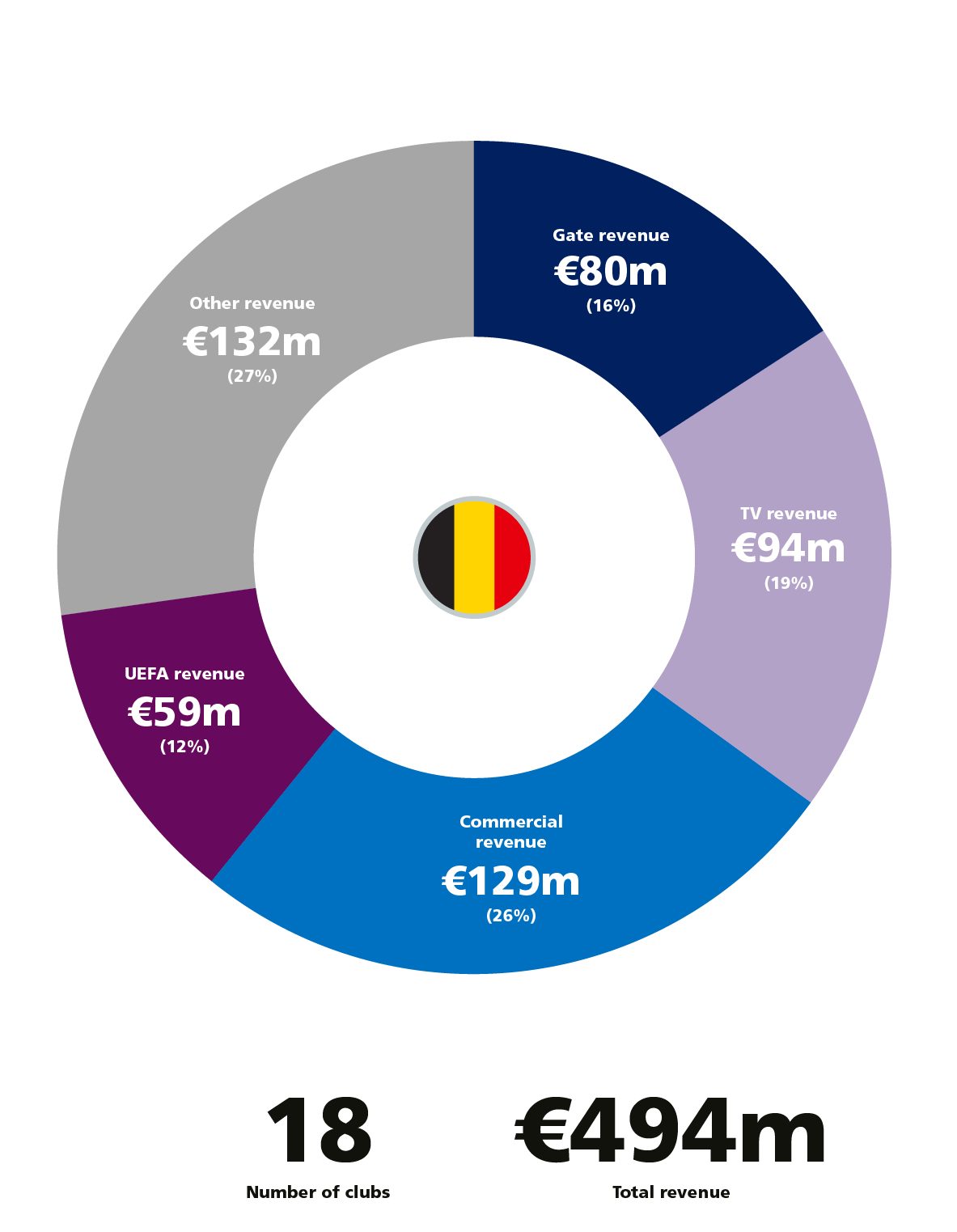

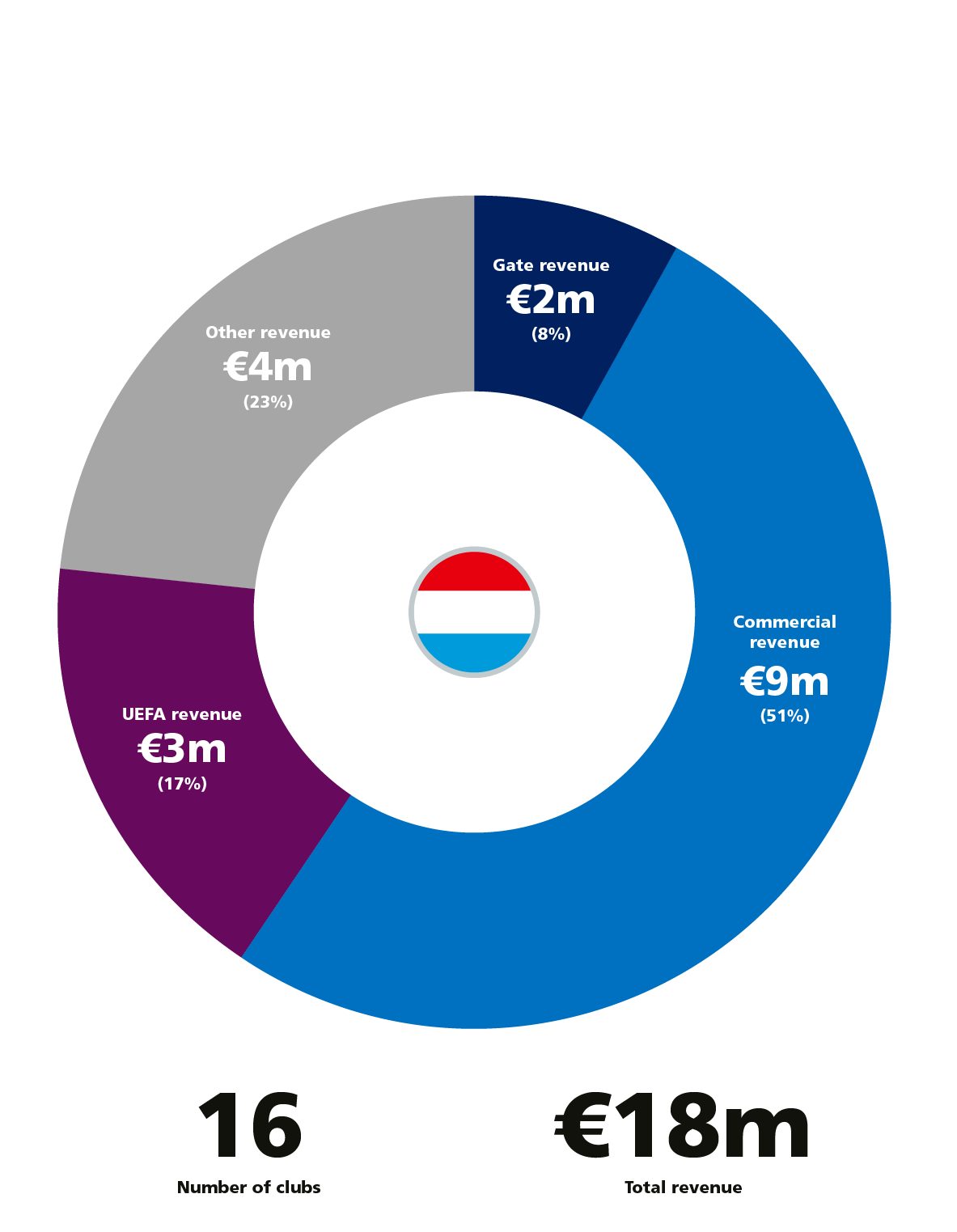

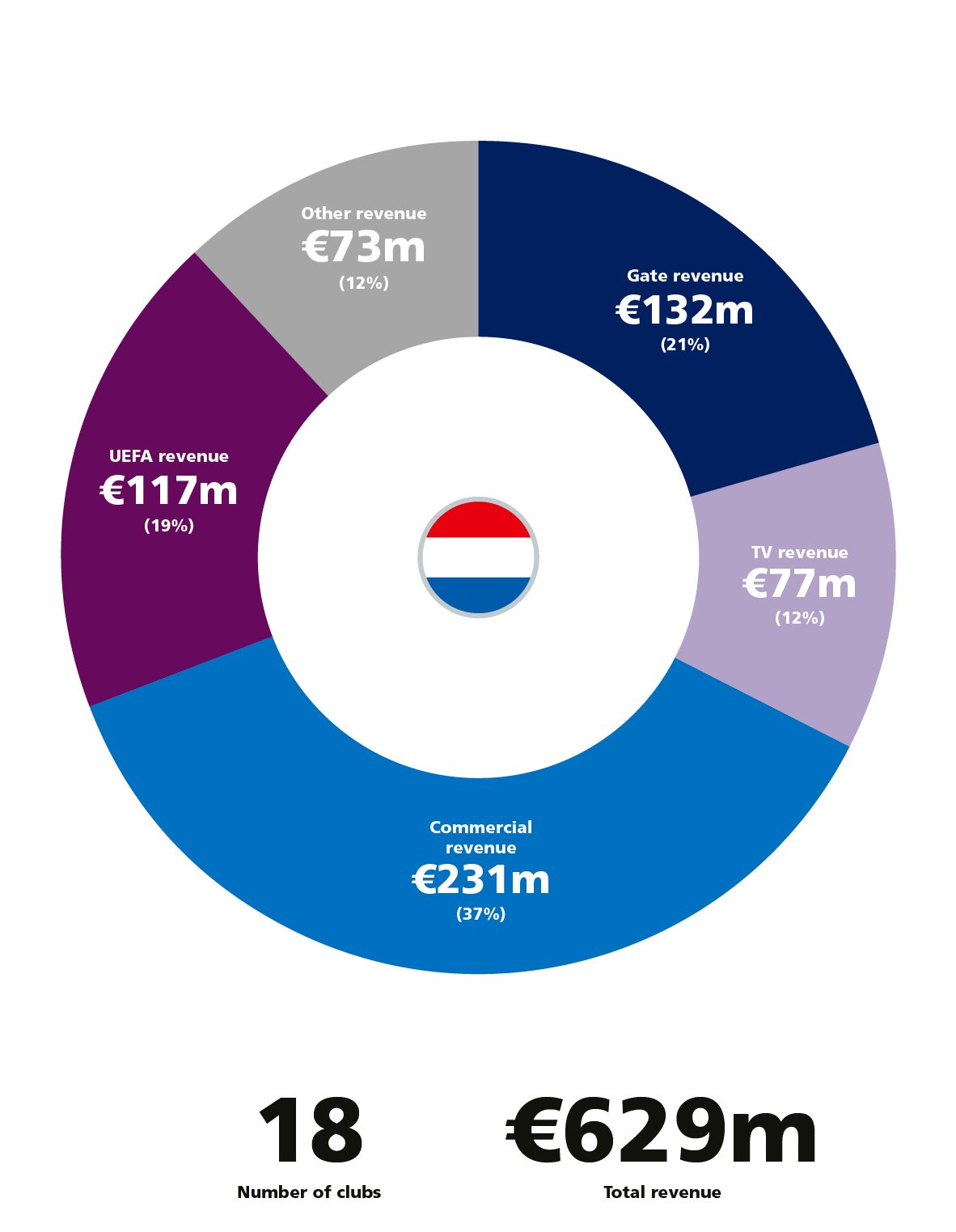

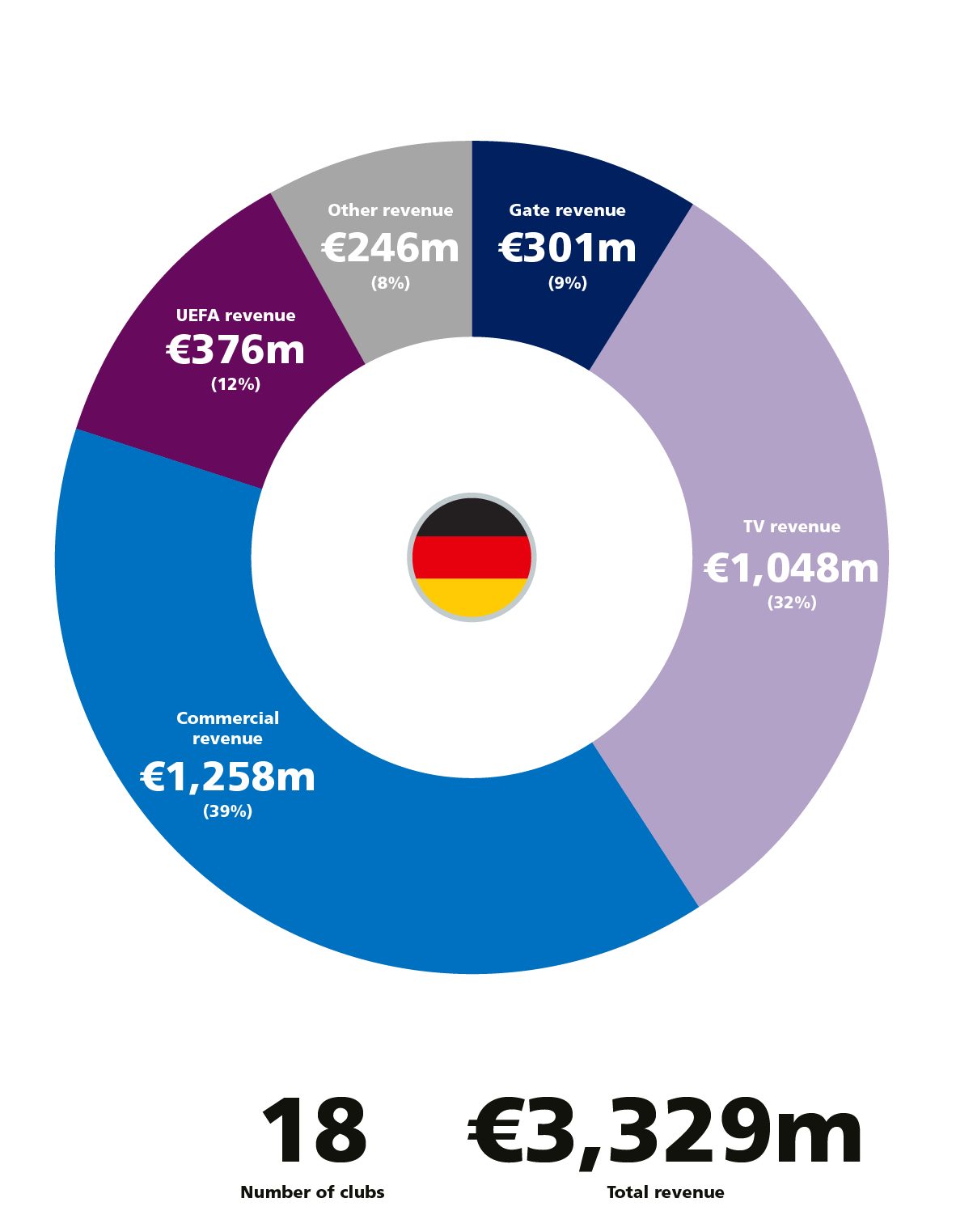

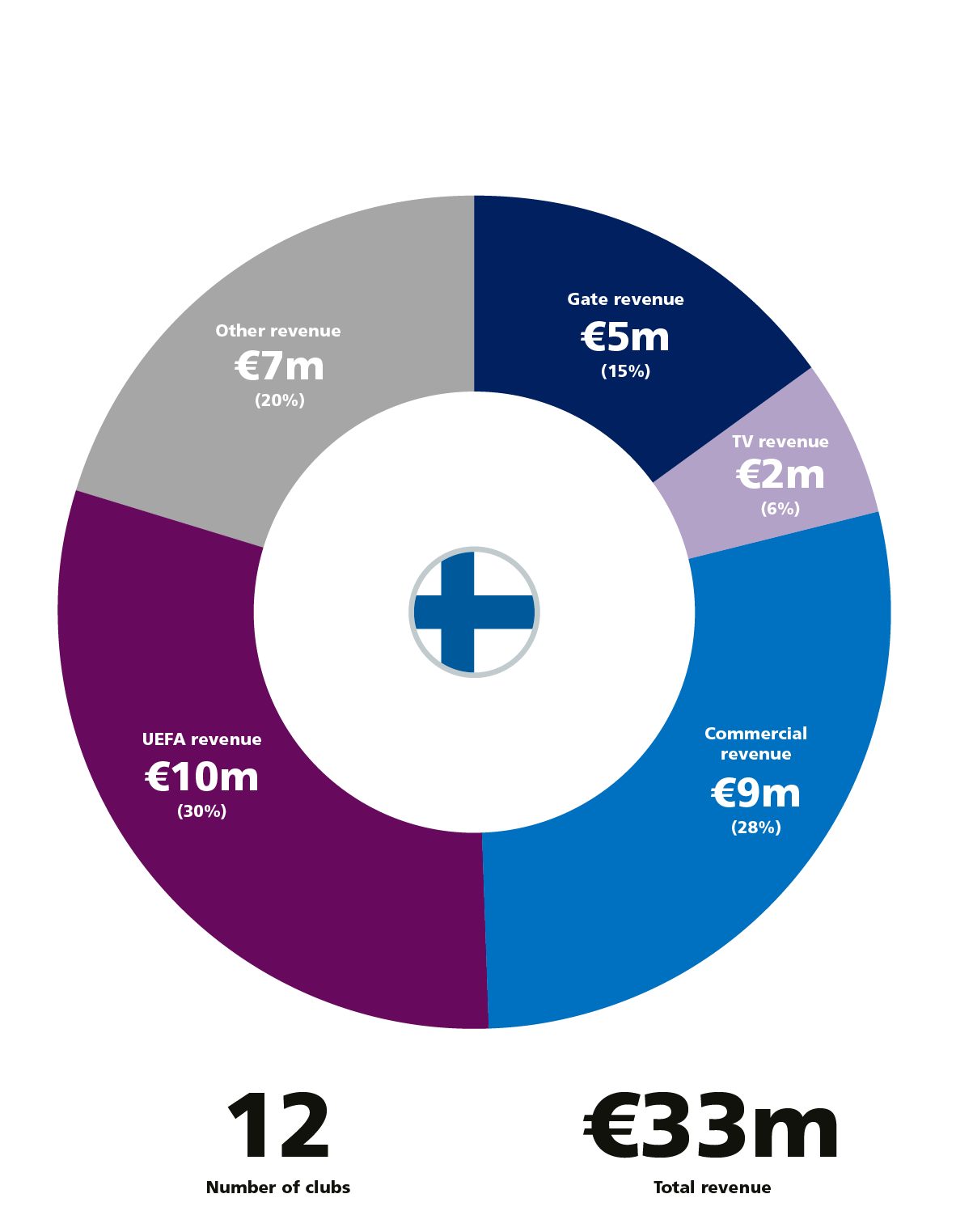

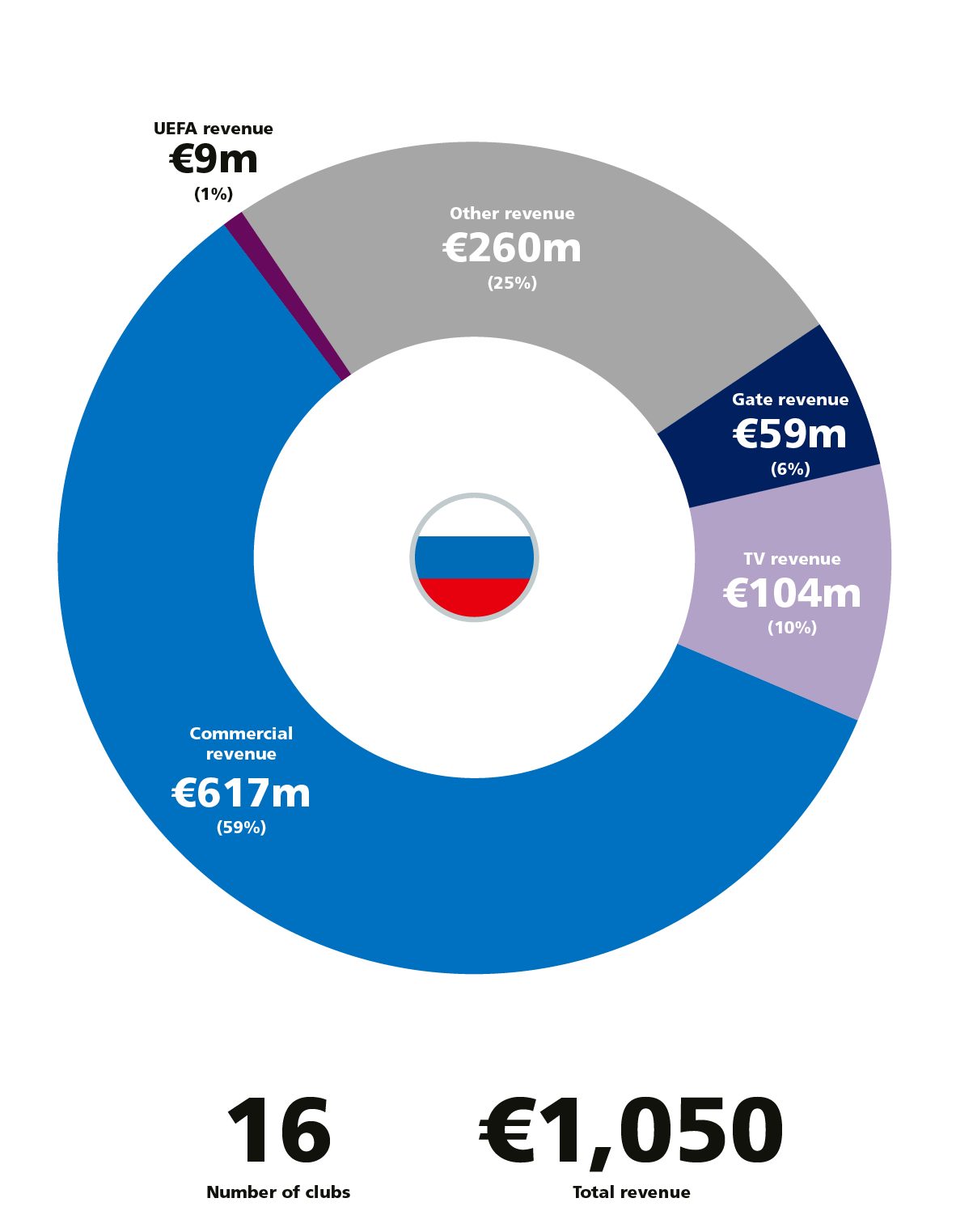

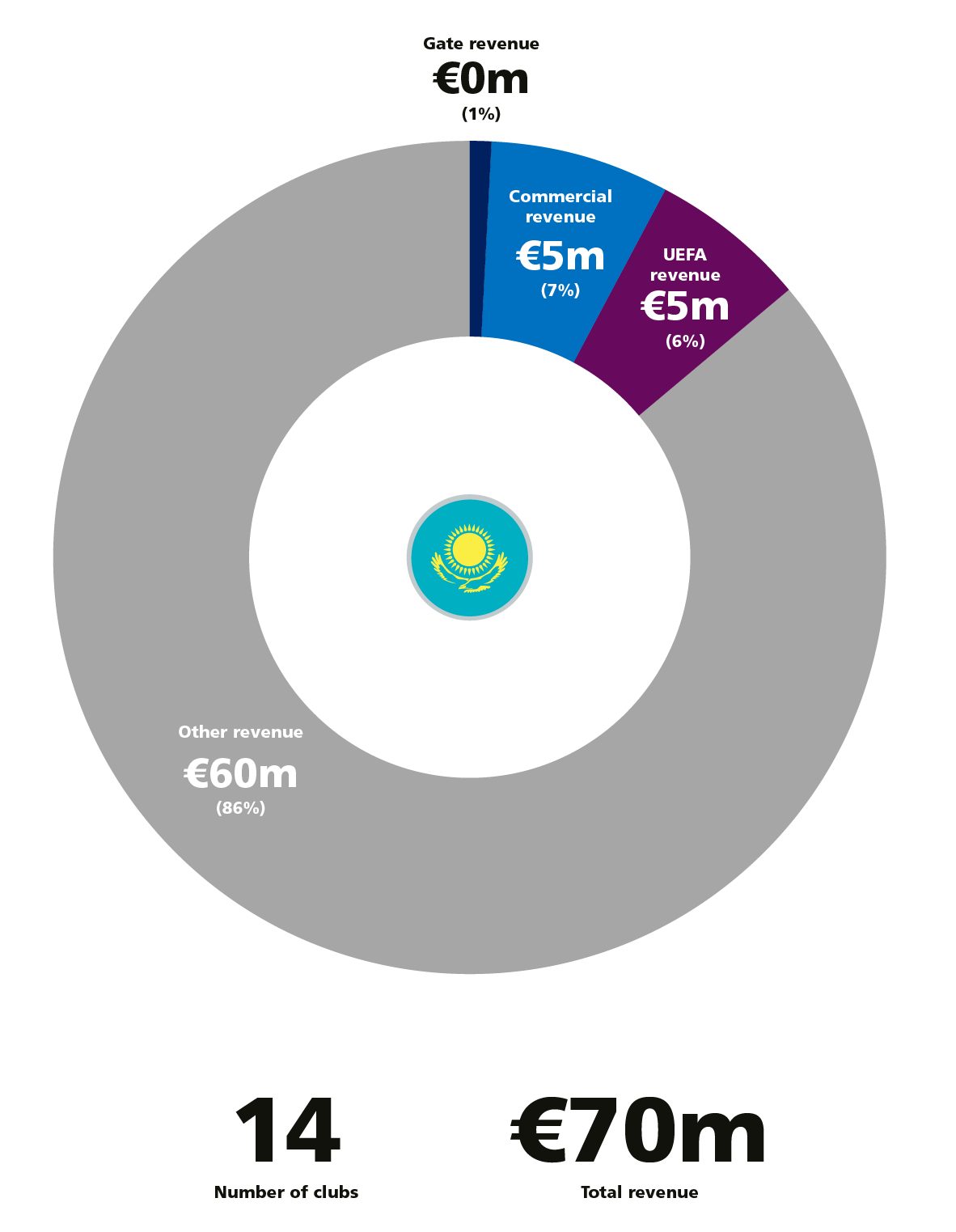

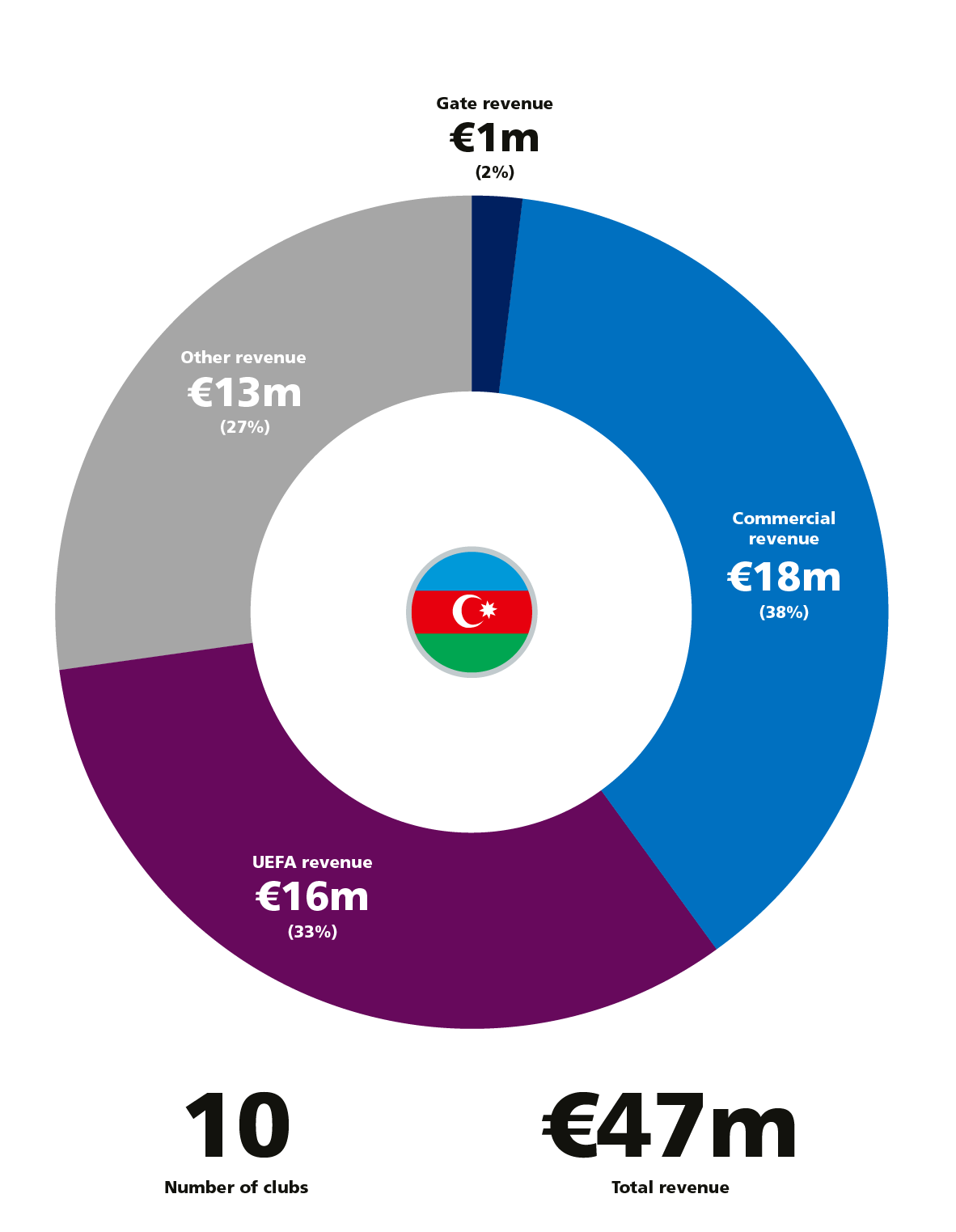

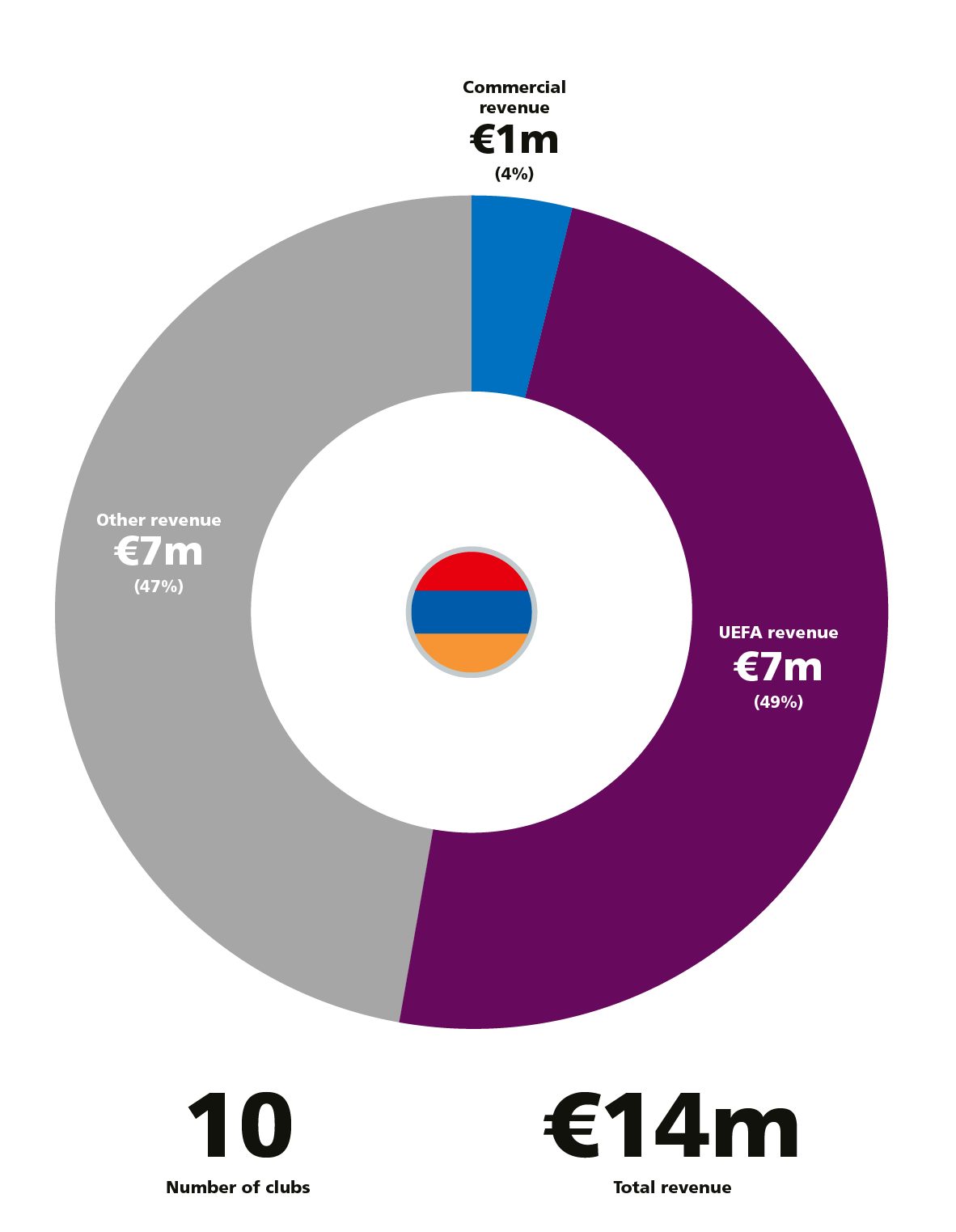

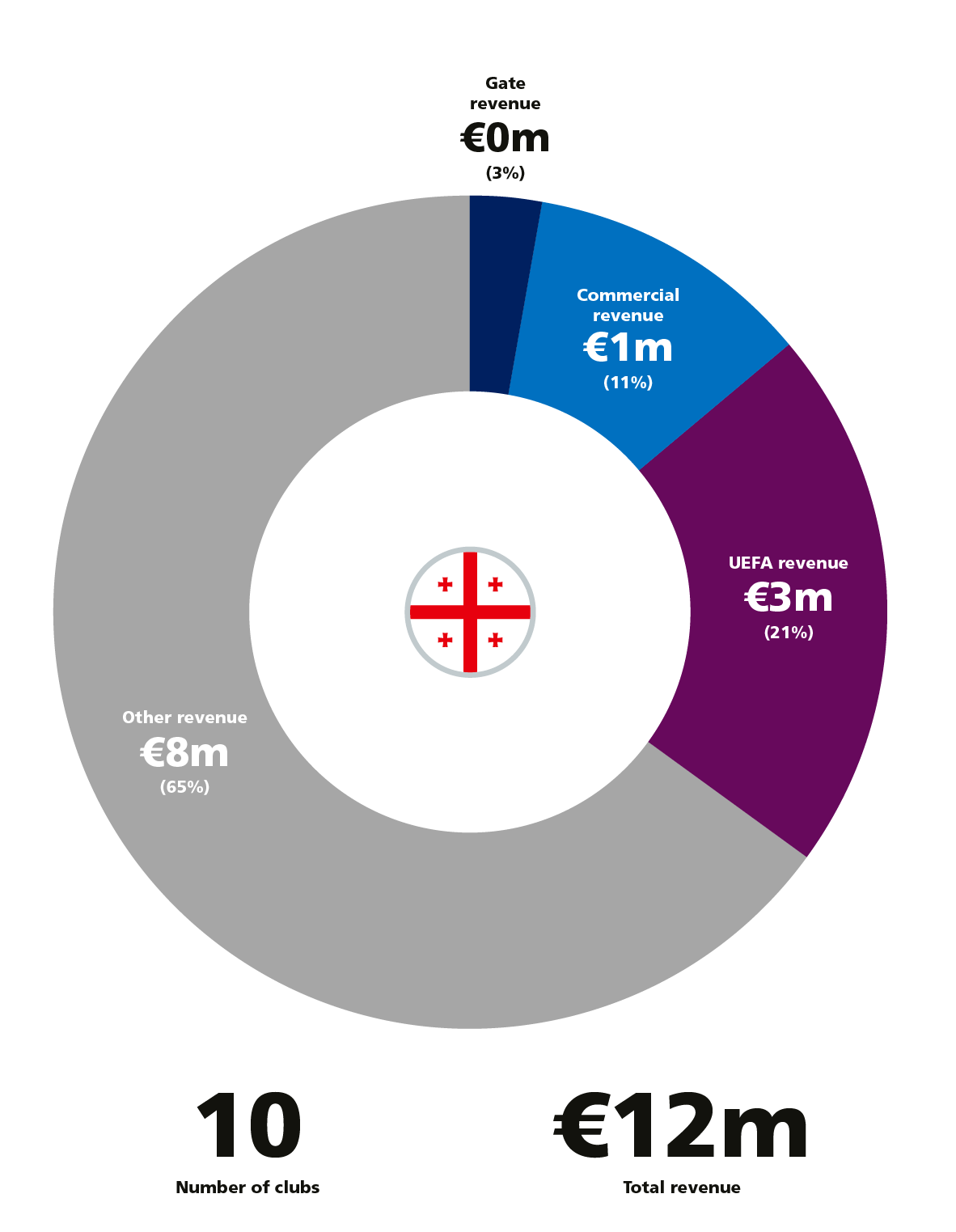

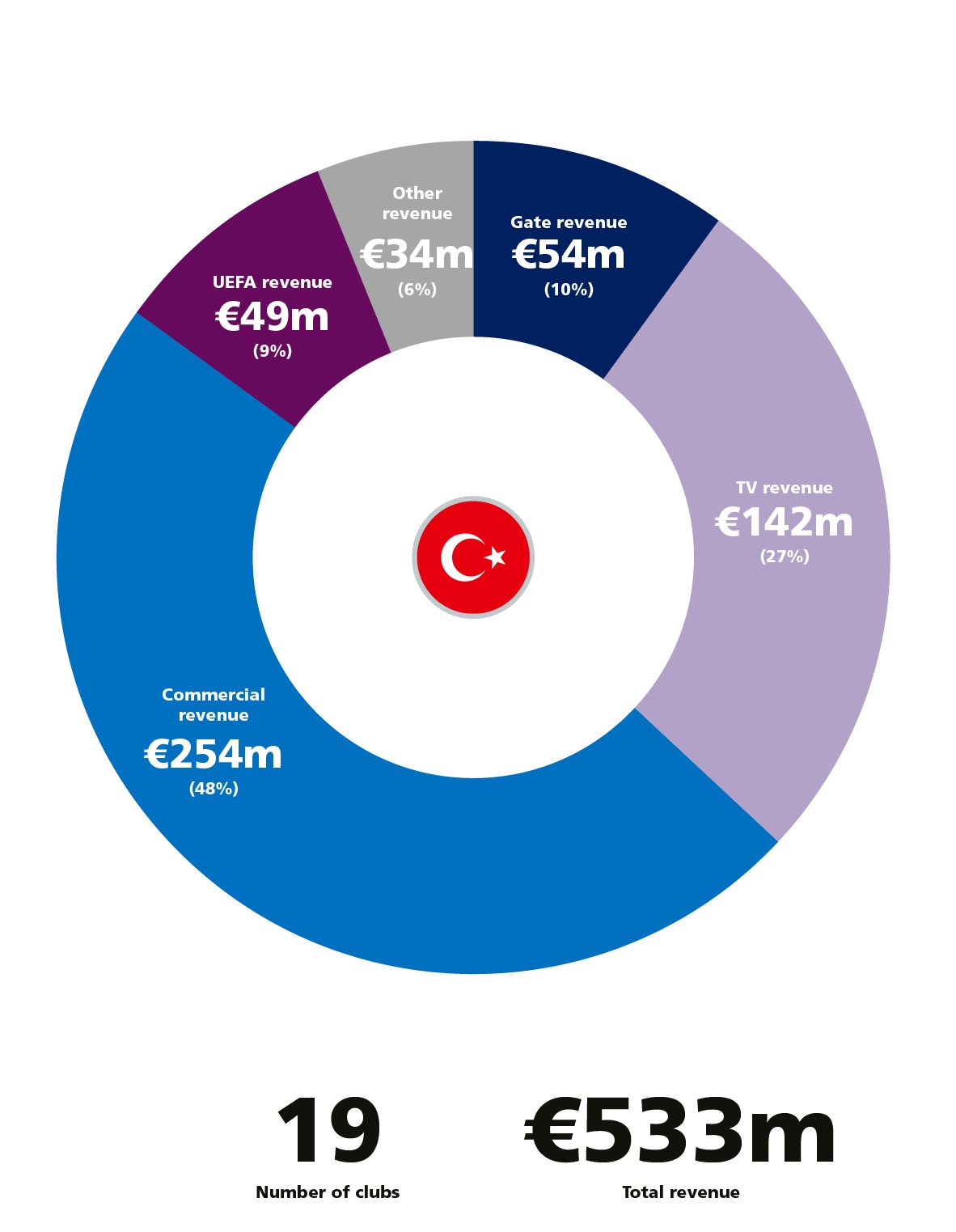

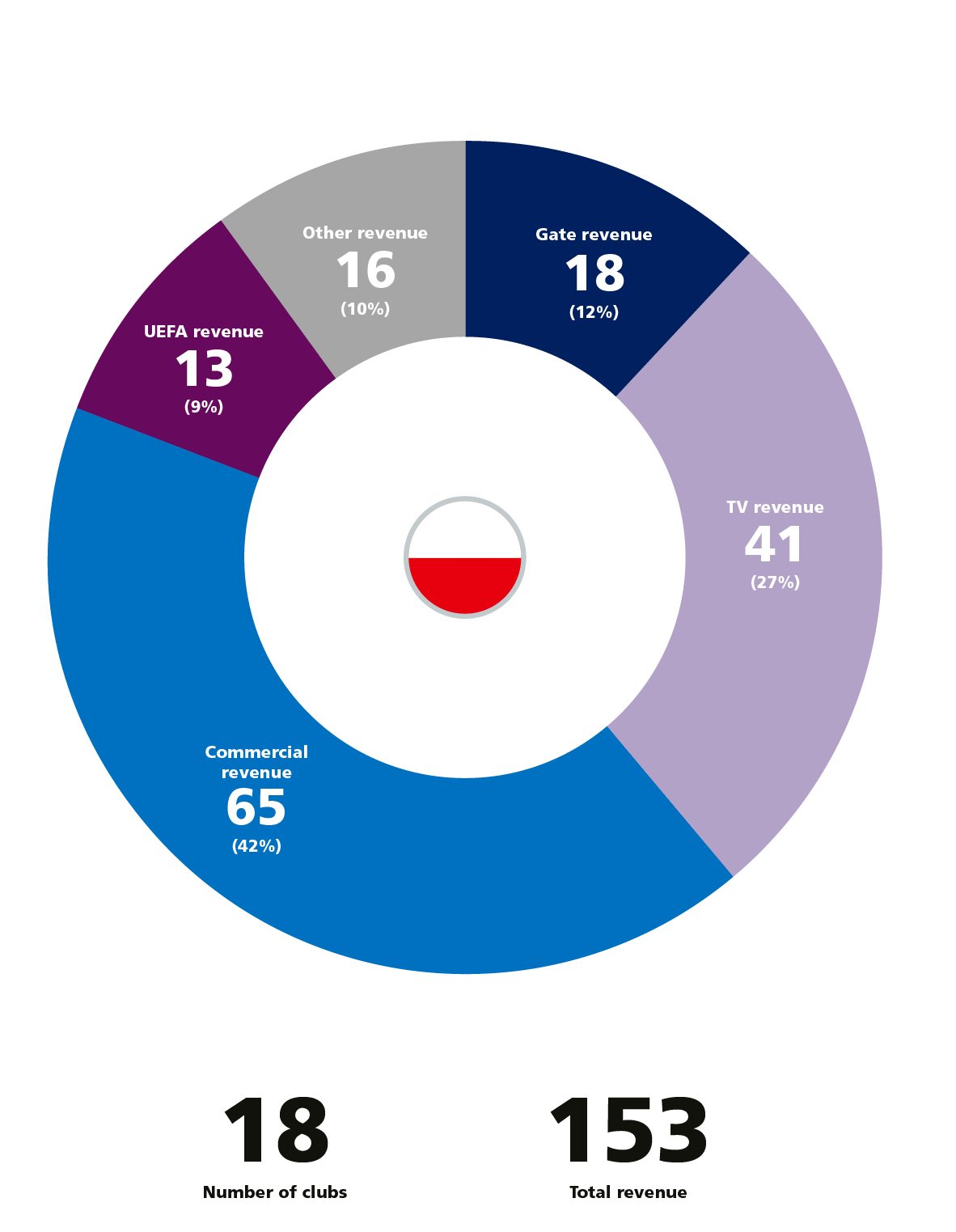

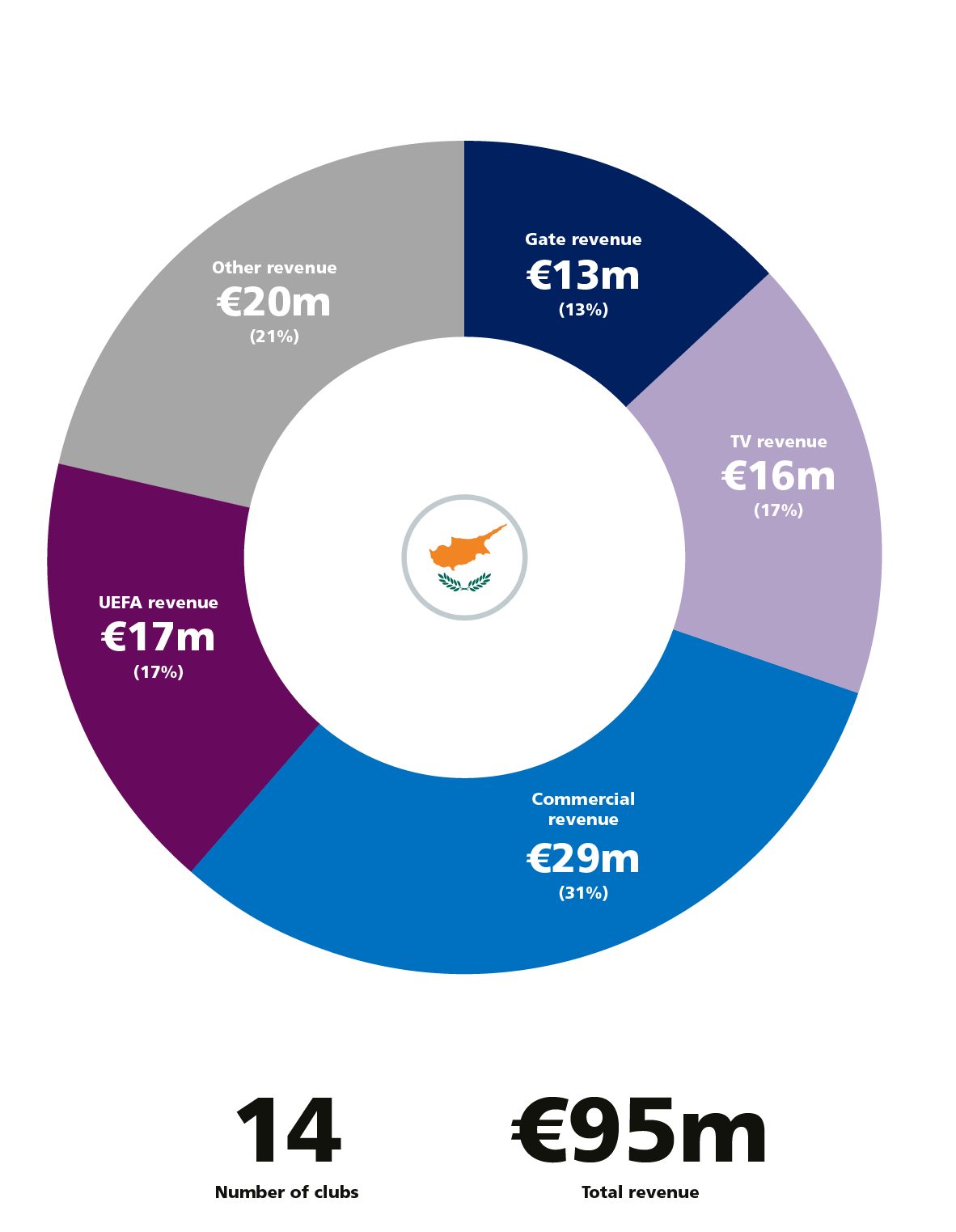

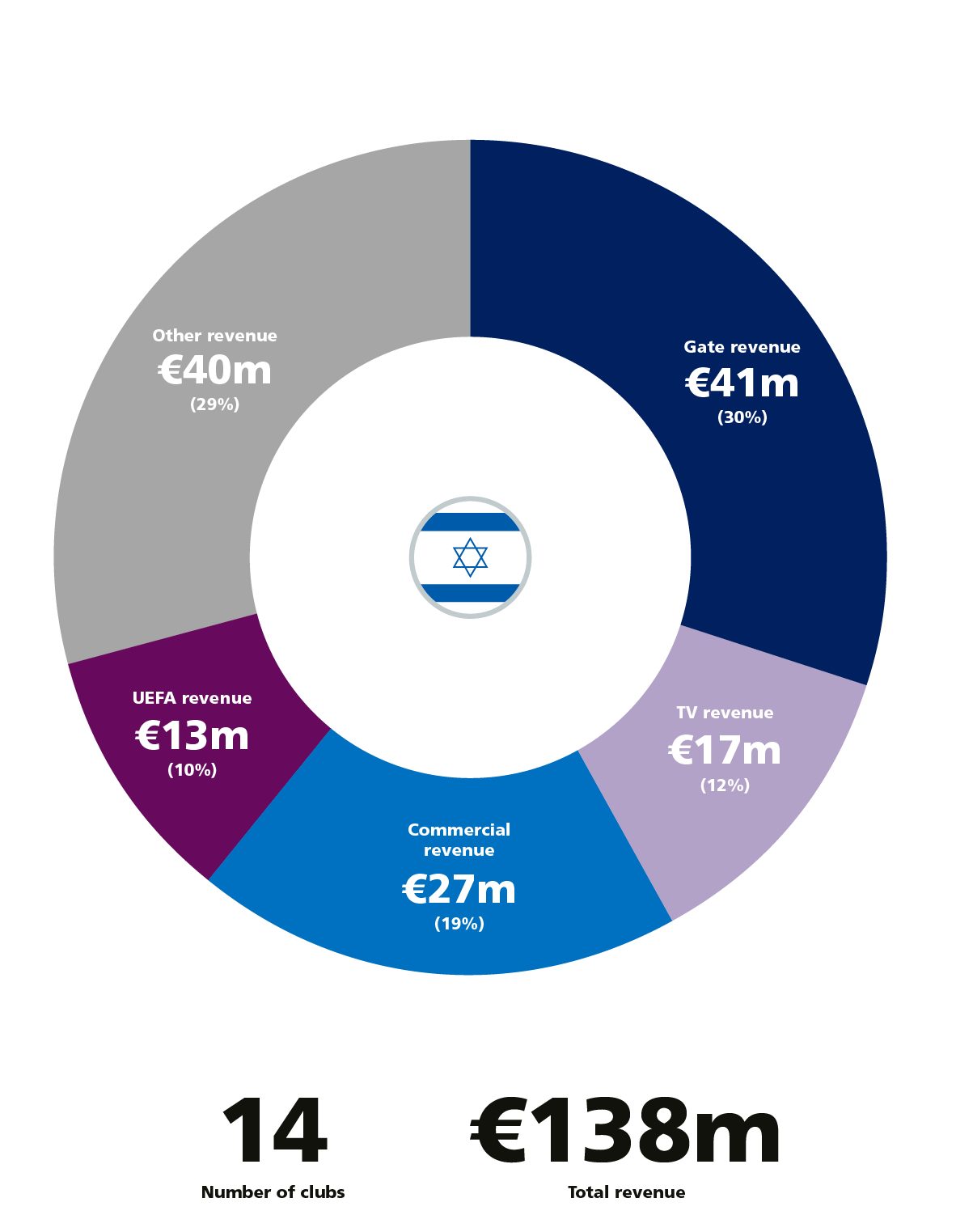

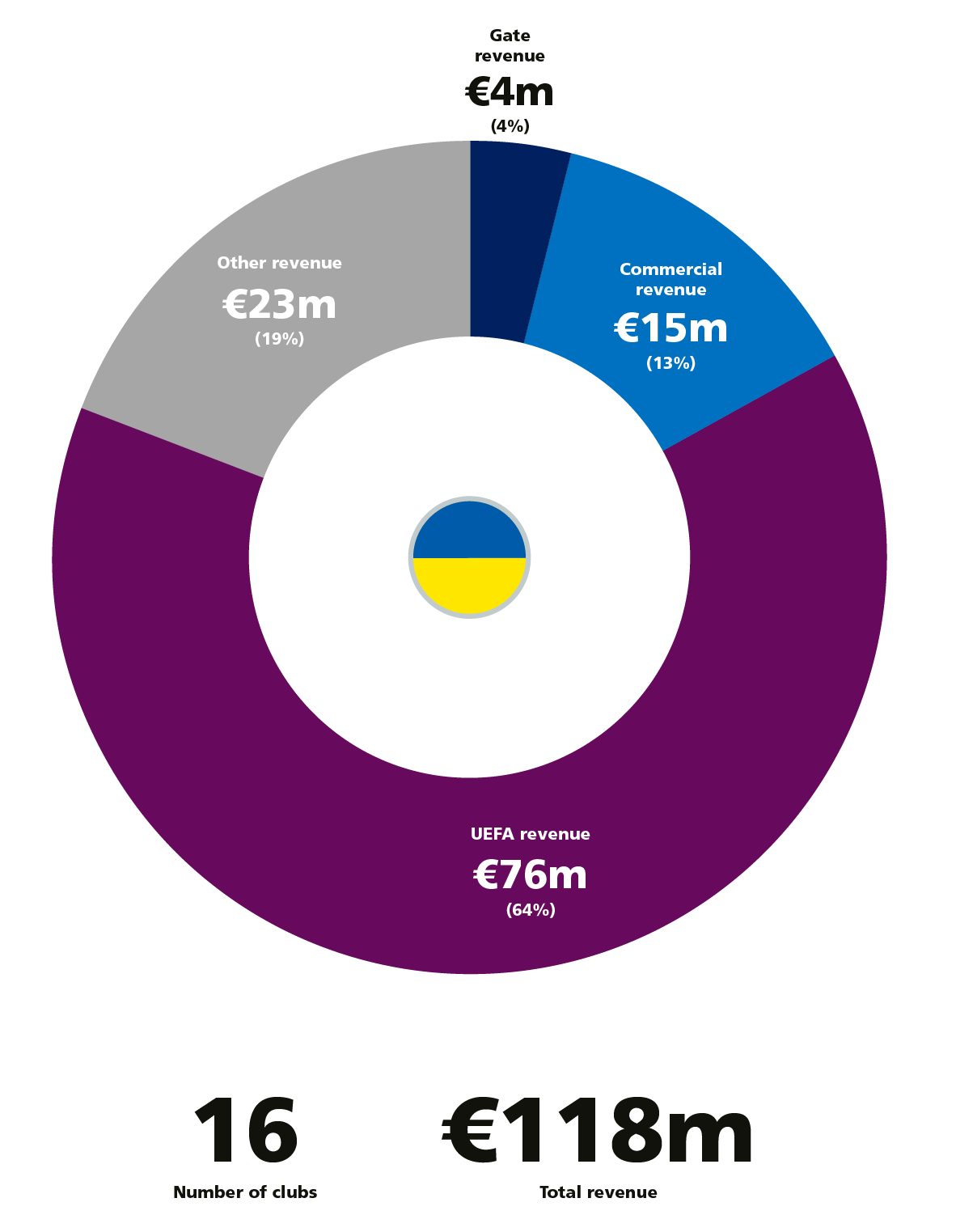

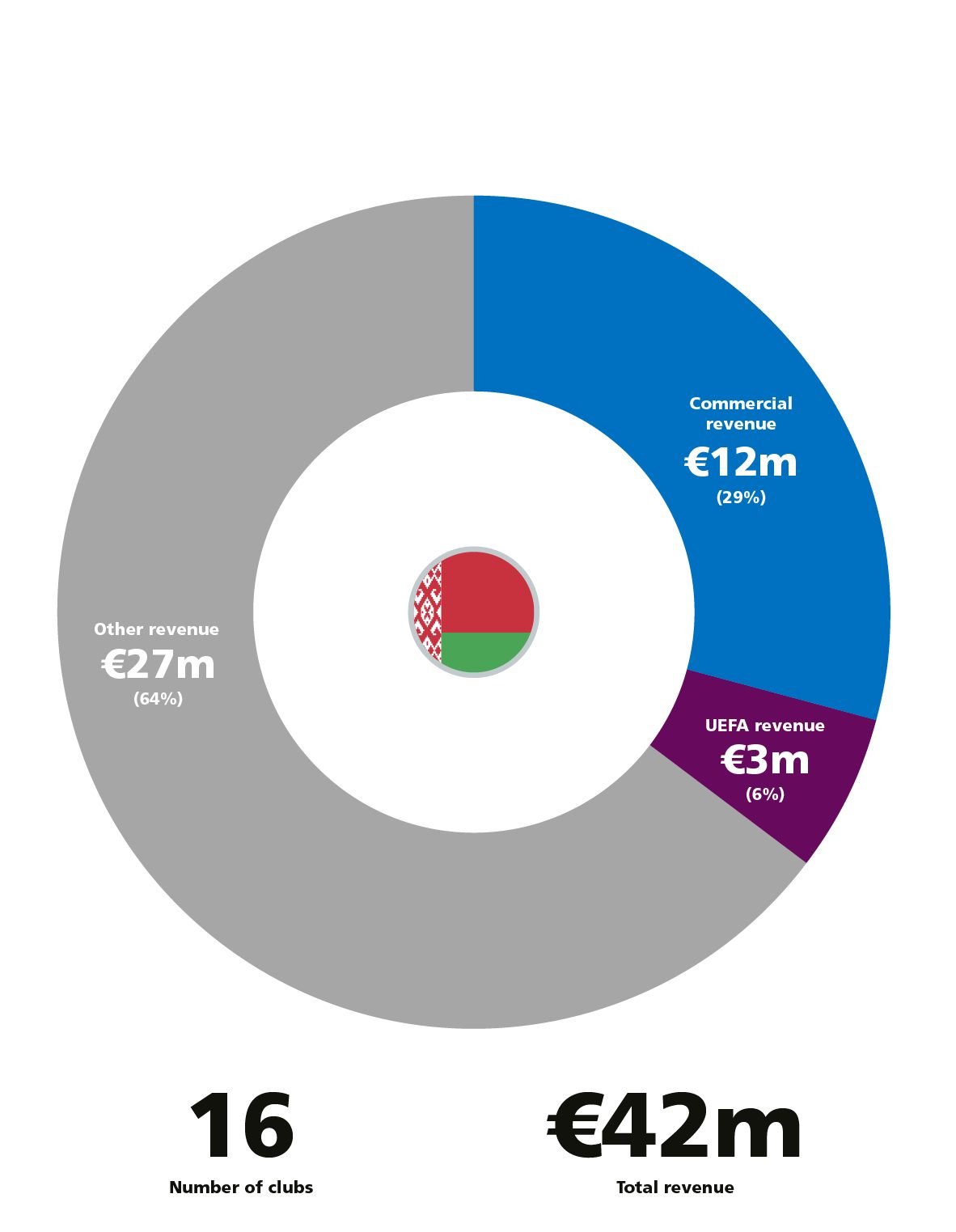

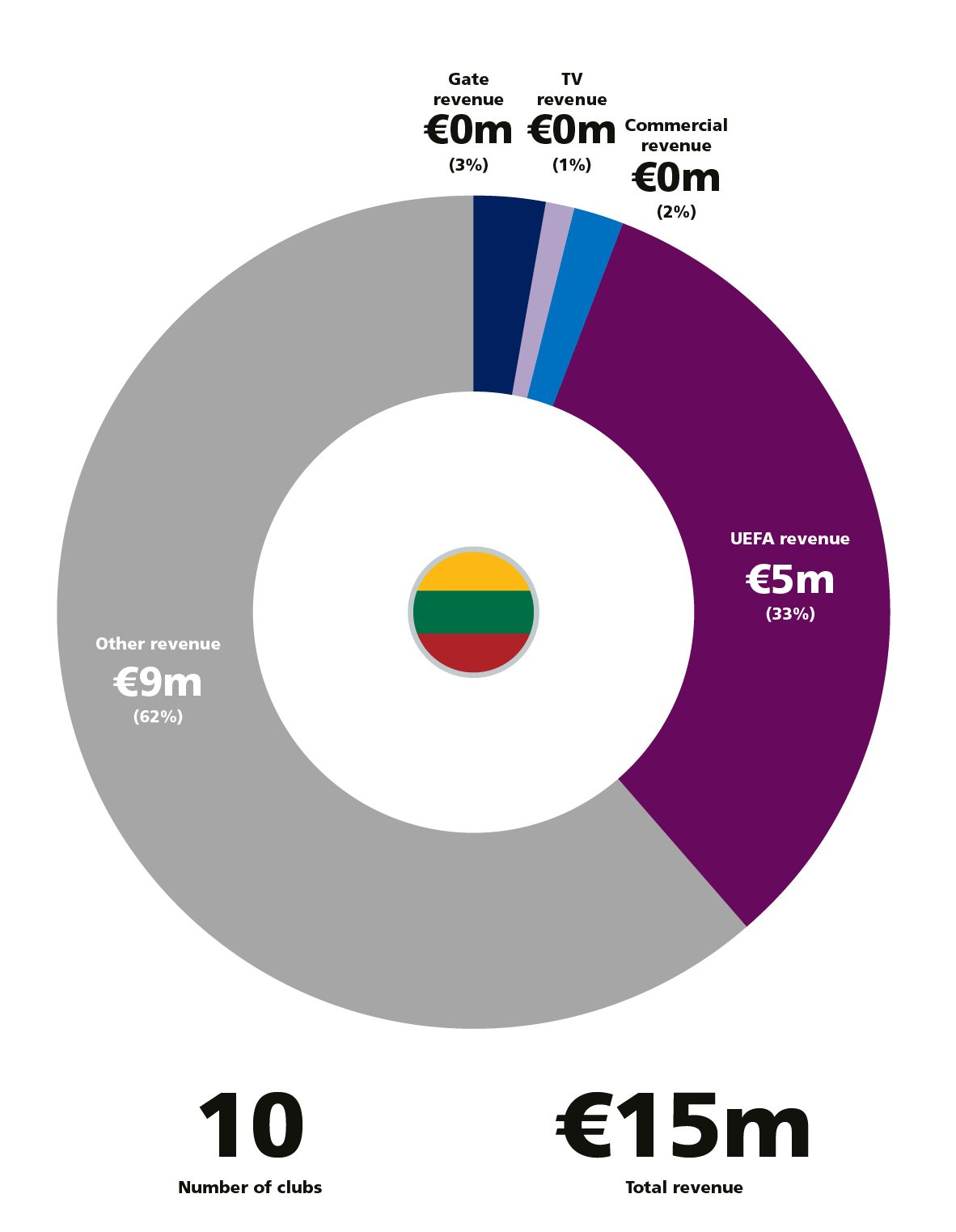

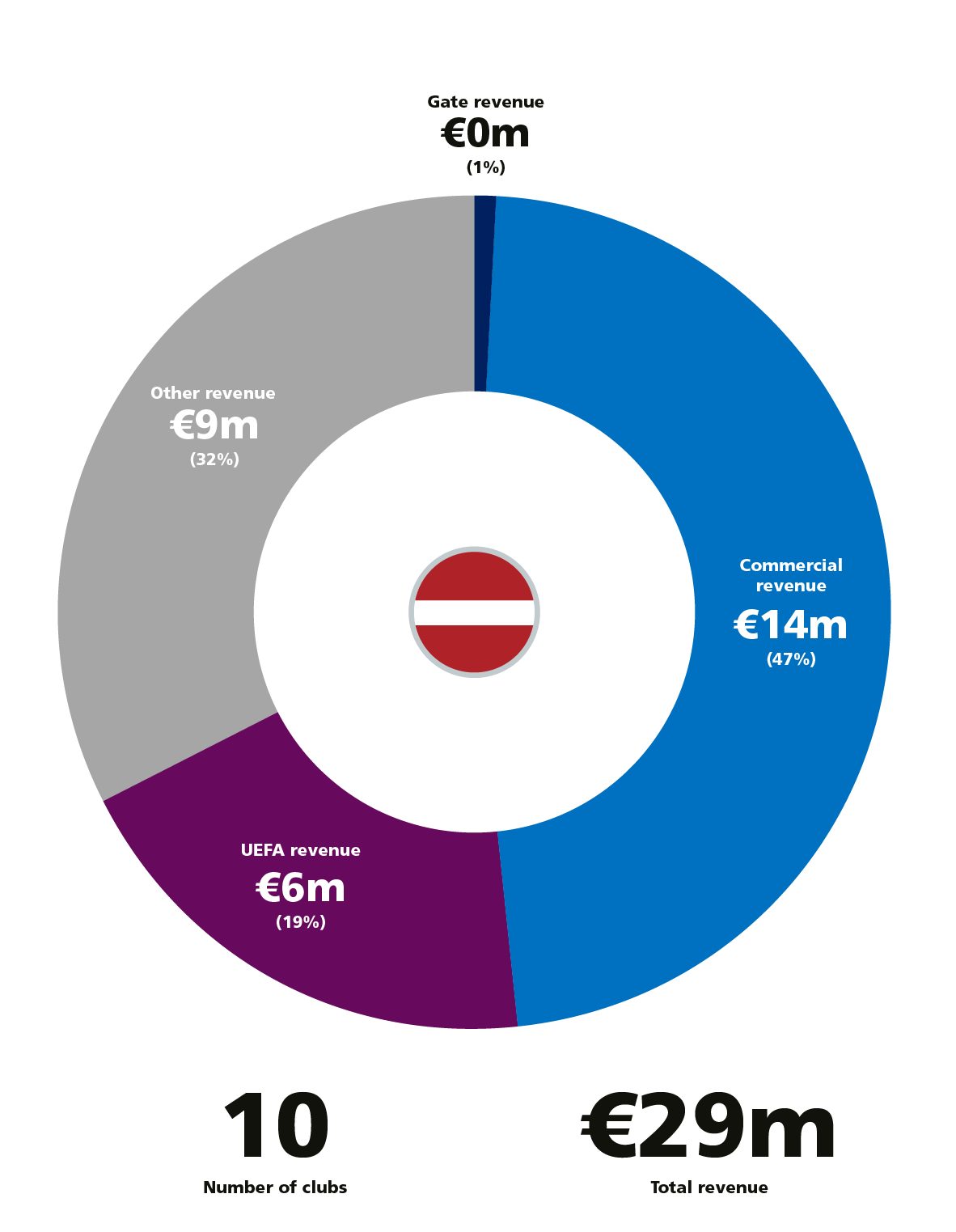

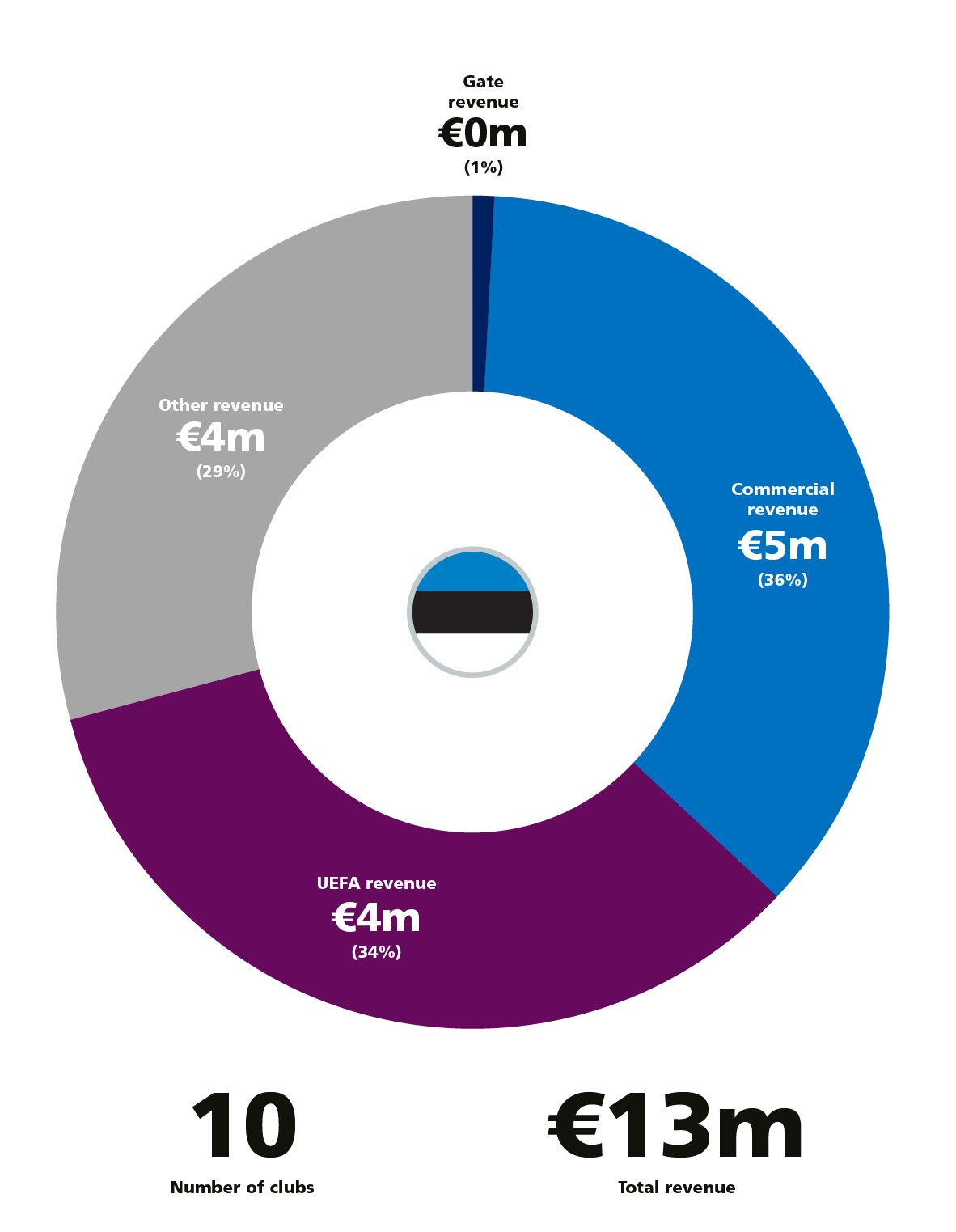

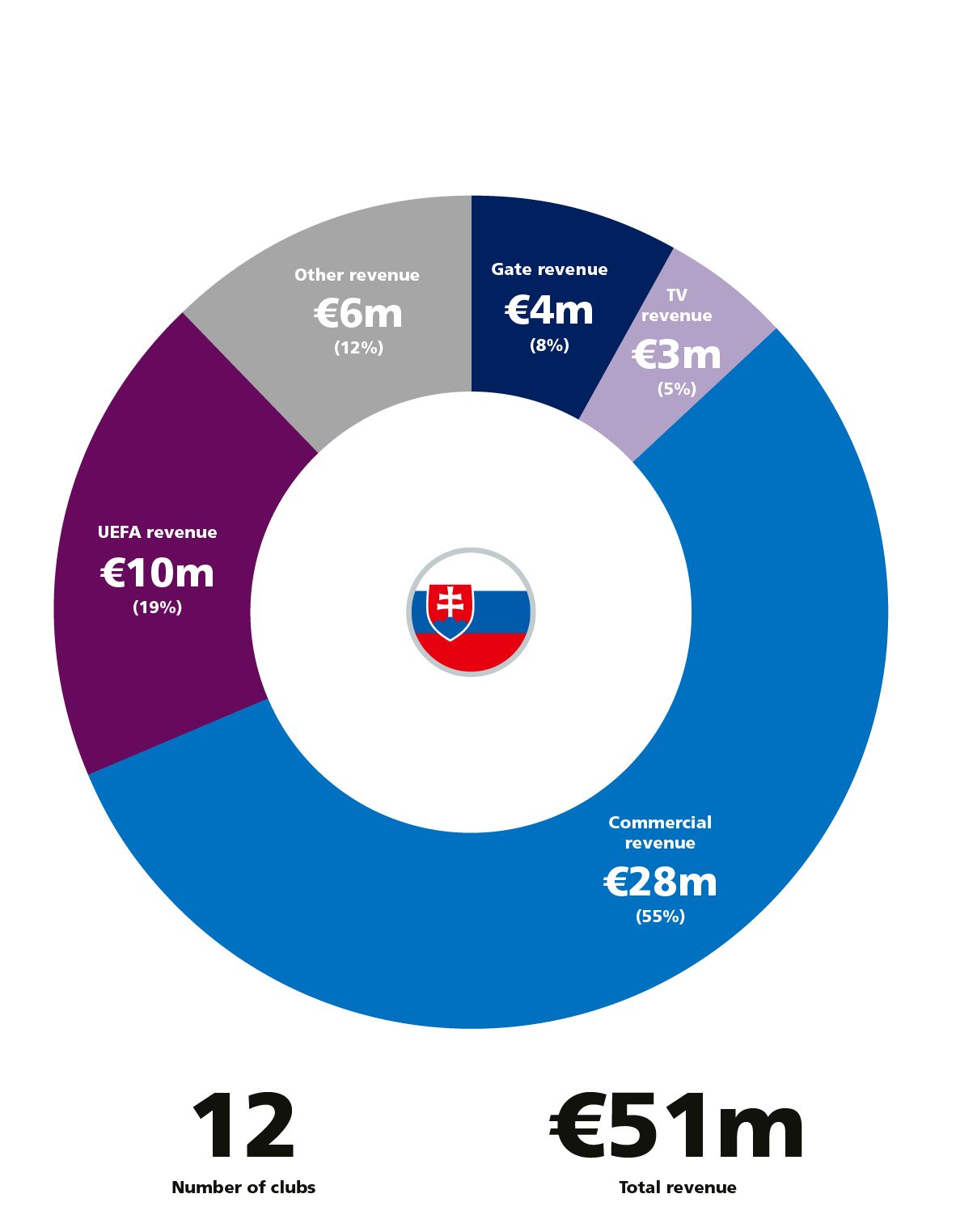

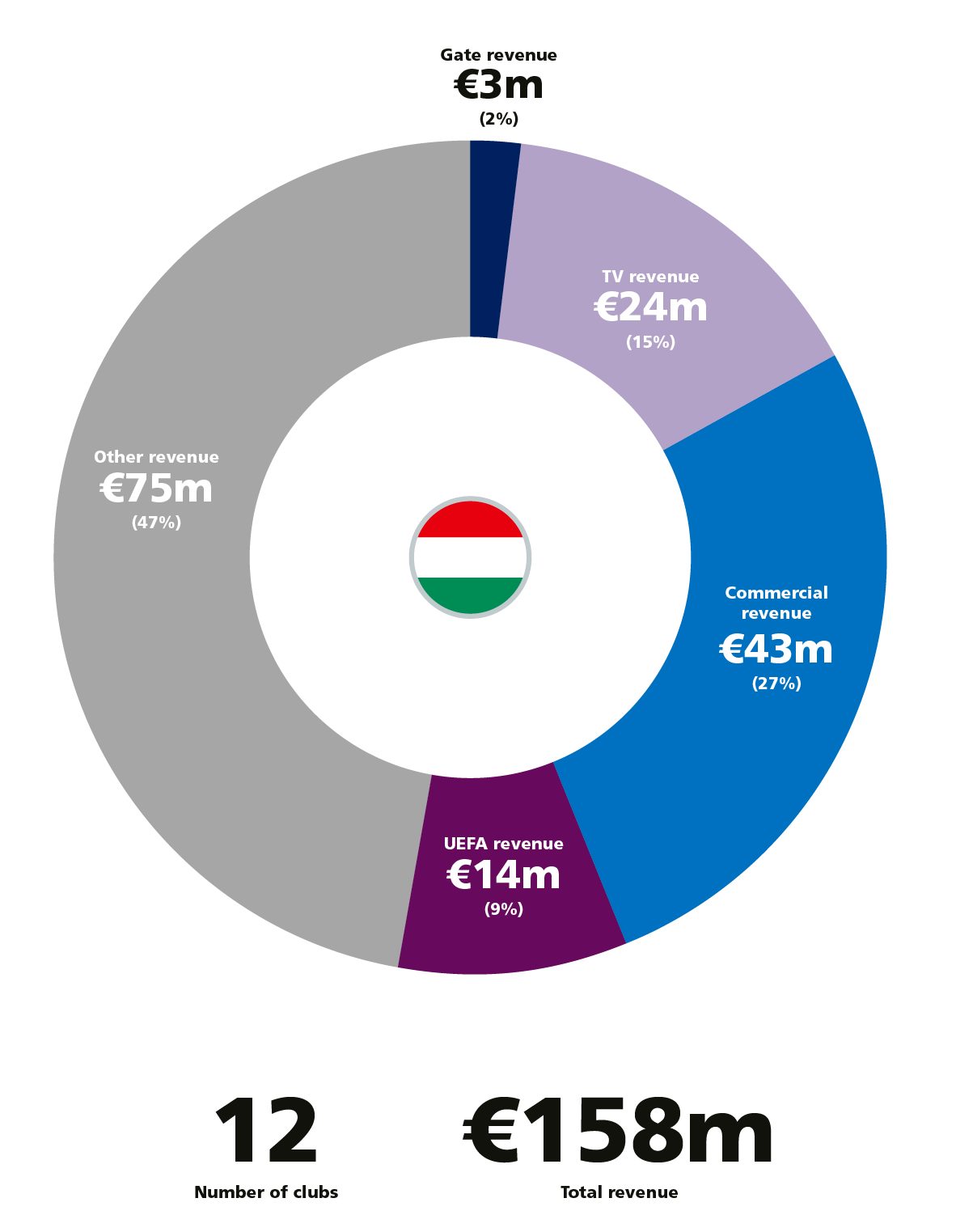

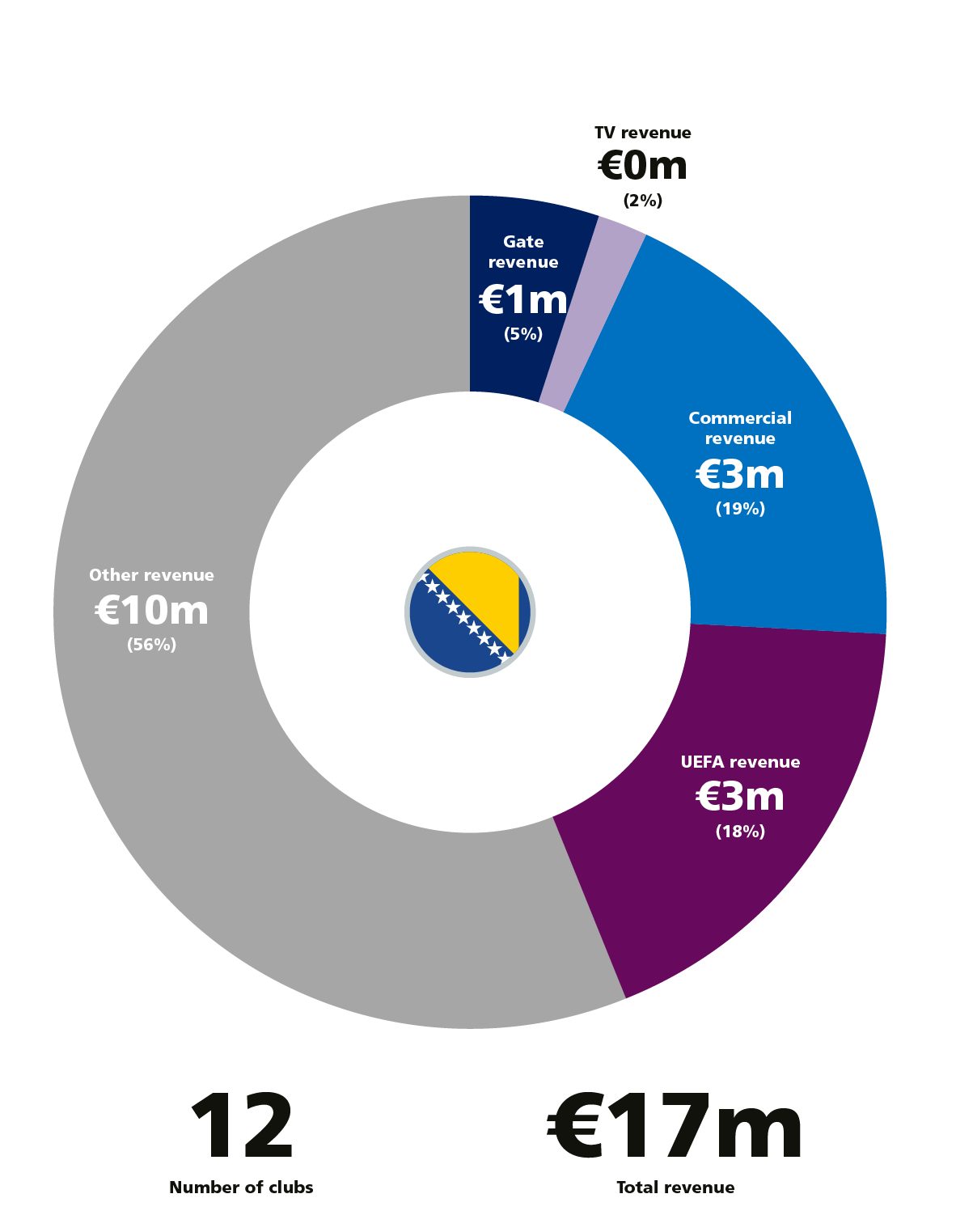

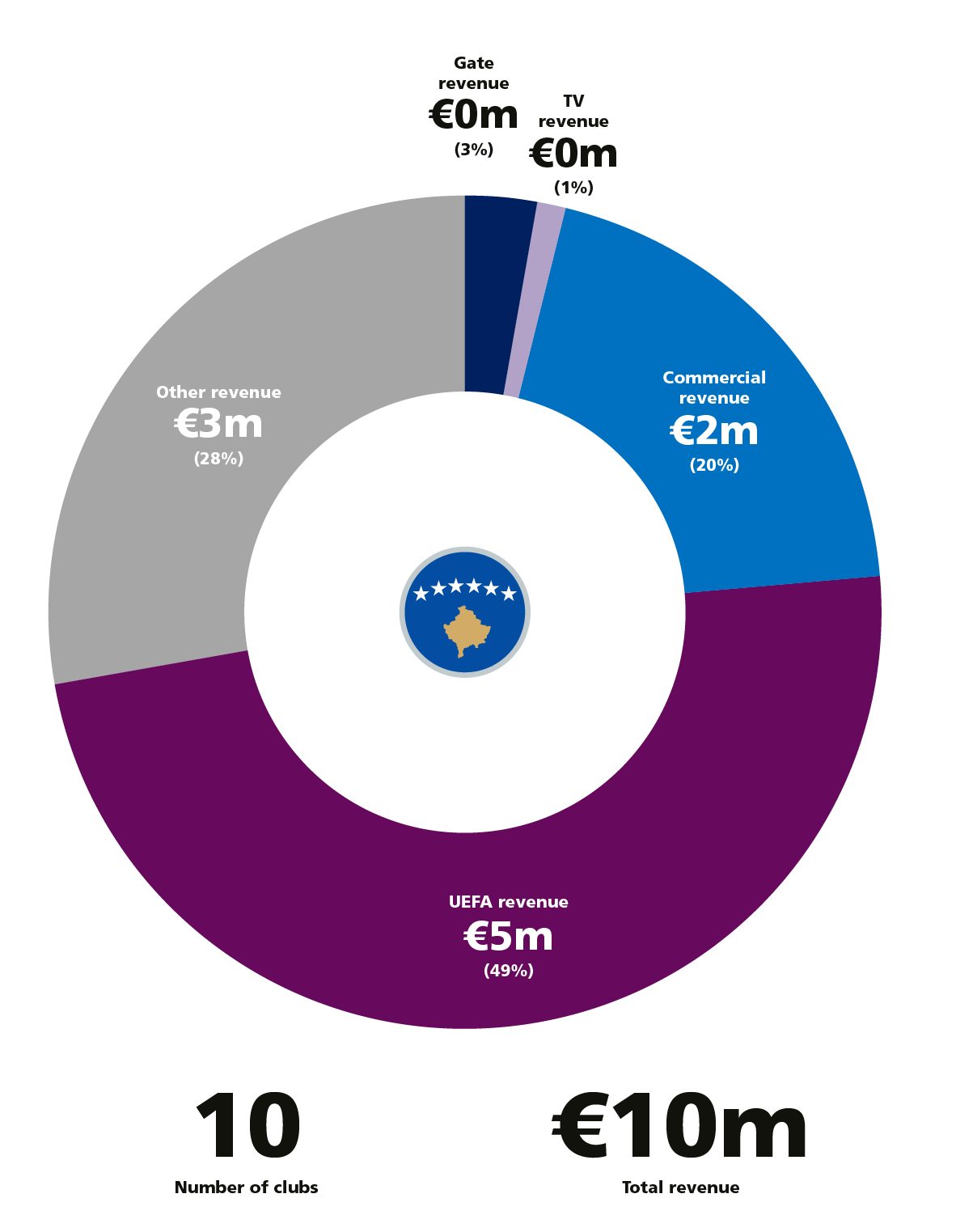

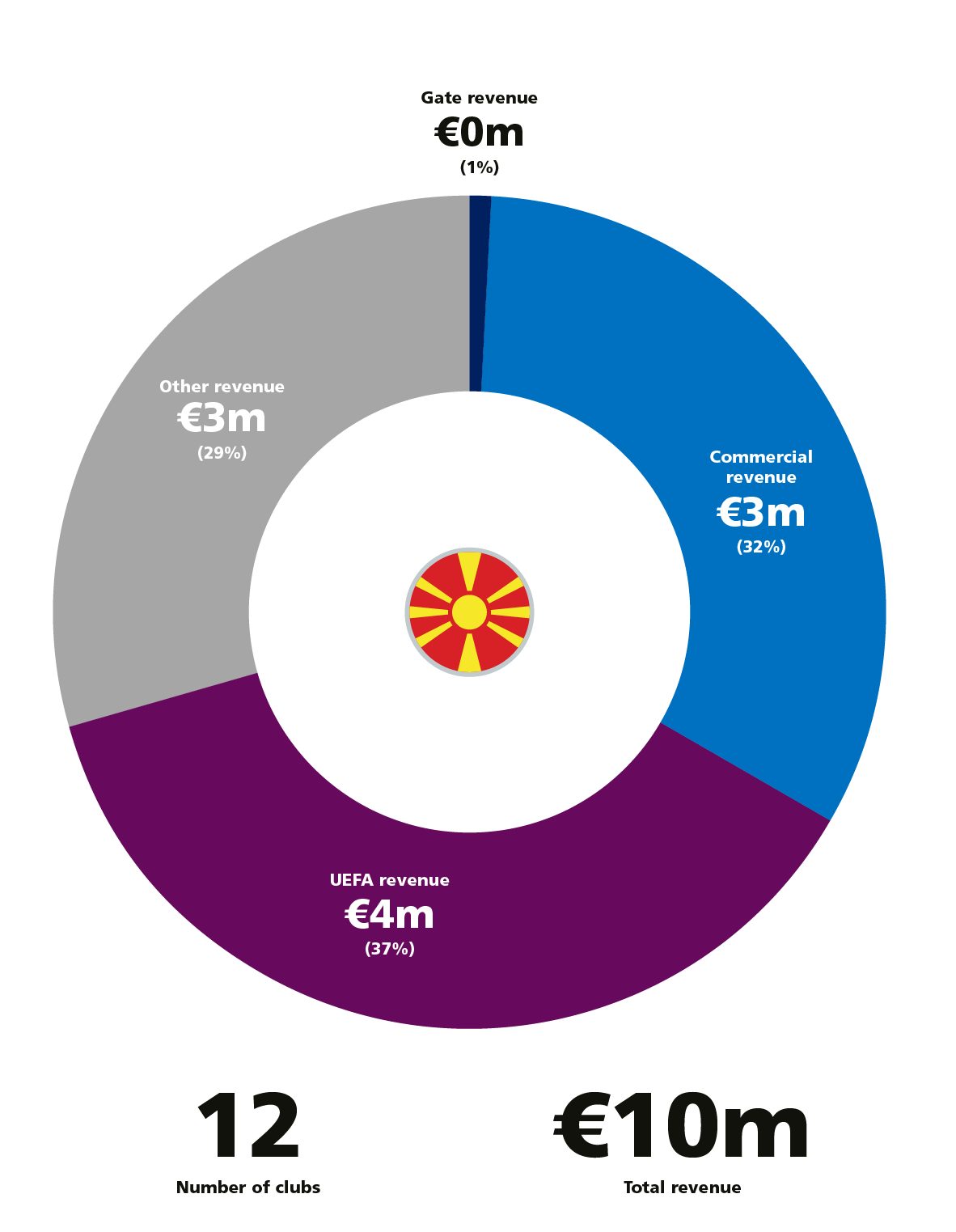

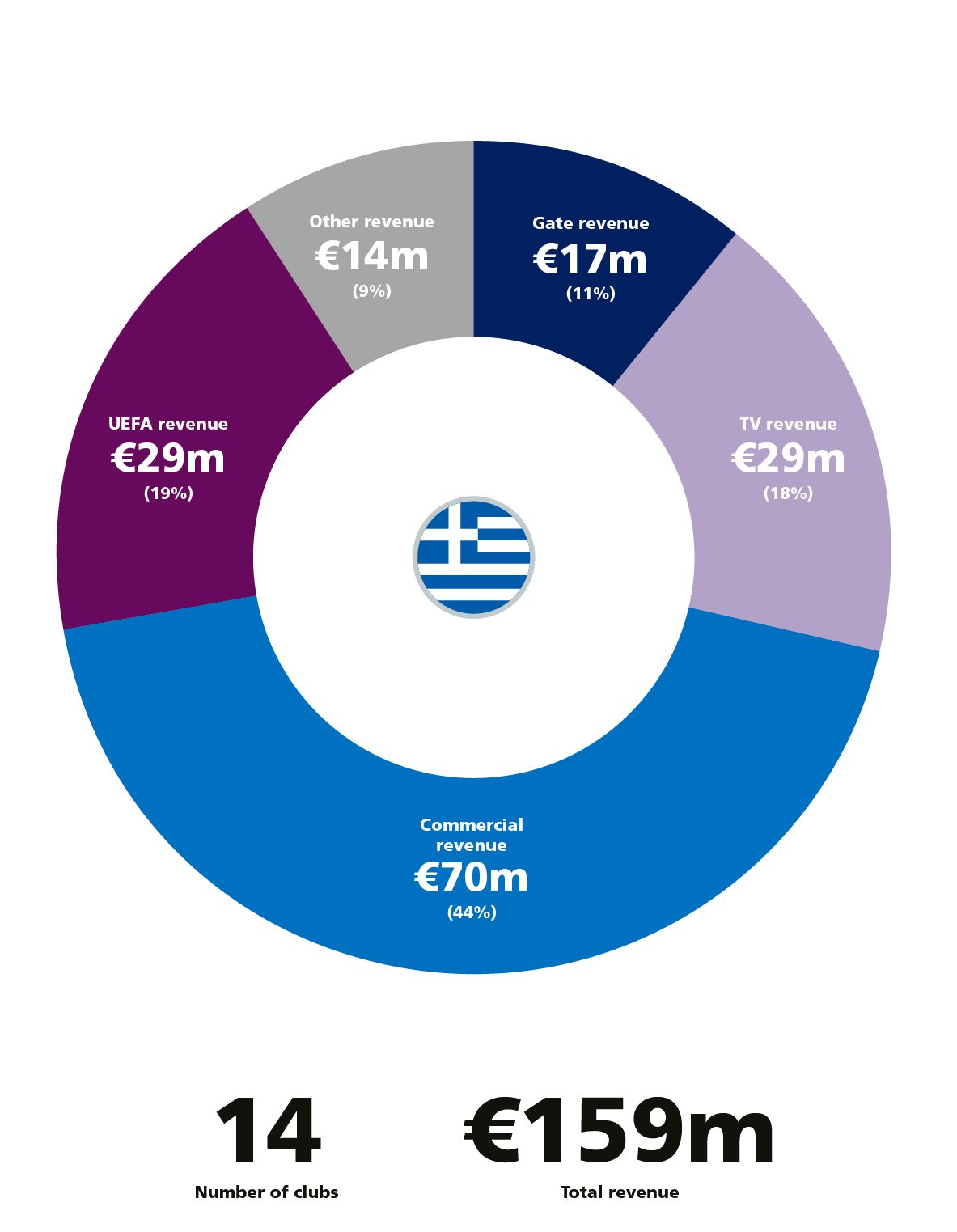

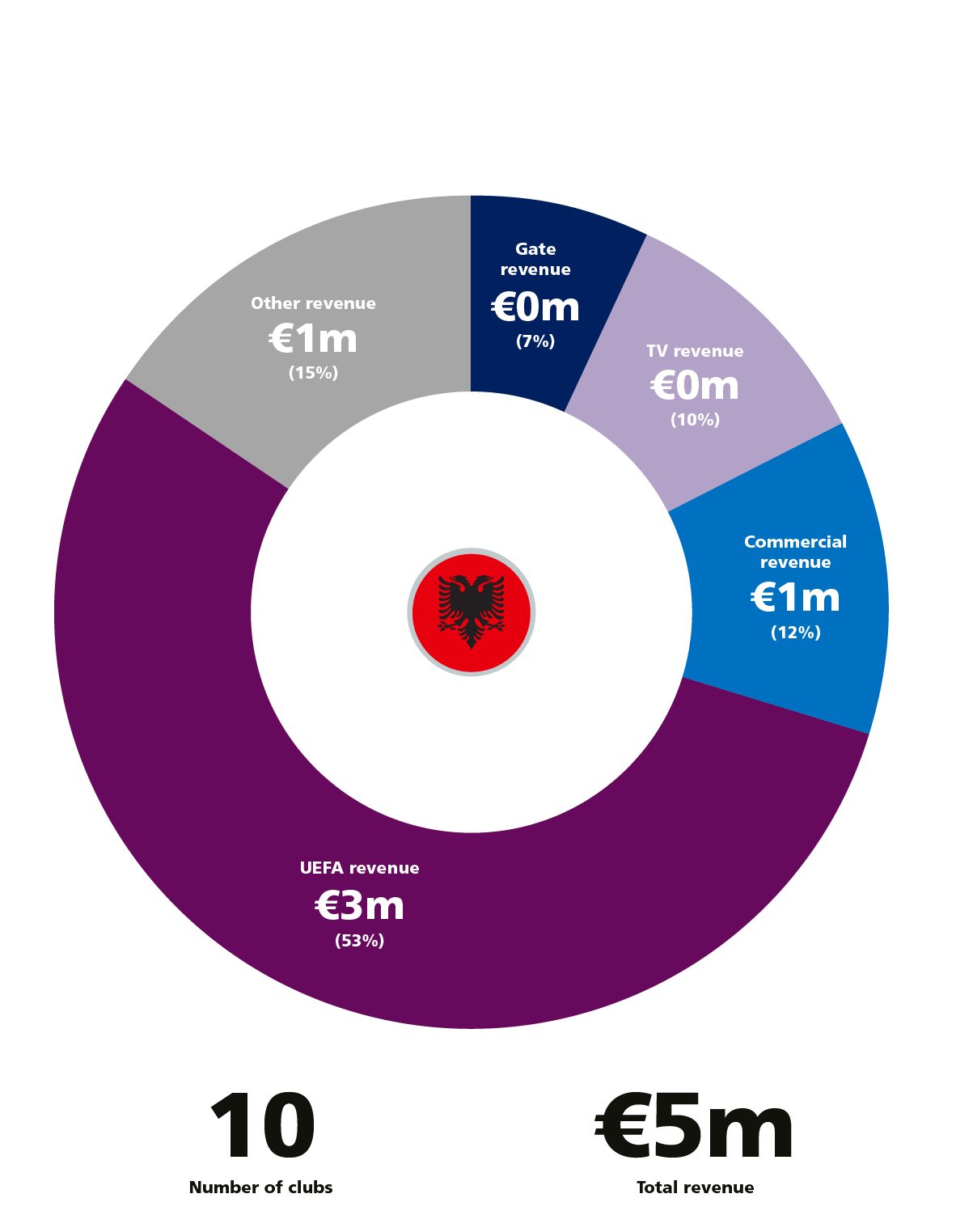

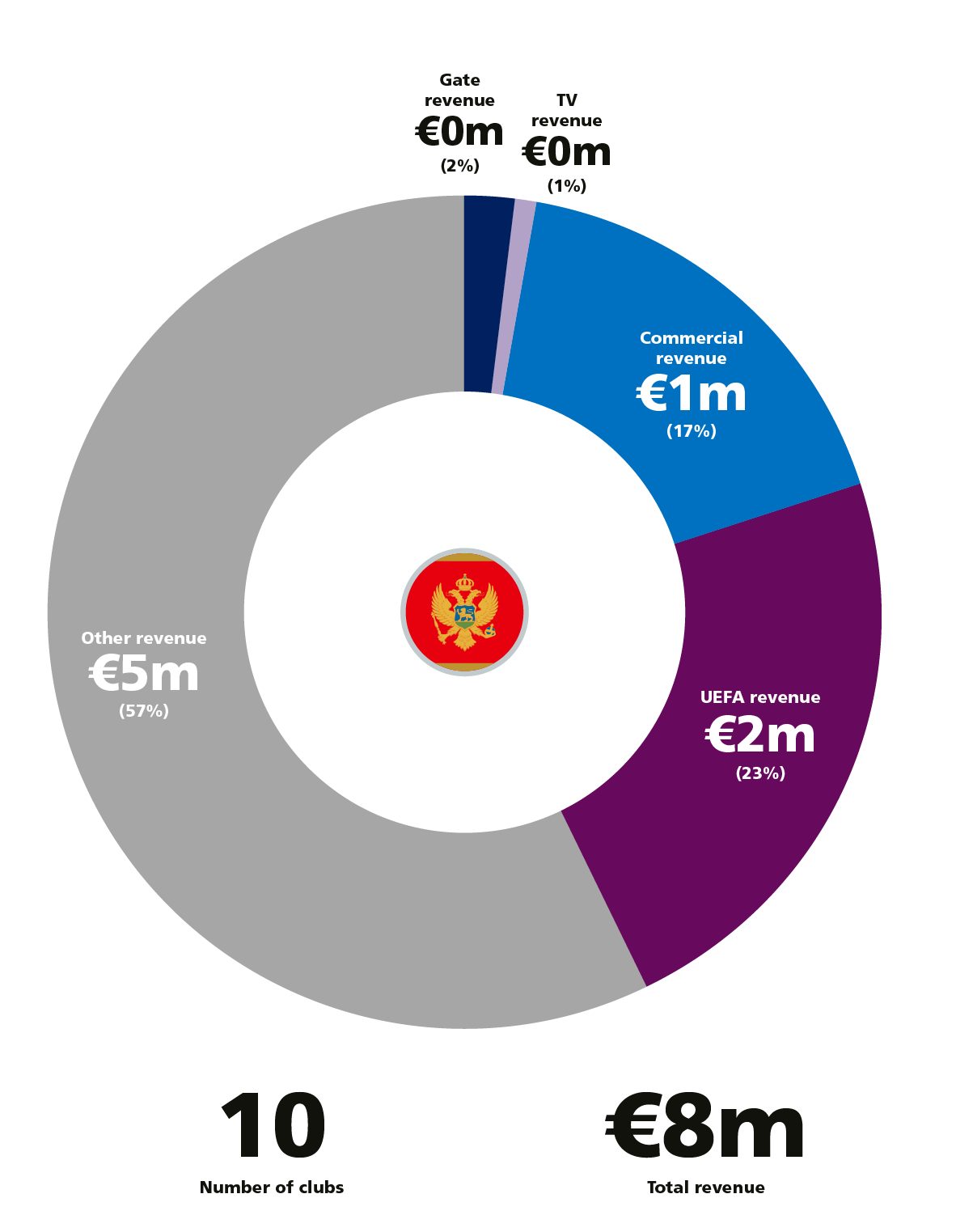

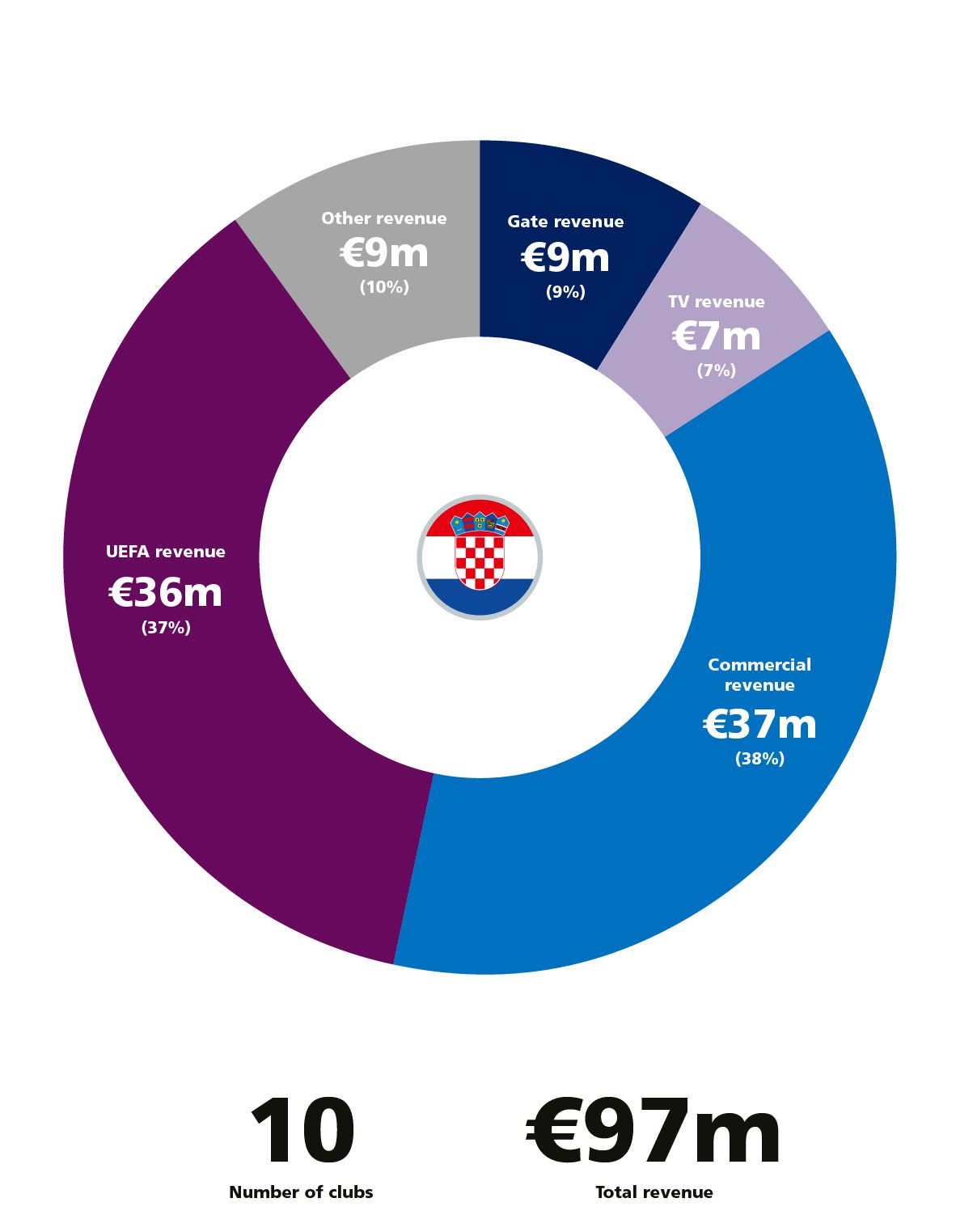

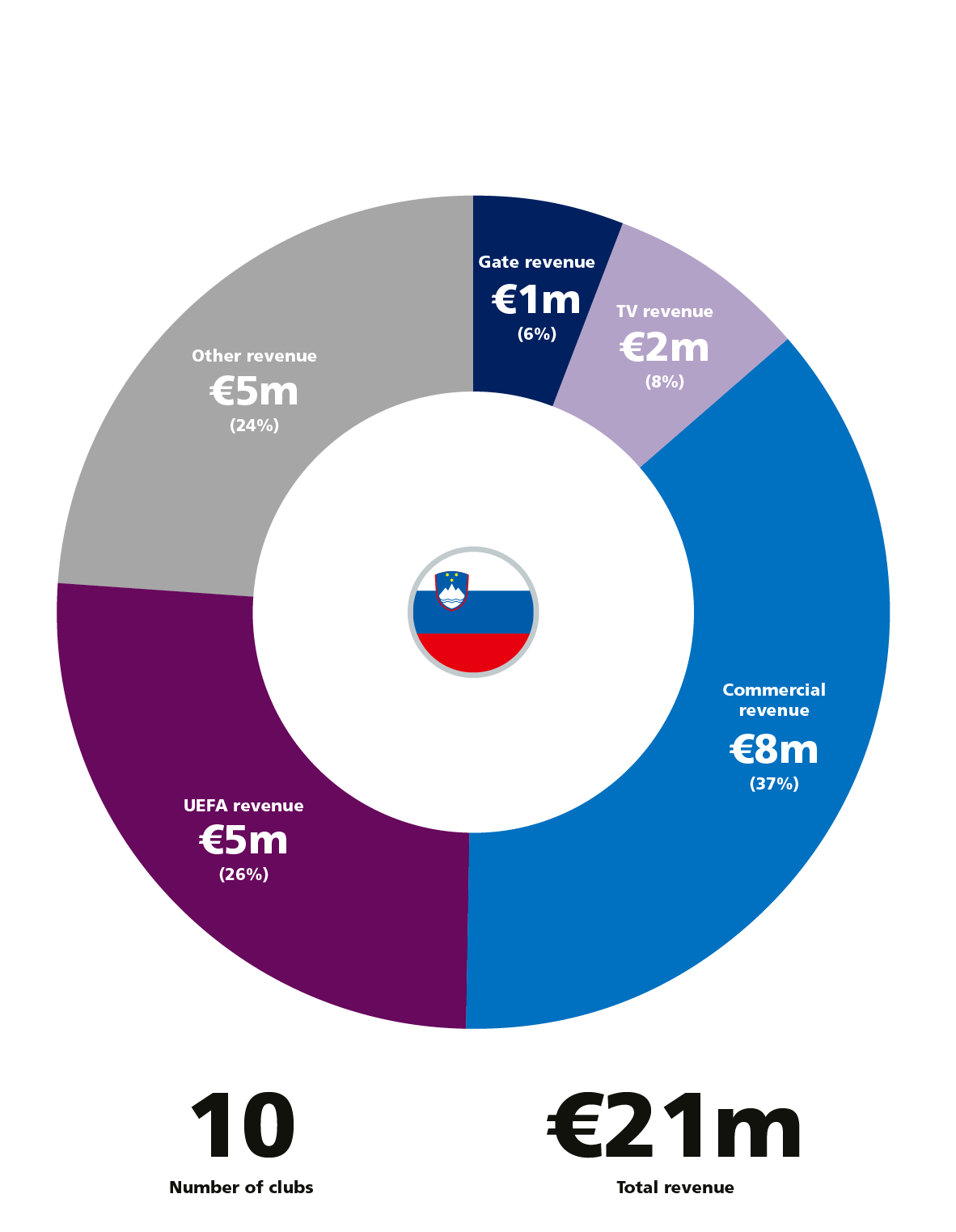

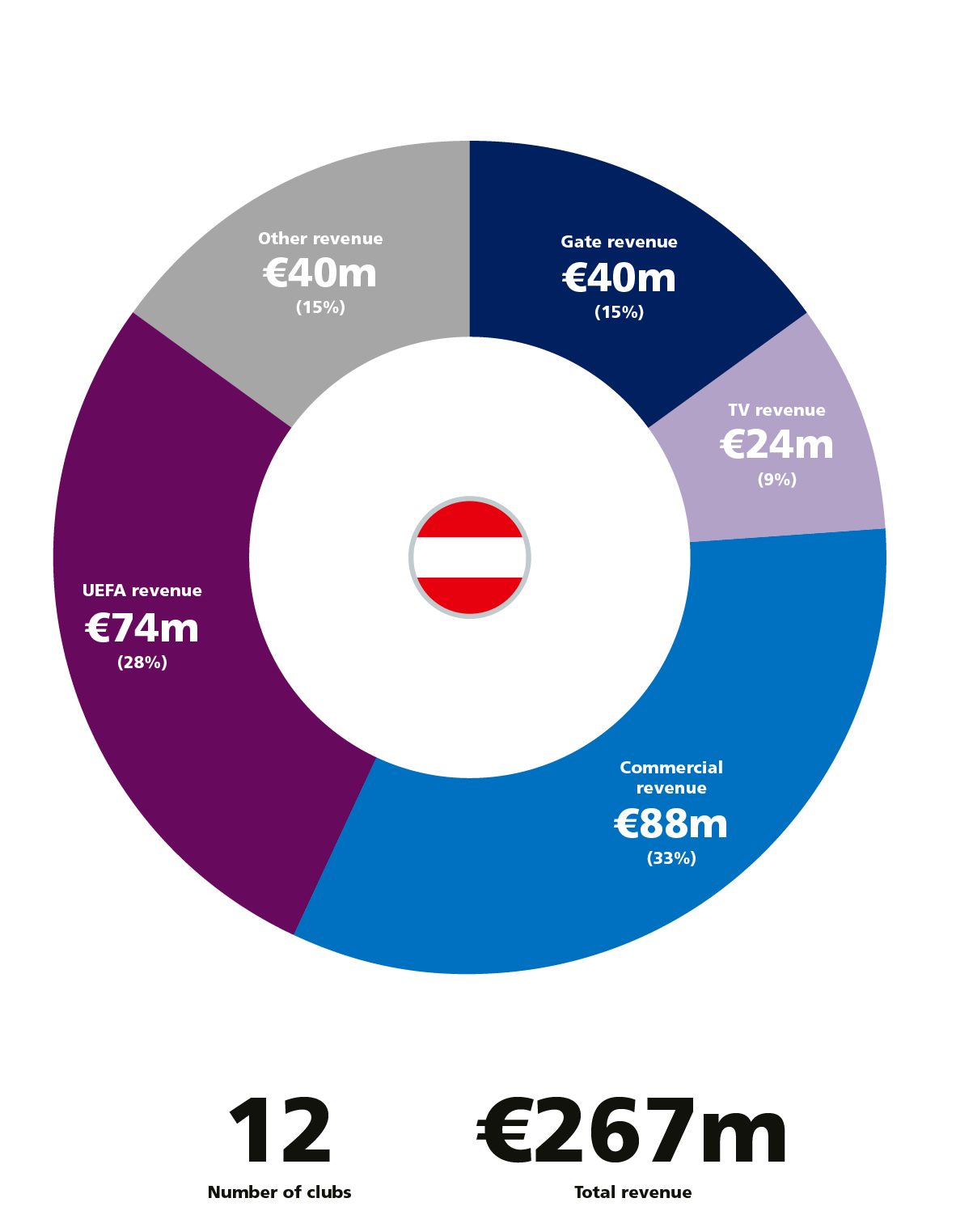

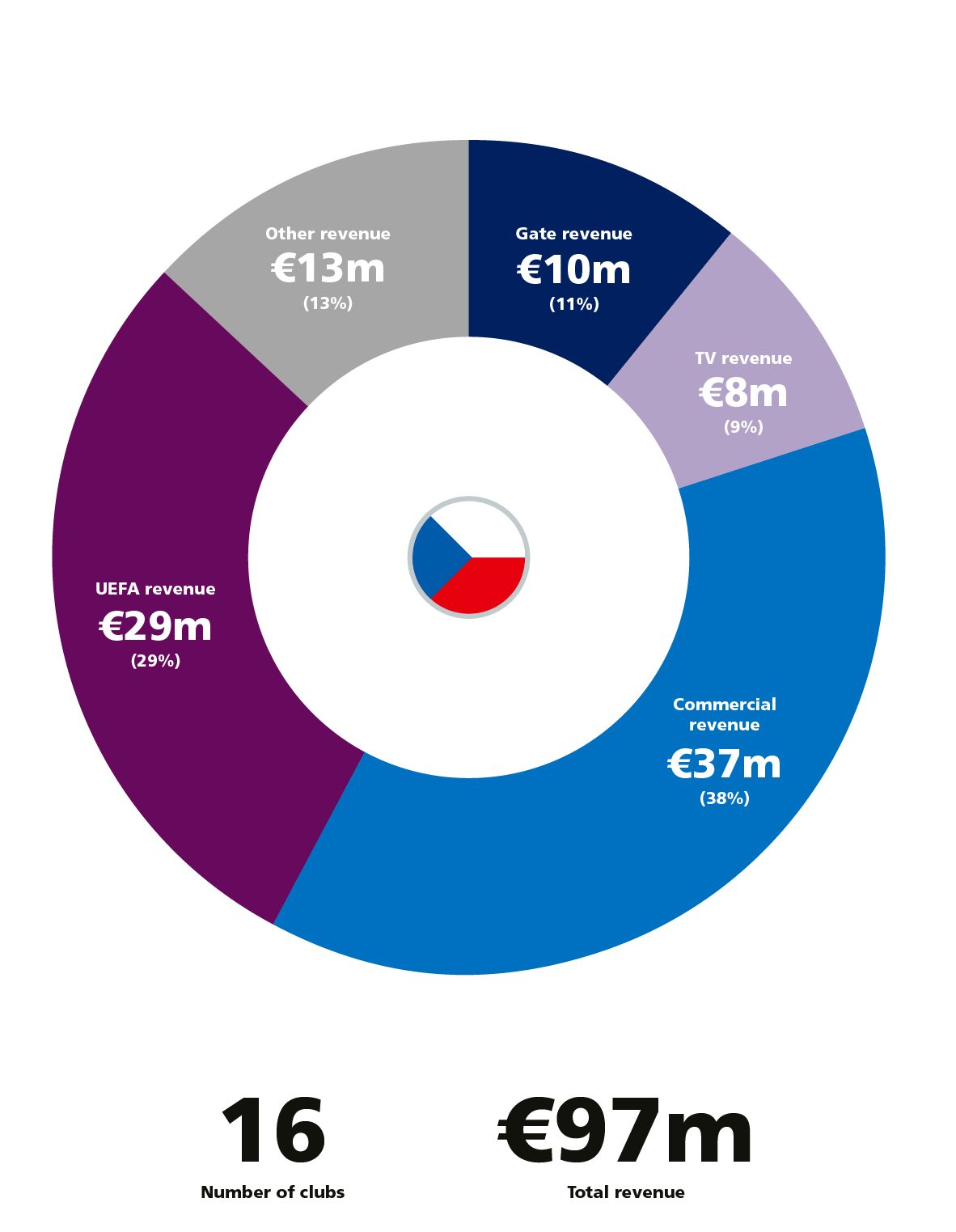

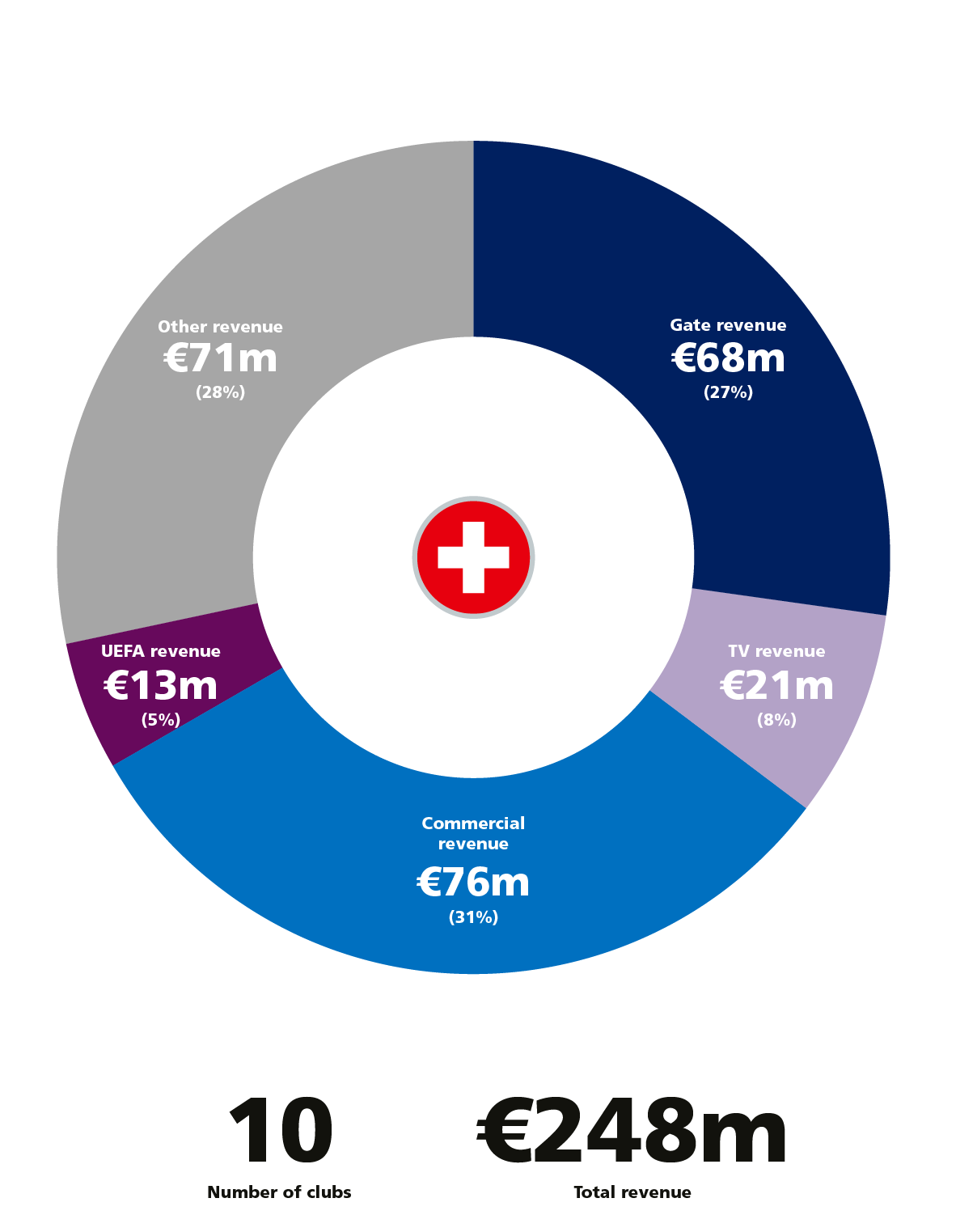

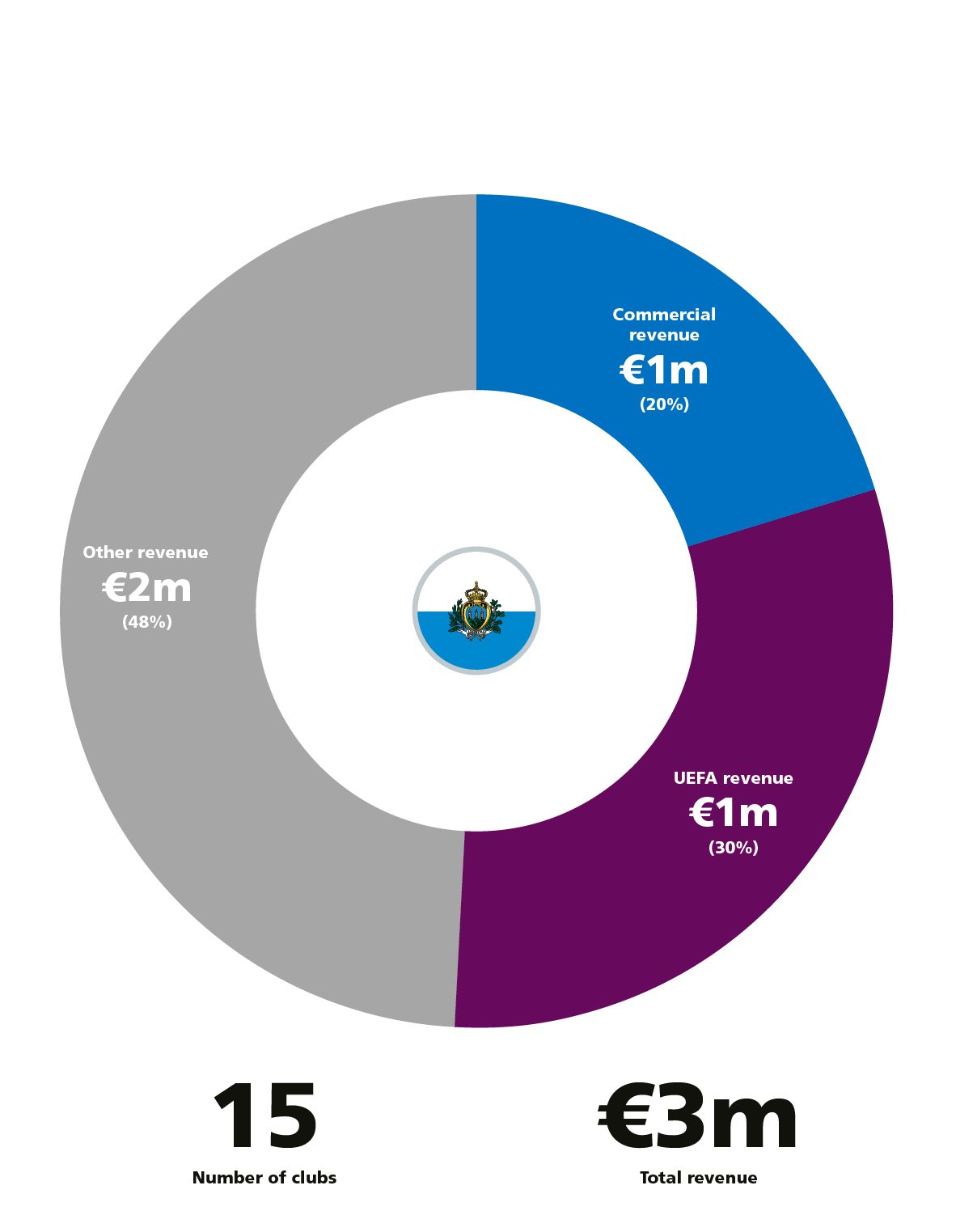

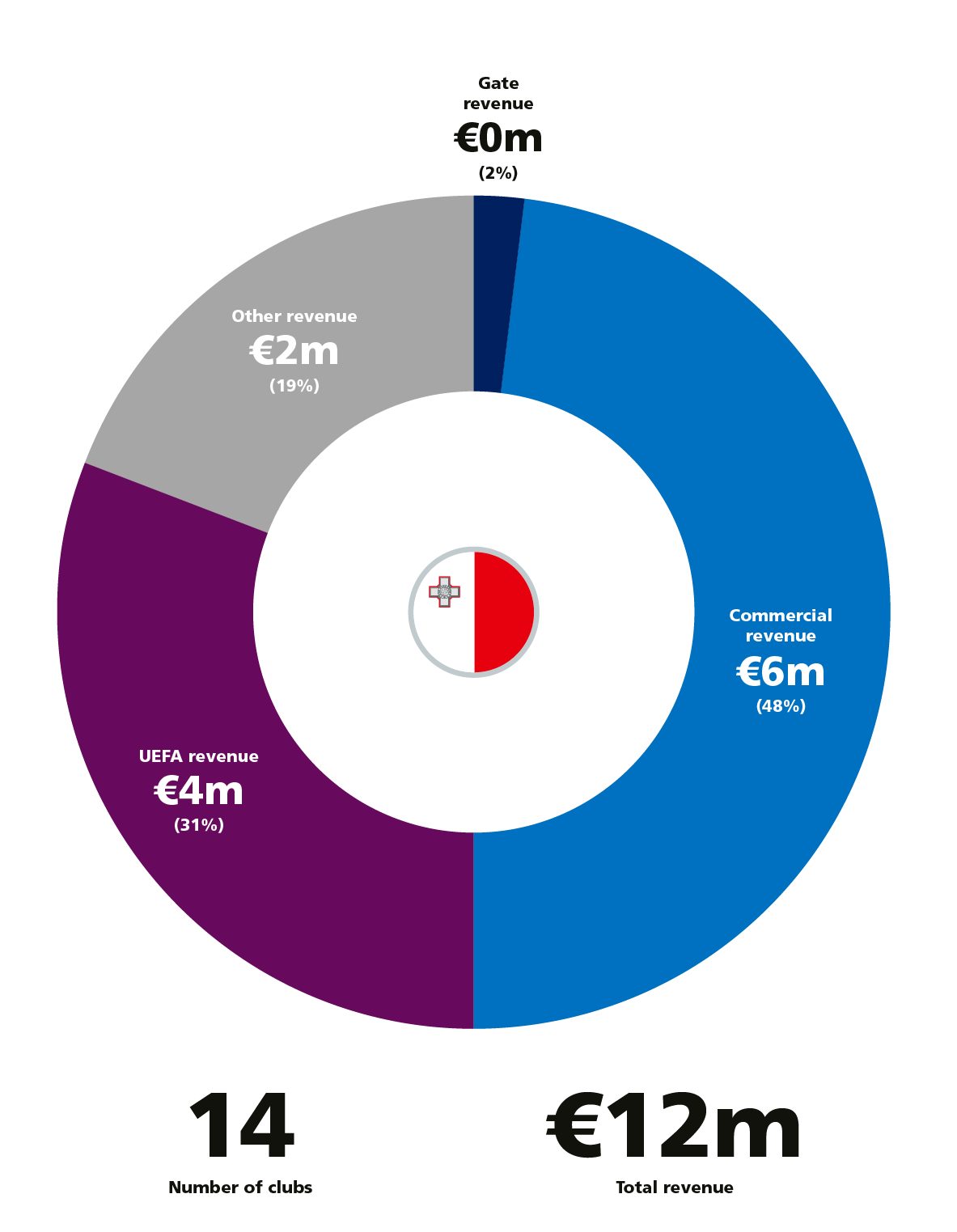

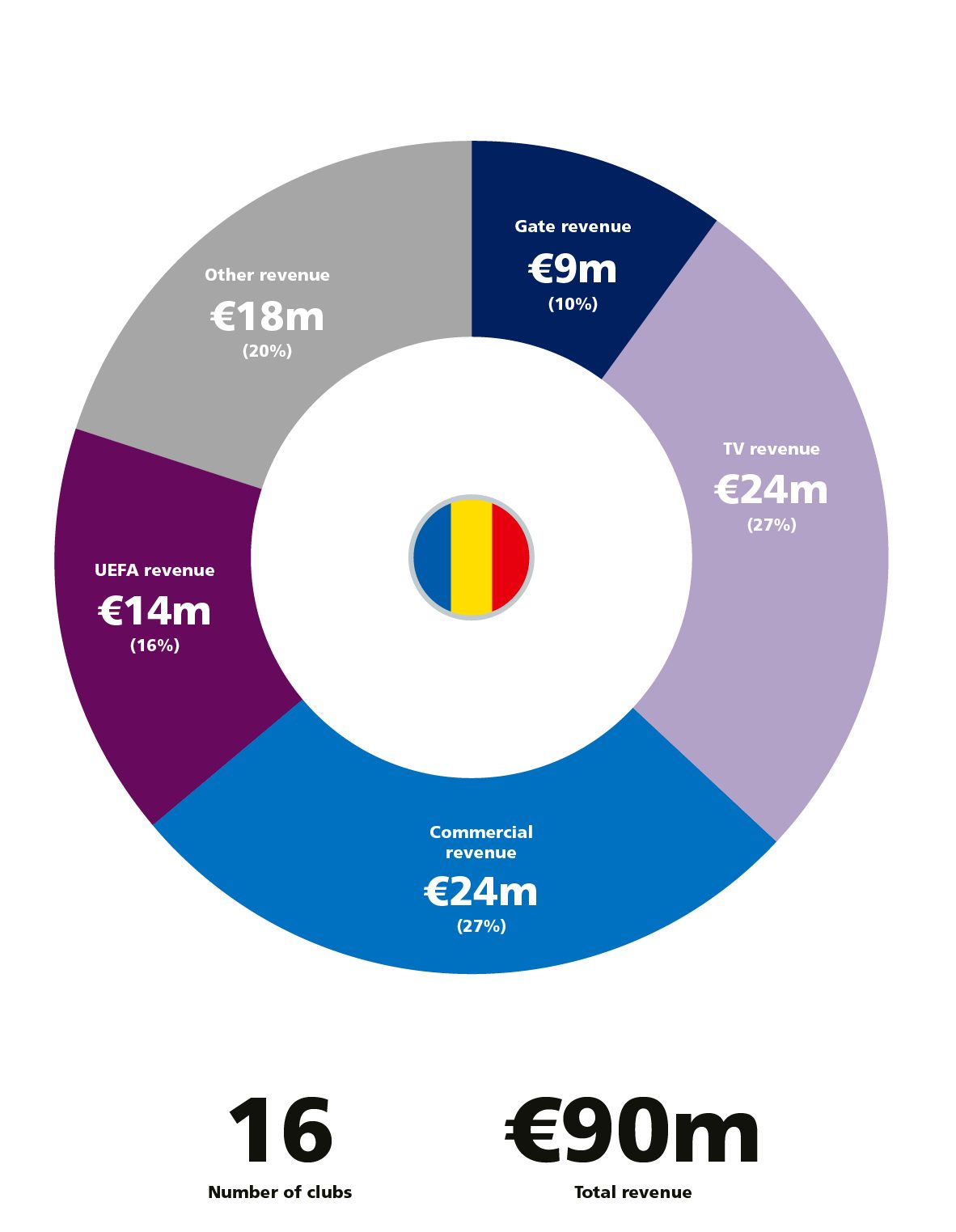

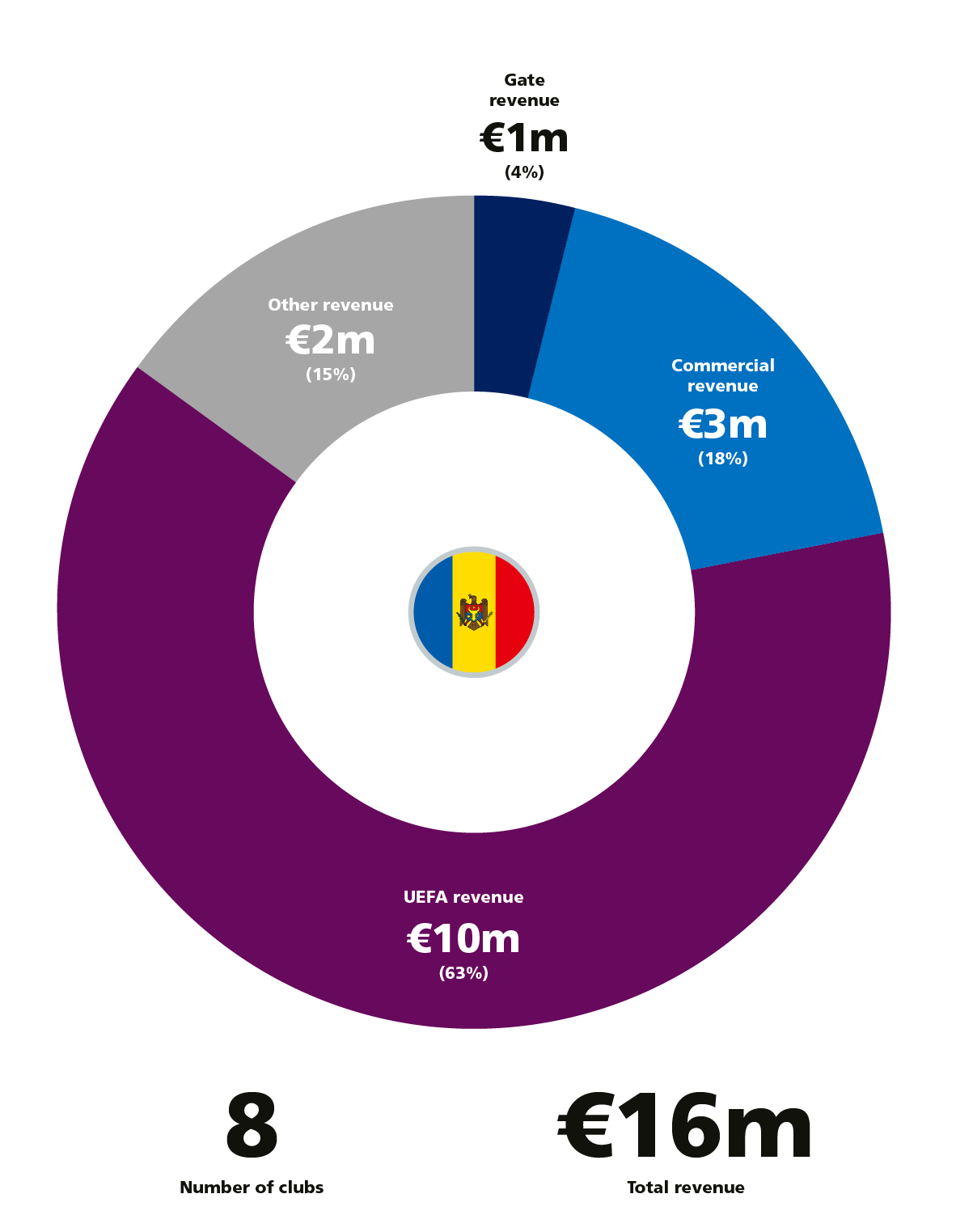

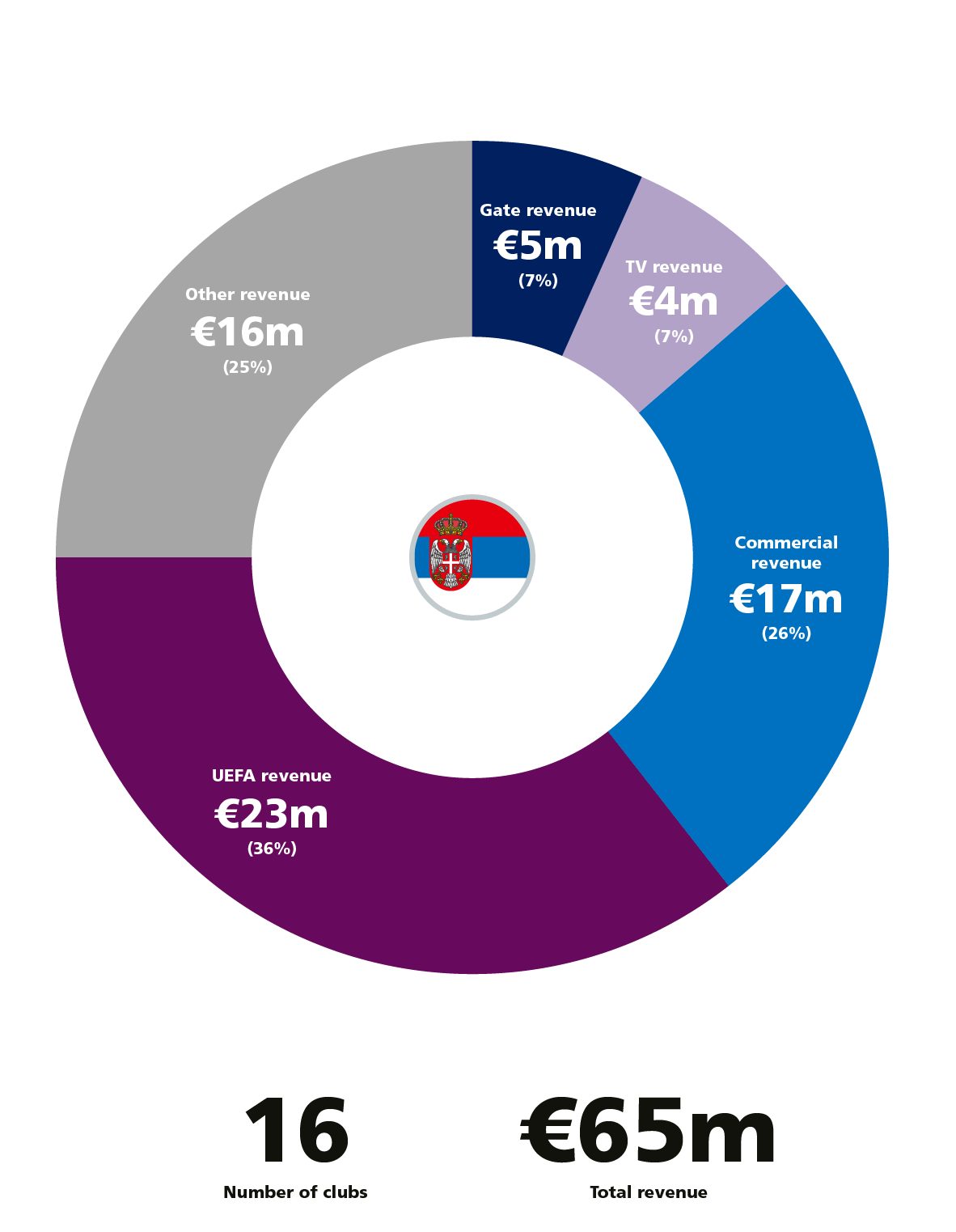

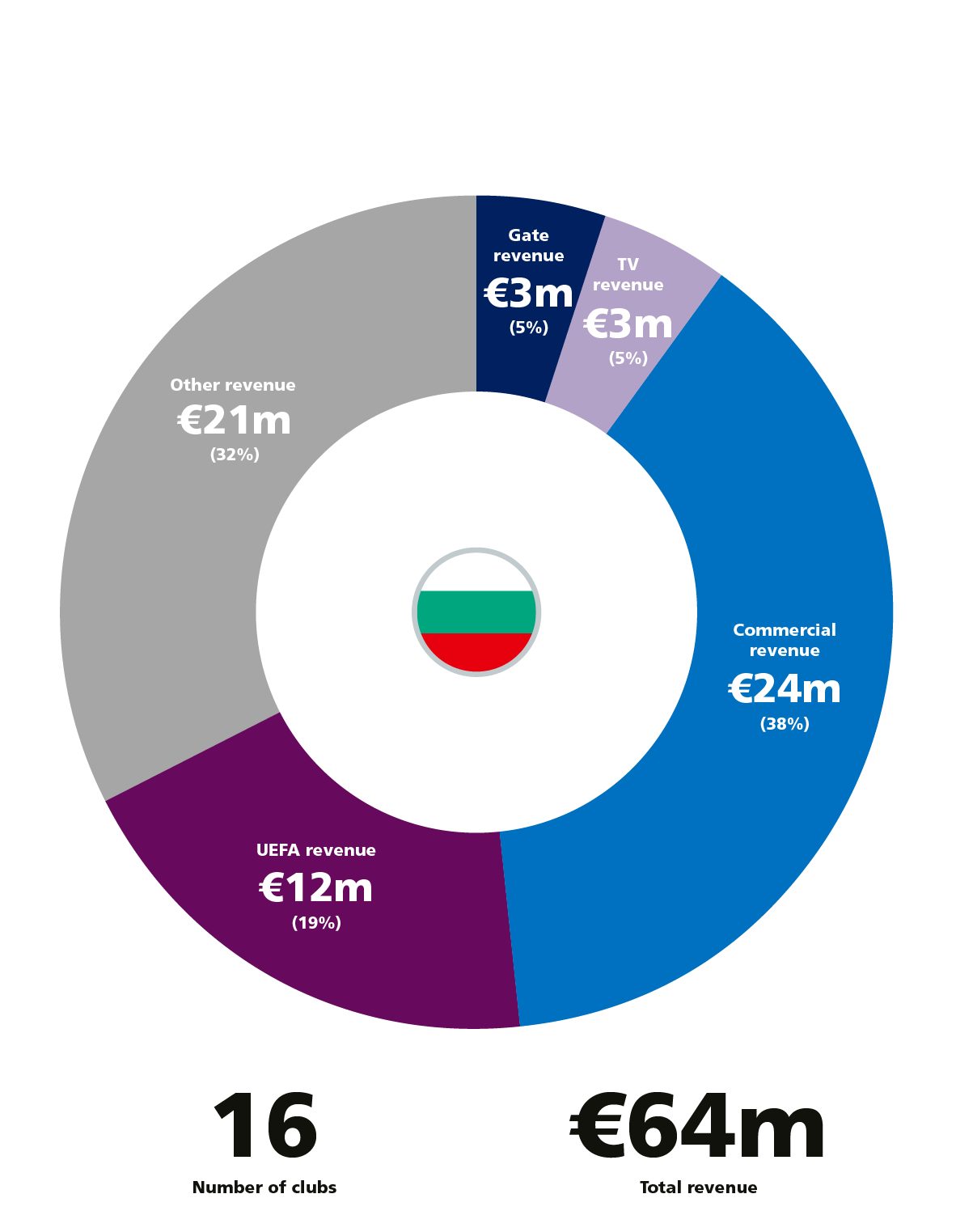

The report provides a country by country overview of where revenue is generated from, as well as country rankings.

Click on each country to view revenue landscape.

The surge in wage costs evident during the pandemic is potentially slowing as sustainability rules bite.

Fast pre-pandemic revenue and wage growth, sustainable wage ratio.

2019

WAGE COST

bn

€

,

0

10

GROWTH RATE

%

+

1

WAGE RATIO

%

+

44

First ever reported wage decrease as pandemic lengthened season pushes bonuses into following year.

2020

WAGE COST

bn

€

,

0

10

GROWTH RATE

%

–

0

WAGE RATIO

%

+

51

Wage growth continued at height of pandemic despite another €3bn of lost revenues. Unsustainable peak wage ratio.

2021

WAGE COST

bn

€

,

0

11

GROWTH RATE

%

+

1

WAGE RATIO

%

+

55

As revenues return wages grow by €1 billion. Wage ratio decreases but still unsustainable.

2022

WAGE COST

bn

€

,

0

12

GROWTH RATE

%

+

1

WAGE RATIO

%

+

51

Positive signs of clubs adapting to financial realities. Wage growth slows and more sustainable wage ratio.

2023

WAGE COST

bn

€

,

0

13

GROWTH RATE

%

+

1

WAGE RATIO

%

+

45

Fast pre-pandemic revenue and wage growth, sustainable wage ratio.

2019

WAGE COST

bn

€

,

0

10

GROWTH RATE

%

+

1

WAGE RATIO

%

+

60

First ever reported wage decrease as pandemic lengthened season pushes bonuses into following year.

2020

WAGE COST

bn

€

,

0

10

GROWTH RATE

%

–

0

WAGE RATIO

%

+

67

Wage growth continued at height of pandemic despite another €3bn of lost revenues. Unsustainable peak wage ratio.

2021

WAGE COST

bn

€

,

0

10

GROWTH RATE

%

+

1

WAGE RATIO

%

+

71

As revenues return wages grow by

€1 billion. Wage ratio decreases but still unsustainable.

2022

WAGE COST

bn

€

,

0

10

GROWTH RATE

%

+

1

WAGE RATIO

%

+

67

Positive signs of clubs adapting to financial realities. Wage growth slows and more sustainable wage ratio.

2023

WAGE COST

bn

€

,

0

10

GROWTH RATE

%

+

0

WAGE RATIO

%

+

61

7,9

7,8

8,4

9,3

9,7

6,9

6,8

7,5

7,5

14.8

14.6

15.9

16.9

All Clubs

7,9

7,8

8,4

9,3

9,7

6,9

6,8

7,5

7,5

14.8

14.6

15.9

16.9

All Clubs

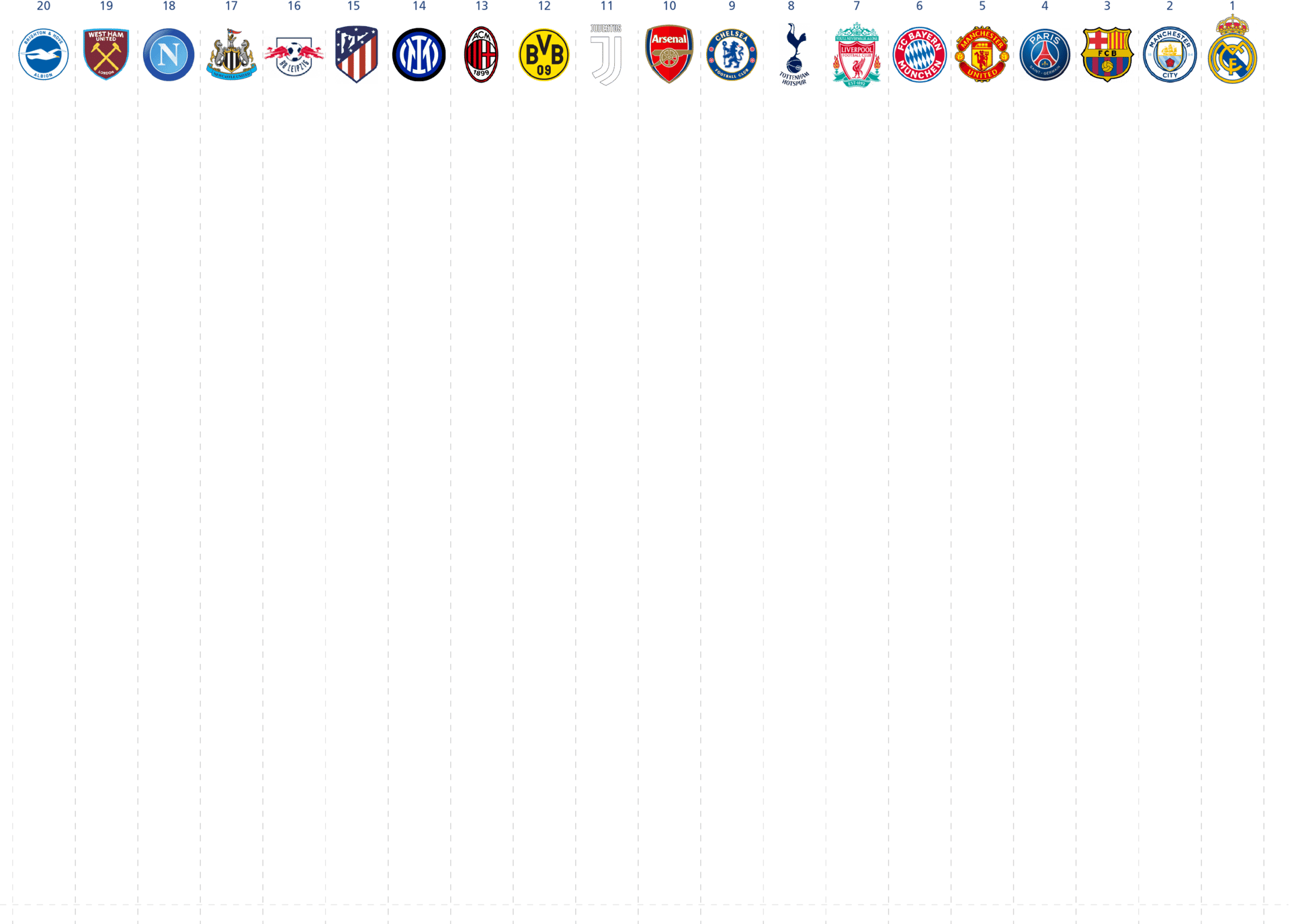

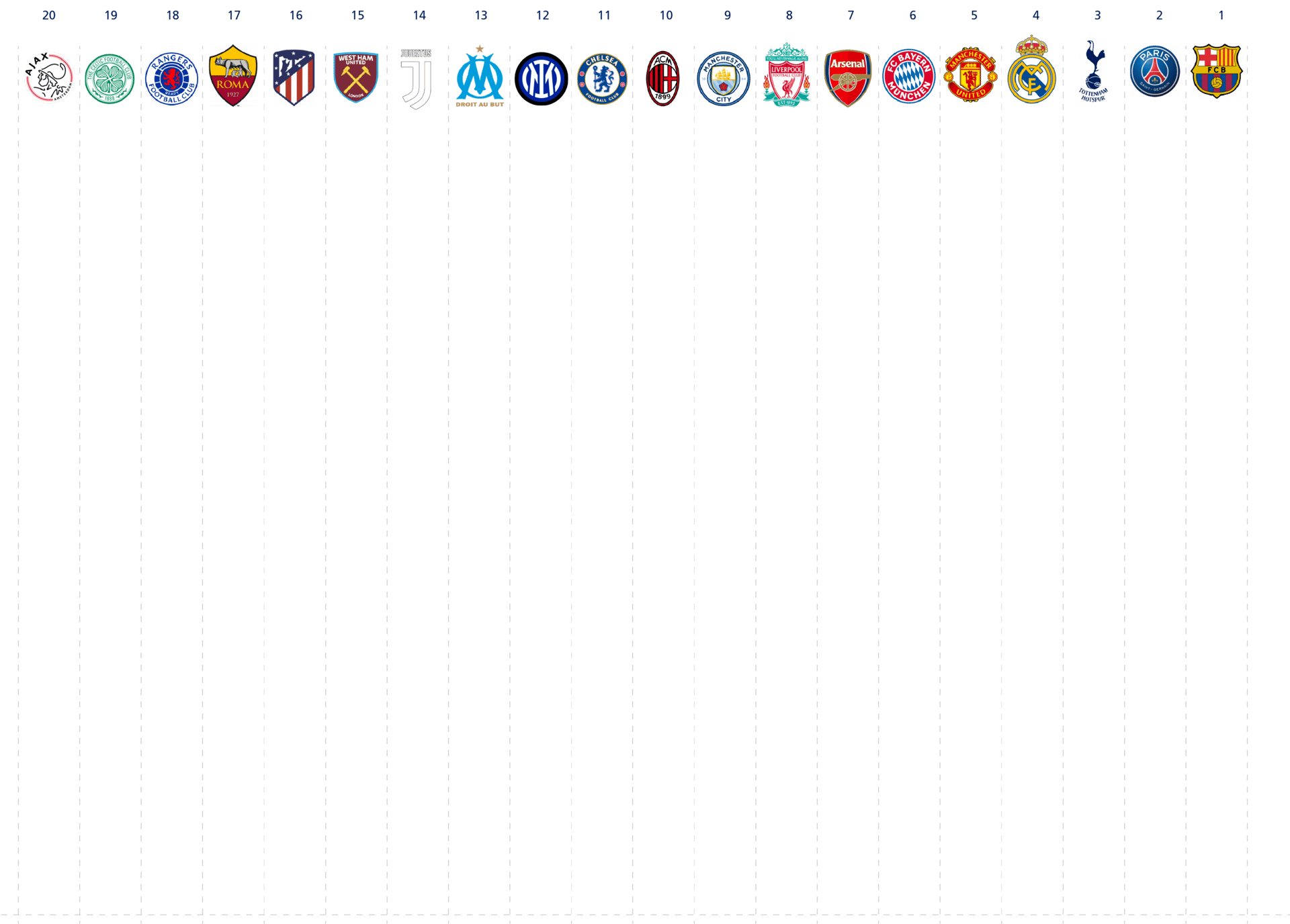

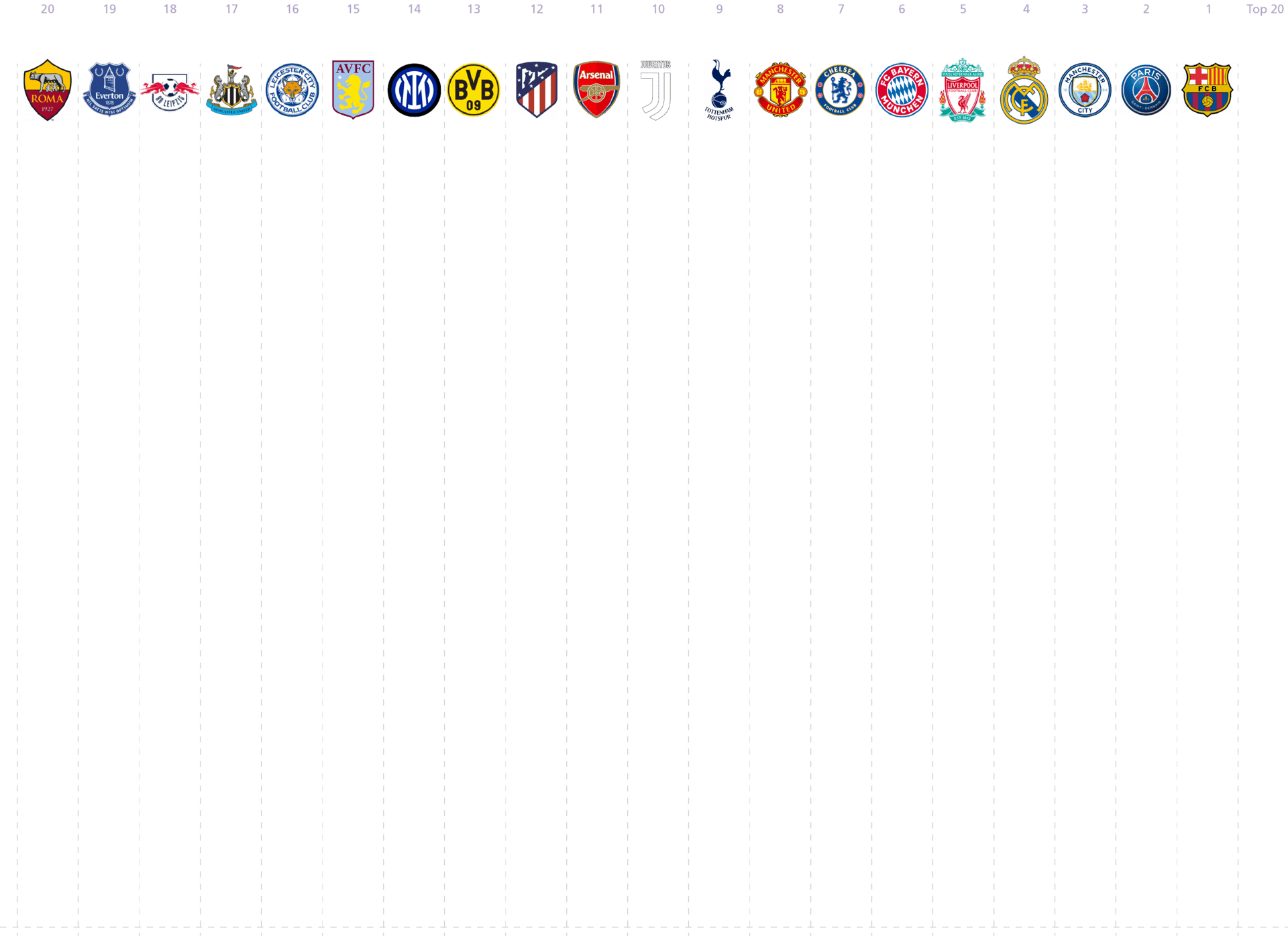

The full report features fourteen different club by club comparisons with a selection of these topics presented below.

You can explore how much each club makes from gate revenues, then delve further into how much this represents per match and per supporter visit.

You can also explore which clubs spend the most on wages and which clubs squads cost the most transfer fees to build.

Click on each metric to view results

54

44

57

36

58

64

59

37

81

90

€40m 48%

123

97

128

85

€60m 45%

134

100

194

177

195

167

209

178

311

289

343

369

355

294

368

330

377

324

369

266

401

371

247

204

€64m 26%

83

79

Click "1 FC UNION" to see example

Total revenue

Gate Revenue

Gate Revenue Per Fan

Total Wages

WAGE RATIO

TRANSFER COST of squads

Balance Sheet Cost of Squads

Total revenue

Gate Revenue

Balance Sheet Cost of Squads

Gate Revenue Per Fan

Total Wages

WAGE RATIO

Transfer costs of squads

Click on each metric to view results

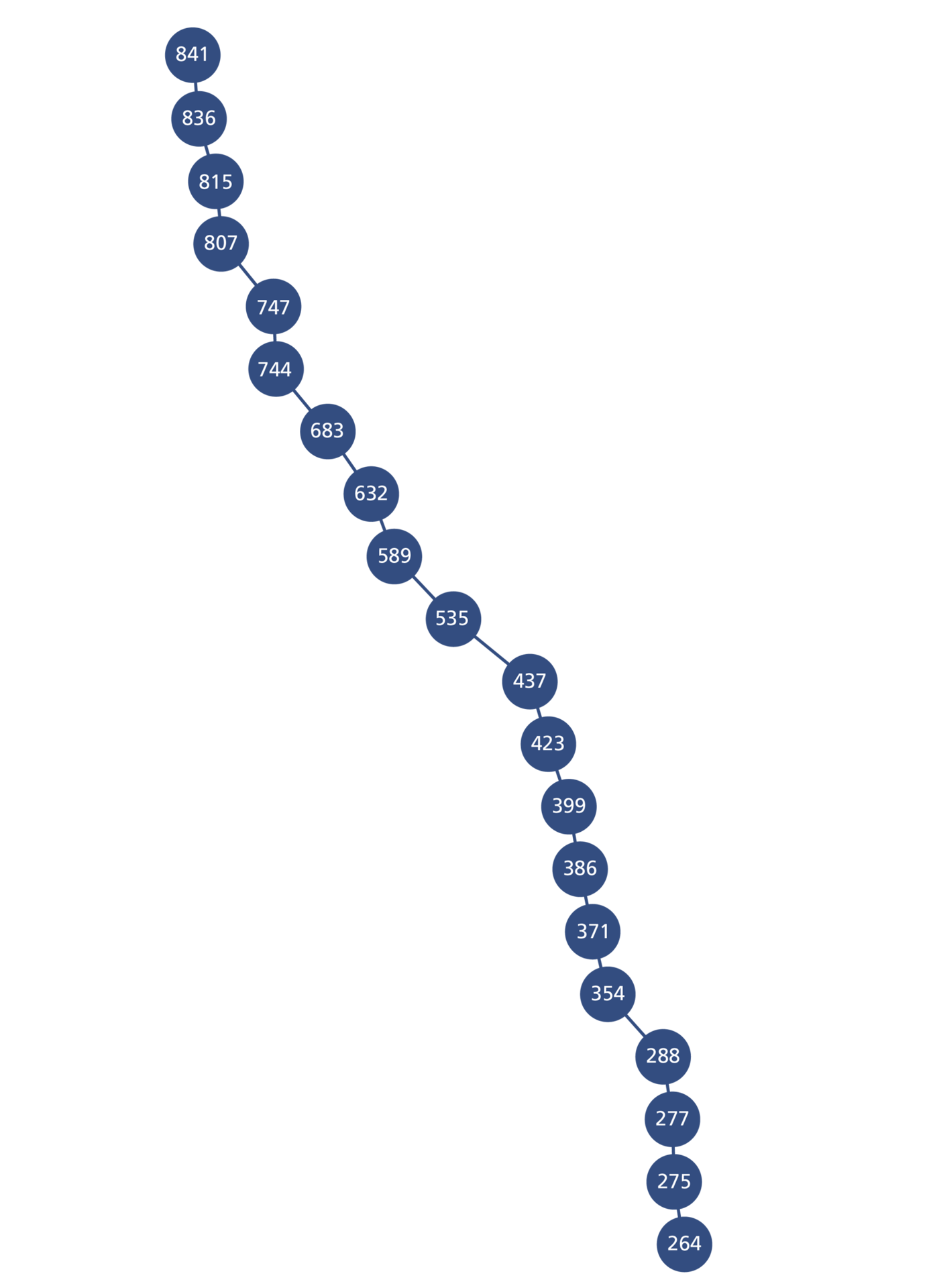

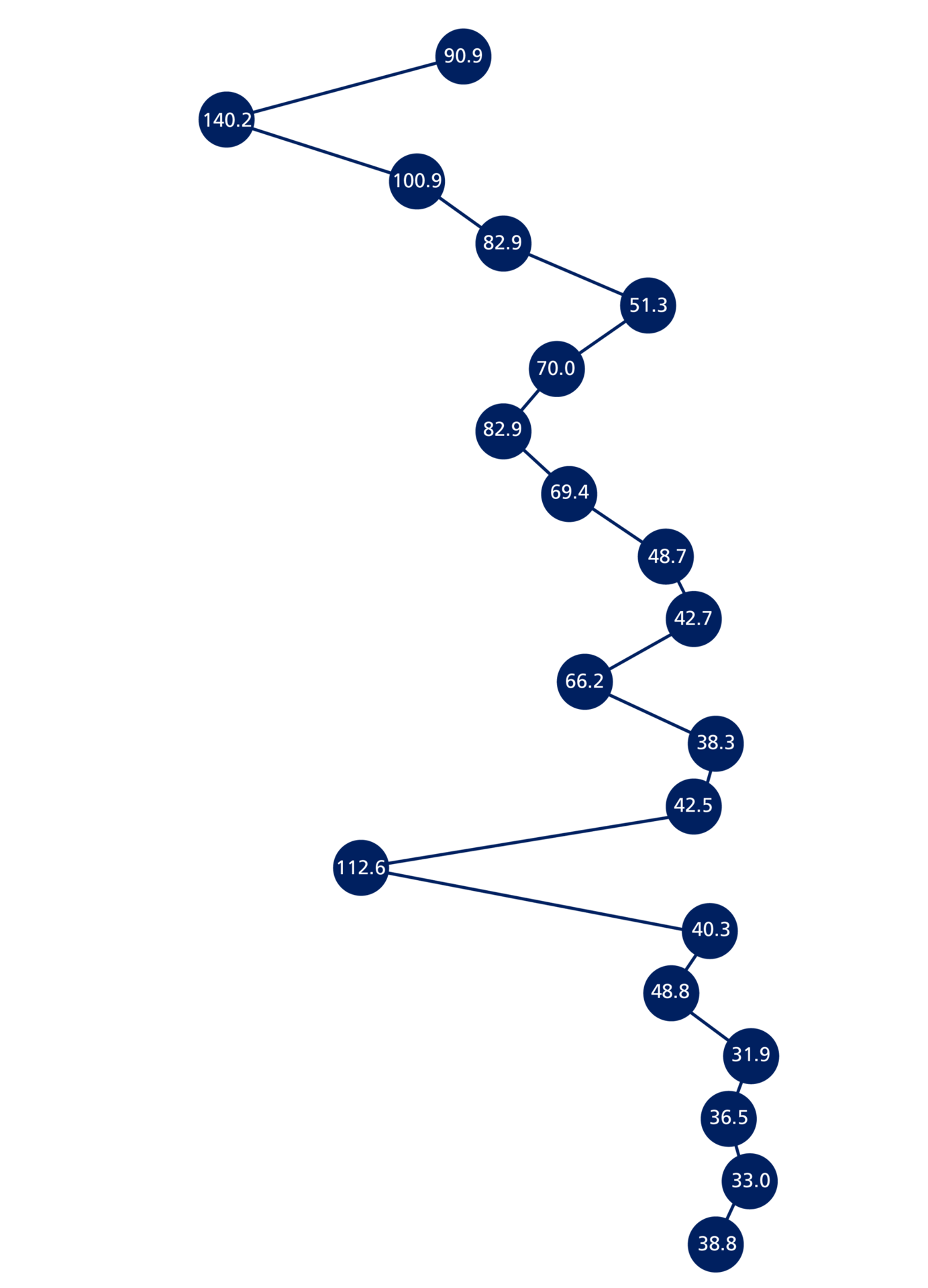

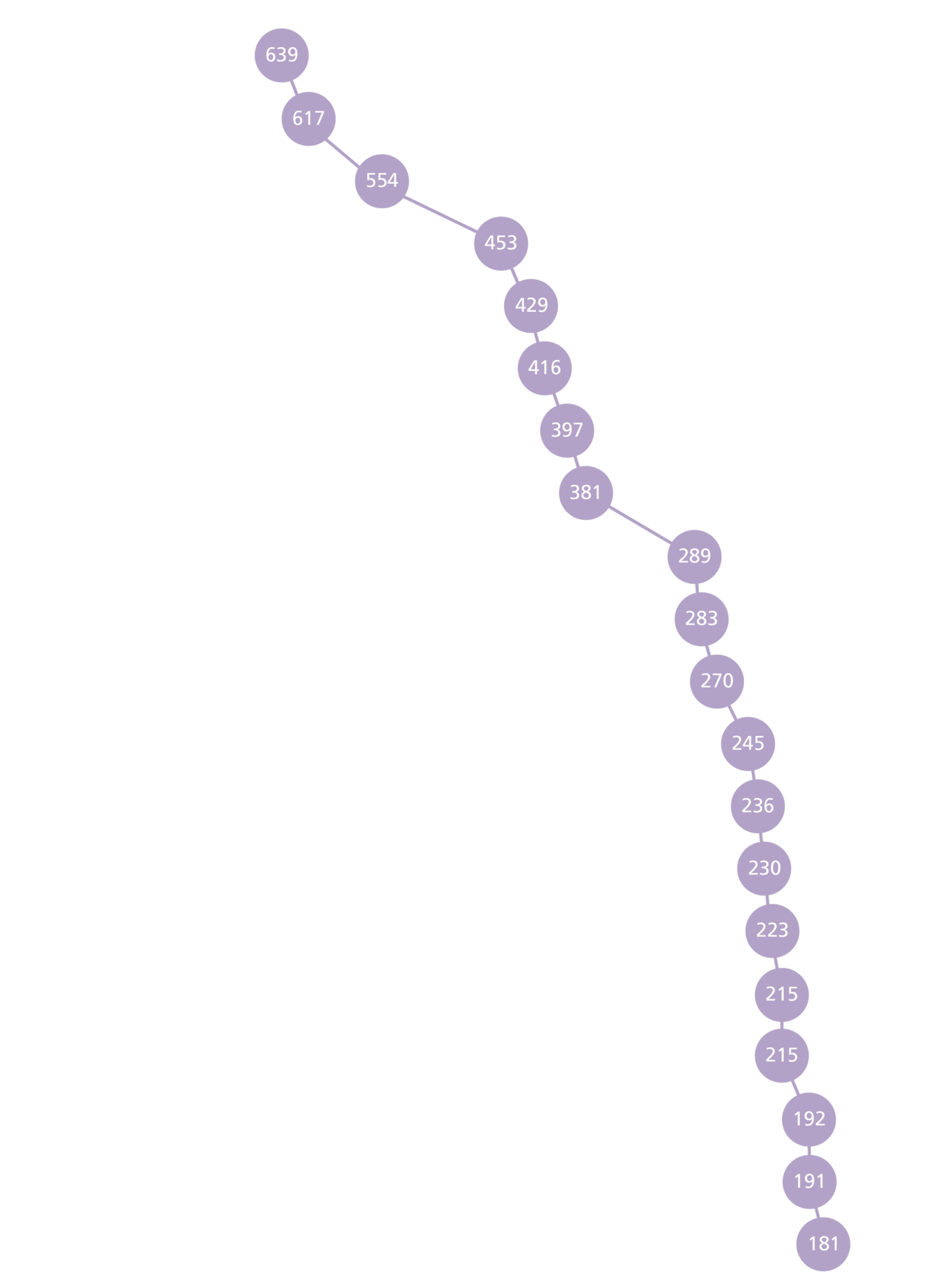

Total revenue (€m)

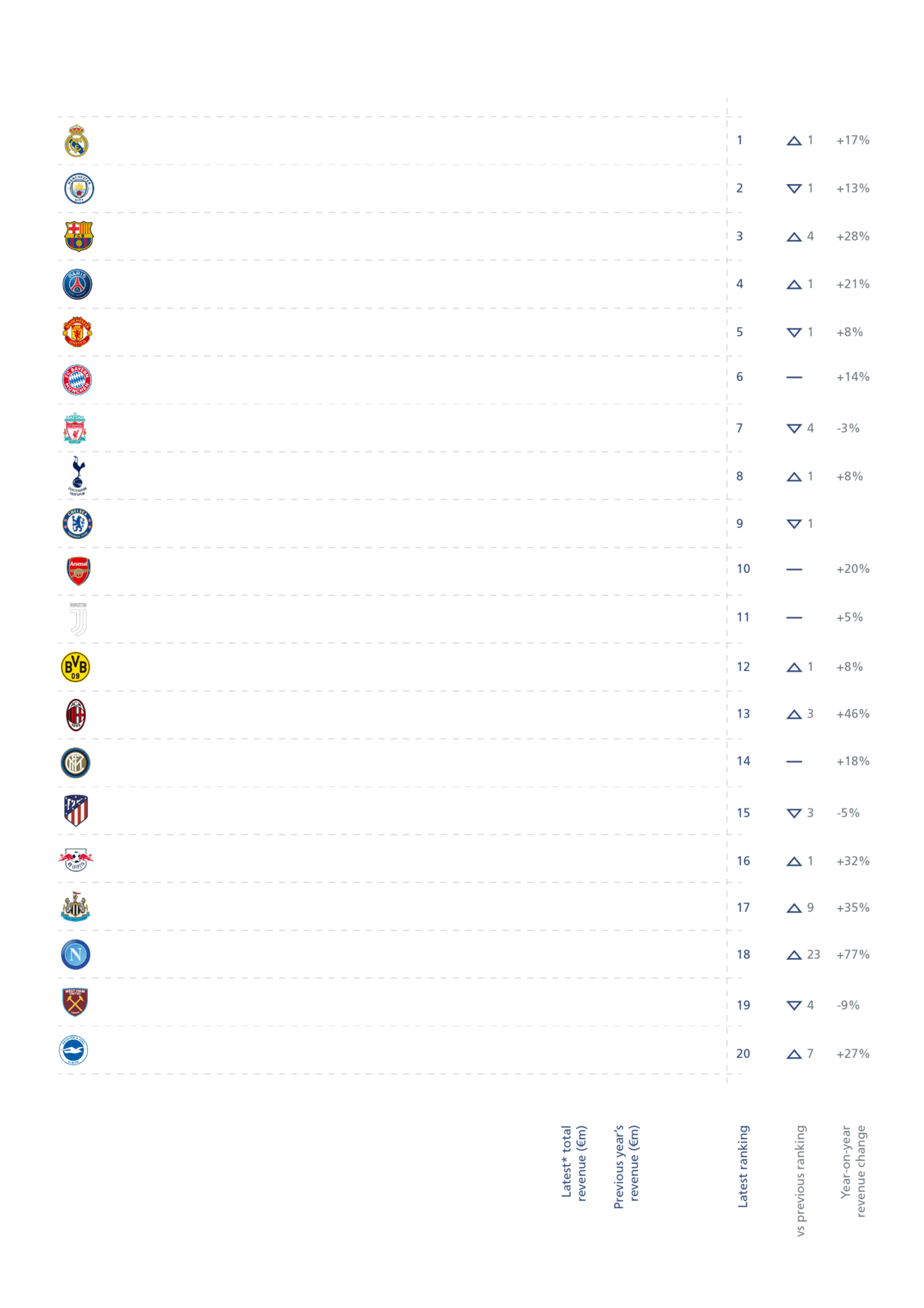

15 of the top 20 clubs reported their all-time record revenues in 2023

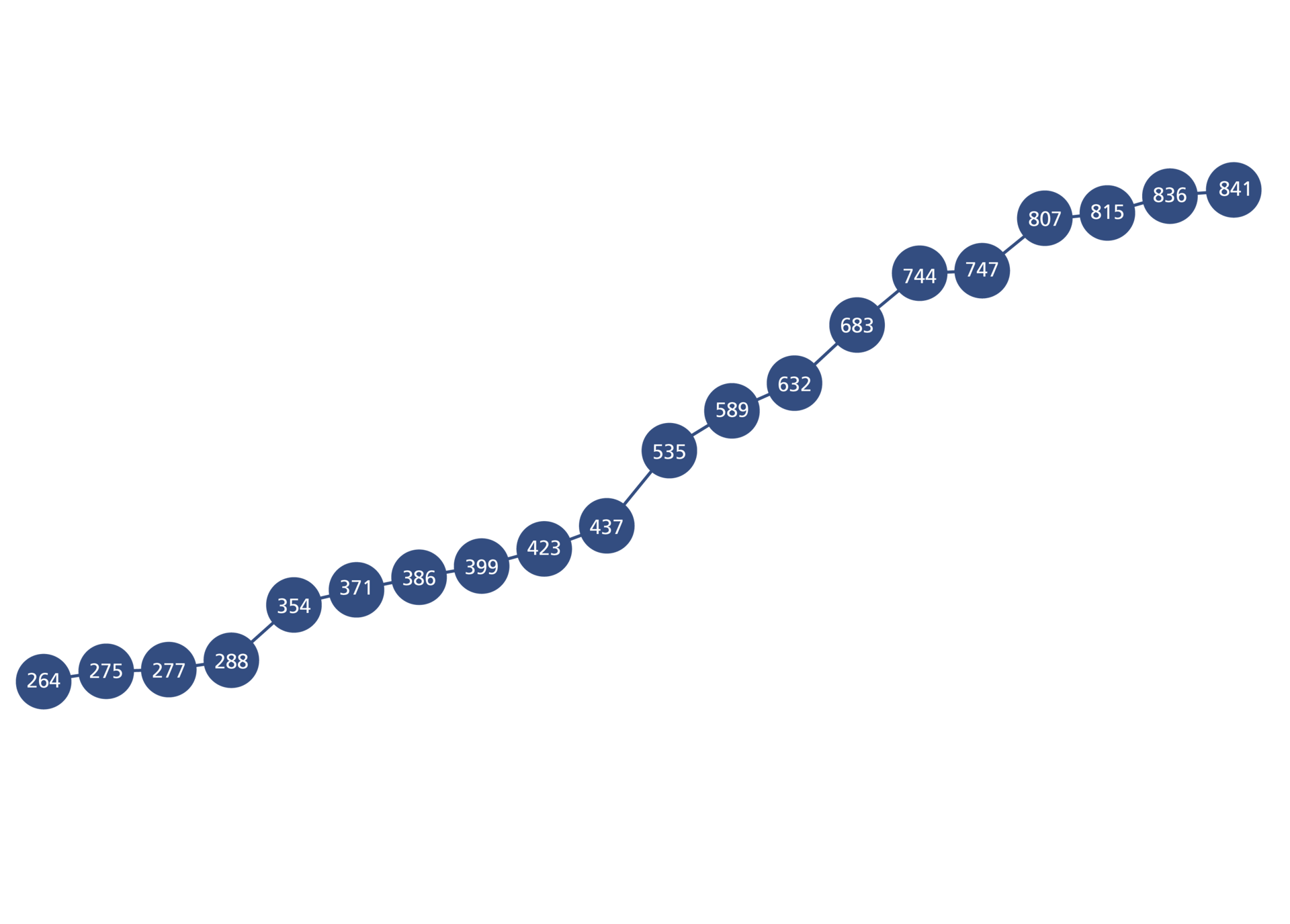

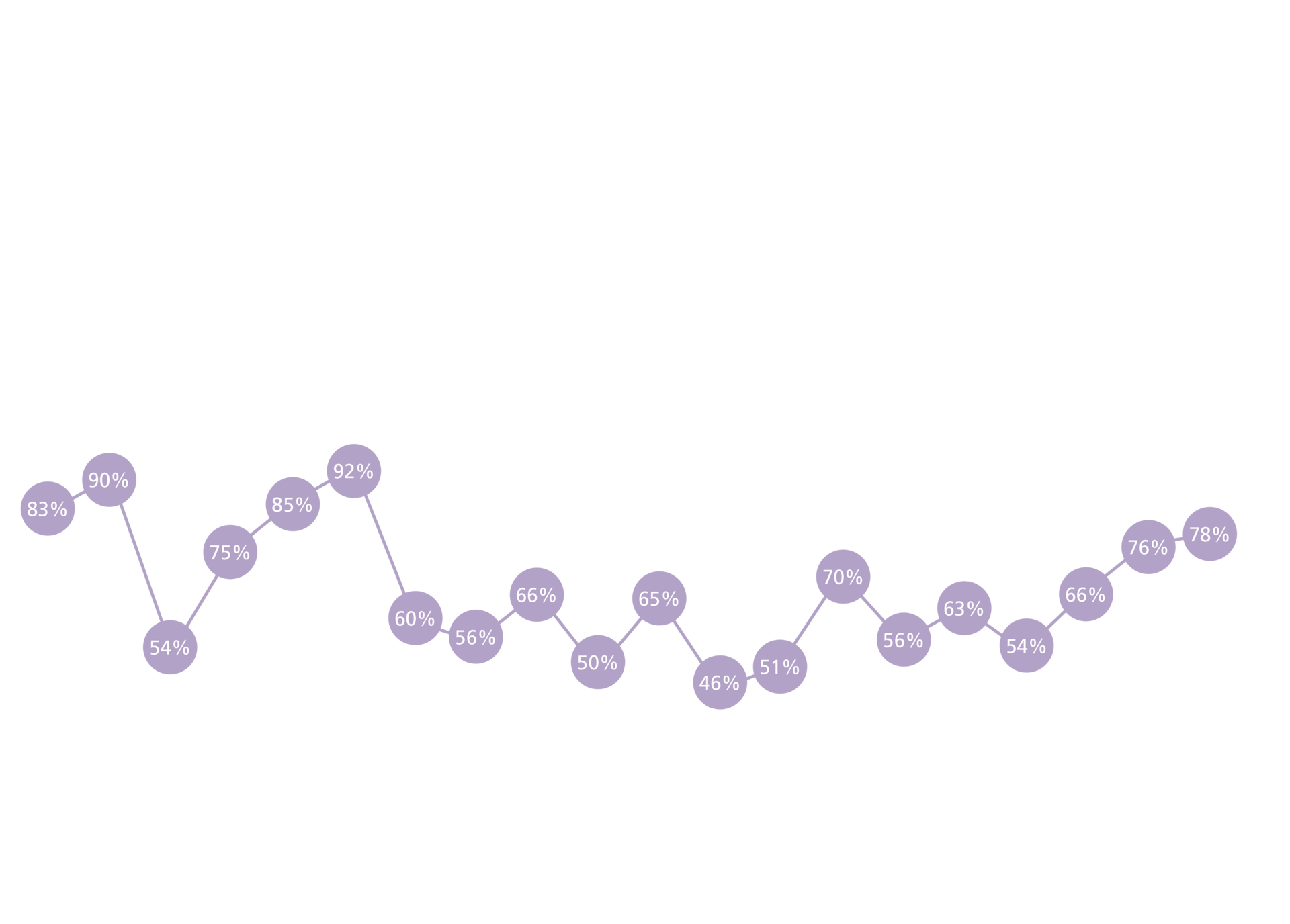

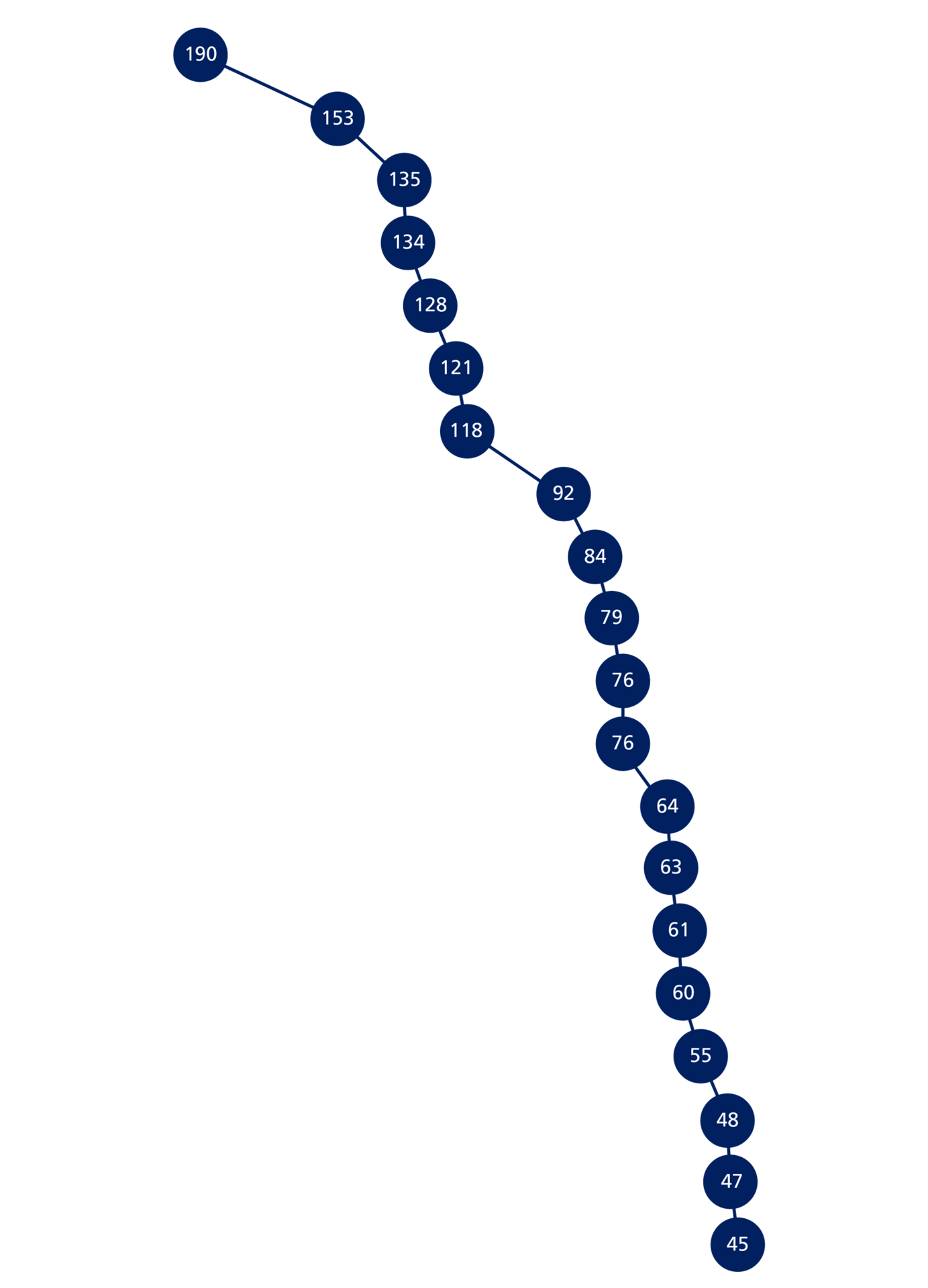

GATE REVENUE

Gate revenues increased 31% in 2023 among the top 20 clubs

Gate revenue per fan (€M)

The hospitality mix and ticketing prices dictate average income per match visit

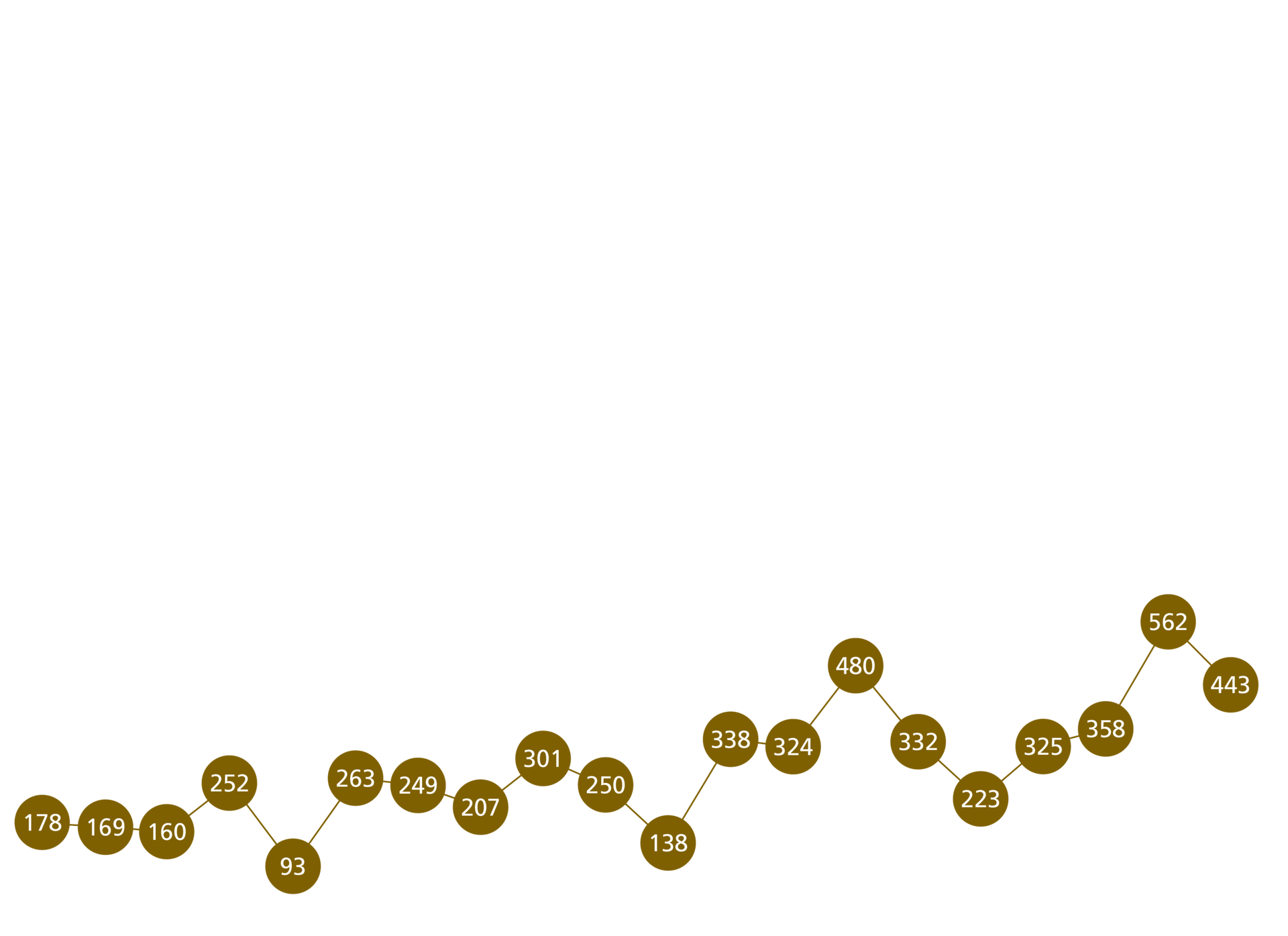

total wages (€m)

Player wages declined 1% in 2023 as clubs prepare for updated financial sustainability rules

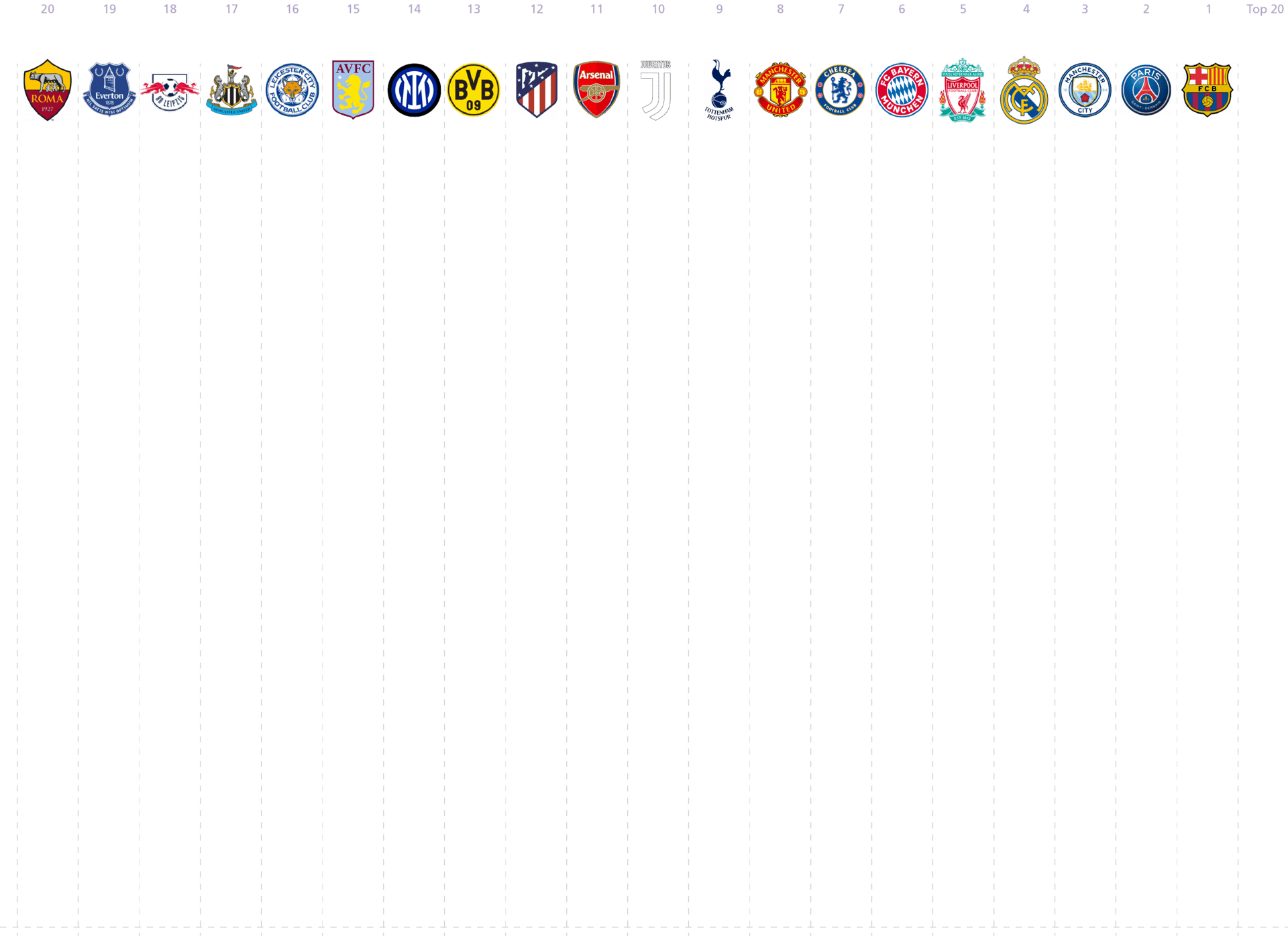

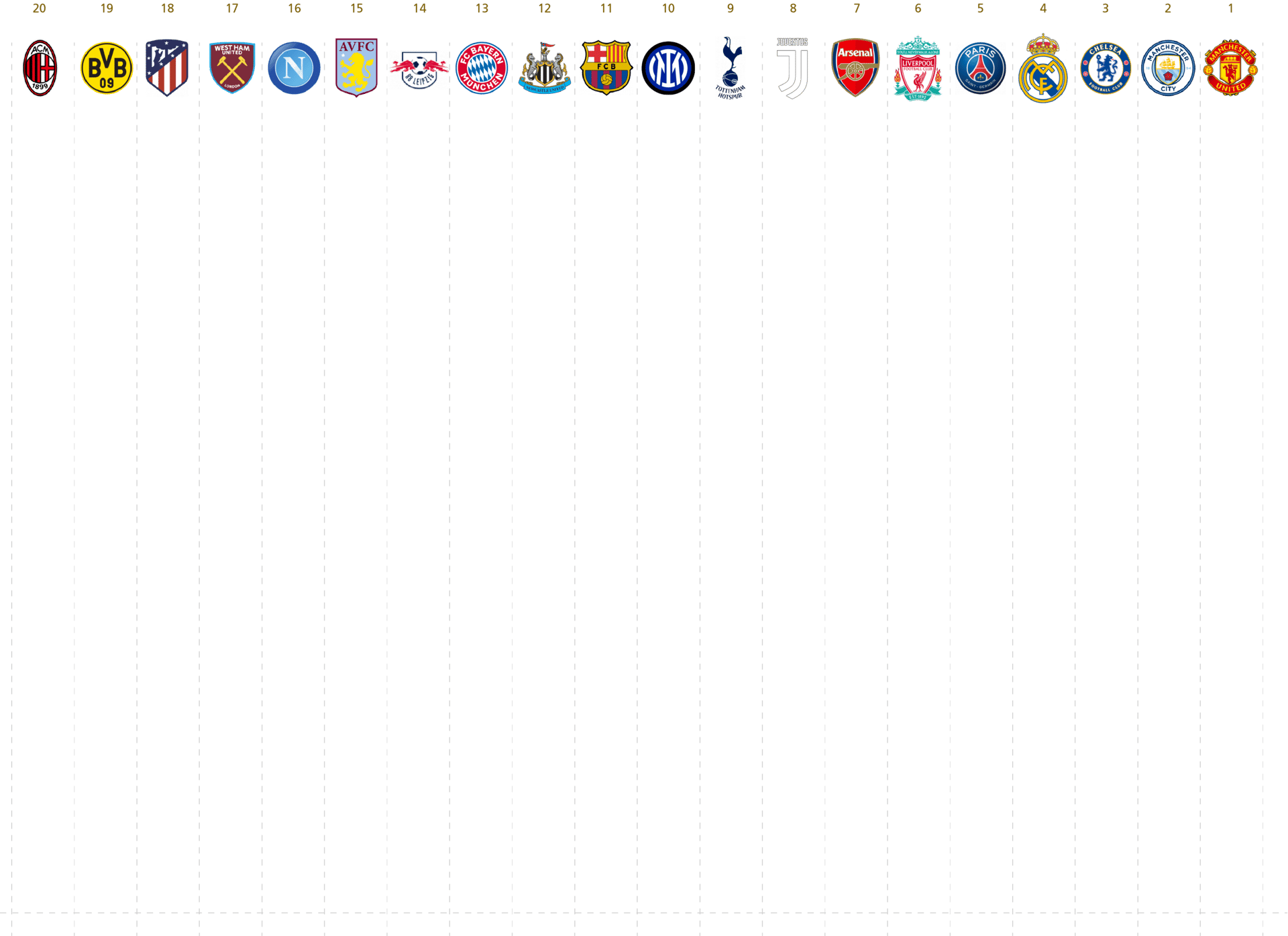

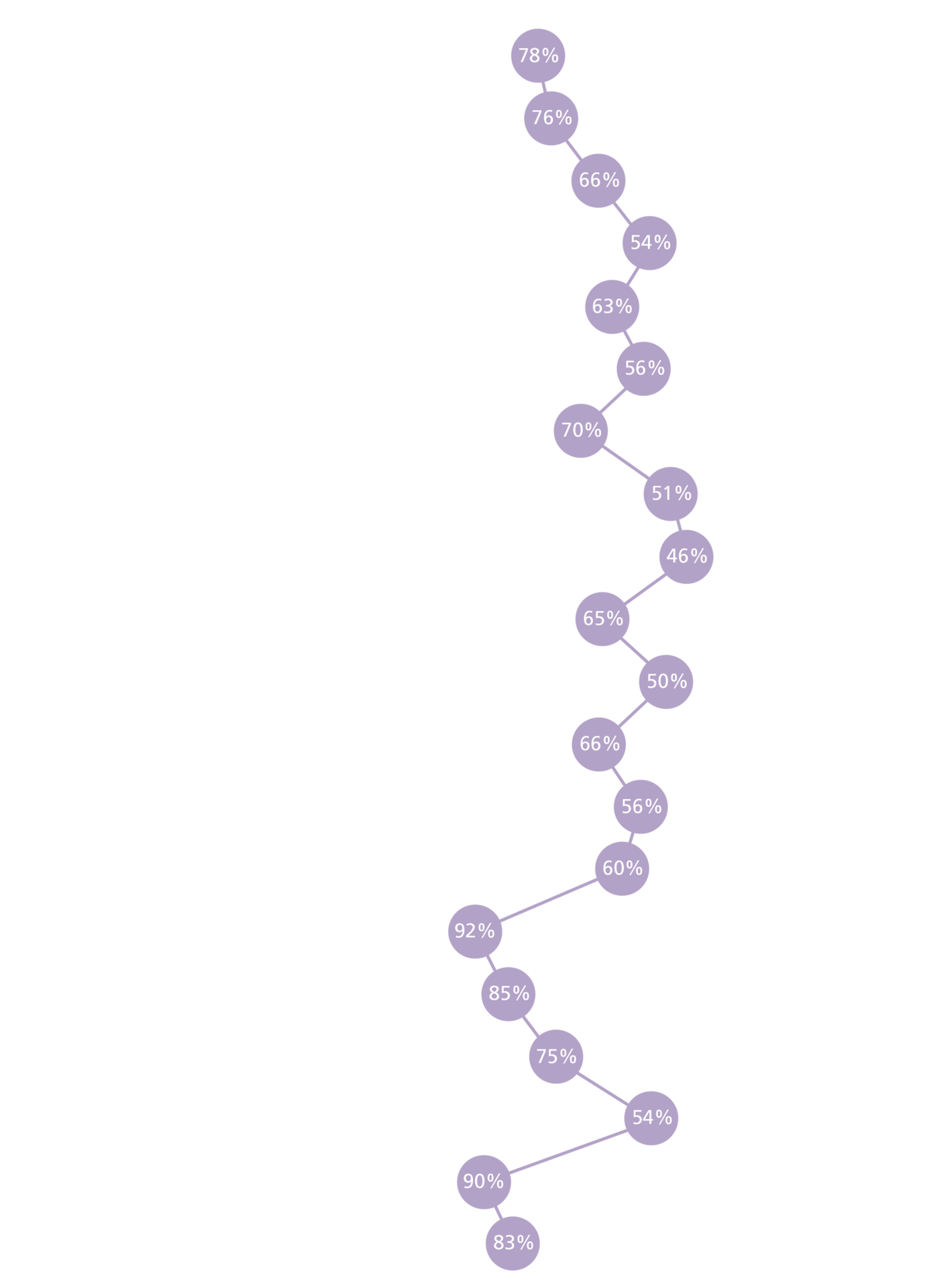

Wage ratio

The wage to revenue ratio is the most common referenced metric for wage affordability

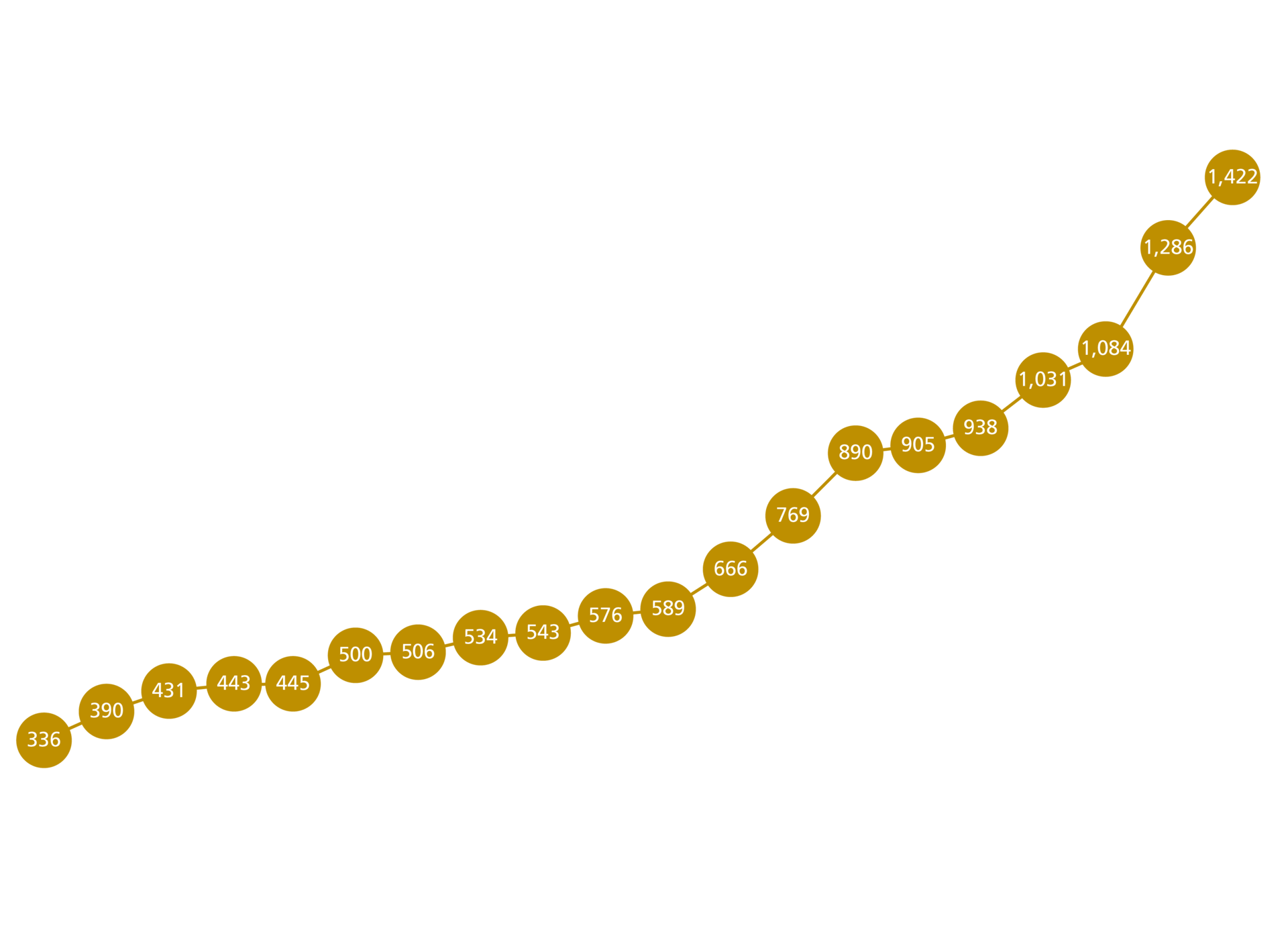

Transfer costs of squads (€m)

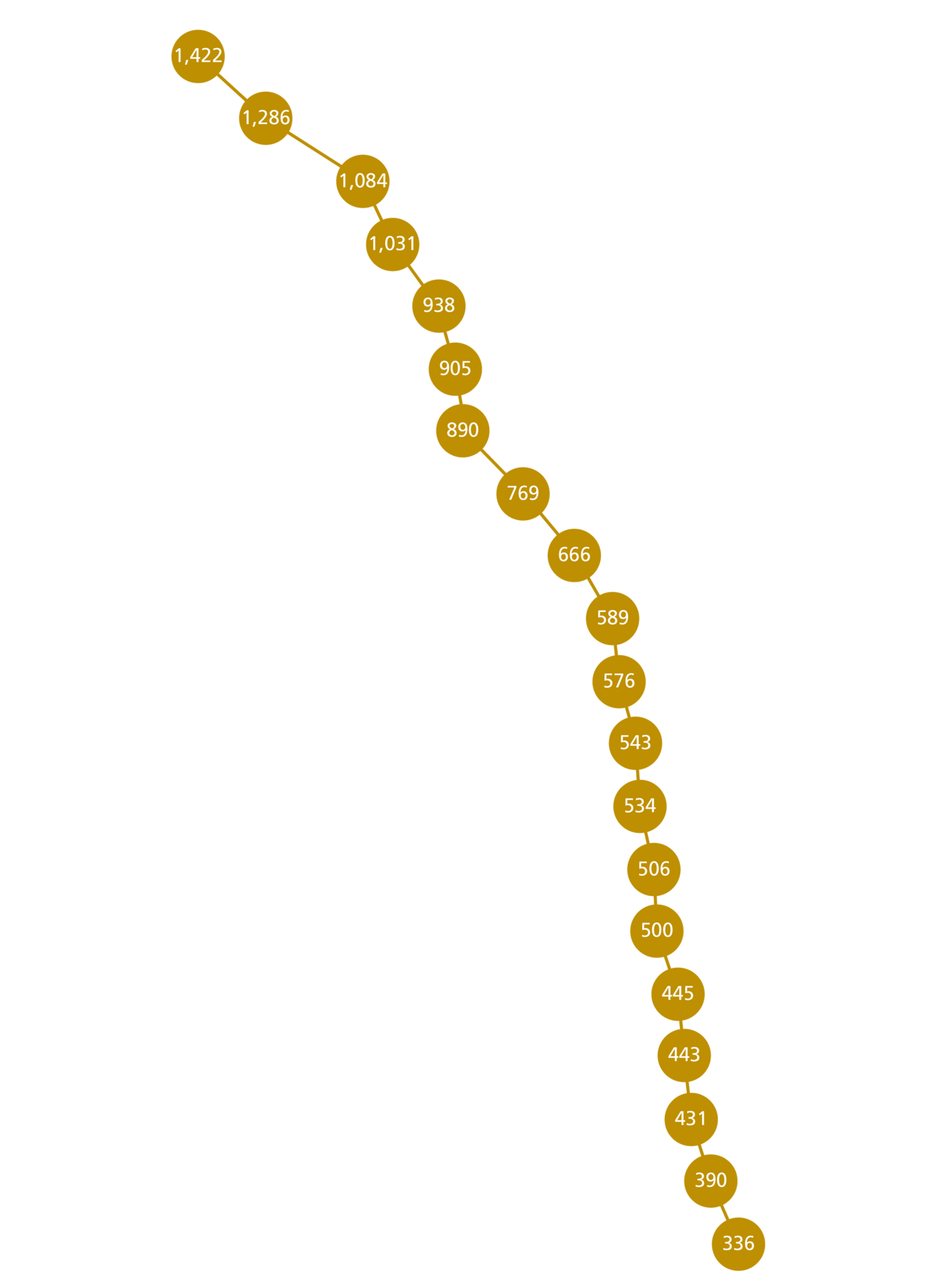

The 2023 year-end Manchester United squad cost €1.422m in transfer fees, beating the previous 2020 Real Madrid record.

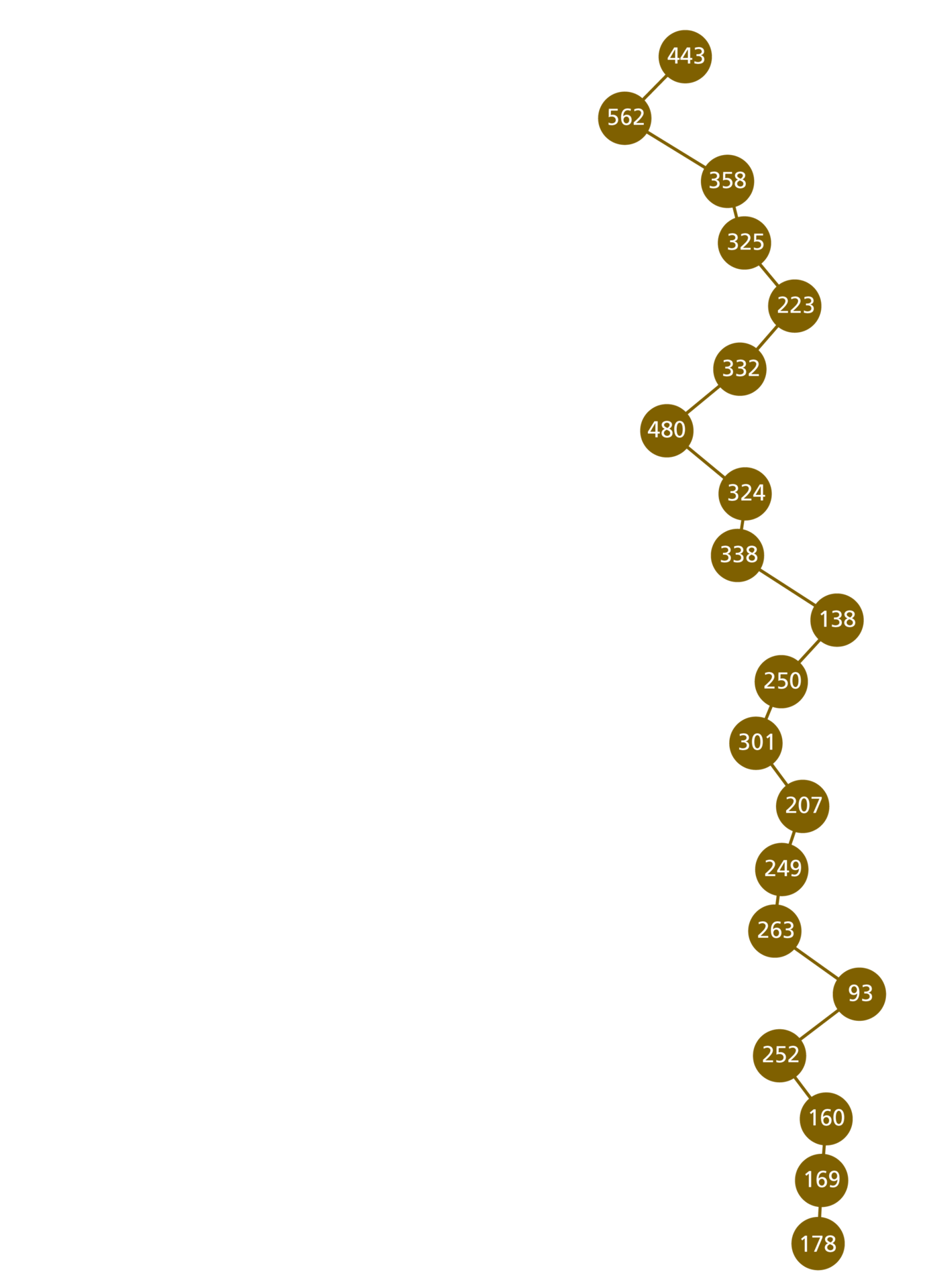

Balance Sheet Cost of Squads (€m)

The transfer fees appear as an asset of the club. The value is reduced across the contract of each player.

Total revenue (€m): 15 of the top 20 clubs reported their all-time record revenues in 2023

Gate revenue (€M): Gate revenues increased 31% in 2023 among the top 20 clubs

Gate revenue per fan (€M): The hospitality mix and ticketing prices dictate average income per match visit.

TOTAL wages €m: Player wages declined 1% in 2023 as clubs prepare for updated financial sustainability rules

Wage ratio: The wage to revenue ratio is the most common referenced metric for wage affordability

Transfer costs of squads (€m): The 2023 year-end Manchester United squad cost €1.422m in transfer fees, beating the previous 2020 Real Madrid record.

Balance Sheet Cost of Squads (€m): The transfer fees appear as an asset of the club. The value is reduced across the contract of each player.

The data is the latest available 2023 financial year-end data. The exceptions are Chelsea FC, Everton FC and Leicester City FC, for which data relates to 2022.

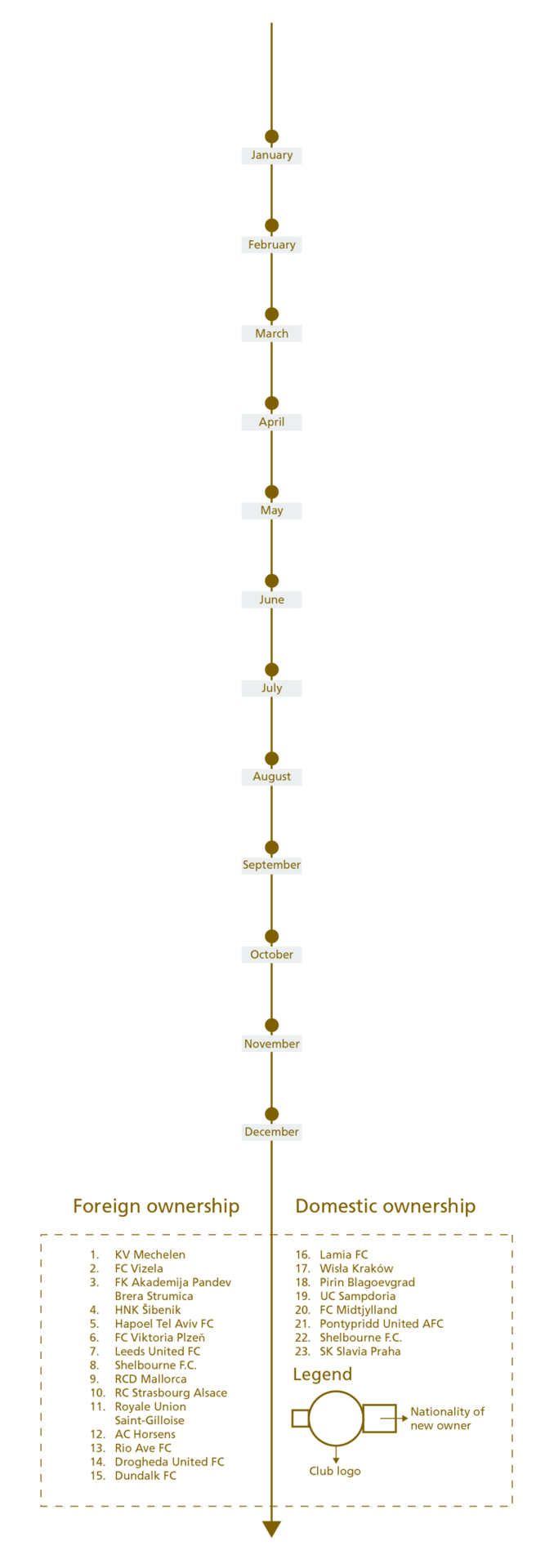

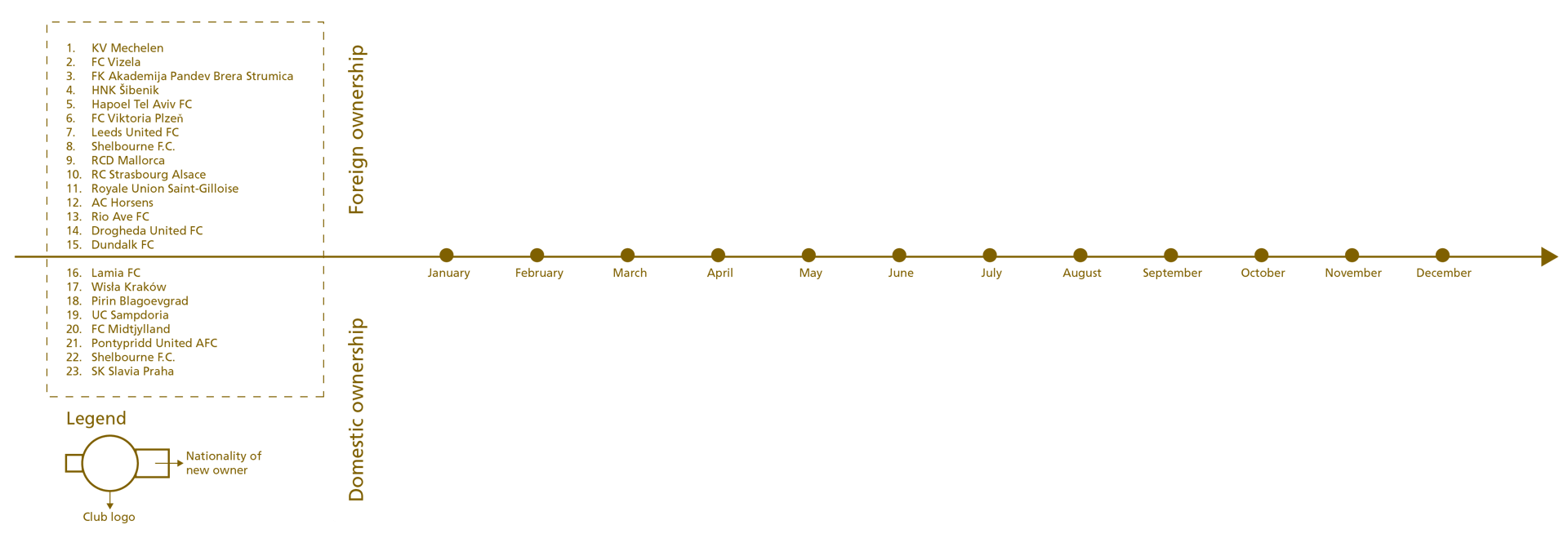

The number of changes of control / ownership at clubs reduced in 2023 after the pent-up pandemic buying frenzy in the second half of 2021 and throughout 2022.

Number of changes in European top-division clubs’ controlling ownership

9

14

8

18

15

15

18

29

Number of changes in European top-division clubs’ controlling ownership

14

9

8

18

15

15

18

29

The number of ownership changes for 2023 may edge upwards once all clubs submit their ownership information.

Nonetheless strong demand to buy into the authenticity of European club football continued from all corners of the world.

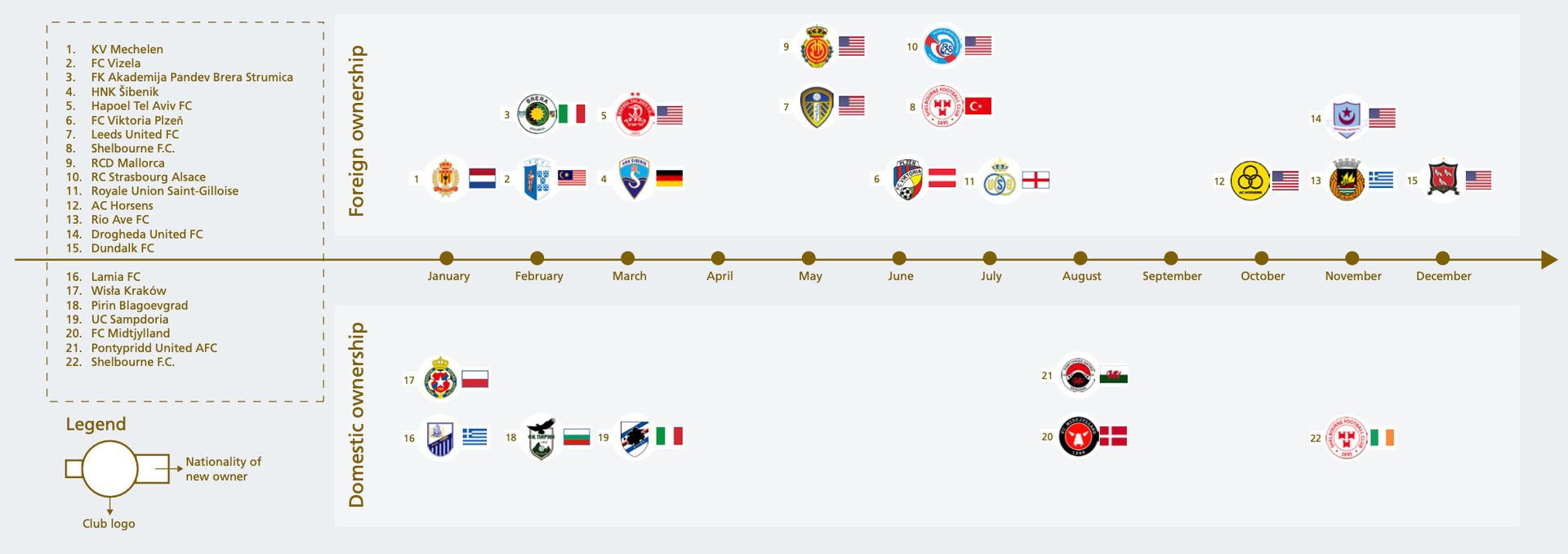

Timeline of top-division club takeovers in 2023

Nonetheless strong demand to buy into the authenticity of European club football continued from all corners of the world.

Every club failure is a local tragedy but the sheer resilience of European club football and the positive impact of tougher financial regulation, has never been better demonstrated with less than 0.5% club failure rate during the last two years despite the €7bn of lost revenues from the pandemic.

Cases of Club Insolvency

15

23

17

35

25

24

16

30

23

8

20

6

20

10

7

7

Annual average insolvency events across the four-year period

14

11

23

24

6

20

10

7

7

15

23

17

35

25

24

16

30

23

8

20

Annual average insolvency events across the four-year period

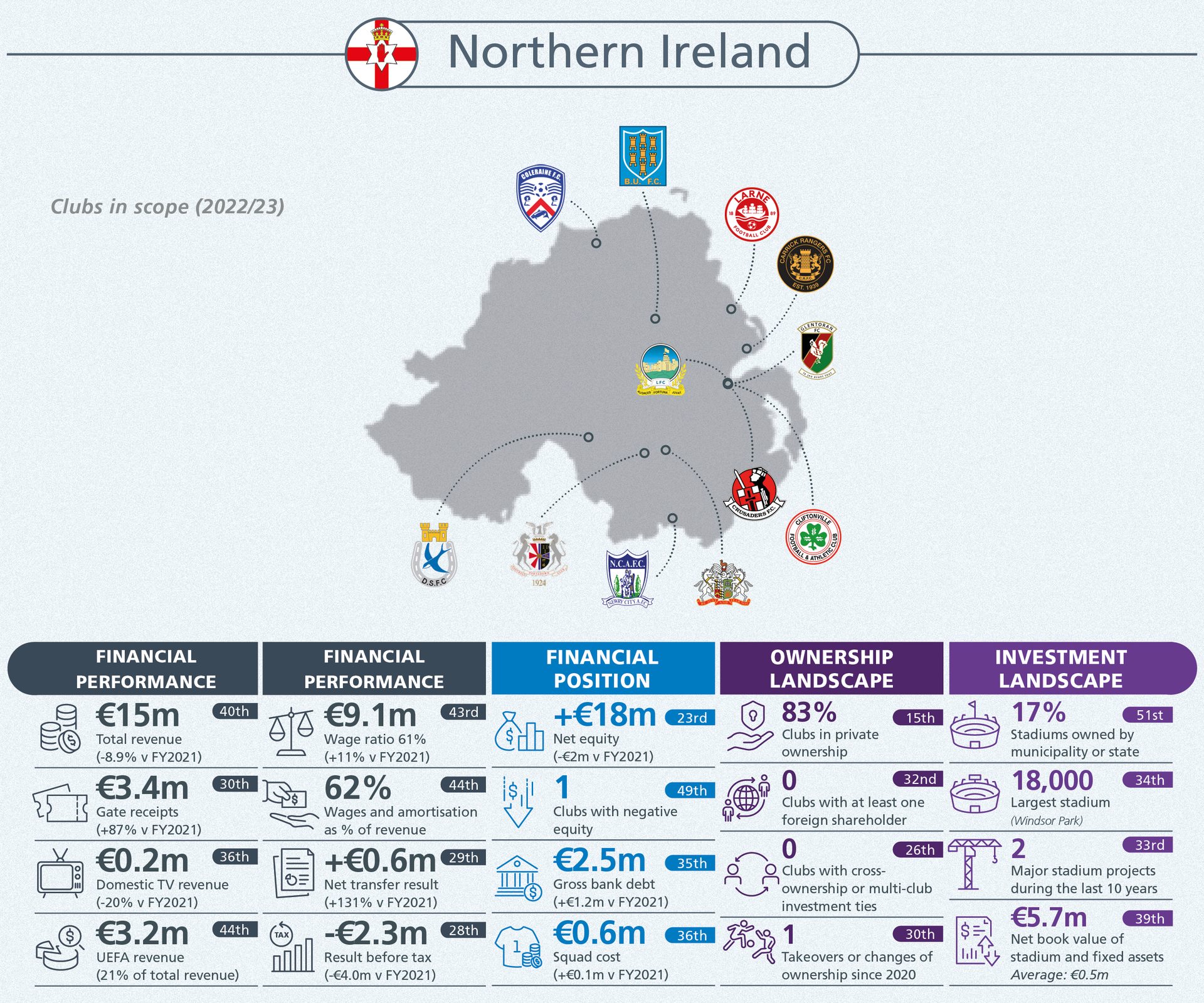

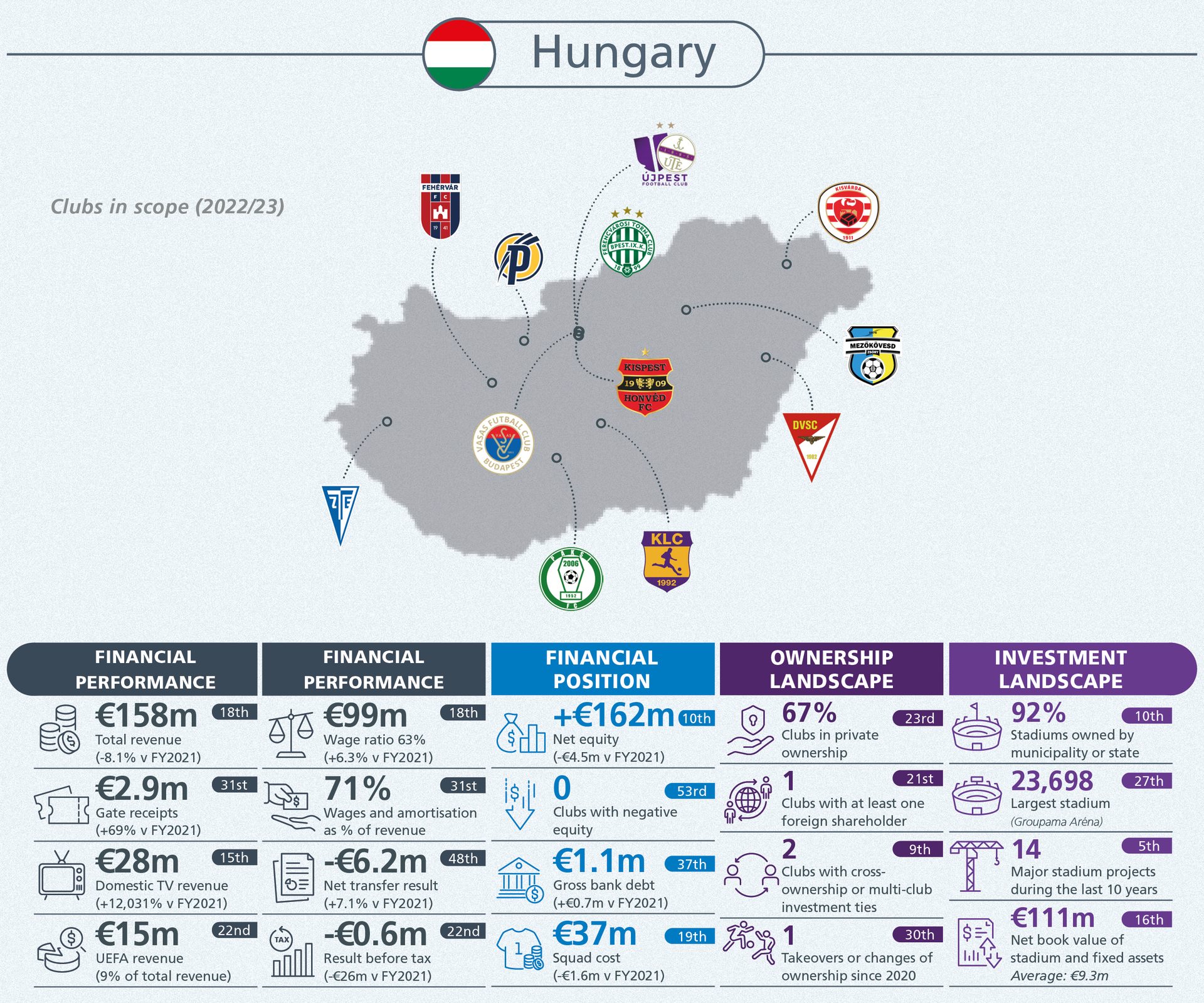

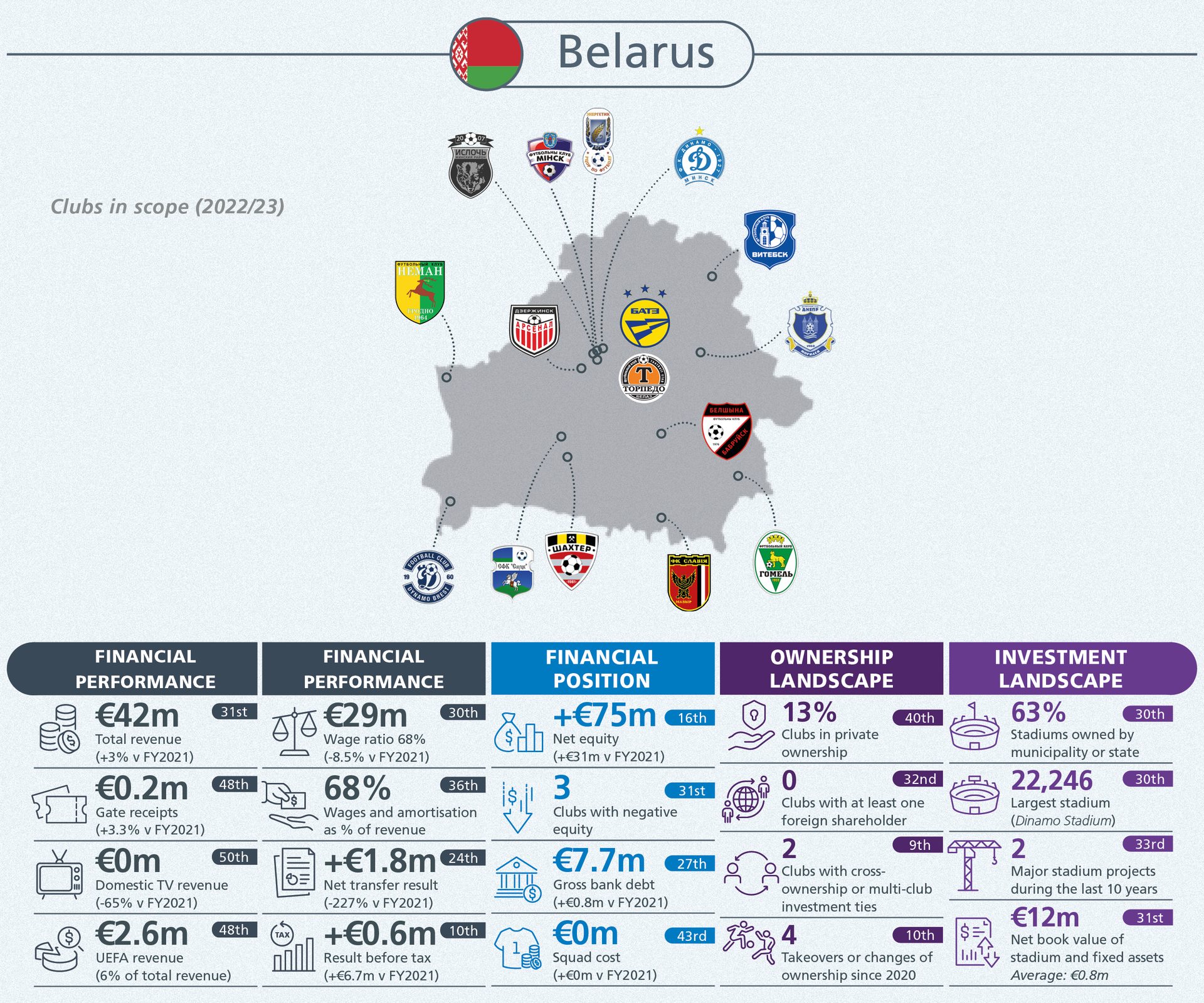

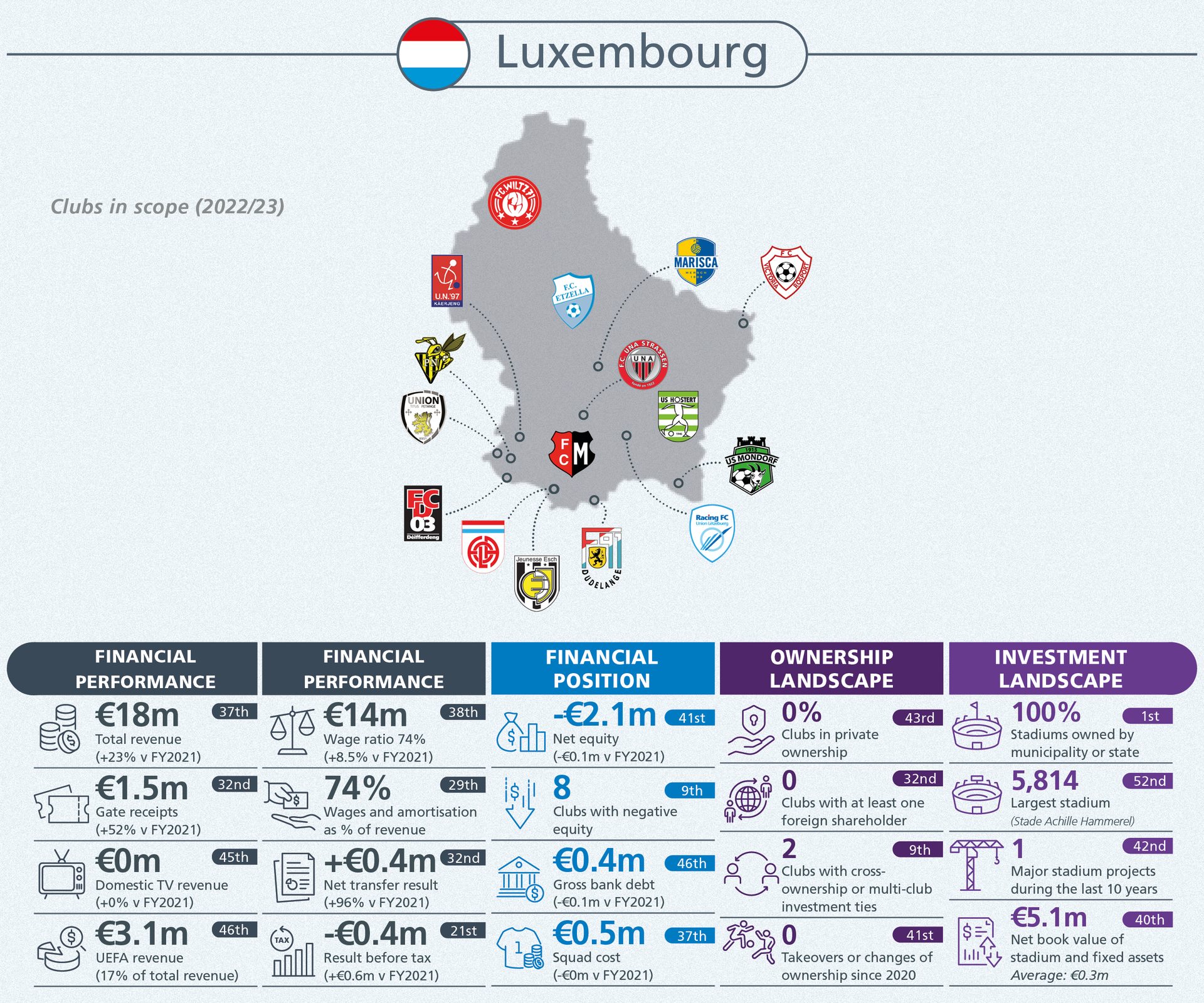

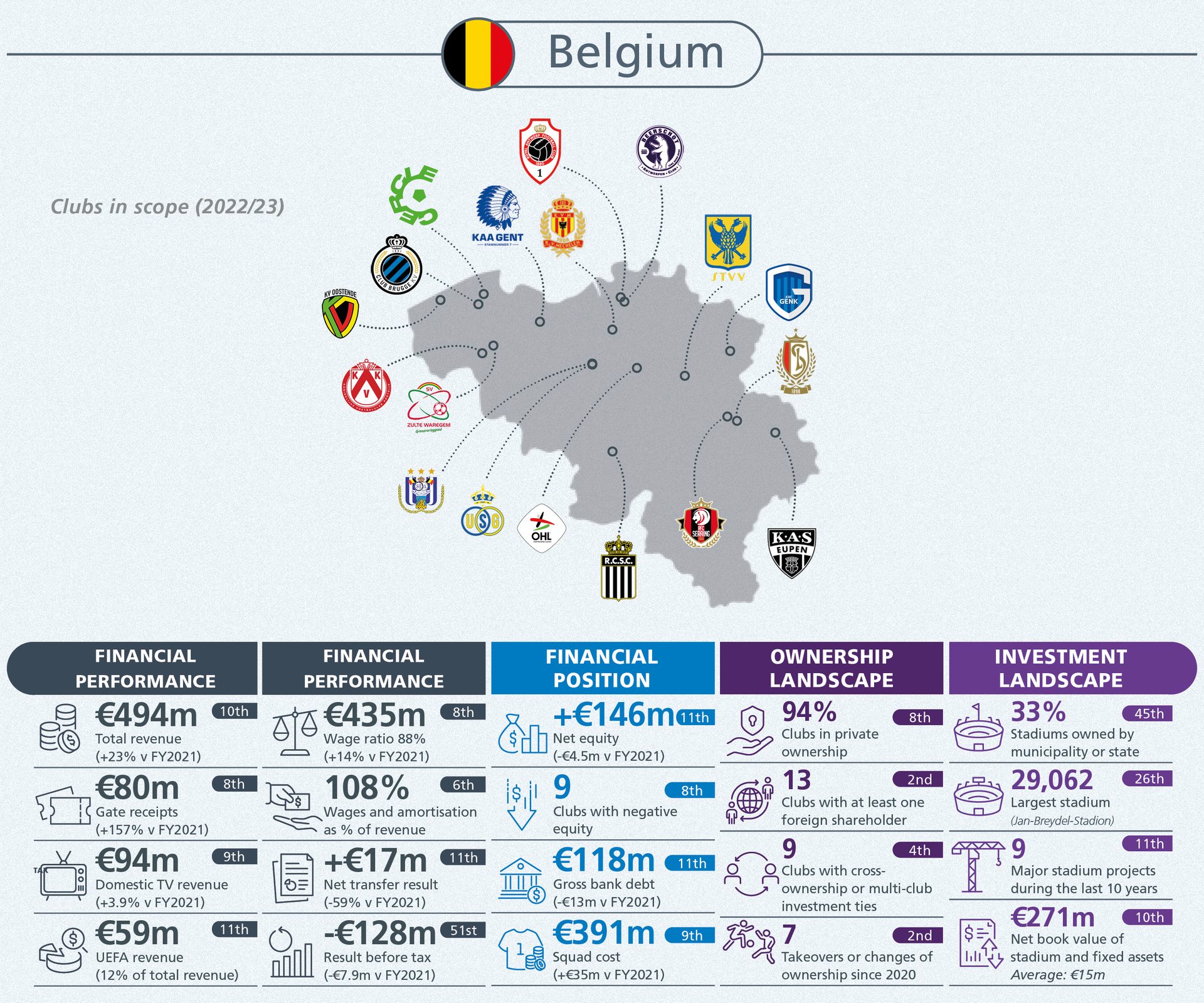

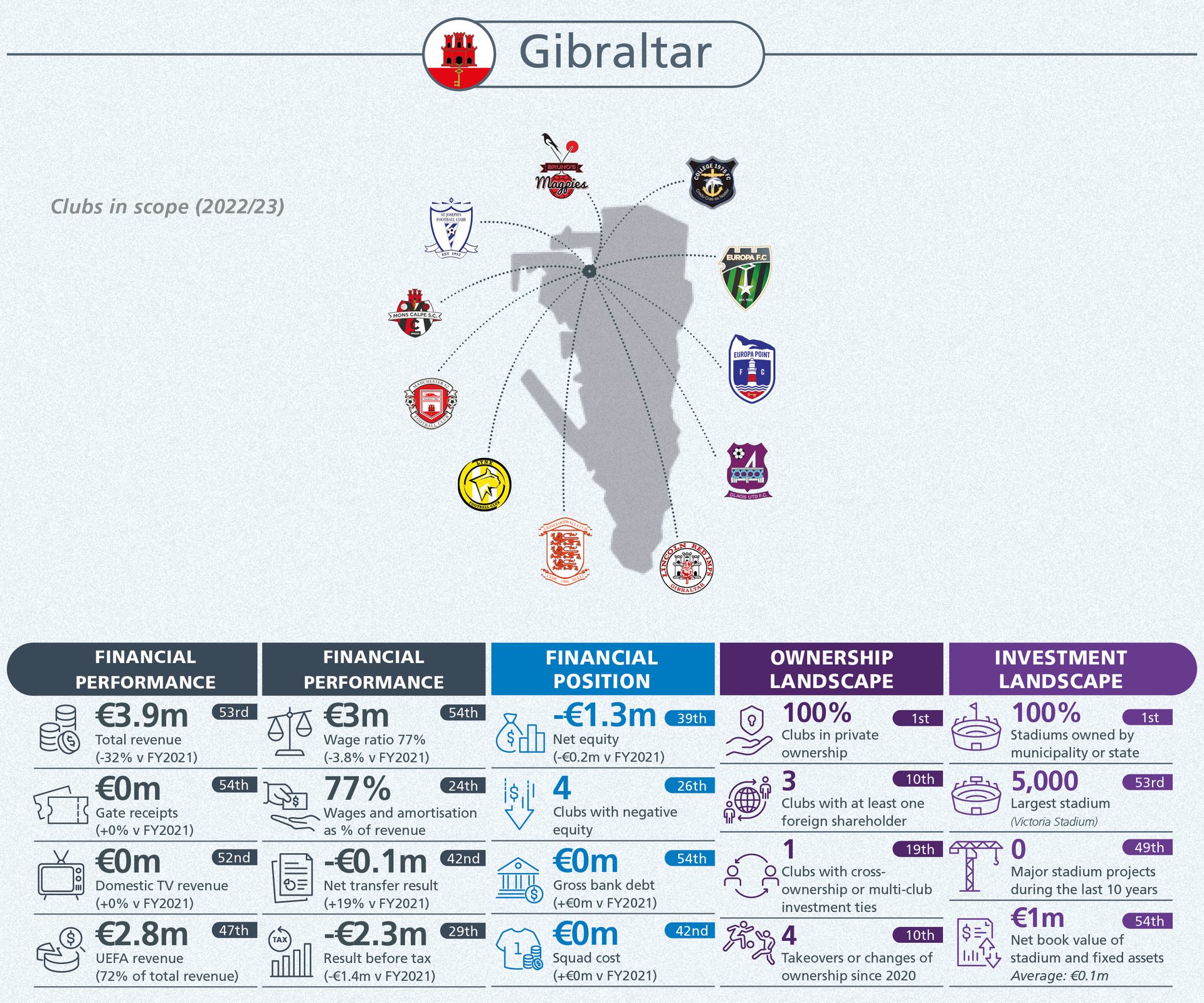

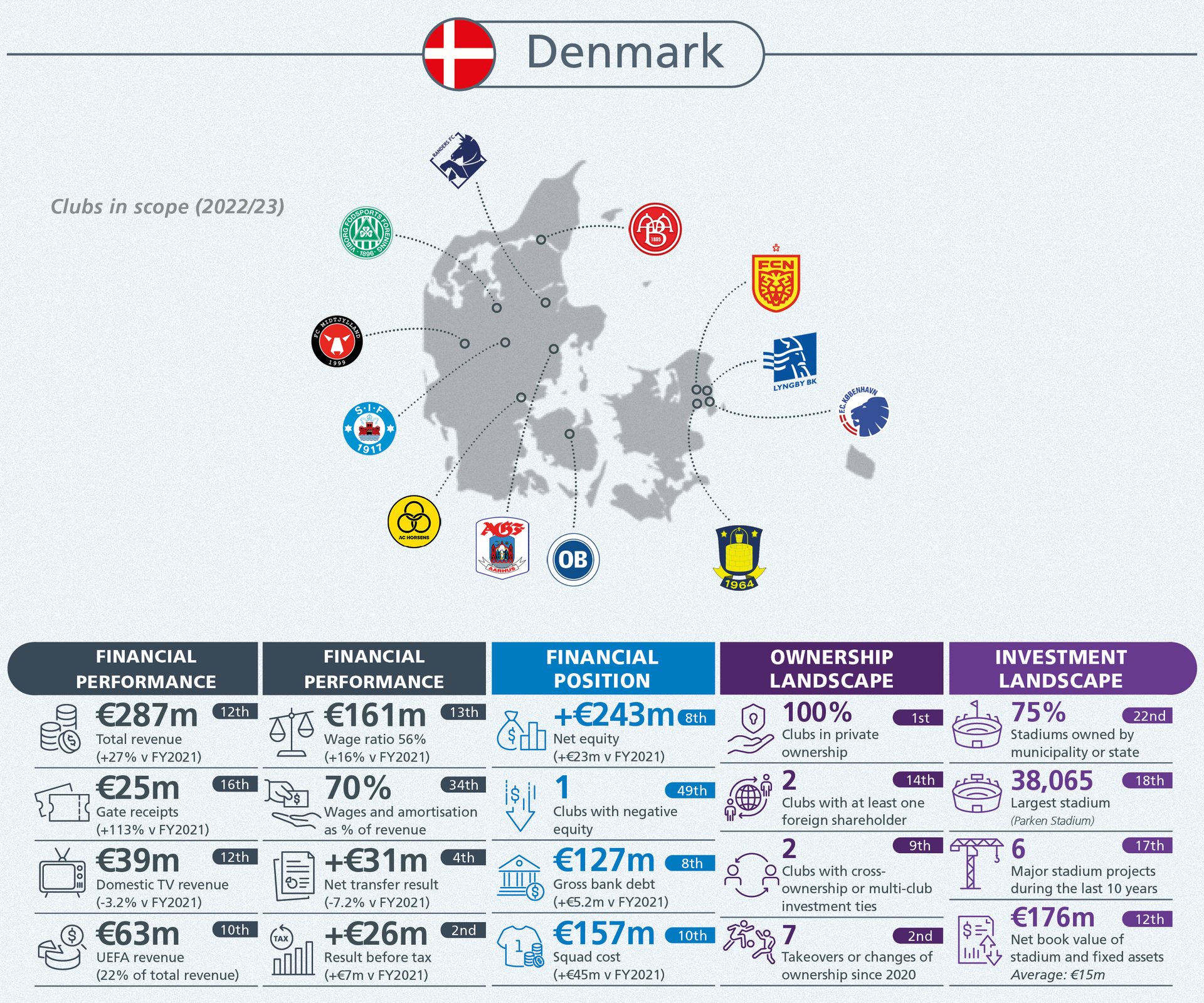

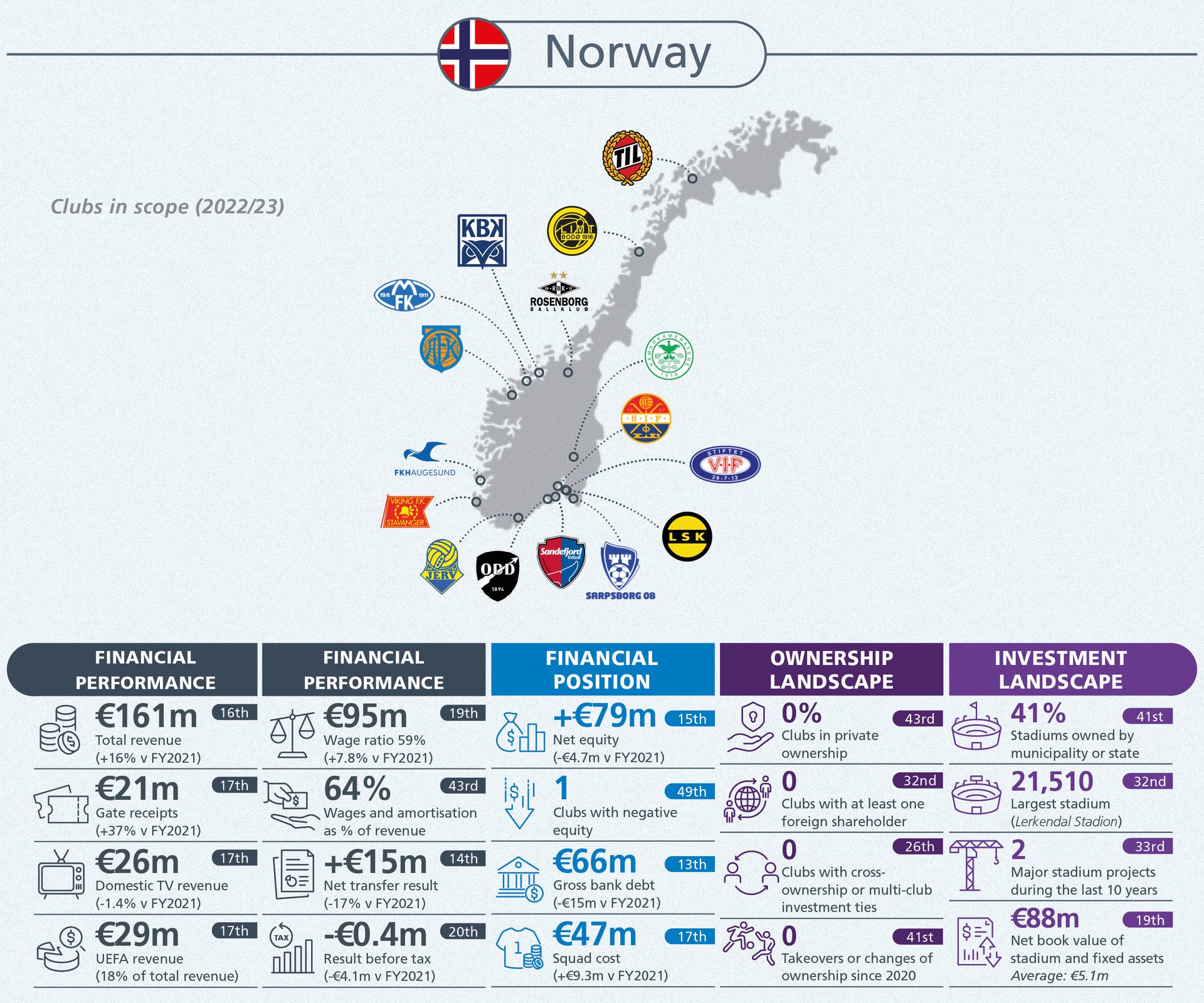

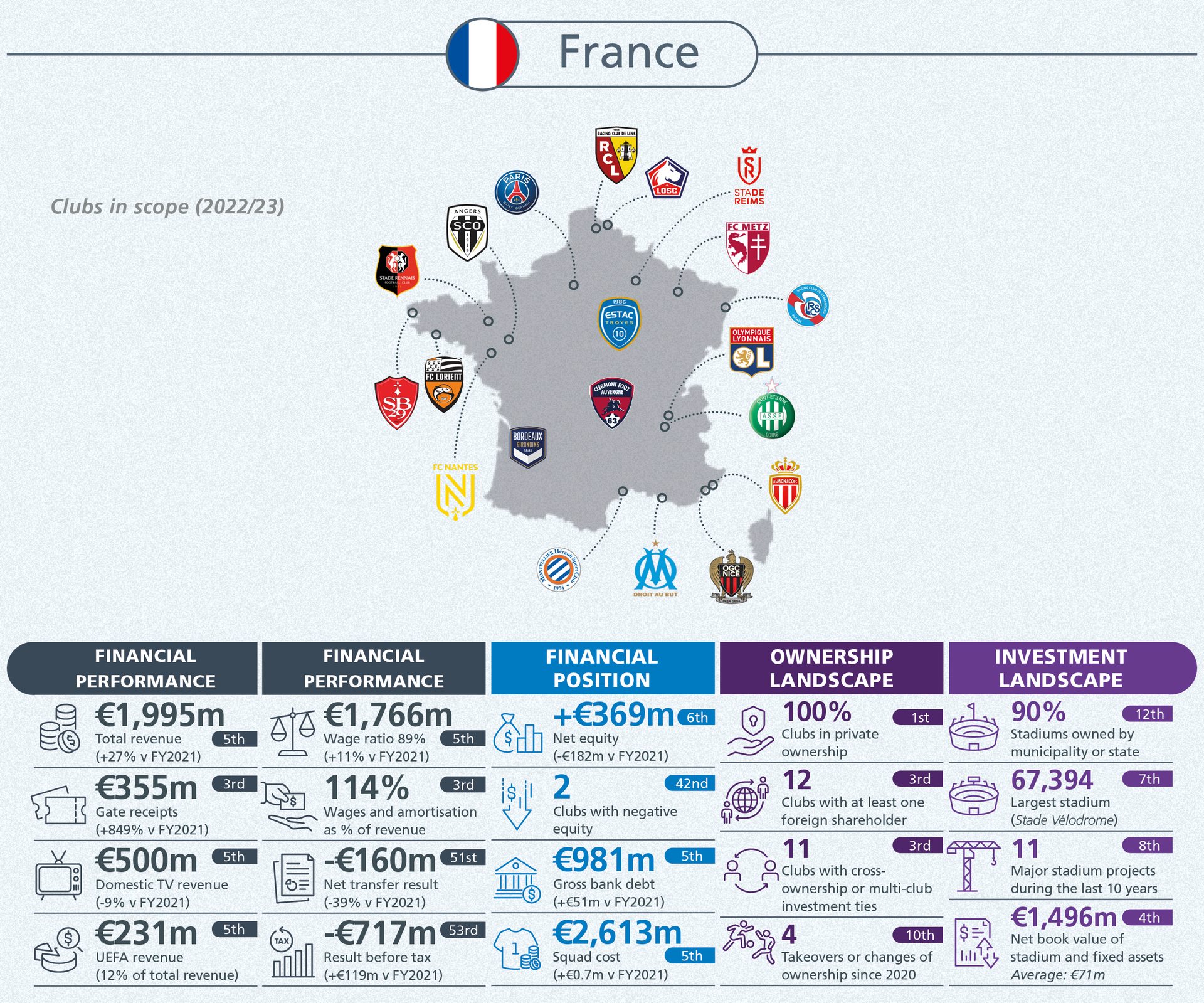

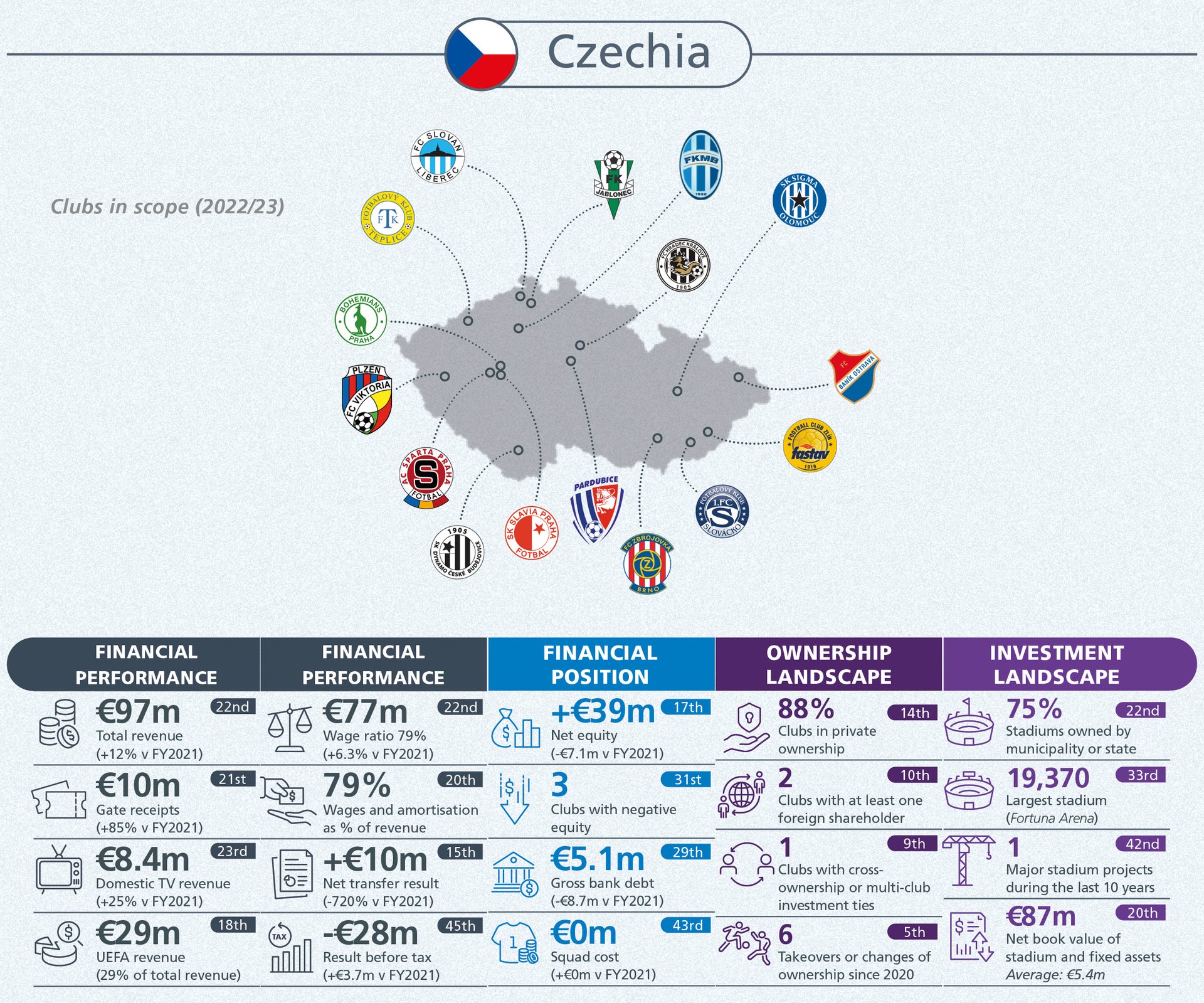

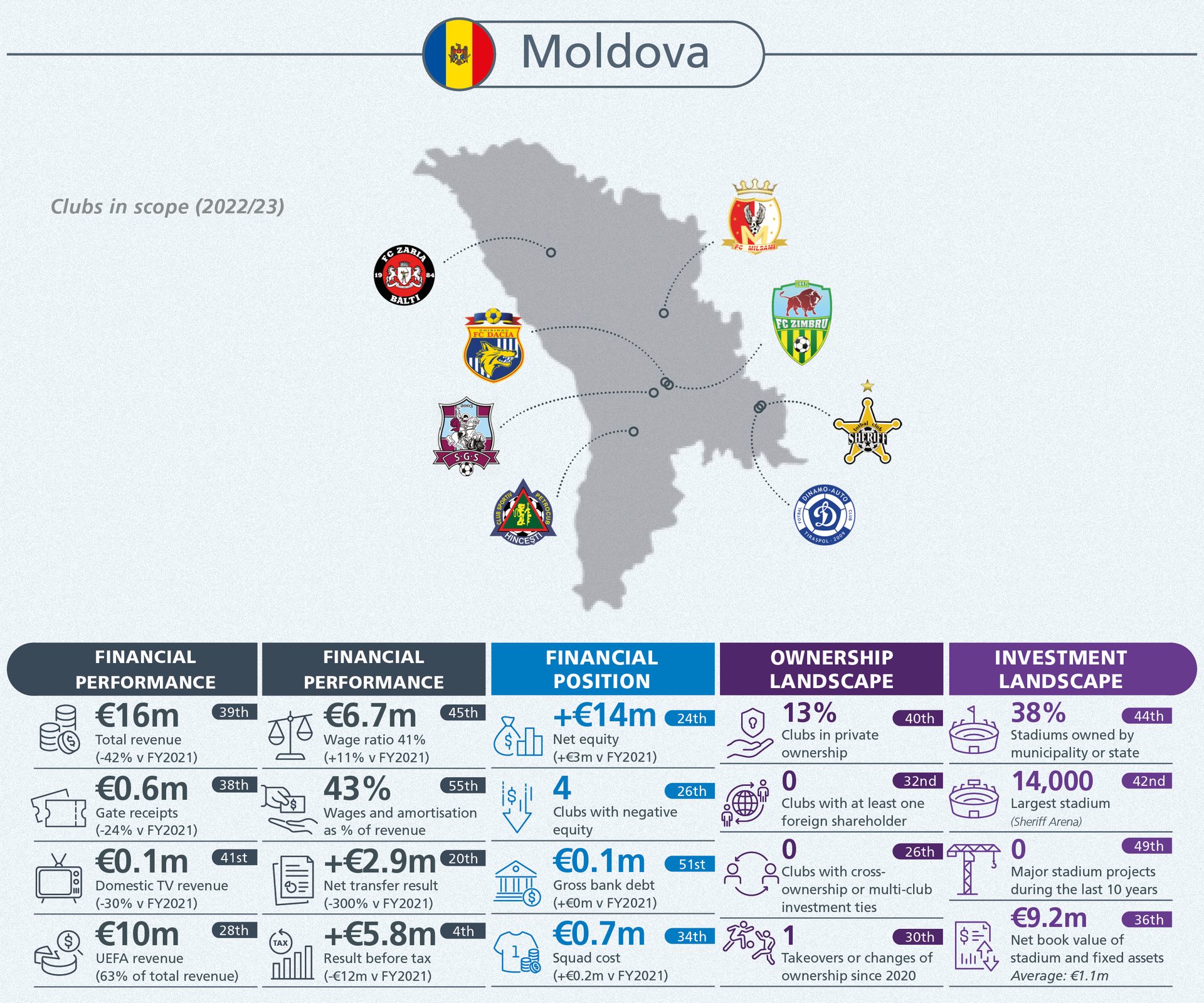

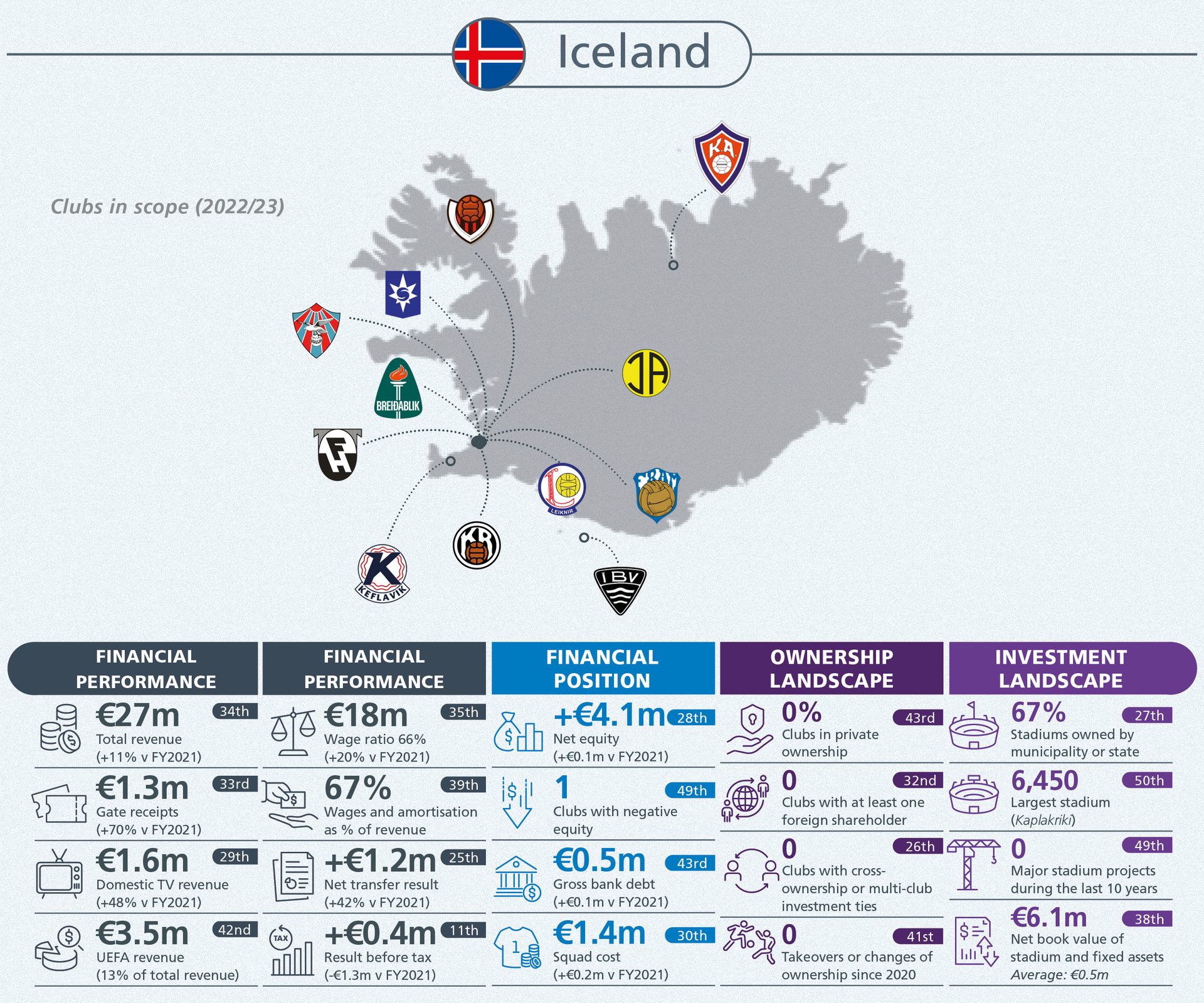

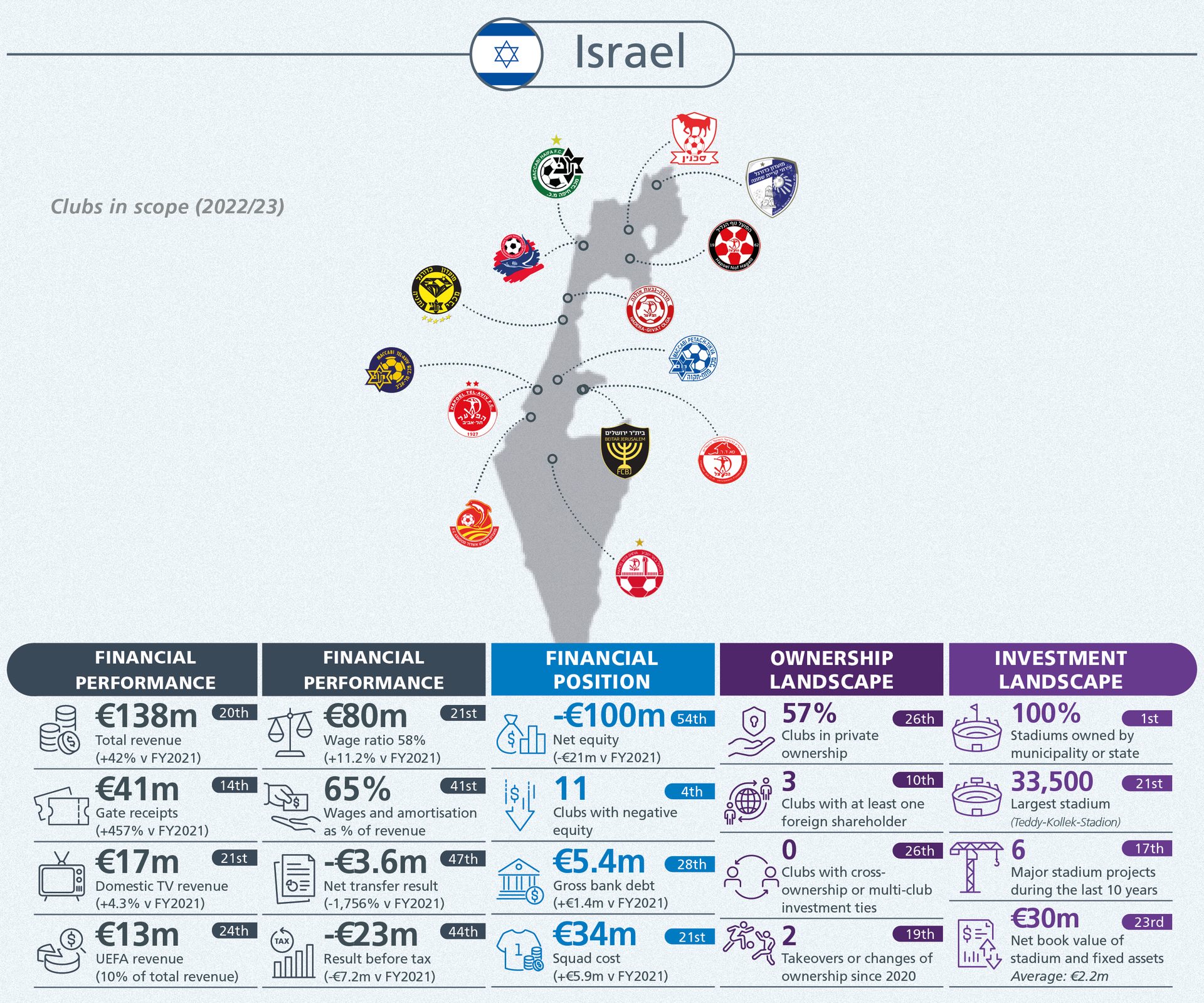

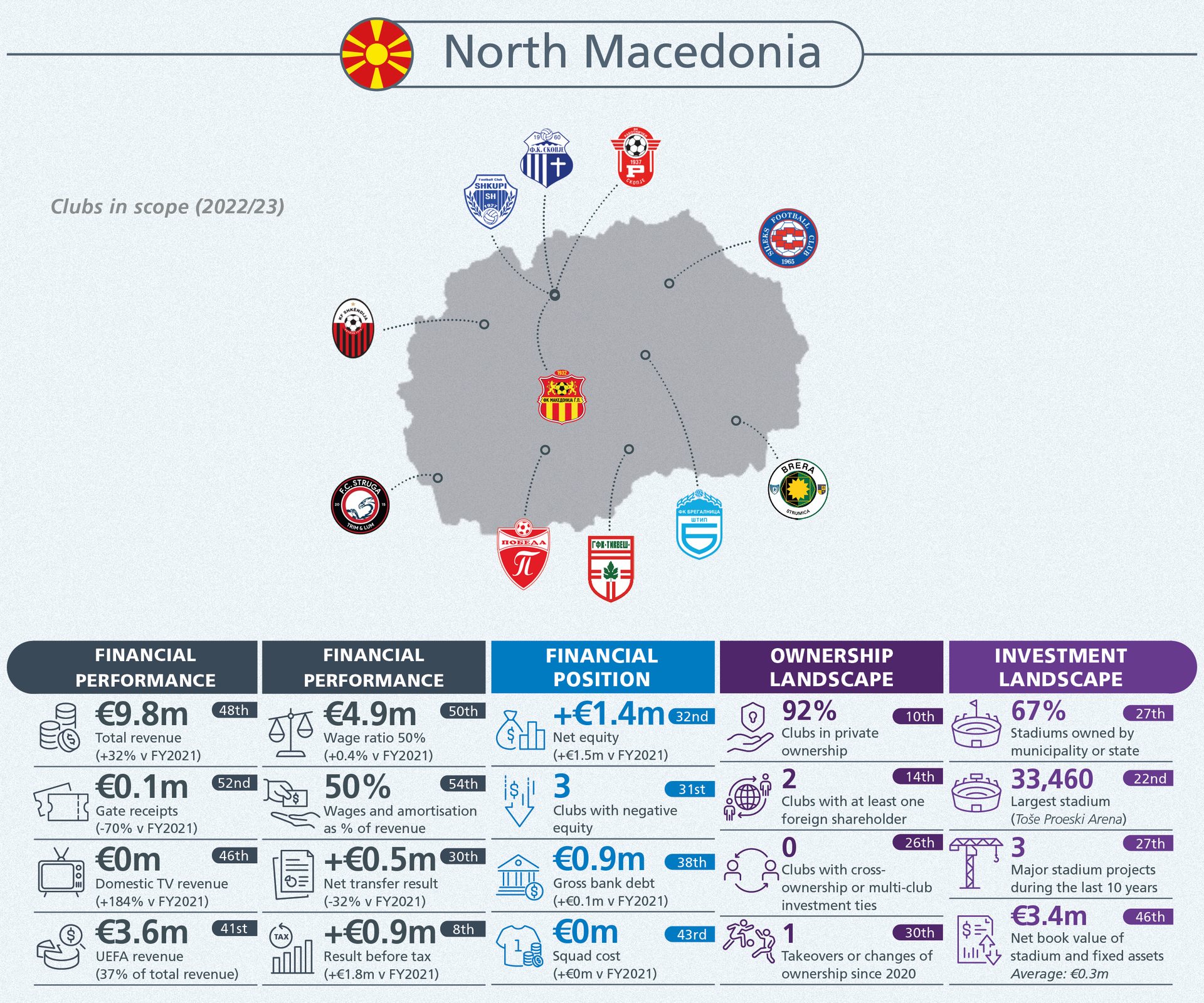

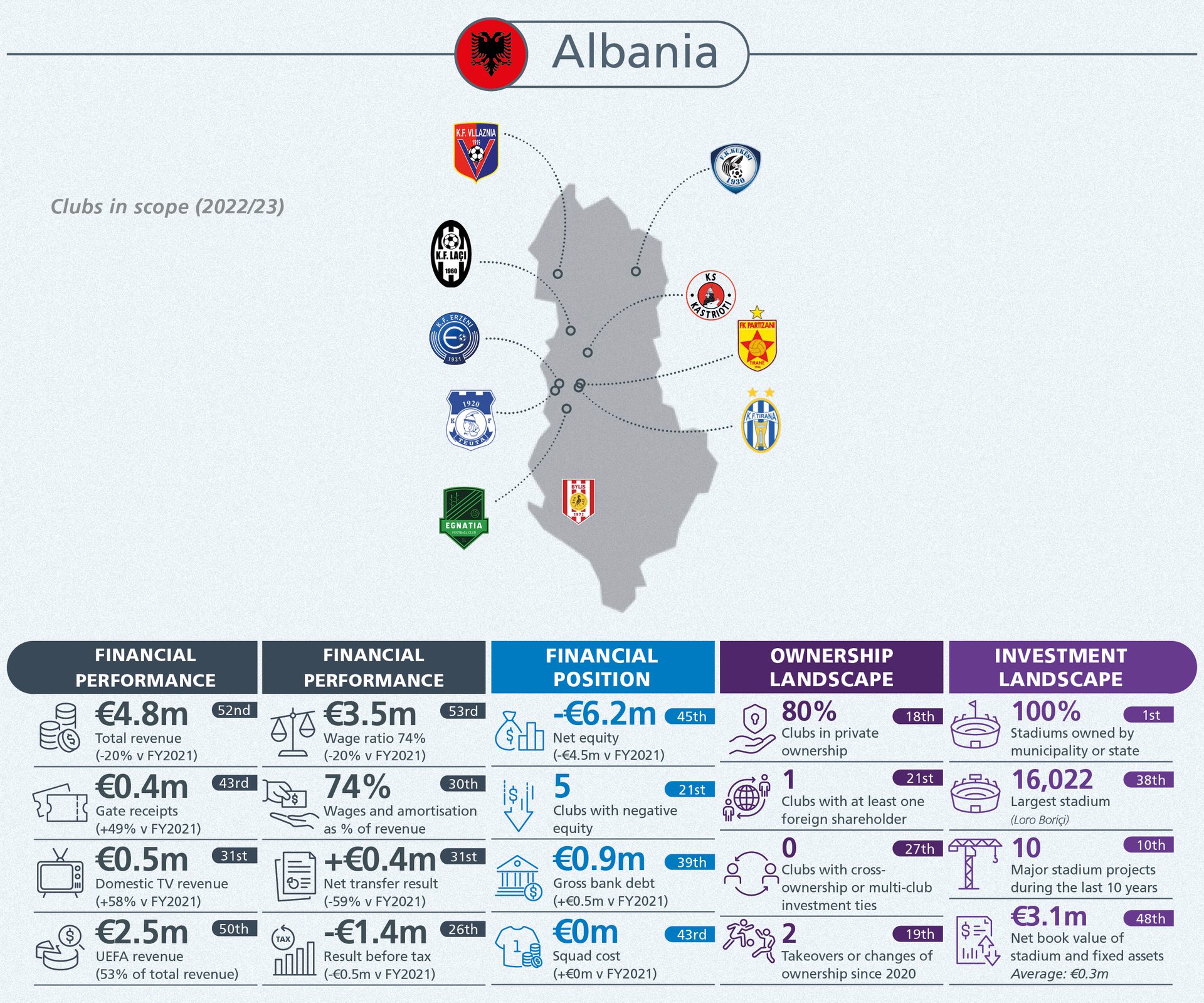

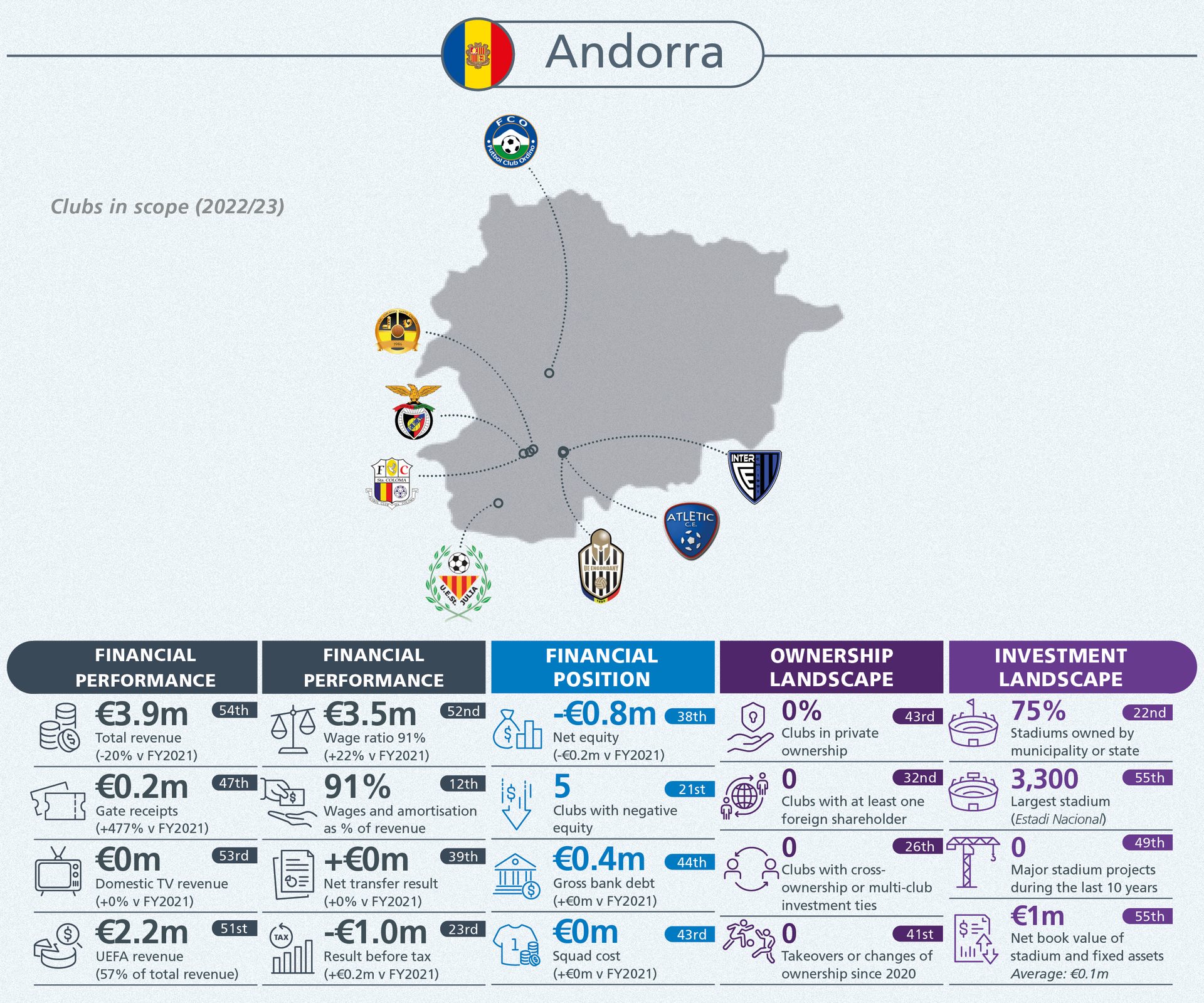

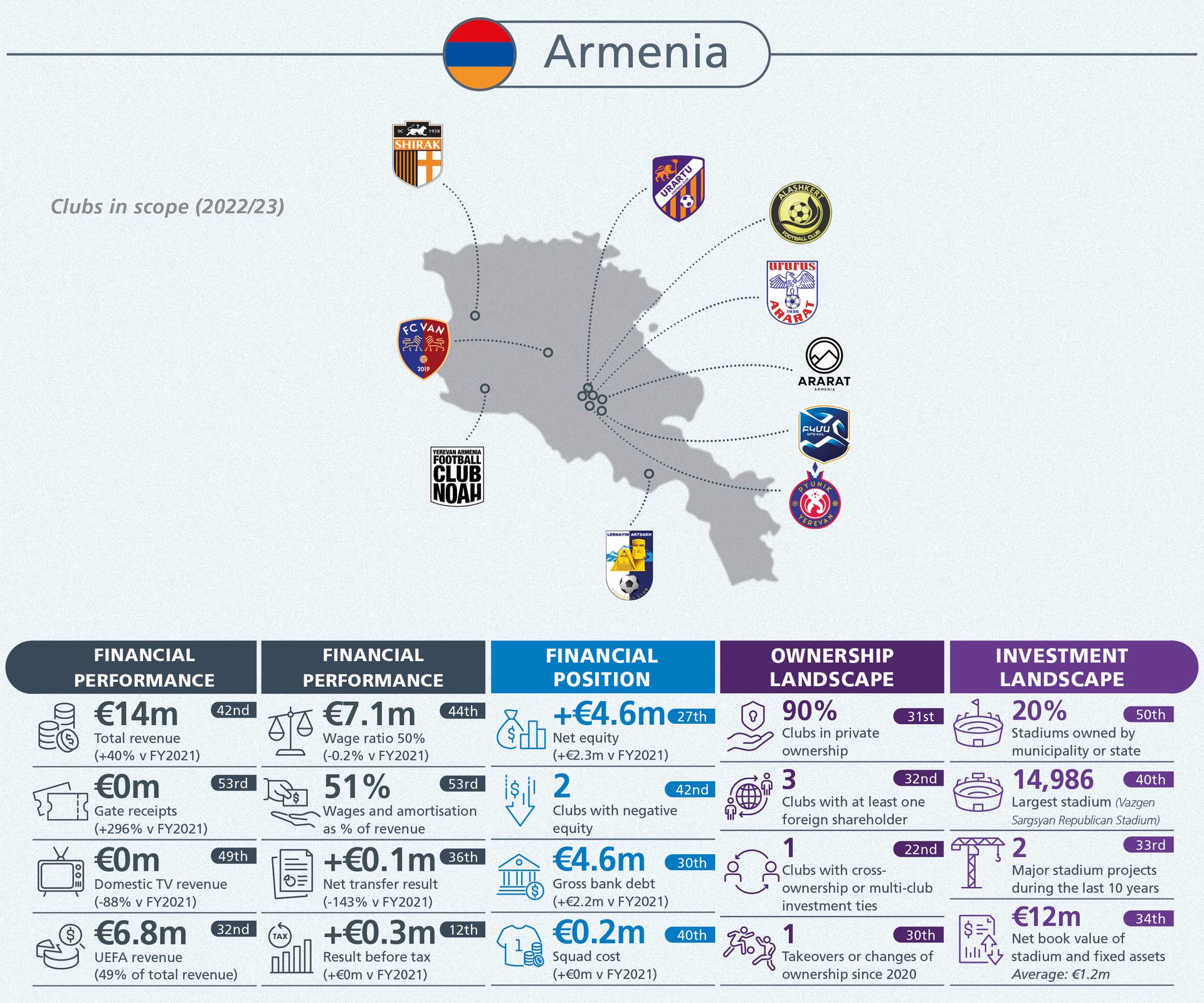

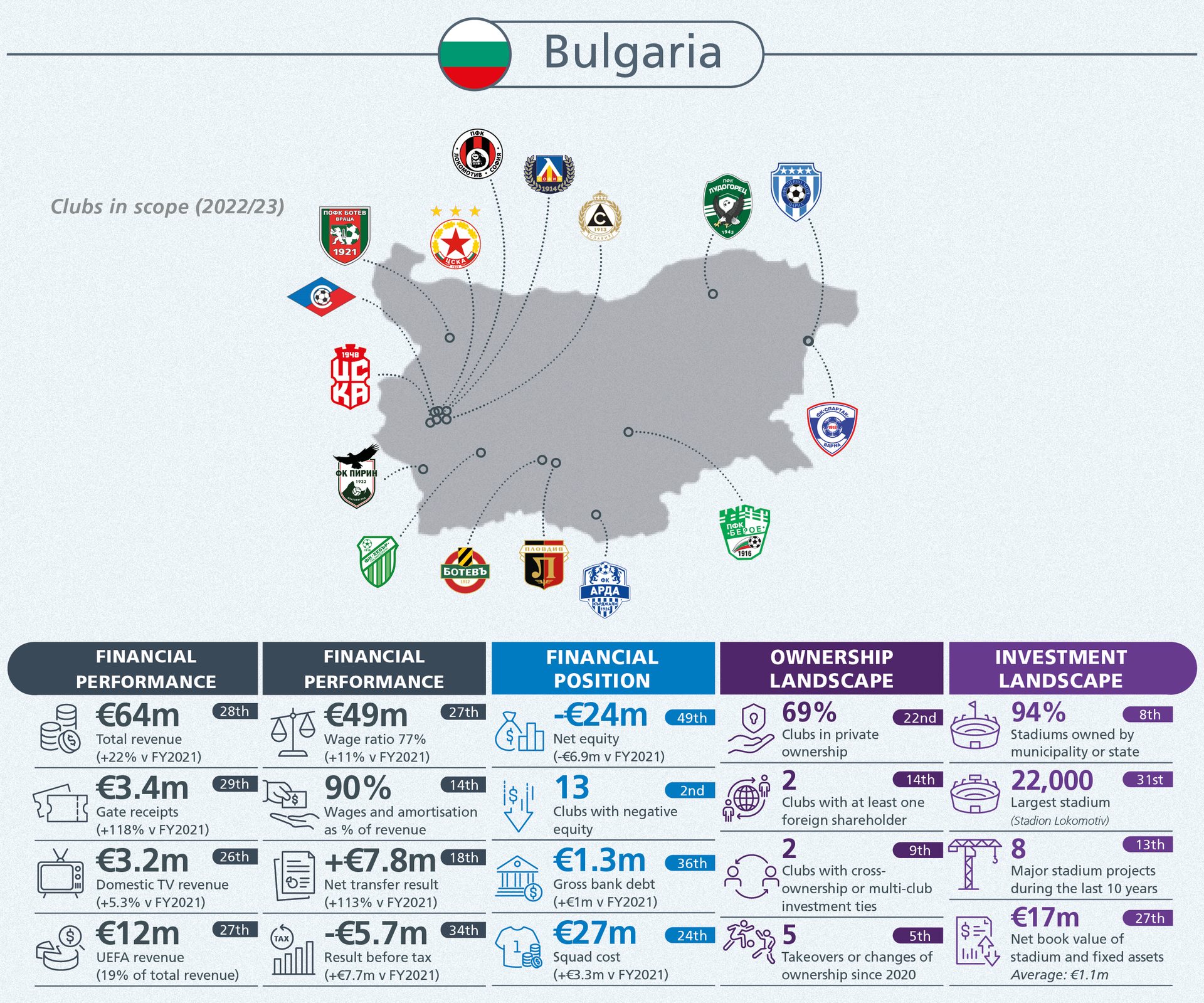

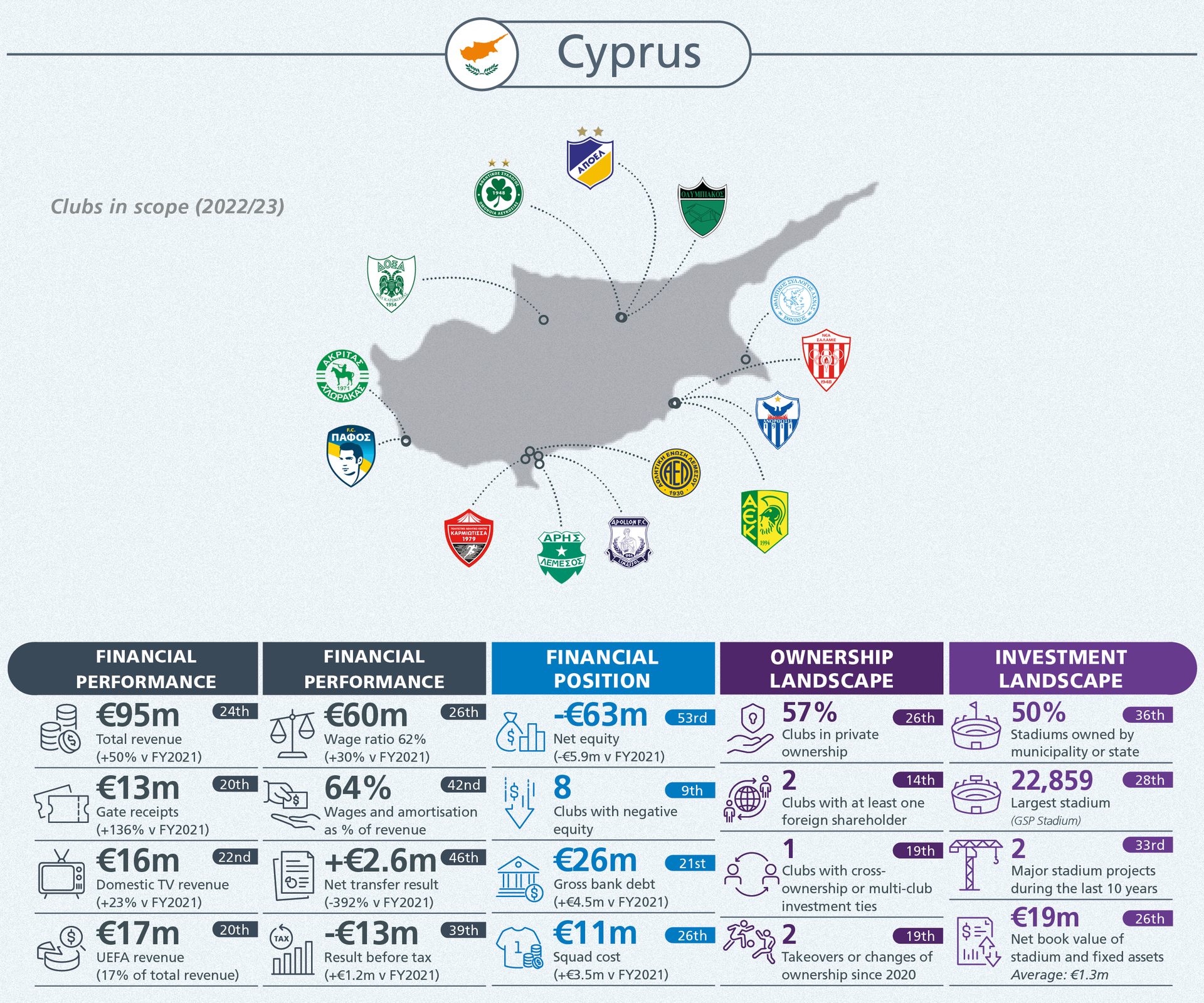

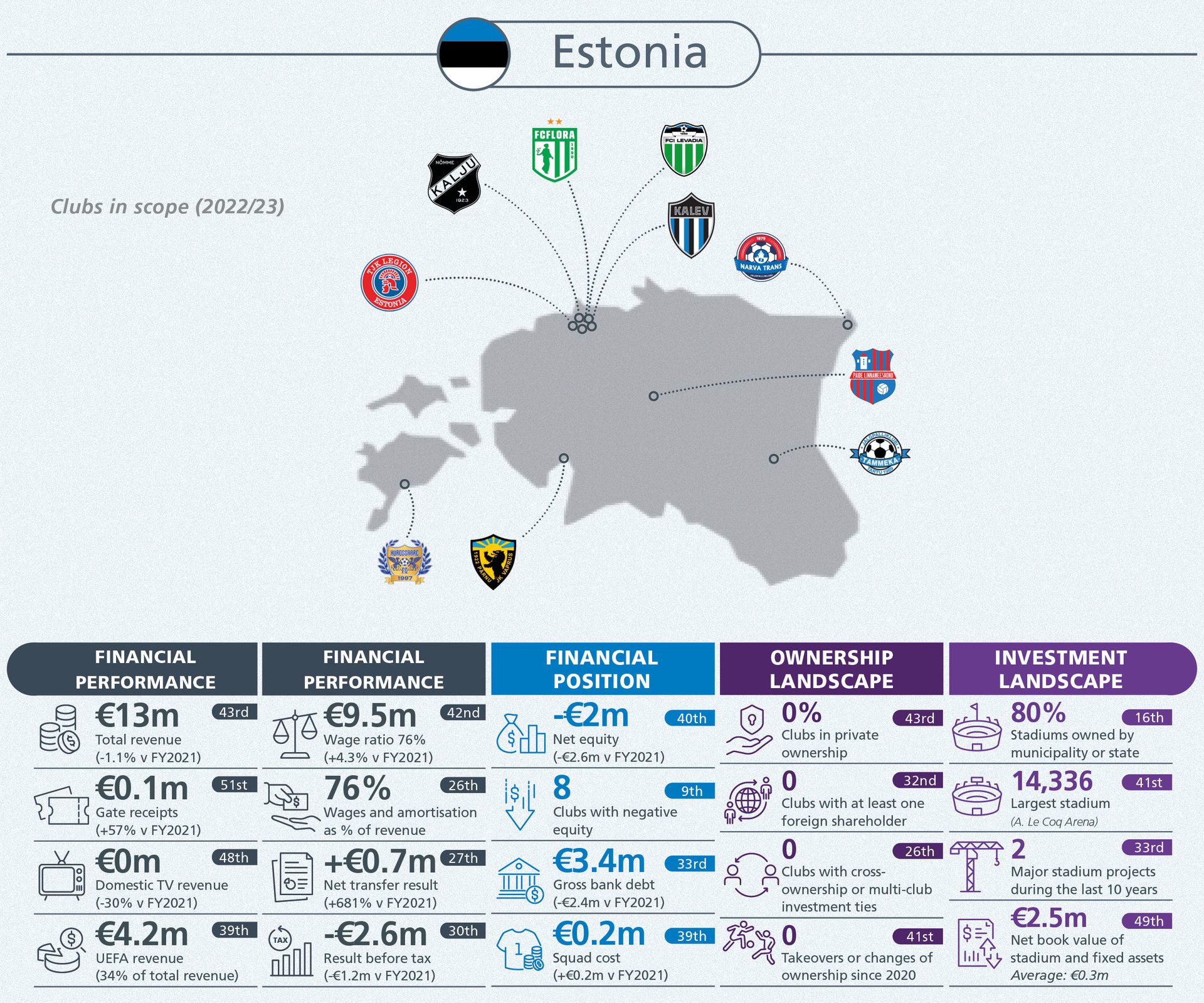

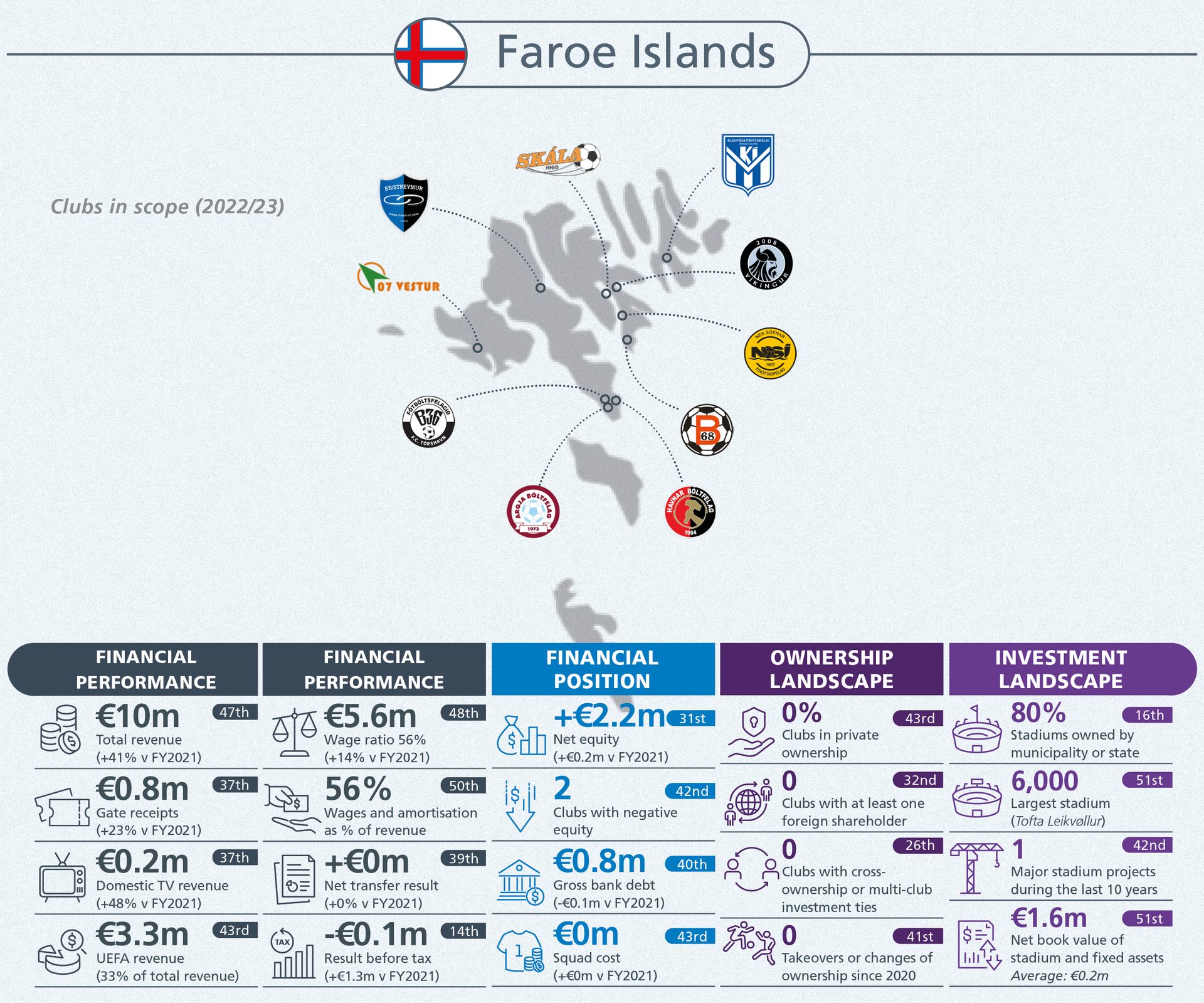

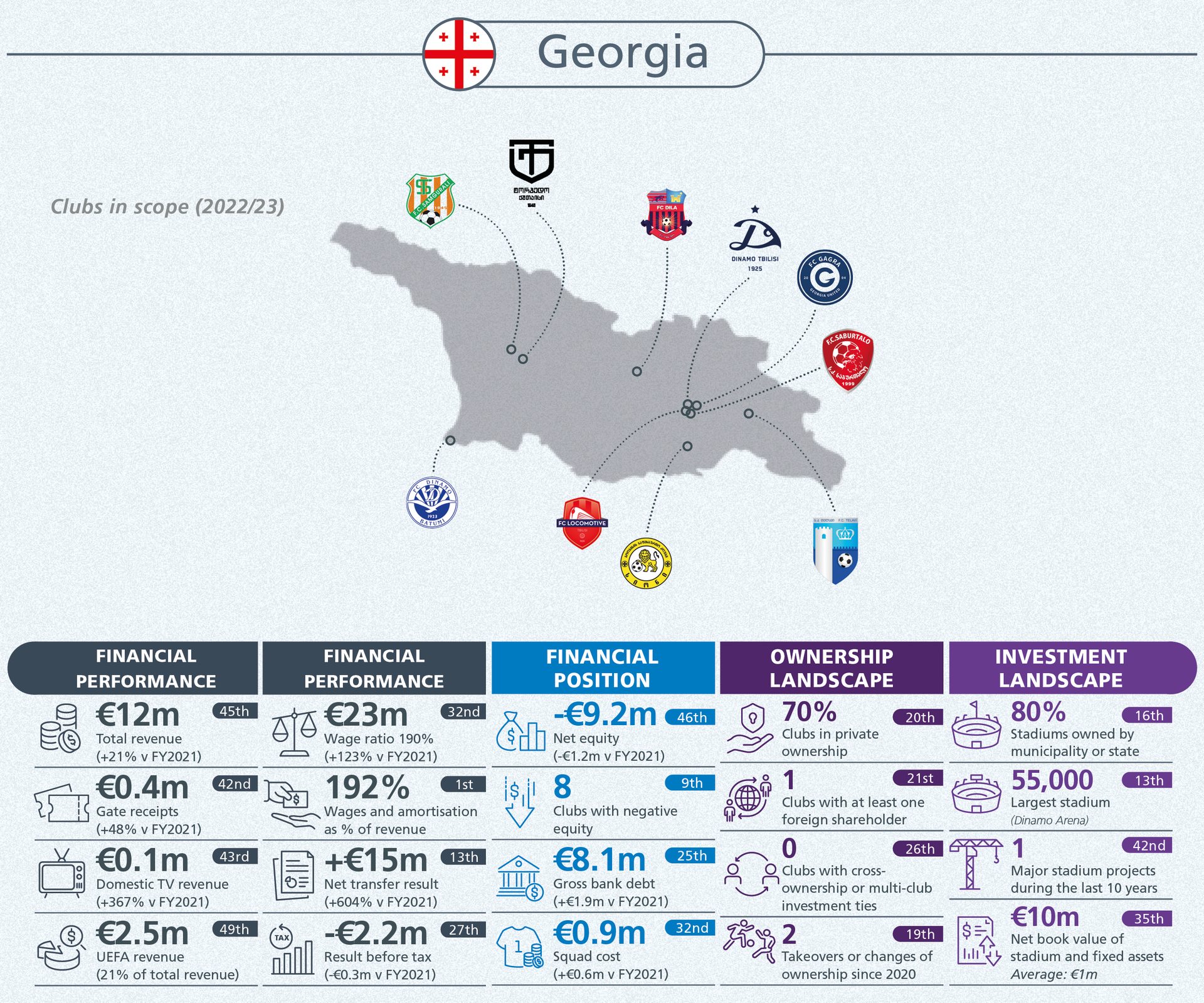

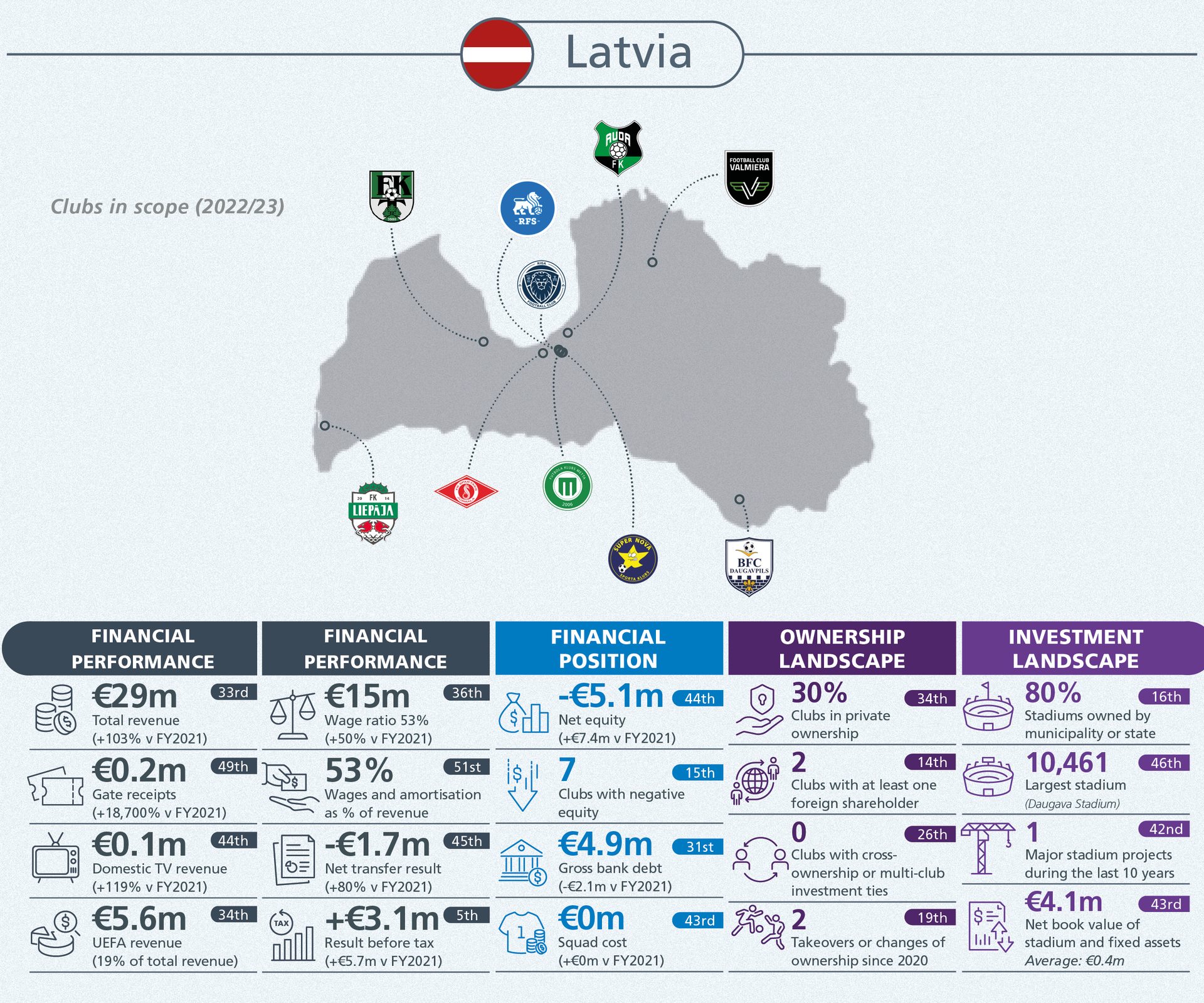

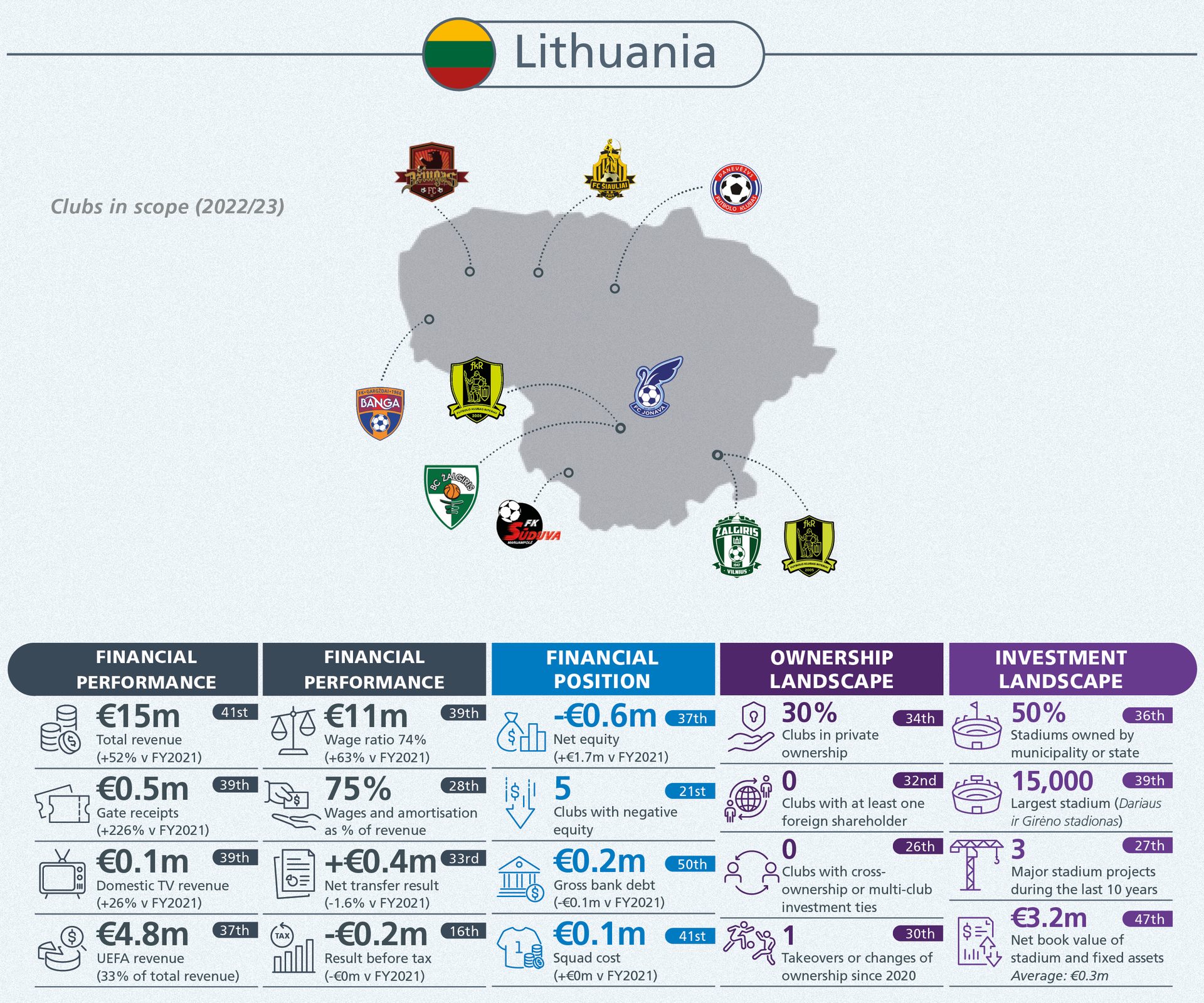

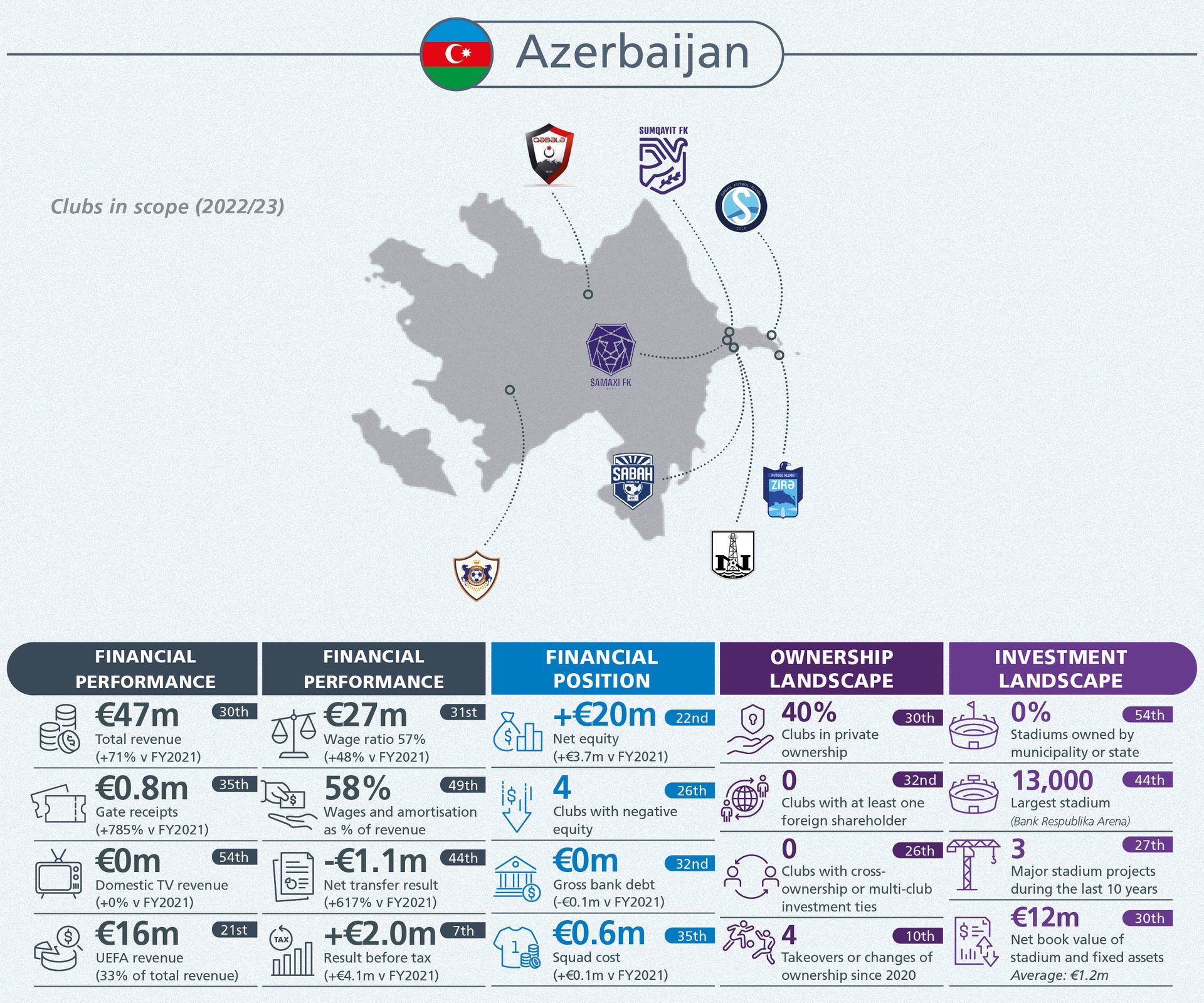

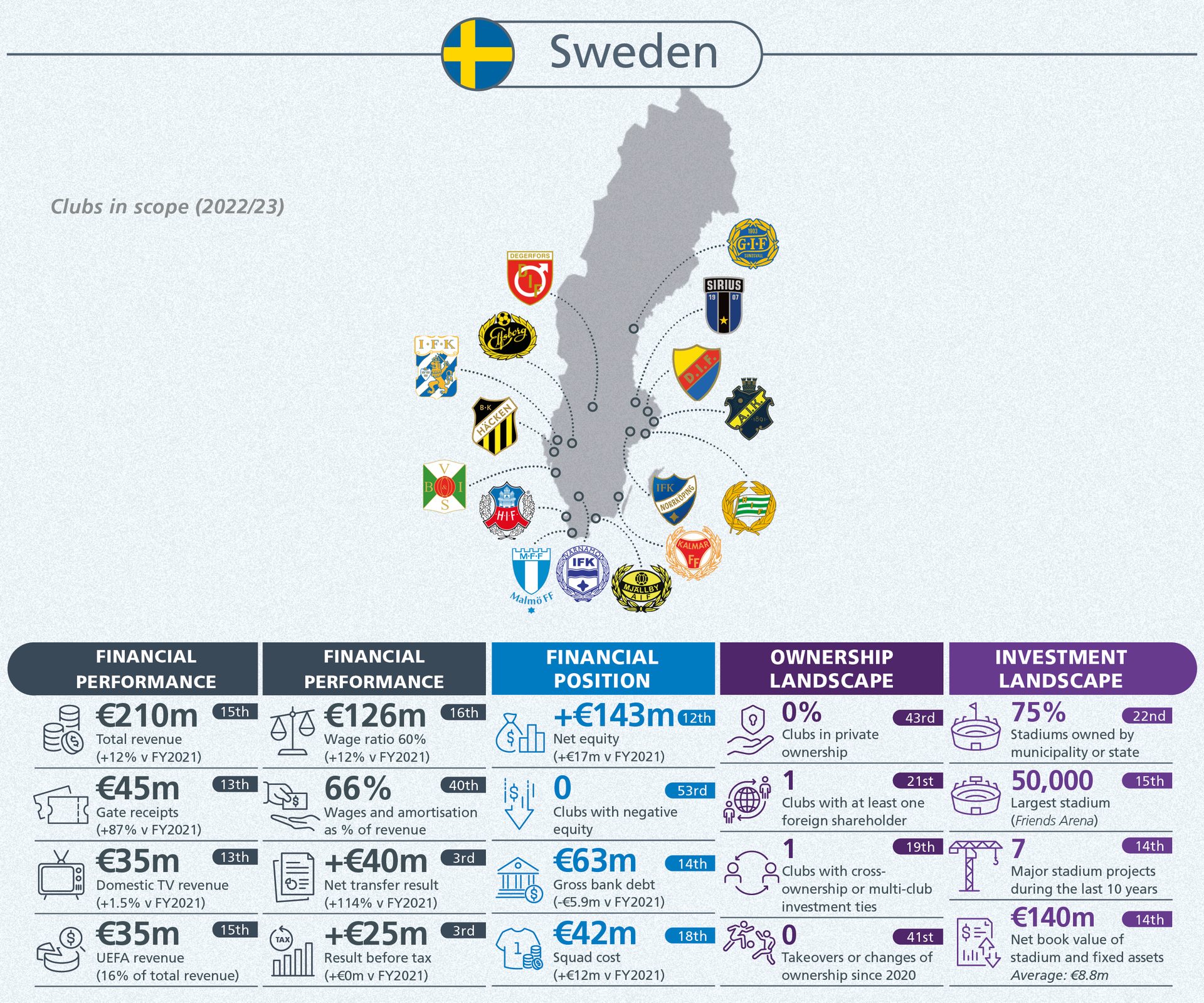

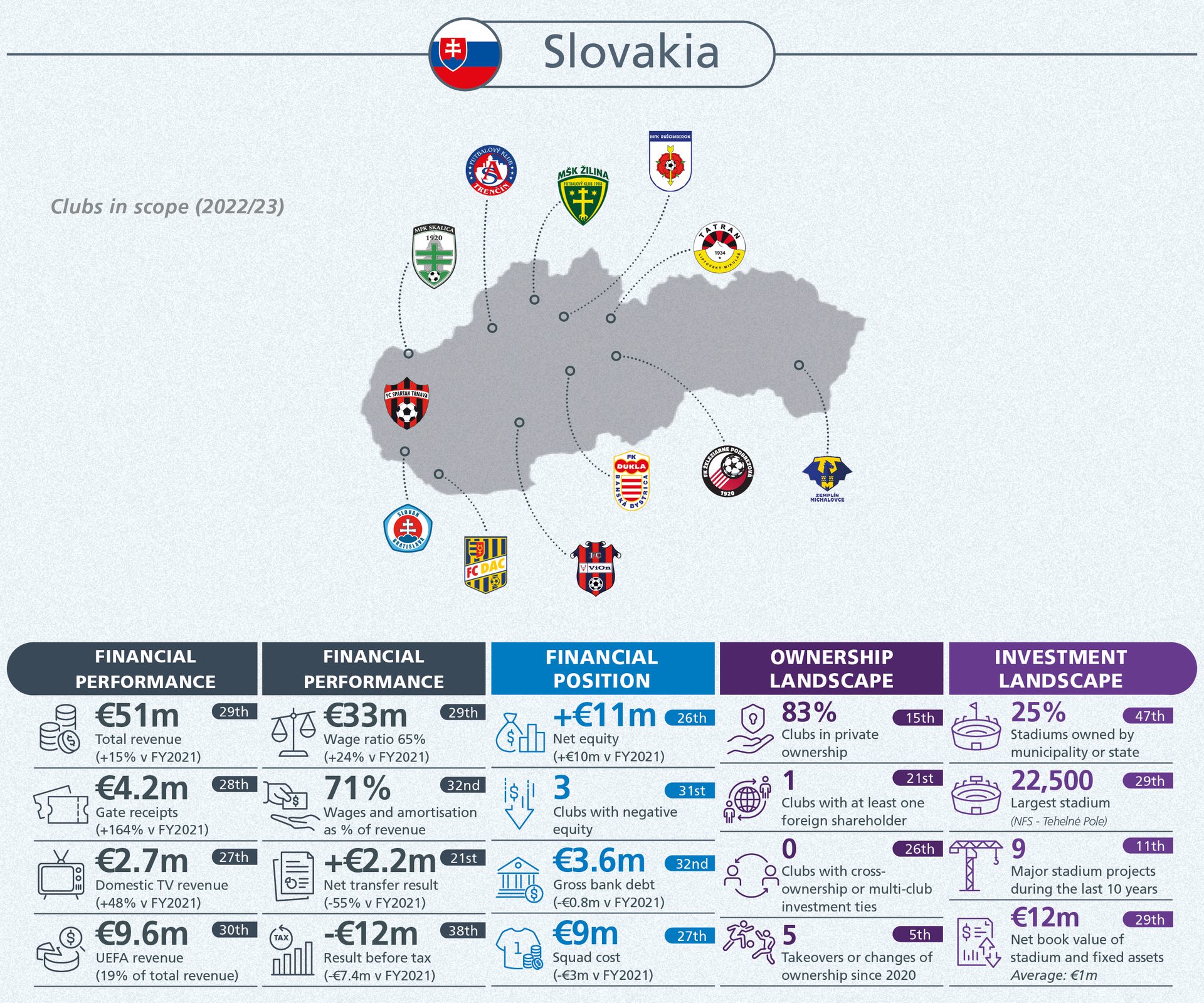

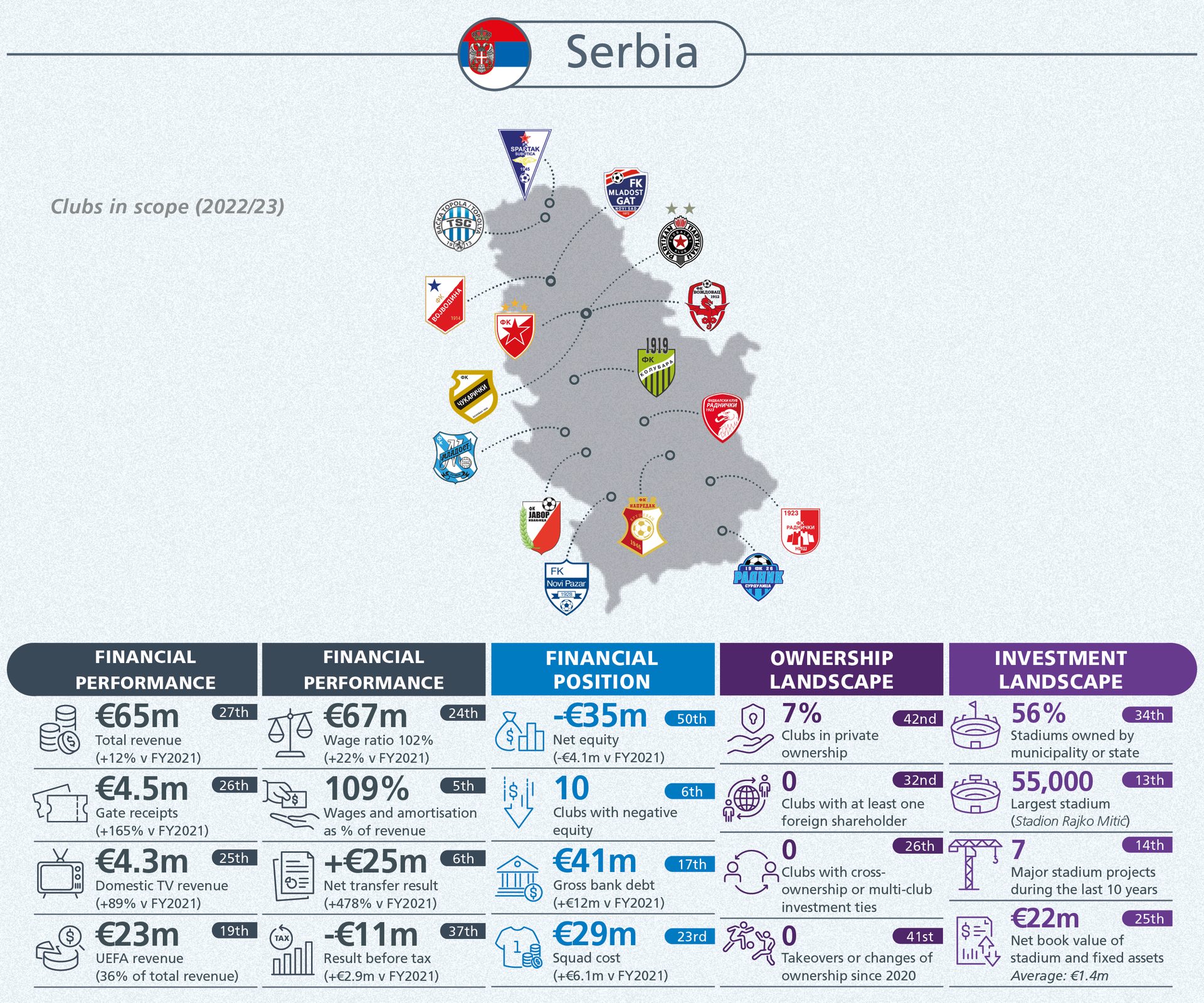

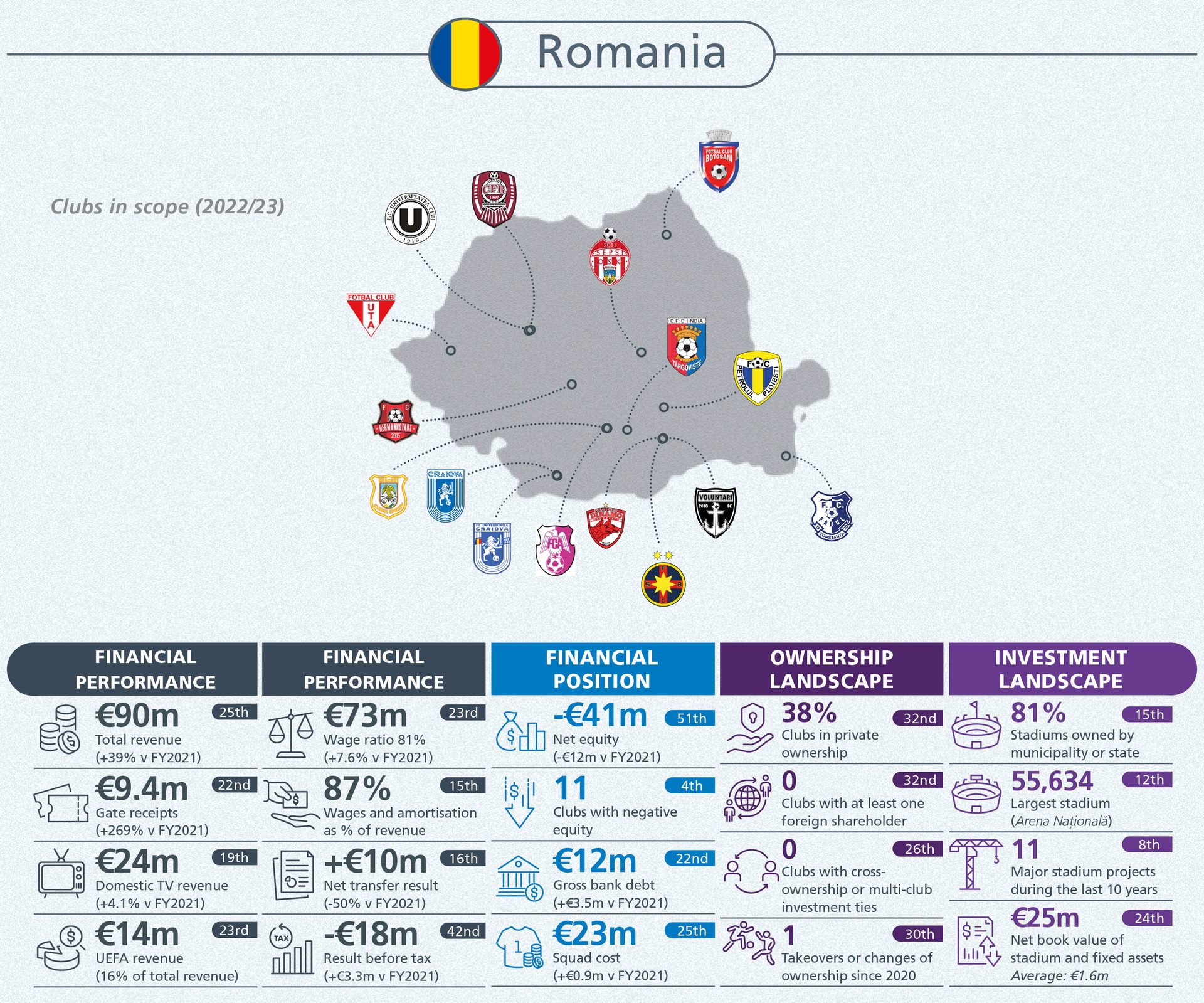

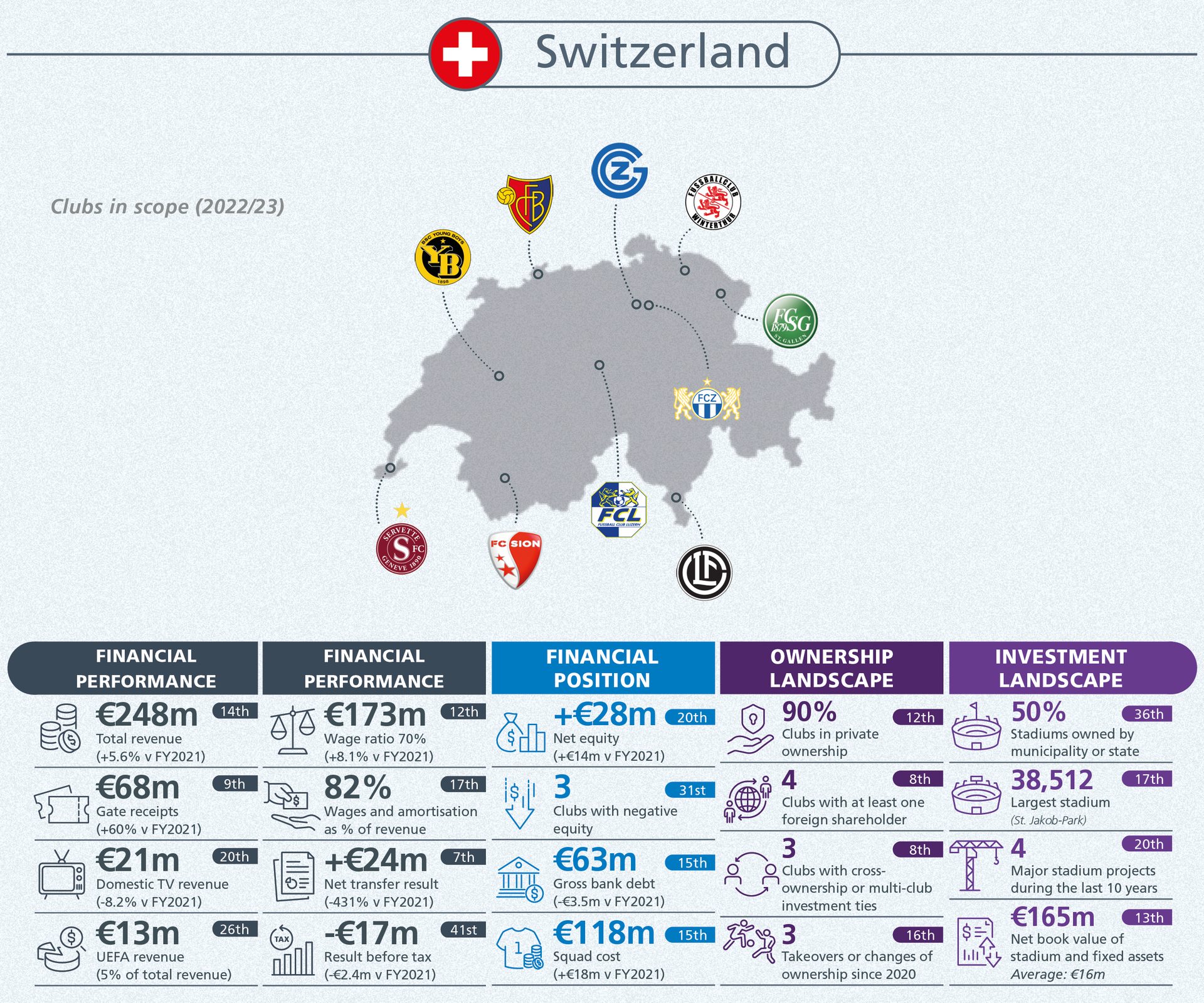

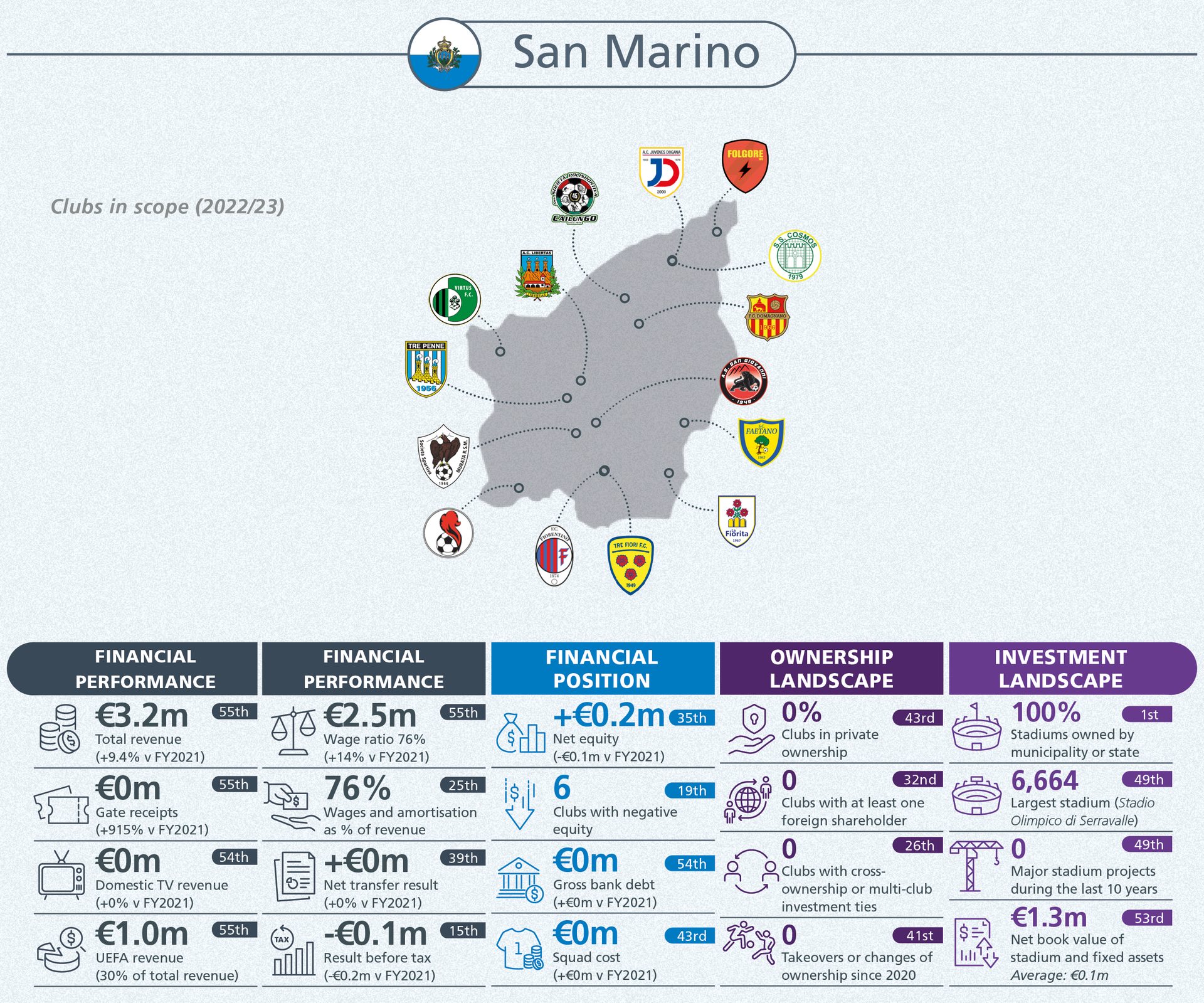

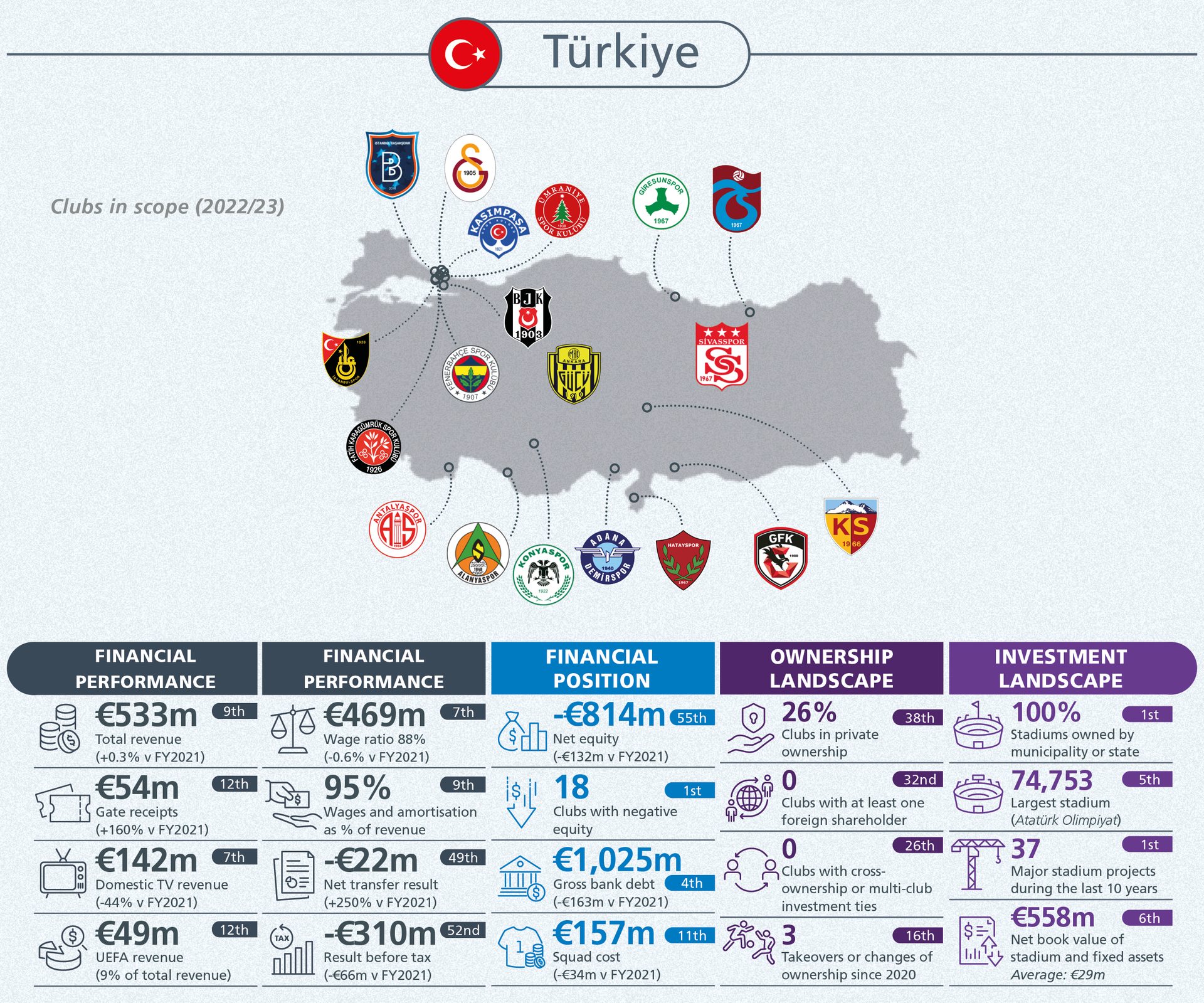

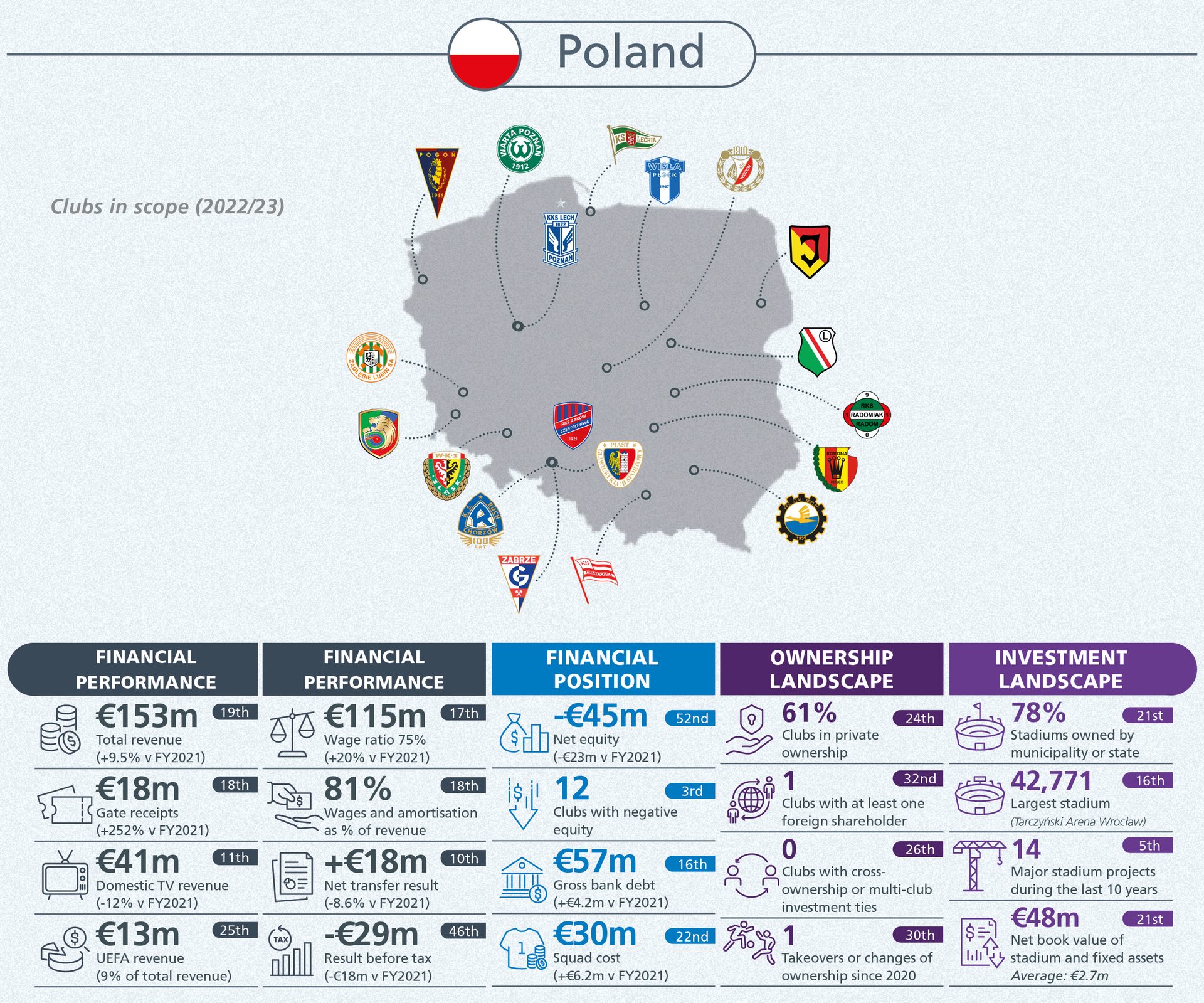

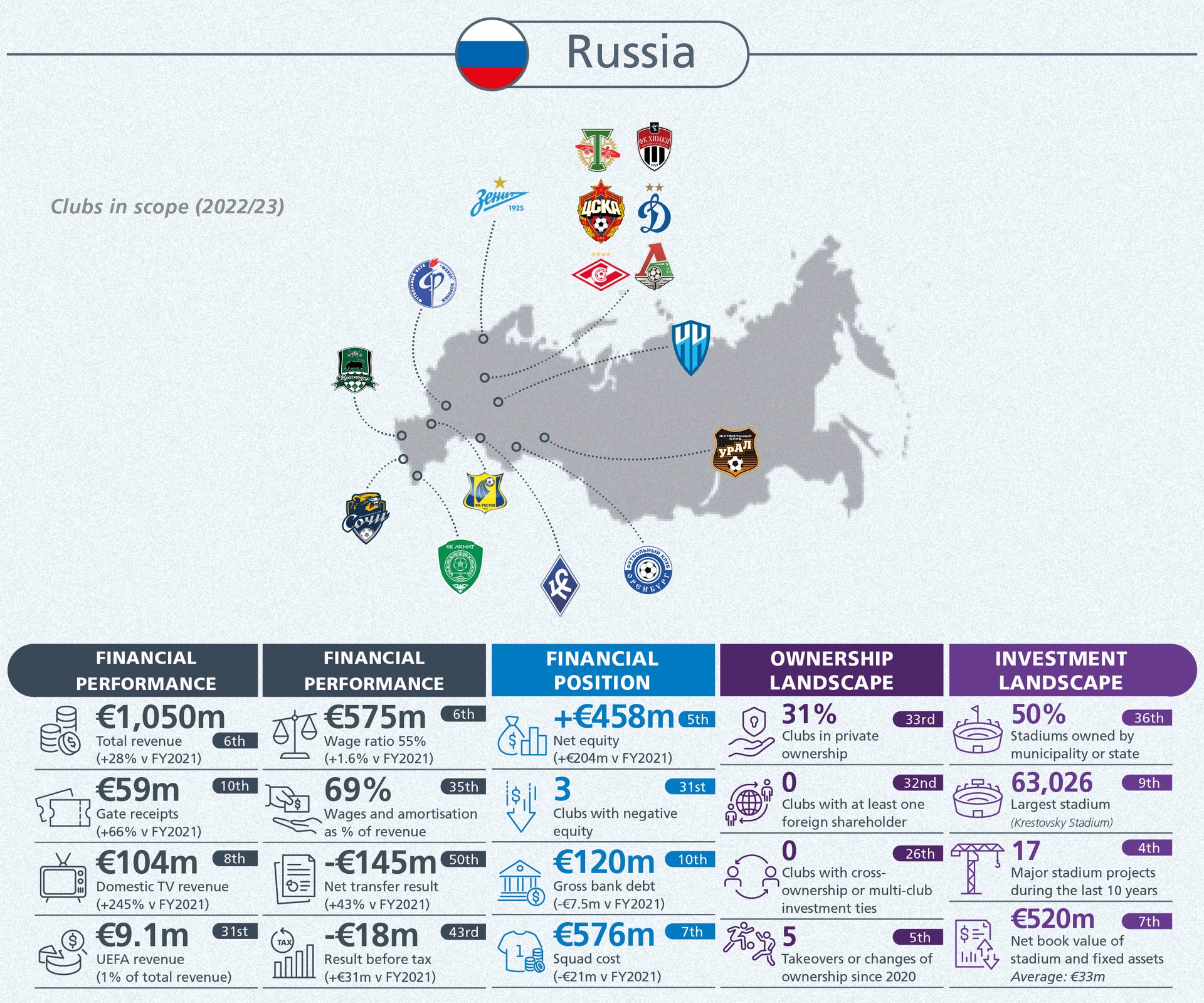

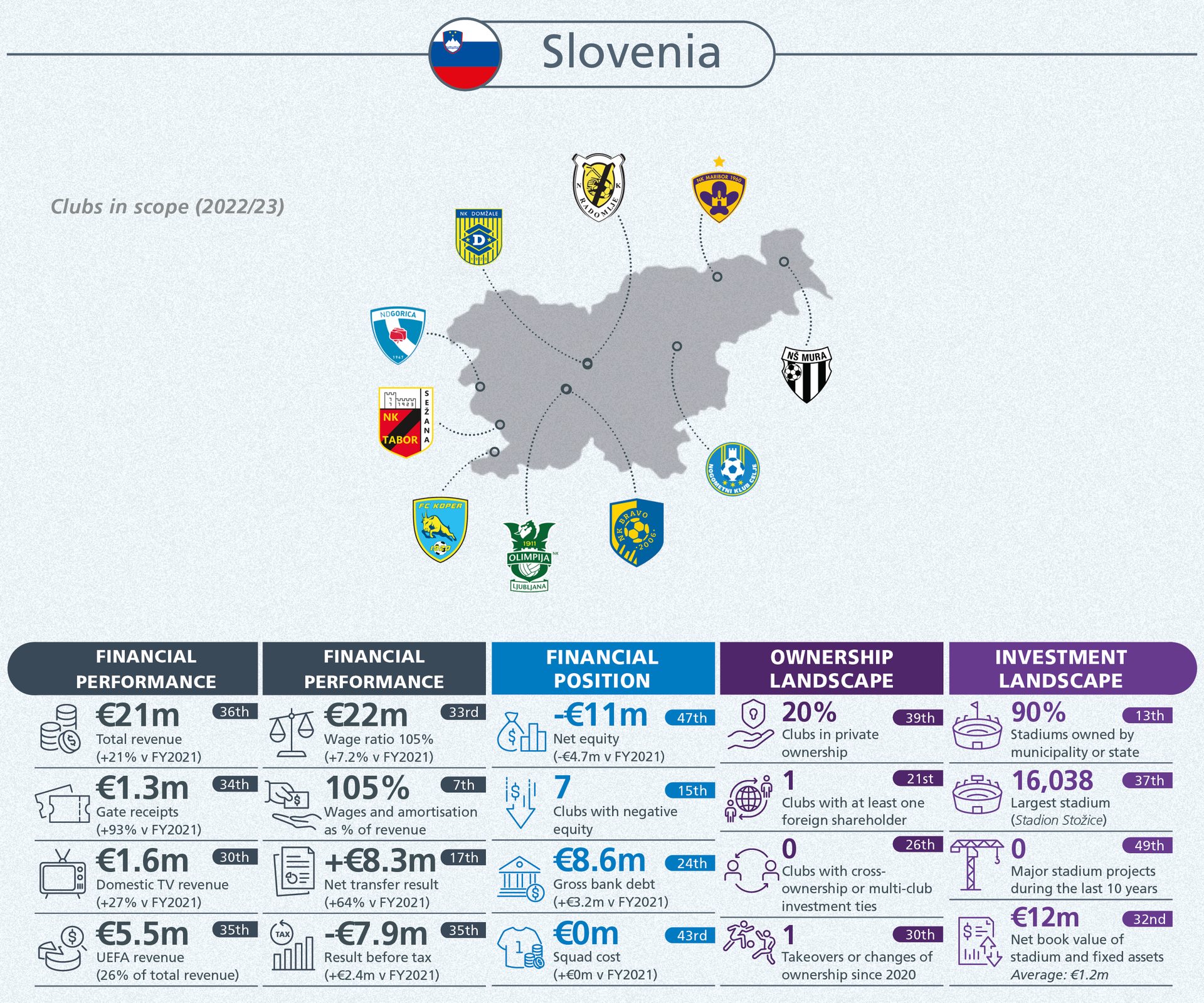

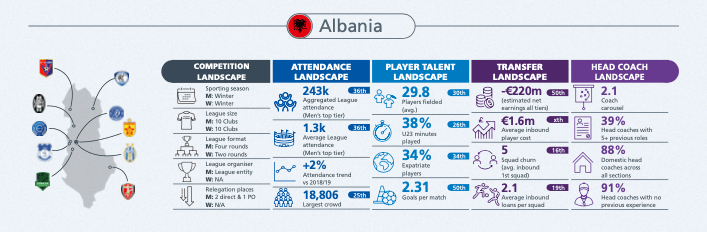

The report covers much more than just the biggest clubs and leagues. More than 700 clubs per year are analysed providing a 360 degree snapshot that is aggregated and can be explored below.

Click on each country to view benchmark statistics.